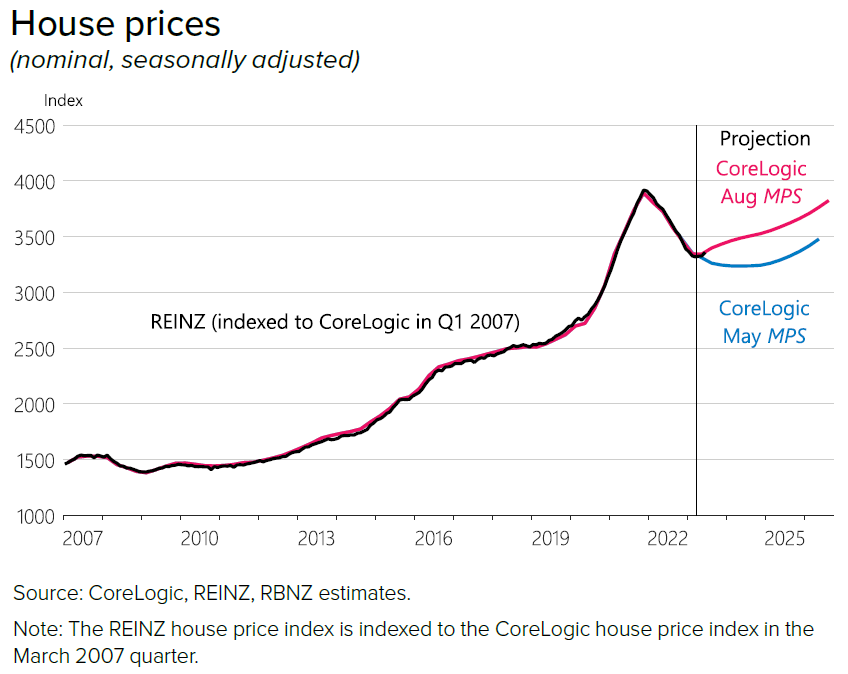

The Reserve Bank (RBNZ) has again changed its view on house prices and now reckons we will see price rises in the current quarter.

And in forecasts prepared for its latest Monetary Policy Statement, the RBNZ said it believed house prices hit the trough - and stopped falling as of the June quarter.

This means the bank has revised up, quite markedly, its forecasts for the housing market in each of its last two Monetary Policy Statements.

Back in February the RBNZ had forecast a peak-to-trough decline in the market of 23%. Then in May it was 17%. Now it's just 15%.

The RBNZ now reckons that prices will grow 1.6% in the current quarter and the by March 2024 we will be seeing annual growth of 3.6%.

However, the RBNZ does not see this rate of growth accelerating, indeed after forecasting a 'peak' annual growth rate of 4.3% in June of next year the central bank sees the annual rate declining back to 2.6% by March 2025. However, it does see prices then rising a little bit more, with the highest level, 5.6%, set to be met in the last forecast month, which is September 2026.

Back in February the RBNZ said:

"House prices are projected to keep falling in 2023, consistent with very low sales volumes in recent months. House prices are assumed to have fallen by around 23% from their peak in 2021 to their trough in mid-2024, before recovering as interest rates decline toward their neutral setting."

But now in its latest MPS it says:

The constraining impact of high interest rates has been most visible in spending and economic activity related to housing over the past year. Higher interest rates have contributed to lower demand for housing, with house prices falling 15% from their peak in November 2021 to March 2023. Stronger net immigration, alongside a peak in interest rate expectations, has occurred at the same time as house prices have started to stabilise in recent months. While the outlook for house prices is highly uncertain, they are now assumed to have reached a trough earlier than was assumed in the May Statement.

The RBNZ said the stabilisation in house prices over the June 2023 quarter "was earlier than anticipated in the May Statement".

"The rapid return of net immigration, an increase in the number of residents due to the one-off 2021 resident visa, strong employment and nominal wage growth, slower increases in retail mortgage interest rates and a relatively low number of houses available for sale have contributed to this recent stabilisation in house prices," the RBNZ said.

"Consequently, we assume no further falls in house prices. We assume house prices grow gradually over the next year before increasing at a slightly faster pace in nominal terms over the remainder of the projection."

"Although house prices have stabilised, they are significantly below their previous peak. This lower level of house prices is expected to flow through to less household spending over the projection, as aggregate household wealth has fallen substantially."

65 Comments

Checks calendar. Nope, not 1 April.

LOL! - and the downturn with all the unemployment to boot hasn't even happened yet!

Translated - "through unintended consequences we cannot risk them falling any more"

It becomes more obvious by the day the 'institutions' want to keep house prices beyond the reach of Barbie and Ken.

What will it take? Pitch folks?

NZD under .60 will put more pressure on inflation.

Notice they speak of nominal wage growth, not real wage growth. Unless real wage growth heads into positive territory, inflation heads quickly back down to 2% and credit rules relax again, there will be no or minimal chance of any house price growth coming from anyone outside the investor class.

My guess is they are predicting the Fed will crash the global system, then open the global flood gates to credit for the investor class. Also they predict National wins a coalition government, allowing that very same international investor class to flood NZ with all that cash to stash in a safe place during the impending recession/depression.

At current prices together with a new higher normal for interest rates, FHB's providing support at this point is financial cannon fodder. These are real people not pawns in a game to protect the greedy from the fallout of poor decisions.

Homes should be for living in and not speculating on.

Homes should be for living in and not speculating on.

I totally agree. Stop this and NZ really would be making progress.

It is amusing to see two articles on here, back to back on the same day, in which one says prices are still falling across most of the country on Trademe, and the next saying the RBNZ says house prices have stopped falling. This is a clear case of 'don't believe your lying eyes', so which set of eyes are lying?!

DGM showing signs of clinical anxiety this morning.......

They know that headlines like this can lead to FOMO and upward movement in house prices.

Anyway, the DGM can hardly complain....... for at least the last 18 months, house prices have been weakening, so they've had ample opportunity to buy on favourable terms.

All good things, however, eventually come to an end - and housing market corrections are no exception.

TTP

FOMO means nothing without credit availability.

My Favourite - Interest Rates Will Stay Very Low For A Very Long Time. And then they Broke all Records for the race to the Top. And still more to come.

As The Prophet would always say, what the Vested Interest Brigade say - Believe The Opposite !

Cover to allow them to continue to raise interest rates?

One only has to look at that graph to understand why we have the social ills we do...

Agreed, that graph must match the DGM's daily Prozac prescription. The RBNZ forecast is for more trips to the Chemist.

^Douchebag of the day award

The DGMs will always find a way to negatively spin headlines like these. 50% crash incoming!! They’re just struggling to accept that we’re past the bottom.

Is this a smoke signal to suggest there is no relationship between dairy auction prices and the bubble?

"Consequently, we assume no further falls in house prices. We assume house prices grow gradually over the next year before increasing at a slightly faster pace in nominal terms over the remainder of the projection."

I can't see any street parties from my webcam (overseas at present). Perhaps the msg hasn't cut through yet.

"Although house prices have stabilised, they are significantly below their previous peak. This lower level of house prices is expected to flow through to less household spending over the projection, as aggregate household wealth has fallen substantially."

OK. This seems like confirmation that the wealth effect is in reverse. But the prior comment says house prices have stopped falling. That possibly means that the pointy heads believe that there is no synergistic downward spiral between the wealth effect and house prices. But they don't say. Or don't know.

There has to be enough excess wealth AND credit availability for there to be growth, at present that is still in reverse gear, therefore this is a prediction of a significant back track on interest rates due to an impending crash. Are we seeing here a prediction of incoming hyperinflation?!

Just more nonsense, when was last time the RBNZ got any forecast correct now trying to tell us no further fall in house price’s which is already incorrect and the next faze of the crash is just hitting another slippery slope.

'phase'. But your point is clear.

Do you get the feeling the RB is worried about "macroeconomic stability" i.e. some financial institutions incl maybe bank or two failing, so they're trying to jawbone up their balance sheets?

RBNZ = Rhetoric Bank of NZ

It’s not a forecast mate, it’s fact. Go to a few open homes maybe to gauge the room instead of vehemently refusing to accept the reality that we’re past the bottom. I realise it’s a tough pill to swallow though,

He has more ticks than you, it stands to reason DTRH must be right

When I look at that graph, I want to see rates rising further to kill this ugly house price growth which threatens our social fabric and productivity

All these prediction news releases should be put in context. We need a graph of past RBNZ predictions and how much they were off the charts. Then we can classify the current one among the others to gauge how bonkers it is

Yes please. A range on the reliability of past predictions and then extrapolated out for a prediction on the range of reliability on this one...

Surely RBNZ have such a model themselves....

I'm picking house prices to flat line for the next couple of years. With inflation sticky it will be a fall in real terms. I don't foresee the projected rise in unemployment rate (4.5%) to have a negative effect in house prices. Those at the bottom of the employment ladder are less likely to be players in the housing market.

Depends on what happens at the election in October, if National get in then there will be more confidence in the market and I see the RBNZ prediction being about right. Been picking the bottom to be from August to October for a few weeks now. I think this summer will be the start of the recovery.

I'm going to stick with my prediction of several weeks ago.

So all those mortgage holders still to roll off the cheaper rates are going to be sweet? Is this what they are saying?

Nah.

They just say stuff they hope will happen...

Just like inflation was temporary and interest rates will stay low for ages.

Economists my @$#%

The RBNZ’s most powerful tool is the OCR, that is, the Oral Crap Release.

Yeah. And it's Safe and Effective.

My 1.23 cents (inflation adjusted) is that house prices *might* find a floor in the 2500 to 3000 range on that graph. The fundamentals (interest rates and inflation) suggest that even that range will be difficult to maintain as that level correlates with mortgage rates of 3.5% compared to the current 6.5%.

This is simply a case of wait and see, as lots of highly leveraged people will not be able to sustain these interest rate levels indefinitely.

Nice comment!

Maybe if the index reflected real house prices. Divide by your 1.23 for a more appropriate comparison to the before times.

Not a word about potential economic troubles, a recession, bankruptcies or rising unemployment. Quite astounding in my view! Well, based upon the RBNZ's rosy forecast of a goldilocks economy, I would agree that house prices may rise again, BUT sadly, I don't see the economic future of NZ as positively as they do.

Bit like Bernanke in the US Yvil before all hell broke loss with the GFC (subprime issues are 'contained', no housing bubble etc)

Realised that there is no point listening to what central bankers have to say after watching that unfold.

They tell you what they would like to happen, not what could or is likely to happen.

What are they smoking

Didn't an article I read today suggest the Gloriavale party was thinking of allowing foreign investors back into our property Ponzi?

Luxters concern for Kiwi battlers with huge mortgages, on rnz about an hour ago, bought a tear to my eye:-(

desperate times call for desperate measures..... get OUT NOW!!!!!!!

7-house-Luxon and his band of merry Property Investors (MPs).

Cant imagine they have a vested interest in stoking the eproperty market

I'm genuinely worry about this, should I be worried?

Isn't that little uptick a classic Bull Trap on the speculative bubble graph. Its all down hill from there. Just google it.

The RBNZ history of prediction successes?? ZERO. and a BIG FAT ZERO at that.

They will be hiking big in the next 6 months and ALL debt funded assets will tank bigger, than a milk laden Fonterra 18 wheeler!

The dead cat bounce I believe it's called

Houses prices up 10% in 12 months. GUARANTEED.

Why stop at houses? Why don't we ban the importing of fridges? Limit supply, provide preferential lending to fridges purchases and bid the prices up. I'm certain it'll make us a Rockstar economy. One day I can tell my grandkids about how the old Kelvinator I bought for a dollar is now worth $150000, and that the new generation is just too lazy to ever get cold food storage of their own as I take half their food to be able to use my cooling facilities 🙃

A lot of commenters here are terrified that house prices may start going up.

Yet, it's like the tide going in and out or the sun coming up in the morning.

Not so. Just wanting and orderly reset to a level that wage earning kiwis avoid being exploited by speculators. The key message yesterday was rates likely higher, and definitely for longer. According those hiding on five year fixed rates are more likely to get run down by rates hikes than they were a week ago.

Downwards always stickier than upwards. Patience with the popcorn...

Your second sentence confirms my observation.

I'm one of the terrified. I better start making plans to move to OZ when it does, like my other workmates.

Sounds like they are not watching what is unfolding in China right now.

Agreed. CCP can compell citizens to bring their cash back. Lotta cash sitting in Auckland.

Sounds like a contrarian indicator.

If you flick thru the latest auction results here...

https://www.interest.co.nz/property/residential-auction-results

... you sèe why the spruikers are wetting themselves!

Properties RV'd at 960k are selling at 630k,

Properties over million bucks are not moving.

Most sales are at the lower end of the price range and selling at pre covid Cv hikes.

Hey Orr, the prices are falliing AND FAĹLING FAST.

End of the day its not that people don't want to buy, they absolutely do. They just are facing the reality of 7% debt and cannot make the payments and put food in their mouth. Both terminal in their own way.

I am firmly in the camp of wanting house prices to moderate another 5-10% over the next 6-12 months. However, citing a few anecdotes doesn't make my wish come true, and neither will it make yours Mofo Fomo. The REINZ monthly report is the best data we have and the last one supports the narrative that the market has plateaued or may have even had a small up tick. With inflation where it is property value is still declining, however the equilibrium of influences is shifting. Spring and an election may be enough to generate month on month momentum the "wrong way".

Guess they didn't ask the interest.co.nz comments section

Sounds like RBNZ has got their predictions wrong again. I'd think with all the doom and gloom around its unlikely to go up anytime soon. Maybe Grant Roberston's been telling them what to say.

popcorn.gif

The best time to buy property is when interest rates are up. And that's right now. It will never get cheaper to build a house with all the new building code compliance increases.

Just watch Oil prices head higher going into the Northern hemi winter ..US SPR needs refilling + demands increasing with more energy demands ... NZD weakness .. inflation in energy with effects all consumers goods and workers ..

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.