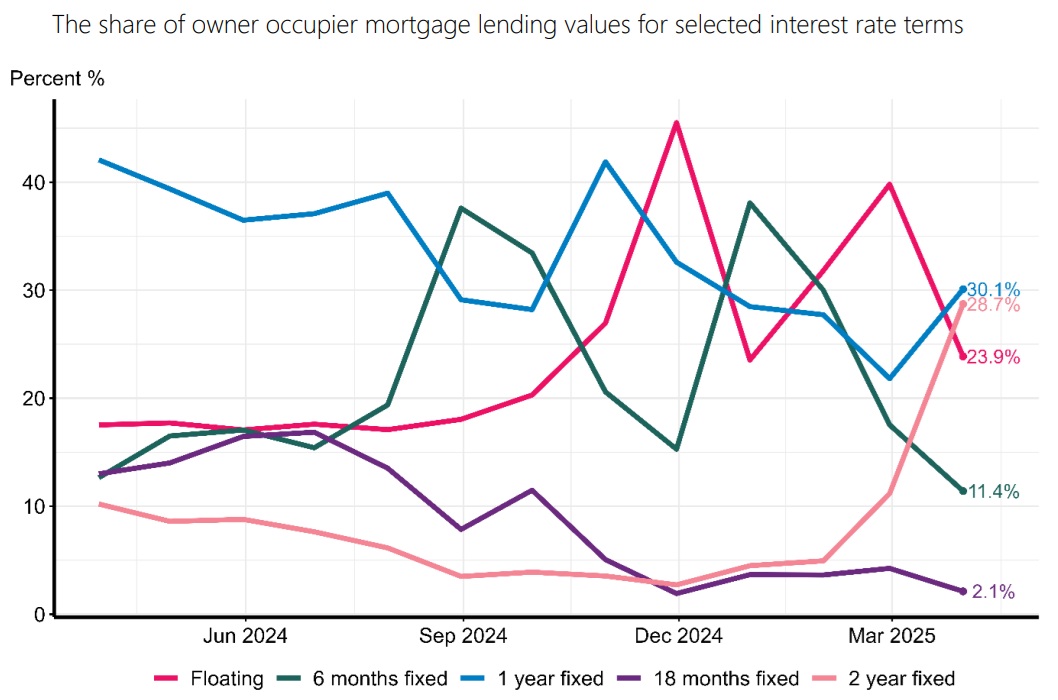

The move to longer term fixed mortgages is under way - big time.

The latest monthly figures from the Reserve Bank show that among the new mortgages uplifted in March by owner occupiers, nearly 60% of them were for either one or two year fixed terms.

It's true to say that the one and two year terms are traditionally very popular.

However, since the start of last year as home owners realised that lower interest rates would be coming, there's been a big migration to very short terms - and even to floating rates.

But, with the Reserve Bank having dropped the Official Cash Rate from 5.5% in August of last year to a current 3.5% and with banks following suit, the somewhat longer fixed terms are coming back into view.

Of the $5.725 billion of new mortgages uplifted by owner-occupiers in March, $1.723 billion (30.1%) was fixed for one year, while $1.644 billion (28.7%) was fixed for two years.

It has been a big turnaround in a month.

In February 39.8% of new owner-occupier mortgages were on floating terms. But in March, just 23.9% of the new mortgages in that month were floating.

Six month terms have recently enjoyed great popularity as well, but in March the share of six-month fixed term new lending for owner occupiers decreased from 17.5% to 11.4%.

It is surely no coincidence that as I write the two lowest 'special' rates being offered by the major banks are 4.99% for both one-year and two-year terms.

The home owners have been quick to latch on to the lowest possible rates and recently that's been in the shorter terms.

Now, however, clearly there is a mood that - firstly the one and two year rates are 'attractive' and secondly that there may not be too much more potential for significant further interest rate falls - although with the global political situation being as turbulent as it is, there's quite a bit of guess work in trying to work out exactly what will happen.

The RBNZ's C71 data series has data going back to 2021. It differs from other monthly series published by the RBNZ in that it shows mortgage figures for after the mortgage has been uplifted (while other series highlight mortgage figures for when the mortgage has been committed to). (The RBNZ summary of the latest data is here.)

The C71 data therefore shows the flow of the money and into what rates as and when it happens.

The picture painted since the beginning of 2024 has been of homeowners going shorter and shorter with their mortgage terms as anticipation grew of the RBNZ beginning to cut the OCR.

But now as said above, we are coming to the stage where people are considering longer terms again.

In terms of residential investor mortgage lending, it increased to $2.2 billion in March from $1.7 billion in February.

The trends were the same.

One-year fixed terms accounted for 31.1% of new lending, up from 21.7% in February. Two-year terms accounted for 26.5%, up from 11.6%, while floating dropped to 26% from 43%.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.