They've done a lot already, but the Reserve Bank (RBNZ) can still do a bit more cutting of the Official Cash Rate (OCR) - as far as those taking out new mortgages are concerned.

While the RBNZ has dropped the OCR from 5.5% to the current 3.25% since August last year, there's significant numbers of those taking out new mortgages that seem prepared to wait for more cuts and lower mortgage rates.

The RBNZ's latest new lending fully secured by residential mortgage figures that highlight what terms new mortgage holders are taking their mortgages out for, show that in May the most popular choice for investors (with 37.3% of the $2.5 billion they took out in the month) was for floating terms.

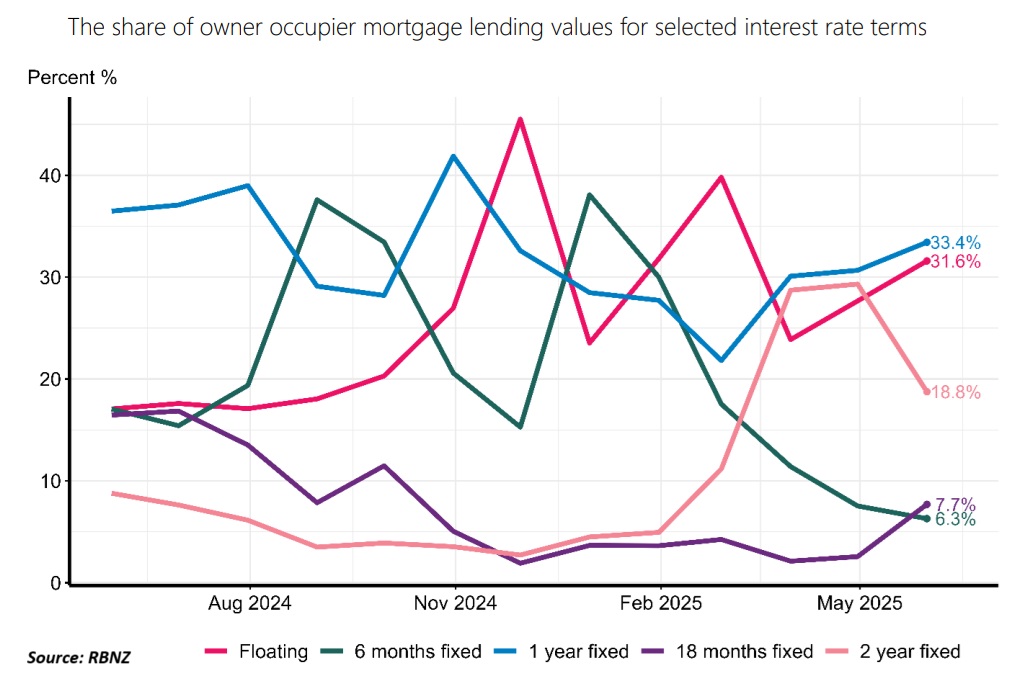

For owner occupiers the most popular option was the one-year fixed (with 33.4% of the $6.4 billion taken up), but very closely followed by floating, with 31.6%.

These figures, which are a relatively recent addition to the RBNZ's data set, date back only as far as 2021 and show mortgages as they are actually uplifted rather than other when they are committed to, as other data sets show. The RBNZ's summary of the May data is here.

So, we get to see quite a compelling, almost realtime view of the chopping and changing of strategies.

And there's been a lot of chopping and changing.

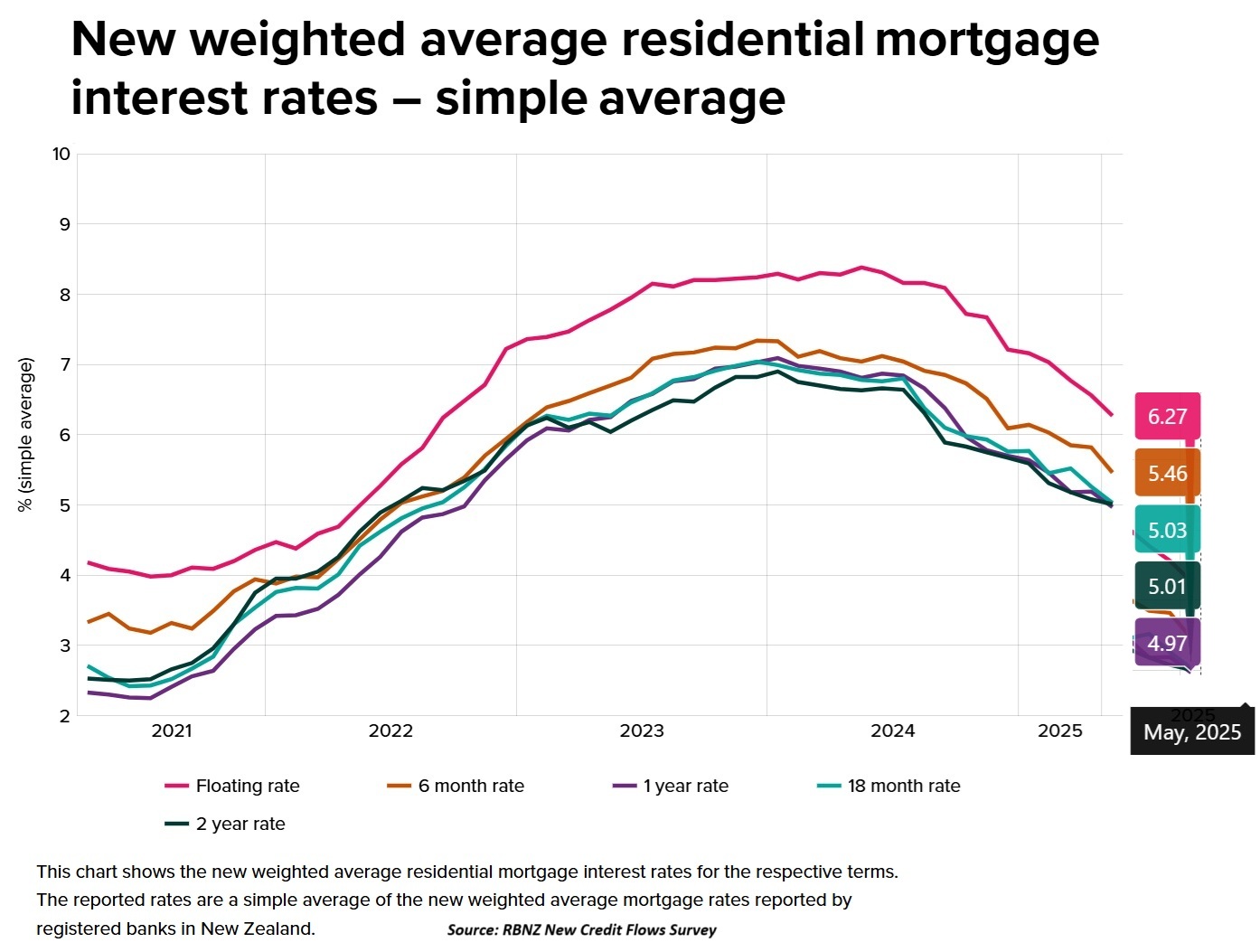

From early 2024 those taking up mortgages started to go for shorter and shorter terms in the anticipation that the RBNZ would start to cut the OCR. And indeed, mortgage rates themselves started to come down even before the first OCR cut in August of last year.

In May, of the grand total of $9.038 billion worth of mortgages taken out (which for the record is the highest monthly tally since July 2021), some 33.7% was floating and 66.3% was fixed. A year ago, in May 2024, just 17.7% of the mortgage money taken up in that month was on floating.

But anyway, in terms of the decisions being made, the homeowners are applying a sharp eye for the best deal they perceive.

In April a move toward two-year fixed rates was very much in train, but this has reversed markedly in May - and it's significant that has coincided with lower one-year rates going on offer. In April 29.3% of the owner-occupier mortgage money was on two-year fixed rates, but this dropped to just 18.8% in May.

Of course, it's well worth mentioning that the RBNZ had an OCR review on May 28, at which it did lower the OCR to the current 3.25% from 3.5%. It's a fair bet that more than a few people who took out floating mortgages in May were waiting on that decision.

While the RBNZ left the OCR unchanged at its latest review on Wednesday (July 9), it did hint strongly toward cutting further - which means there will now be strong expectation in the markets of a cut in the next review on August 20.

So, it will be interesting to see how the mortgage patterns develop over the next few months.

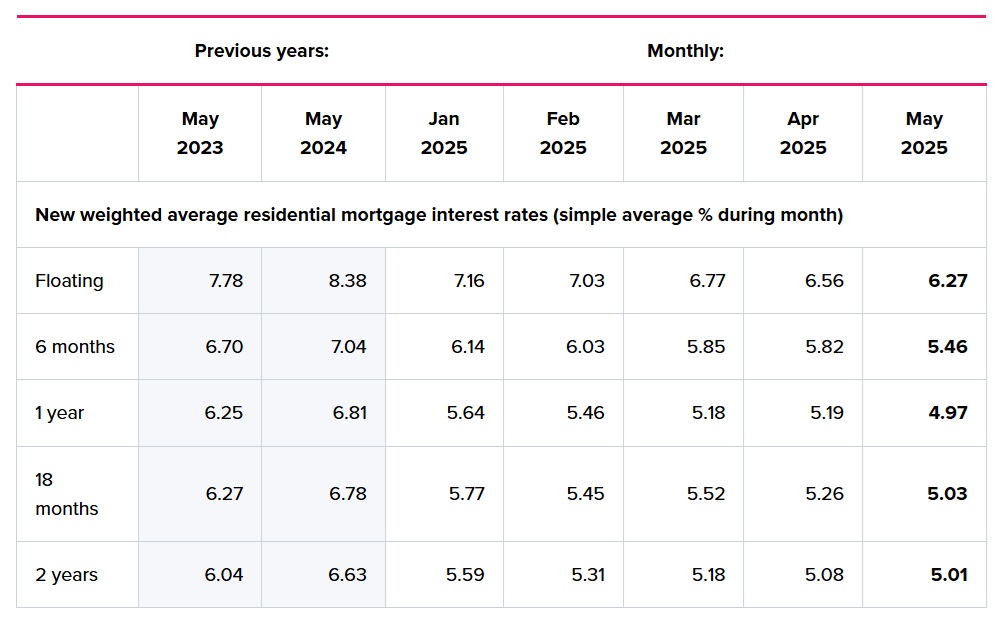

Separate data from the RBNZ shows the weighted average interest rate paid on the respective terms every month.

And this is pretty informative in terms at looking at how influenced people are by the rates each and every month.

The figures show that in May, the average weighted one-year rate was the lowest of all rates, at 4.97%. This is in fact the first time the one-year rate has dropped below 5% since October 2022.

Hardly then any great surprise that the one-year rate was the most popular choice for the owner-occupiers that month.

The big question now is how much longer people are prepared to wait for more OCR cuts. There's still some economists who see the OCR going as low as 2.5% this year, but others see a low point of more likely around 3%. Market pricing at time of writing was hedging between a low point of 2.75%-3.0%.

Right now it's difficult to see banks reducing their fixed mortgage rates significantly without further significant OCR cuts.

5 Comments

Unless absolutely necessary, why would anyone opt for floating over a 6 month term? Monetary policy does not implement at break-neck speed. Barring an emergency, it's almost always a measured process. Some people are receiving some bad advice I suspect.

People must have too much money. The difference between floating and a six month fixed term is 1.55%, that would be close to $4,000 on a 500K mortgage. It's extremely unlikely to win following this strategy.

Unless you are using it as an overdraft facility with while running a building project, or similar. Money in and money out while maintaining a negative balance. I'm sure lots are doing this on a commercially priced OD.

If the average punter is convinced that rates are going to drop further then it is probably a good time to fix long term.

haha probably true

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.