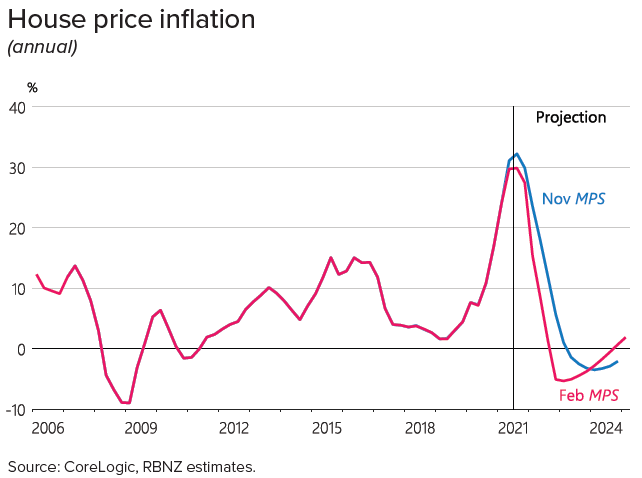

The Reserve Bank (RBNZ) is now forecasting an earlier - and sharper - period of house price falls, and expects in total that house prices may fall about 9%, starting from the current quarter.

In projections released with its latest Monetary Policy Statement on Wednesday the RBNZ forecast that there would be falls in the prices of NZ houses for each of the next nine quarters (including the March quarter we are in).

The annual rate of price drop would peak at 5.4% in March of next year (2023) the bank said.

In its last series of price projections in the November 2021 Monetary Policy Statement the RBNZ forecast that house prices would not start to drop till the December quarter of this year. And the peak annual rate of fall was only 3.5%.

The REINZ's figures for January showed a significant fall in both prices and sales - which was consistent with the anecdotal evidence that had emerged last year that the market was coming to an abrupt halt.

The RBNZ is predicting that there will be quarterly falls in excess of 1% in each quarter of this year, with the biggest - of 1.5% - projected to occur in the September 2022 quarter.

In the latest MPS document, the RBNZ said house prices have been expected to decline moderately towards more sustainable levels since it published its August 2021 Statement.

"However, the magnitude and timing of house price falls have always been uncertain," the RBNZ said.

"Nationwide house prices fell in December and January.

"Higher mortgage interest rates, policy changes related to investors and tighter credit lending standards are some of the key factors weighing on housing demand."

The RBNZ said its "central forecast" was for prices declining about 9% from the end of 2021 to mid-2024.

"The assumed slowdown in prices also reflects a significant increase in supply of new homes at a time when there is near zero net migration. Nationwide residential building consents are at record high levels, and residential construction is assumed to remain high for at least the next few years."

106 Comments

Be quick!

"Timing the market is better than time in the market"... Wait..

With plummeting valuations it's time out of the market.

Sell everything and hold cash.... wait...

Sharp minds would understand that to be a less bad strategy than holding real estate that is correcting in nominal terms for a prolonged period.

Brock

You really haven't got your head around the conceptual understanding that owning property is about long term and short term fluctuations are irrelevant.

The most important current short to medium term factor for home owners and potential FHB is one's ability to service the mortgage . . . and current trends and signals from RBNZ and bank economists is that is likely to get increasingly tougher.

The ability to service a mortgage is a function of the size of the mortgage.

It is extremely positive news that the size of the mortgage required for home ownership is now set to decrease for a number of years. This helps both first home buyers and those who wish to upgrade.

While you may consider "fluctuations" irrelevant, the astute first home buyer faced with the prospect of taking on 100k or 200k of unecessary extra debt during a period of rapidly rising interest rates couldn't be blamed for biding their time to let the coming correction play out. This reduces the likelihood of negative equity and keeps their options open.

As you say, home ownership is a long term thing. There is no need to buy immediately in an extremely overvalued and rapidly correcting market. One should never catch a falling knife. The wounds take a long time to heal.

I bought at the “peak” in 2015. If I had listened to people like you where would I be now?

tell me how selling now and buying back in later “when” prices drop isn’t timing the market?

do you think you should sell your family home now, uproot your family, gamble on prices falling and being able to buy back in?

2015 obviously wasn't the peak. Peak looks like 2 months ago. If you can afford the mortgage payments, that's good for your circumstances. But not everyone can afford to hold. Everyone has different circumstances.

The peak for me is when prices are so high people cannot afford a deposit and cannot afford repayments based on income, high inflation, rising mortgage rates, increased supply of houses, people leaving NZ, lower immigration, increased taxes, higher regulation. Not good for some, but ok for others. As with everything time will tell.

As an aside other half is in Insurance she has noticed a lot of people selling rentals and discontinuing their rental insurance. Take what you want from that.

Looking back it’s easy to say if things were or weren’t a peak but at the time that’s what plenty of people were saying.

The peak back then was Nov-Dec 2016. I know because my partners parents hit it perfectly at Auction with an eye watering sale at the time.

The writing is clearly on the wall for those that choose to pay attention.

If somebody has a family home already, no it is not likely to be worth the hassle.

Those who are aspiring first home buyers or wanting to upgrade... absolutely should let the correction play out.

Prices were trending upwards in 2015 and that's the critical difference. Prices have changed course and are currently declining, which logically gives people who are looking to enter the market reason to pause, especially as small % drops equate to substantial amounts of a deposit.

Hi Printer8, could you please state your agenda? I notice you ask this question to everyone.

Ex property investor association. Children with multiple rental properties.

Probably also has a child who is an econo-missed, it would explain the reaction.

probably a self-serving specufestor

"The annual rate of price drop would peak at 5.4% in March of next year (2023) the Reserve Bank said."

The spurious illusion of precision......

TTP

Both timing and time in is better than either

If RBNZ forecast doesn't stand. Who will be held responsible?

Does anyone in this government or bureaucracy take any responsibility for what they say?

This is all big scam.. Where is the police?

Currently busy having poo flung on them by people who have stopped believing the government narrative.

Panic buying toilet paper... slinging poop at law enforcement.

Welcome to the pinnacle of human evolution!

If their forecasts have been wrong roughly 100% of the time, what's the point?

If anything, they should forecast rising house prices, lest govt does something stupid to save those poor landlords and speculators.

CourtJester

Yeah? Who we going to listen to?

I recall:

"I could buy a property in the ballpark of $1.3-1.5 million right now if I wanted to - but I'm being prudent and protecting myself because I see a gigantic downside risk. I feel safer not jumping into a very unstable market".

CourtJester 20 Sept 2020 :)

Even bigger downside risk now, given what's happened since.

pity, you should have. You've probably missed out on circa 30% growth (approx $400K) in that time.

Of course you went back to that comment just to make this about my person. You're childish.

So, did I make the right decision? I still think so. I wouldn't be very happy to be paying back a million dollar mortgage at 5-6-7%... But your mind probably can't comprehend that people aren't all buying houses to flip them after a year or two. Pity you're so narrow minded.

By the way, how is this even relevant to my comment above? Seriously. You just commented to offend me. The smiley faces betray you, troll. Get a job.

He's infantile.

So bitter CourtJester.

If making the right decision means missing out on circa $400K, which would be the equivalent of your mortgage being free for over half a decade then yes you absolutely nailed it :)

My bad if you were offended but I just didn't want you to feel like you won the lottery with your bad decision. Remember, the best time to buy was always yesterday!

Why is not buying property a bad decision. Friend of mine invested in IT company 10 years ago for 200k, plus he added his expertise. He sold for over 20 mill.

We are setting up supply chains around the world using e-commerce channels. Been tough going, but starting to see upside, much more lucrative then property over long term and lot more diversified for risk. Also don't need hundreds of thousands for deposit. Good fun as well, as you can work on laptop from anywhere.

Property is not the best investment decision out there, but it is an easy one for people with no skill to grow different businesses. They also lack skill or knowledge of different investment vehicles, so go for low hanging fruit.

New Zealand needs more of his ilk and fewer of these bludging property investors being subsidised and sitting around on their ass-ets.

Another narrow-minded 20/20 hindsight invidivual. Or are you and printer8 the same person? That smiley face again after a trolling remark...

Are you bitter that you didn't invest in Dogecoin in 2020? You could have made $400k profit in a matter of weeks if you invested just a few thousand. Same argument, exactly as idiotic.

P8, decisions are made based on information available at the time. Your argument is like saying you were stoopid paying insurance on your house last year because it didn't burn down.

Hmmm, you can't judge individuals financial position based on these comments. Everyone needs to evaluate and make moves according to his her own tolerance and strategy

The RBNZ said its "central forecast" was for prices declining about 9% from the end of 2021 to mid-2024.

I enjoyed Orr's remark on this when questioned about it during the press conference: "We're more confident of the direction than the magnitude".

Take from that what you will.

"The RBNZ said its "central forecast" was for prices declining about 9% from the end of 2021 to mid-2024."

House prices were 9% lower than what they are currently just a few short months ago. Soft-landing is in the making......

You may loosen your seatbelts.

TTP

Seat belts? The wise have perfectly good parachutes. Others will need roll cages.

Hi R-P,

"Others will need roll cages."

You were rolled good 'n' proper when you came out with your phoney house price predictions a few years back.

The term deposit investments that you urged people to make turned out to be a complete fizzer over the same time period.

What a monstrous botch-up you made. 👺 Your appalling track-record is well-known.

How about a respectful apology to anyone unwise enough to believe you? They'll be after your blood.

TTP

You seem to have made a worse 'botch-up' in the past? I see people here rib you all the time about it...

Those who rib me are plainly envious.

For instance, in early-2020 I was one of the very few people (here, or anywhere else) that predicted that NZ house prices would rise in response to the initial Covid outbreak - as they did (and by a substantial margin).

A few people here conveniently overlook that.

TTP

Nice man, how much did you get at the TAB?

Tim, the economy has travelled even further down a dangerous path. Mortgage Brokers have played their part just as did banks. While the party has certainly carried on a little longer the true price of the money printing experiment is still in front and in plain sight. It's no botch up on my part. I played no part in creating this mess. Greedy short sighted Mortgage Brokers, banks, Real Estate Agents and their gullible clients did.

"Tim, the economy has travelled......"

You can't even get my name right‼️

TTP

What a monstrous botch-up you made Tim 👺 Your appalling track-record is well-known Tim Property Brokers and director ordered to pay $1.5M for price fixing | NBR

Careful Amokk, you are showing envy.

One of my many character flaws :)

....its easier to lend credibility to the RBNZ than to PRICE FIX houses.

"....its easier to lend credibility to the RBNZ than to PRICE FIX houses."

Show us your evidence about who "price fixes" houses?

Or is this more of your crap?

TTP

Is this the tile and timber swindler ?

Hi Amokk and Retired Poppy,

You produce no evidence - simply because there is none.

What is evident, however, is that you’re both clowns. 🤡🤡

There's little point in talking further with either of you because, as the time-honoured wisdom states: “Arguing with a clown only makes you look like one”.

TTP

Those real estate companies that were convicted and fined a combined $23m will think twice before attempting something similar. Fines aren't a real problem because that is just another cost of doing business that gets passed on to the customer, the real problem is that last year penalties were changed to include up to 7 years prison time. So I think we can be confident Tim is a rehabilitated man.

Retired Poppy, this has made my day!

This. The direction is obvious assuming that that rates go the way advertised.

The bottom is anyone's guess. Though whilst inventories rise prices will go down.

We've also not had the fed make thier move yet. Don't loose sight of that little chestnut.

Plenty of room for a downward correction.

Is it possible that the bankers have known for a while that the fall will be a big one (back to pre Covid prices), but they have chosen to communicate the change through a series of increasingly gloomy forecasts, sending a signal to the market without completely freaking people out.

This. If your JA OR Orr, why come out strong now when the market is already retreating?

For all anyone knows, we were already started along an Ireland sized decline, even before this 0.25

Don't want to kill the golden goose too early, we still need to feed the village this winter.

We're in the presence of a financial genius!

People get used their house value rising and the cost of servicing the mortgage falling. However unnatural the equity gains were they still expect to hold onto them as of right. When Q2 2023 come around and NZ is in recession and home owning voters have seen 100-200k shaved of their equity and they are having to spend another 10-20k of after tax salary just to service the mortgage interest.

Will the lure of a 3rd term for Labour create the need for interest rates to be cut?

I still haven't plugged the last year's 30% property price gains into my net worth spreadsheet. Anything that goes up that fast can go down just as fast.

Total wishy washy with a 9% fall over a period of years. Factor in they have no idea where we are going next month and its all just silly trying to predict that far out. My prediction of single digit gains this year has as much chance of being right. Maybe I should limit that to just Tauranga as Auckland is going down the crapper.

That's not what I'm seeing at the coal face, trying to buy (another) family property (so brightline or other pseudo CG 'tax' won't apply). Now RBNZ have broadcast that they have no respect for savings nor are they serious about tackling inflation, I am even more strongly motivated to purchase something for a silly price, as I really have no other choice (and am not prepared to park my cash in stocks for 10years). I see prices remaining static if not increasing slightly.

I understand your position. I'm also wanting to make our next family home purchase, but we just taking it pretty easy. No rush.

Consider hedging your position.

Orr has clearly communicated he sees current prices as unsustainable and the market has dropped the last couple of months.

If you are serious looking now, what's the harm in waiting 3 months. At this point all I see is more inventory (options) coming online.

Or start to make low ball offers. See what you get back.

Where we are from, 1hour from Auckland, there are for sale signs everywhere. 1 month ago there were 2 pages of property for sale, now 4 pages. Last week most houses came onto market. Also houses have either been for negotiation or auction, now we see actual prices.

Without a meaningful increase in OCR this is just noise.

It's now back to pre covid levels, not insignificant, with more coming along. This is going to play out over 1 or 2 years.

yep, who really knows where house prices are going . . . . not me and I doubt Mr Orr does.

what we can say with 100% certainty is, interest rate hikes will start to bite at some point, but maybe not at a whopping 1% OCR. Maybe after 13th April hike or possibly the next one. For some context, today's rate hike only takes us back to where we where at Feb 2020, hardly eye watering. Lets see it get back to 3.5% (April 2015) 3.5 x today rate. Or better still, lets go to June 2008 @ 8.5%.

Seems crazy, but that wasn't that long ago. If we can't tame inflation, we are going even higher!

Well I can't say where house prices will be in 2023 but I'm prepared to wager a substantial amount that they will be down 5% in the current Q1 of 2022 compared to Q4 2021

Anecdotal data would agree. there is already an oversupply of housing - 29 000 listed on trademe as of this morning- this time last year it was 22 000.

I watch the Wellington market specifically hutt valley.

Lower hutt - 564 houses for sale - which is 14 weeks SOH- this time last year there was 180 houses for sale.

Upper hutt- 230 houses for sale - which is 11weeks SOH - this time last yeas there was 84 houses for sale.

Currently 37% houses on the market in lower hutt have been on over 2 months.

200 of the 564 houses on the lower hutt market have a listed price - approximately 60% of them have lowered their prices since listing with a price. Average price reduction is 70K.

Of those with a listed price- approximately 40% are listed at a price 50K lower than their current QV valuation.

good on you. thanks for sharing your data.

Still only 829 for sale in Tauranga compared to 1100 when I was looking 2 years ago so that probably explains why prices are still rising down here.

$70K drop is quite a lot if working out the reduce deposit required and the interest paid over a 30 year mortgage term. Especially if rates keep normalising back to historical norms.

Great analysis - keep up the good work. This market needs more people like you impartially informing others.

Yep great data. I don't have the stats like you but without doubt where I live there are a heap more properties for sale, signs up everywhere. Also many that have been on the market for several months, clearly still holding out for big $$$.

Nice Post, thanks. Could be some bargains down in the hutt later this year.

There's still room for upward valuation.

Be quick!

More room by the day!

There's definitely more room at auction room these days

Genuine question: At what point do you see room for upward valuation ending?

Don't be surprised if these quantitative price falls are tested in focus groups to gauge sentiment before being announced to the public. I know it sounds ludicrous, but house price falls need to be as understated as possible so not to scare the sheeple.

How many are willing to catch the falling knife?

Bernard is that you?

His twin

I can not find anything in the past when they predicted 6% inflation.

My understanding is they also have a task to control inflation.

The annual rate of price drop would peak at 5.4% in March of next year (2023) the bank said

I'm pretty confident we'll see this drop of 5.4% in the current first quarter of 2022

.... and when it suits, the RBNZ has credibility.

Hello RP, been a while

The main issue with falling house prices is that most people feed their losses in the hope that they will recover them at some future point and/or they can't afford to sell and take the loss.

So the true extent of the real fall never is shown in the stats, because until you sell it is never recorded.

If what you are paying is no more than before the downturn, then as long as you can do that everything is fine, but if repayments go up, or you are feeding a paper loss investment that was purchased needing capital growth to give you the return, then you could be in trouble.

The money to feed the loss normally comes from other areas like holiday money, KiwiSaver, health, education, long-term savings, or selling spare assets like boats etc, or taking other jobs etc. The neglect of these areas can have its own negative effects.

How long you can hold out depends on your reserves and how long the downturn runs.

I would guess, that many people are tighter than they normally would be due to Covid, businesses on the brink with a loan over the house, having already raided Kiwisaver, etc.

And then we have that group of people that have purchased off the plan, paid deposits, and are expected to settle on properties where they cannot get finance (if at all) under the same terms they signed under, and the price had dropped.

Hmmm....

So what is a face value 9% decline, could easily be an 18% plus privately subsidized one.

https://www.youtube.com/watch?v=xhFrnHRlbKI

Have a look at this from the USA .....so many parallels, but won't happen here coz we're diff'runt......

Terrible in how it's presented, but very valid observations.

I think they are just jealous. Its not real.

Is it a joke, not giving a thought about the increase of 60% and then worrying about a fall of 6% to 9%.

...RBNZ is predicting...

There's your problem. We already know RBNZ couldn't forecast Easter.

Touché

When have I heard this same speech before? Before COVID? The Start of COVID? During COVID?

Always nice though to talk about doomsday - it keeps us alive and certain people on this comment section alive banging on their chest as they live day-in and day-out for this stuff. Fun times!

-7

Slowly, but surely, the last bulls are turning bears.

In recent times Yvil has done so, and now the eternally bullish Tony Alexander has done so, finally today stating house prices will fall.

But there's still a few permabulls around - CWBW, Ashley Church, Carlos 67....

“……and now the eternally bullish Tony Alexander has done so,..,”

Not turning bears, it is just an age thing. My father in law for one is a bit like that.

TA is actually a regular on here ….

I find TA quite rational. He called it correctly that housing wouldn't collapse post lockdown, whereas the infinitely more qualified comments section was jumping up and down with glee at "the end of the ponzi"

Yes he's mostly very good.

It only didn't due to financial stimulus.

Said stimulus is just the flick of a Switch.

The replacement cost of housing stock is up 20% since the start of the pandemic. By 2024 it will be up 40%. Obviously new sold at a premium prior. Do all the comment section hawks expect existing housing to sell for 50c on the dollar compared with a new build?

Most of the house price rises over the last decade or so has been a rise in land price - this is the fat that can be trimmed if prices fall. New builds would come down too as the section prices fall.

It's very obvious that land prices are a large component if you simply compare house prices in different regions. It isn't that much more expensive to build in Auckland than on the West Coast.

No great loss considering house prices double every 10 years.

A drop of 10% and they'll still be well over any rational price to income ratio. Me old hometown, ex statehouses in a mid-lower class suburb, houses valued at $850k. You'd have to be living on another planet to think that is sustainable relative to what these people earn, unless you think it is socially sustainable for the entire suburb to become a renter class. Will it correct over a long enough time-scale? Absolutely. Will it happen in our life-times? Ideally, but not something i'd bet on.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.