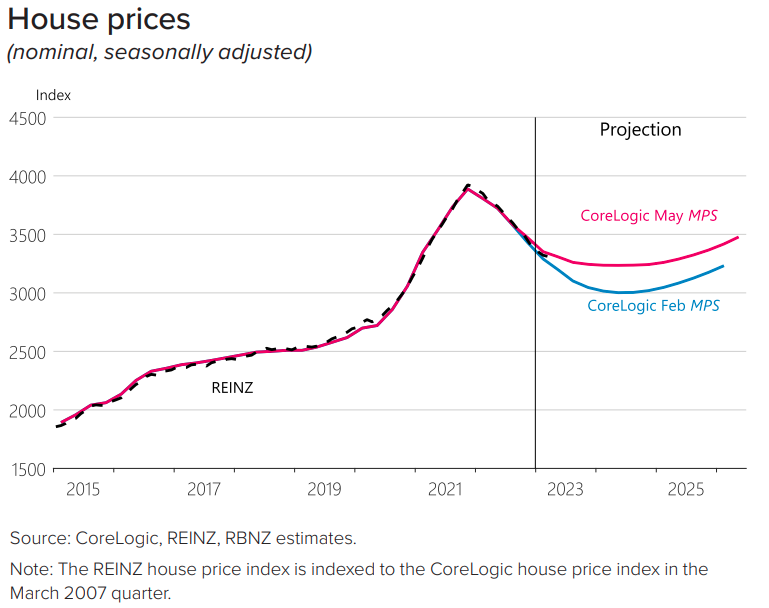

The Reserve Bank (RBNZ) has changed its view on house prices and now sees a much smaller overall fall than it did in its last detailed set of forecasts in February.

Back in February the RBNZ had forecast a peak-to-trough decline of 23%. Now, however, it sees just a 17% overall decline.

In February the RBNZ said:

"House prices are projected to keep falling in 2023, consistent with very low sales volumes in recent months. House prices are assumed to have fallen by around 23% from their peak in 2021 to their trough in mid-2024, before recovering as interest rates decline toward their neutral setting."

But it has changed its tune somewhat in its latest Monetary Policy Statement (MPS) issued in conjunction with the latest Official Cash Rate Review.

It is now forecasting that the falls will be much slower than they have been in the second half of this year and will have just about finished by the start of 2024.

It then sees house prices starting to rise (slowly) again in the second half of next year.

In the latest MPS the RBNZ said that house prices have fallen 15.3% since their peak in November 2021, measured in monthly terms.

"However, there are early signs that house prices may not decrease as much as expected in the February Statement," the RBNZ said.

"The rapid return of net immigration, an increase in the number of residents due to the one-off 2021 resident visa, strong nominal wage growth, stable mortgage interest rates, and a relatively low number of houses available for sale have contributed to a smaller decline in house prices than expected in recent months.

"These factors have led us to revise our house price forecast higher since the February Statement, and we now expect a peak-to-trough price decline of 17%, measured in quarterly terms.

"The fall in house prices to date is expected to flow through to lower household spending over the projection, as aggregate household wealth has fallen substantially."

44 Comments

Great.. These statements from RBNZ do help already inflated market.

Yeah right. TUI Add.

Only 1.7% to go. BUY NOW! Of course, that's if you believe that the RBNZ has gotten on top of inflation, while the global financial markets are saying it hasn't.

RBNZ Governor, Adrian Orr, shatters the wistful hopes of the DGM today.

Anyone who buys a house now will like likely be sitting pretty in 5 years time......

Thinking longer term is the key. (Avoid dwelling on the chill winds of 2023's forthcoming winter.)

TTP

I see we have reached the suckers' rally part of the downturn.

Normal service resumes Q4 2023 and Q1 2024. Will relay this to the water cooler crew. Should be a few head nods to suggest 'yep, that sounds about right.'

Sounds about right to me. The market was looking for assurance going forward and if rates have truly halted then its back to BAU.

Never underestimate your intuition. And when you have the chicken bone readings from the RBNZ, you can be feeling good. Hang on tight.

Open up the yield based cash flow analysis spreadsheet... another 4%... Yeah Nah

water cooler crew

Do they hang out with the Bloods, Crips or Normies

Source: Core Logic - Translated into english:

Source: Burning hot garbage analysed by an ignoramus panhandler.

You're welcome in advance.

-SMG.

More nonsense, so many so called experts have got forecast’s wrong add this to the list

Isnt that like the basis for about 80% of the traffic on this site?

The other 20% gets censored...

Not you though DTHR, as you told me: "Yvil, I have been correct in all my forecasts" Wow, you're the man indeed ! hahaha

Apart from you Yvil most people on this website would be better at forecasting that these so called experts, don’t forget to see that financial advisor if you are over leveraged in fact maybe you should stick with cutting down trees as cutting down a few trees made you a extra million, you are quite good at storytelling or making things up.

No need for me to see a financial advisor, I can just follow your advice for free since "your forecasts are always correct". You must be a multi gazillionaire with such 100% correct forecasting skills!

If the RBNZ forecast proves correct, I think it's likely house prices will underperform inflation for years, much like the 70s.

Its a no recourse statement. If only you could bank on this prediction, just like interest rates staying in the 2-3% range would continue...

Unfortunately you can't fix the prediction and stump up later.

the sub 5% 2 year rates will kick it off

They get their advice from an Independent Economist with the Nickname "The Comb"

The RBNZ is independent and free from political influence. Yeah right. This year’s election has no influence. Yeah right

HW1 will sleep better tonight over this news. After all wealth accretion is so important to him. He must have slept badly over the last 18 months as house prices reversed. I am pleased for him.

but the comb says investors have become net sellers

can you share the link?

Investor insights from The Comb:

A net 4% of investors say they will sell in the coming year. As the following graph shows, this is the second weakest level of transaction intentions over the past two years.

Why are we seeing a fresh deterioration in net investor purchasing intentions? Undoubtedly it is the combination of above average mortgage rates, many rolling off low rates near 3.5% to rates near 6.5%, and the passage of another year removing another 25% of interest expenses able to be deducted against rental income for tax purposes. The tax regime change turbo charges the effect of tightening monetary policy.

Page 2 & 3

https://www.crockers.co.nz/media/p1bdstwt/05-crockers-tony-alexander-in…

So if you're in the Bagrie camp like me, you believe the falls don't stop until investors return as the activity of FHB's and OO's won't move the needle

Forget the green shoots, market bottom narrative in MSM - is all B.S speculation

Any commentator with any credibility would want to see a minimum of 3 months of stable or rising prices before calling a market turn.

Thank you for that. This seems consistent with these two earlier reports

1) https://www.stuff.co.nz/business/131589273/landlords-planning-to-quit-b…

2) https://www.landlords.co.nz/article/976521507/more-landlords-than-ever-…

The main cause is likely that the investment properties are a large cash drain on household budgets when borrowers renew mortgage interest rates from low levels to current levels, the property either:

1) goes from being cashflow positive to cashflow negative OR

2) goes from being slightly cashflow negative to hugely cashflow negative.

Have seen reports of cash top ups of up to 20,000 to 25,000 per year required. That is a lot out of post tax income of household budgets. Even more if the borrowers own more than one investment property.

The key question is: HOW MANY BORROWERS WILL BE UNABLE TO HOLD ON?

Could someone do some follow up articles with those “I’ve bought 20 houses during the pandemic” type shysters, selling their “I worked hard and sacrificed” narratives?

Would love to see how the change from 2.5-6% is working out for them and if they are just working hard and sacrificing still…

FYI, here are some sample calculations done back in Nov 2022, when interest rates were lower than current levels

Also they are assuming in future years mortgage interest rates going down to 4.5% level. If mortgage interest rates don't fall and remain at current levels, would the property investor be able to hold on?

https://youtu.be/LZf7xB0pttY?t=82

Then here is another scenario that might play out - what happens if household income falls? (e.g in a recession- reduction in hours worked for wage earners, lower commission income, etc or even loss of job and the income earner gets a lower paying job).

In the last recession, there was a report of a property investor with 3 investment properties and his owner occupier house, who lost their employment and was unable to find another job, and the lenders moved in to sell all the properties. When previous buyers become sellers, that is how real estate markets go from being a seller's market and become a buyer's market.

Maybe Tony should live up to the social licence and pay us, the public, for his shitty advice over the last 3 years.

He is NZ's version of Jim Cramer.

It's quite simple:

Yes, high immigration will support house prices somewhat, but that will mostly put pressure on rents. On the other hand, interest rates don't need to keep rising for further weakness to occur in house prices, it just needs time for fixed mortgages to be renewed at higher rates.

Conclusion; house prices will keep falling over 2023.

Yvil you have just got a forecast correct house price’s are going to keep falling we’ll done you are coming from the dark side. Did you always want to be a lumberjack.

Future, 2022, XXII and all the other banned accounts, is that you?

I hope he is - would like to see another Scroll opened. I think Future suggested 10% mortgages this year. Seems unlikely, but with stress tests at 8%+ he wasn't far off.

Inflation will continue to be an issue so I'm suspecting the OCR will stay where it is for 12+ months, the alternative would be further increases - especially if boomers continue to spend their tax free capital gains, like drunken sailors, from selling their rental properties.

Agreed and inflation will keep roaring as well. Will it drown out the cries of the speculative moaning about higher rates and removal of tax rinsing.

Nation of renters, $400 per room per week, Wi-Fi included…

Did you say "free" wifi?

Deal!

Ill take it for $500

What has Orr got right so far...

Inflation below the target 3.5% NO

Also, retail spending falling like a brick

Cost increases flowing thru - electricity, Gas, rates, passports, winter food, petrol subsidy removal, imports, freight, etc

I believe the government has to drive inflation down. Not Orr.

I predict inflation to rise again, unemployment to rise, immigration fo drop and tourism to fall.

Orr and Robertson will be proven to be poor managers of the economy and be gone within 12 months

I think Orr will be gone, but only if National get in. The existing setup has become a boys club. People need to realise that the RBNZ were never going to crash the housing market. They tried to jawbone the market over a year in advance that rates would be rising but the sheeple did not listen and kept on spending.

17%? Hmmm, pretty close to my prediction of 18%.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.