A clear split has emerged in the ranks of owner-occupiers taking up new mortgages.

Earlier this year there was a very clearly defined thought - namely wait for the Reserve Bank (RBNZ) to cut the Official Cash Rate further with the hope this will see lower mortgage interest rates.

That thought's still there. But now so is the thought that, well maybe some of those longer term fixed rates are looking okay now, and waiting further might not be a good idea.

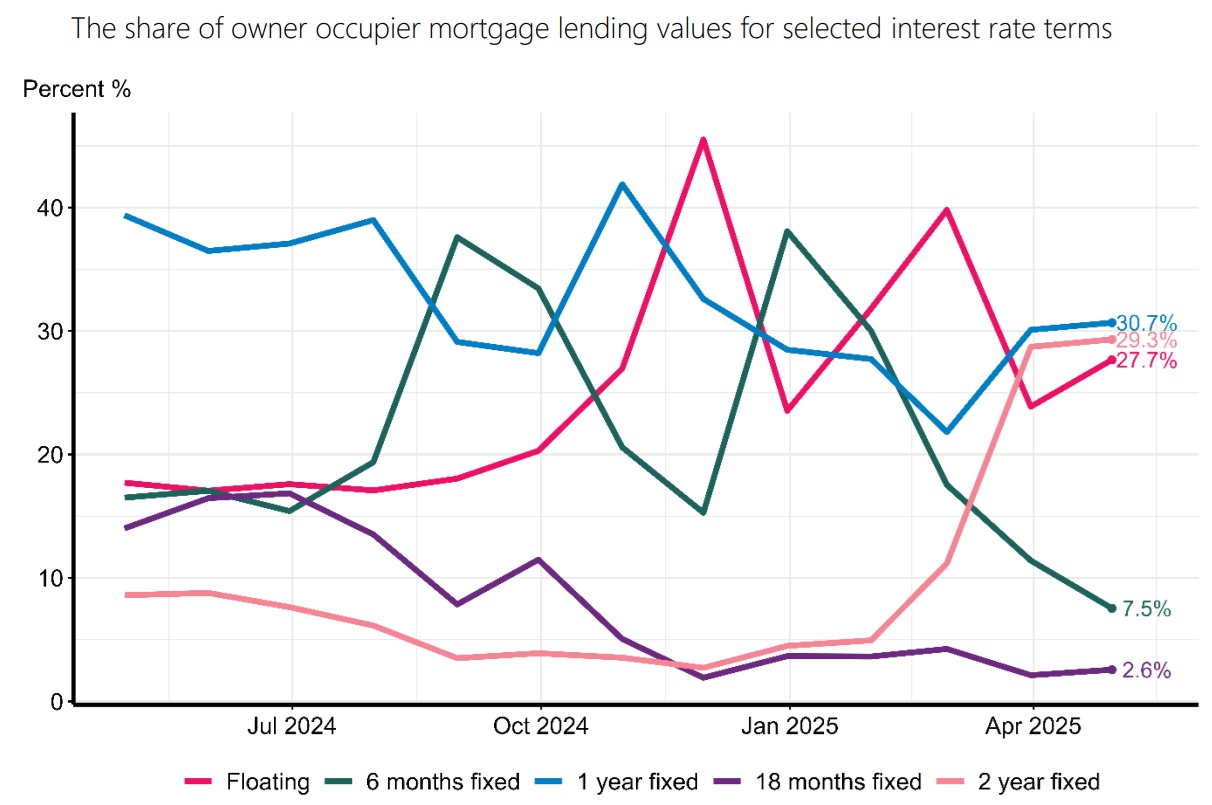

The upshot of this is that the RBNZ's latest new lending fully secured by residential mortgage figures that highlight what terms new mortgage holders are taking their mortgages out for, show that in April for owner occupiers the most popular option was the one-year fixed, very closely followed by the two-year fixed - but conversely not far behind was floating rates, which saw another surge in popularity during the month.

These figures, which are a relatively recent addition to the RBNZ's data set, date back only as far as 2021 and show mortgages as they are actually uplifted rather than other when they are committed to, as other data sets show.

The figures have been a welcome addition to the data sets and they have shown quite surprisingly large changes in strategy by new mortgage customers each and every month.

When it became clear last year that the RBNZ was going to start cutting the OCR from the then peak level of 5.5% (which it duly started to do in August - and the OCR's now down to 3.25%) those taking up new mortgages went very 'short'.

For the owner occupiers, the previously unpopular six-month rates became the 'in thing' and in August 2024, some 37.6% of the owner-occupier mortgages were for six-month terms. The top choice.

But that wasn't short enough. In November 2024 we saw floating rates soar in popularity, with 45.5% of new mortgages taken up that month on floating.

This trend continued into 2025, with just under 40% of new owner-occupier mortgages on floating in the month of February.

However, following continued OCR falls, the winds of change started blowing and in March we saw a serious re-emergence of interest in the longer term fixed rates and this has continued in April.

But with OCR reviews being held in both April and May (and two more cuts to the OCR), there's been plenty of people still prepared to wait and see if they can get a still better deal a bit further down the track.

As the RBNZ's summary of the April data outlines, the top choice for the month for owner-occupiers was the one-year fixed term, with 30.7%, up from 30.1% in March.

Next came the recently abandoned, but now back in vogue two-year fixed, with a 29.3% share, up from 28.7% in March.

But as said above, floating saw renewed interest as well, taking 27.7%, up from 23.9% in March.

However, the share of six-month terms dropped 11.4% in March to 7.5%

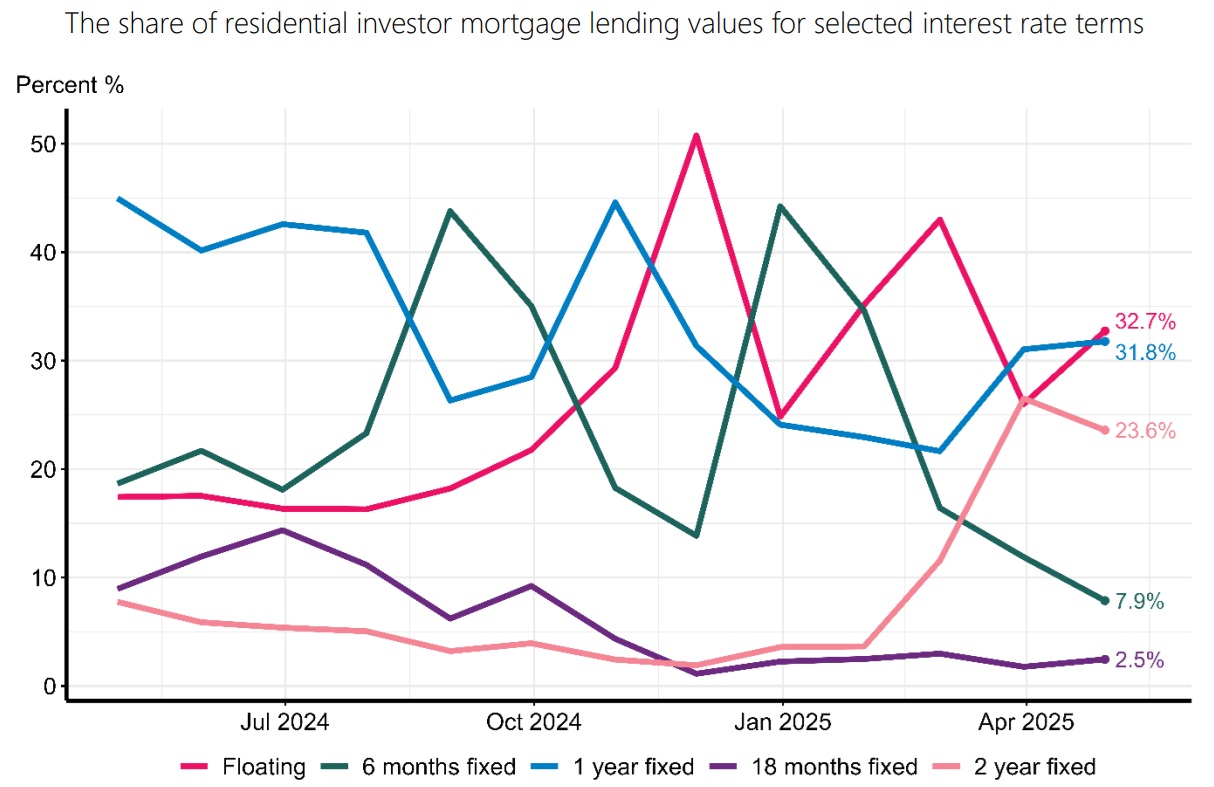

The trends were reasonably similar for the investors - though they got a little more keen on the floating rates during April.

For the investors the floating option was the most popular accounting for 32.7% of new lending, up from 26.0%

The share of of investor new mortgages with one-year fixed terms increased from 31.1% in March to 31.8%.

The two-year fixed terms accounted for 23.6% of new investor lending in April, down from 26.5% in March-25.

Some economists think the OCR has a way to fall yet, and may ultimately end up at 2.50%. But the RBNZ itself has indicated the low point may be either 2.75% or 3.00%.

The recent cuts being offered by the banks seem to suggest that without further significant OCR cuts they might not want to take rates much lower.

Therefore there's plenty to think about for those taking up new mortgages in coming months. And it will be most interesting to see what options the home owners take.

1 Comments

Today's rates are historically still low. Many here will recall 7-10% rates. If you plan to be there a while and have job security then a longer fix is worth looking at.

Lower rates are really an opportunity to hammer the principal of a loan in its early phase. Those that use it to borrow the max are gambling.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.