So, was anybody else a bit surprised at the strength of the August sales data released this week by Auckland's largest real estate agents Barfoot & Thompson?

The 879 sales recorded was by a distance the most for the company so far this year, easily outstripping the previous high of 765. New listings, at 1577, also easily surpassed the previous 2023 high of 1460 in March.

And all this only around two months out from an election that will likely have a significant impact on the housing market.

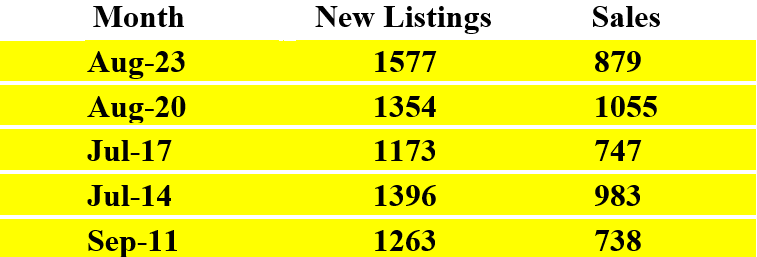

We can't quite compare apples with apples when it comes to looking at what happened in the run-up to previous elections because those fickle politicians keep changing the dates on us, but we can kind of have a go by picking 'equivalent' months around two months before ballot day. So, here going back to 2011 are the Barfoot & Thompson new listings and sales figures about two months before the election. (The 2020 election was also October, while in 2017 and 2014 it was September and in 2011 it was November.)

What we have seen in the past is that house buyers and sellers can tend to hold off in the run-up to an election (2011 was particularly notable) as they don't know what sort of policy mix might be prevailing after - and what that might do for house values.

Okay, we shouldn't make too much of just one month's worth of activity, but the August 2023 figures stand out both for being very much the strongest figures in what's been a very weak year and for being comparatively quite strong when compared with equivalent months leading up to previous elections.

Perhaps it's dangerous to draw conclusions but it suggests a fair few people are expecting National, with its housing market-friendly policies, to win the election and that in any case the worst is over with the housing market and the recent string of falls in prices we've seen.

Are people right? Well, it is definitely worth asking the question of where to from here?

I'm certainly not going to try to predict what happens with the market. That way madness lies. But it's worth having a look at the scenarios. Without trying to state the obvious, it seems to me that what happens next could follow any of the following lines and I don't ascribe greater or lesser odds to any of them:

• The current uptick in activity is short-run. Gloom and doom resumes from here and prices start falling again.

• Prices and activity kind of 'drift along the bottom' for the foreseeable future.

• Prices and activity slowly pick up from here but don't set the world on fire. (The Reserve Bank is picking this, as are many bank economists).

• Prices and activity start to quickly pick up and we move back into 'party' mode again.

• Something nasty happens on the world stage (think GFC) and the market's legs are knocked out from under it (a la the GFC).

I think I've covered most things there. Anything I've missed? So, what do you think comes next?

It seems to me that, certainly in the last 20 years, the kind of 'default' setting for the New Zealand housing market is 'frothy'. Home ownership and housing investment have always been deeply rooted in the NZ psyche. But it seems to me that particularly in the last 20 years - and kicking off with the galloping market we saw in the mid-2000s - the obsession moved to a new level. The number of times we've seen the market overheat has reflected that.

And it does feel at the moment that there are people out there, restless, waiting for the housing 'machine' to start up again. After all it's now been two years since we were in a bull housing market frenzy.

Looking back at the previous market rise it seemed on the face of it utterly preposterous given we were in the middle of a pandemic. But like all these things we can find at least some explanation by examining all the circumstances.

The key thing is that interest rates had hit the floor, allowing momentous amounts of money to be borrowed with interest servicing costs that were actually eminently doable. That was the fuel. All we needed was ignition. And that was supplied by the RBNZ's 'interesting' decision to temporarily remove the loan-to-value ratio limits from May 1, 2020.

Clearly, things are different now. The LVRs are back. Mortgage interest rates are around 7%, while in 2020-21 they were well under 3%.

The impact of interest rate levels on the housing market can't be overstated.

The RBNZ put out some most interesting work in the middle of last year that put our experiences of low interest rates and high house prices into a global context - and the fact was that post the 2008 GFC we saw, compared with other countries, one of the biggest falls in mortgage rates in this country, along with high population growth.

So, we got what we got, culminating in the hair raising 40%+ price surge during the pandemic.

The current level of interest rates would appear to be a significant drag factor when looking at the prospect of any sort of repetition of a raging bull house market.

In 2021 if you borrowed $1 million to buy an Auckland-priced average house you might have been paying around $4200 a month in interest costs. Now you would pay $6650. That's quite a handbrake.

How long will interest rates stay this high then? Well, the RBNZ's signalling that it doesn't see the Official Cash Rate starting to come down till into 2025 - well over a year away yet. That doesn't mean that mortgage rates can't and won't come down earlier if wholesale interest rate levels are anticipating falling rates.

But it would be intriguing to see how the RBNZ reacted if mortgage rates did start dropping before it felt it had inflation (6% annual rate as of the June quarter) completely under control. Earlier this year the RBNZ put out a discussion paper that suggested that central banks could be "justified" in using interest rate rises to combat high house prices. That would certainly be an interesting approach.

Would the current interest rate levels necessarily prevent the housing market from really starting to bubble again though?

Well, as mentioned higher up this article, the RBNZ did explicitly reference NZ's high population growth as a key factor in our high house prices. Obviously with closed borders the population hasn't grown that much in the past few years, but it's surging again now thanks to a new wave of inbound migration. That will certainly continue under a new National Government.

Overseas buyers have been largely ruled out - but they will be back in business under a National Government. And then the reversion back of the Brightline test (don't call it a capital gains tax, whatever you do!) back to the two years it was originally when the previous National Government introduced it. And then there will be the re-introduction of interest deductibility for housing investors.

At least some of these factors would likely be relatively impervious to elevated interest rates.

The election result is crucial as is the aftermath and what policies will prevail regarding housing. It seems at least some people are betting already (by buying now) on what will materialise.

We've seen before that it takes very little to flip the switch in this country from FOOP (fear of over-paying) to the more customary FOMO (fear of missing out). It will be a case of when not if.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

154 Comments

Bought 6 September 2018, on the market 6 September 2023. Draw your own conclusions.

https://www.trademe.co.nz/a/property/residential/sale/hawkes-bay/hastin…

Yup, as I have previously mentioned, the original 5 year Labour Brightline lockout period began expiring from April this year. So a slow trickle of ex-rentals will make their way to the market as the year ticks over. The tidal wave will come in June 2024 when National reinstate the 2 year lockout retrospectively, so everyone who bought before June 2022 will be free to sell up and escape their horrendous cashflow negative situations.

They're free to sell now anyway. If the worst case scenario is paying a little tax on extra free money from housing being pumped by the Reserve Bank, that's hardly a worst case. Suggests greed could be standing in the way of sense.

In any case, buying and selling for the purpose of capital gains is taxable under NZ's income tax act. One hopes this is not yet more tax evasion in the sector.

It's meant to be taxable but there's a loophole/exemption if there was no intent to sell for the purpose of capital gains. It's been abused for sure. Hence rewriting tax law to remove the inequities between capital and income would be the best starting point for any government, rather than ineffectual and complicated tweaks around the edges.

They call that loophole "the property ladder"

But when someone buys a rental, isn't the properties value growth over time where the investor actually expects to make their money? eg when they eventually sell, whether that is 5 years, 10 years or 25 years down the track. So I have always wondered by that gain in value has been tax free. Don't they tax this growth on investment properties in Australia?

When they brought in the removal of interest deductability, I heard a property investor on the radio saying she would prefer that they brought in a CGT. Why don't we have this in NZ?. Instead we have all this discussion over wealth taxes, and and other ways to generate tax, which is a crazy tax, only a few countries have it and it doesn't work. But a CGT on property does work and is perfectly fair. It would also incentise people to invest in other things outside of rentals, such as growing businesses.

Well yes and no, if you buy and sell then buy again you effectively make no money since the prices of all houses go up. Now on your final sale maybe, but then if you say give that house to your children/grand children either directly or indirectly through selling it so they can buy their own. What have you real profit made? You had a place to live, someone still has a place to live nothing of real value has been gained.

There is the loop hole when people say they are investing but not for capital gains when they clearly are judging by their actions, but the problem I see with introducing capital gains is while you may stop those people (and its a big "may" in my opinion since I think they will just find another loop hole) you also impose a tax on people who are truly just trying to rent out a house, make some money on the side and then give those assets on to their descendants. These people could see the house price increase as an negative thing, because instead of having some rental income when they retire, they now have to give their rental properties to their children because they they can't see them buying a house by themselves. On top of that they have to pay a capital gains tax.

The key here is what proportion are doing what? and are we willing to hurt those people you are not speculating on the housing market, in order to punish the ones that are?

Considering you would have to pay 39% of any gain to the Govt, I understand why people might try to eke out their 5 years before selling. And as many people are only selling because they cant afford to keep the property, it is not taxable (ie. no intent at time of purchase to sell). If interest rates weren't 7% they probably would still be holding on. Its these forced sellers that will crash the market.

But doesn't the 'intention' of buying still trump the brightline test? eg If the IRD can show that someone purchased with the intention of a capital gain. Or does the brightline test trump intention?

Brightline trumps Intention, for the period of the Brightline. After that, its Intention (plus the other Income Tax sections that might apply to real estate). But its intention at the time of purchase that triggers the tax, not deciding to sell because interest rates have gone up to 7% and you are haemorraghing cash and cant afford to keep it. As everyone says "I bought that house thinking it would be a good investment for my retirement and to pass on to my children" its practically impossible for IRD to prove an intention to sell at the time of purchase. Intention is designed to capture those who bought properties knowing that they were only going to be temporary holds - developers, flippers, subdividers, landbankers, etc. People who are flipping properties were always captured by the Intention test, Brightline just removed the administrative work. It should never have been used as a backdoor capital gains tax because now its distorting the entire market by preventing the supply of homes on the market. And if that distortion is removed suddenly, then things could get really ugly.

I honestly don't know how people especially in Auckland be able to afford an investment property based at the current interest rates, plus the restrictive nature of lending.

I am mortgage free, debt free and looking at purchasing a 1.3m investment property in Auckland is impossible. Bank lends me 800k. I need to find 500k cash. Then pay over 7% at 800k which (back of the envelope) equates to ~5k a month.

That's before rates, insurance, blah blah blah, and also I need money to live.

God knows where the money is coming from but there's seems to be lots of cash rich people out there buying.

I don't think they are all cash rich. I know many people with investment properties who are under financial stress. Having held investment property during the GFC I am always surprised at how many people think/thought hosing was a one way bet. I bet a whole generation now have a new perspective.

...no guessing who they will be voting for then.

A party who advocates a free ride for property speculators while working Kiwis bear all the tax load?

Neither of the two main parties help working Kiwis.

You'd think that a party named for workers, labour, would have policies like low income tax rates that help workers. But on an income of $100,000/year, Te Pāti Maori, TOP, ACT, National, and even Greens policies result in lower income tax (in that order). On $200,000/year income, it's ACT, TOP, National, Te Pāti Maori, Labour, Greens (in that order). I'm talking purely income tax here, not benefits, rebates or capital taxes.

Absolutely, Labour suffered from becoming National Lite in their approach of overtaxing work and propping up property.

By not adjusting the rich pricks tax brackets because that would give tax cuts to the rich, they have created a scenario where the poor are now paying the rich tax brackets. Its an own goal for the socialists.

What about nice rich people? Or poor pricks? Or is anyone with money automatically a "prick", and to be a good person, one has to be poor?

Its too late to ask Cullen. I guess it has to rhyme.

If that's the case, this cost of living crisis is making the country collectively less pricky.

"Socialist" is such an odd term in New Zealand. The old - who received debt-free entry to the workforce and affordable housing thanks to their forebears' taxes - sit on a universal welfare benefit while handouts go to business and landowners when there's a flood, a drought, or other hard times, yet wag their finger and tut-tut "socialist!" at younguns while claiming to have done it all on their own two feet.

FYI I am not that old, my entry to the workforce involved a lot of debt, and I may not get a universal welfare benefit. I also tend to vote left (but maybe not this time). But I am not really a fan of my income being taxed to buggery to give to other people while I am paying off a huge mortgage for an average Auckland house. In fact most of the recent socialist policies benefit old people, like winter energy payouts and free prescriptions.

Yes, apologies - it wasn't actually aimed at you specifically but at the way the word is thrown around in NZ so often.

You are coming into the market, I have been there, it is a joke. The sales here (if they are investors) will be people already in market looking for incremental upgrades or downgrades. The math for new entrants is not there at the moment, even the existing investors running high debt levels will be well underwater at the moment.

Well, banks don't care how much existing properties you have, whether they are with a mortgage or not. All they currently care is how much you earn and how much you spend.

So based on that, even if you have 5 investment properties today, if you aren't earning another 200k, you can't leverage your existing properties to buy another. The banks don't care thanks to CCCFA.

Mr Frank if you have 5 investment properties retail bank won't touch you anyway you have to go to 2nd tier. Resimac Avanti Base Corp all will loan you with no income if an individual or if they don't then set up a company and the CCCFA dosnt count

If no one new is entering into the home ownership club we have effectively returned to the Middle Ages. You are either a land owning duke or a turnip growing serf. Land can be swapped between nobles but not acquired by the peasantry. The lot you are born into is the lot you will die in.

The lot I accepted years ago. Fortunately, I quite like turnips, mashed in with spuds.

The underlying issue for NZ’s housing market is the shortage of dwellings……

That issue is unlikely to diminish anytime soon. While it’s around, there’ll be more upside than downside in house prices.

The prospect of a National/ACT Government in a few weeks time is bound to buoy housing market sentiment. 🛟 But I’m stating the obvious. ✅

TTP

Interesting - Americans are defaulting on credit card debt and auto loans at a greater rate than the GFC.

USA housing sale transactions are down 49%.

Zillow is offering 1% down payment to try and get buyers.

The housing affordability index has dropped off a cliff to a level lower than the GFC.

My nomination for a spruiker Tui Billboard:

Obviously, NZ is DifFeReNt, so we won't see any job losses here and no further recession. Inflation is already less than 2% and mortgage rates will plummet back to 2% & and 3% next year. Everyone got massive pay rises last year and the cost of living is plummeting lower. House prices will be up 10% to 15% next year *Guaranteed*

I really hope you’re right. After living through the Labour govt chaos of the last 6 years I’ve decided to sell my Auckland property once prices improve, cash up and move money offshore in case they get into power again.

Don't worry delboy this time next year we will be millionaires. He who dares wins. Rodney still a plonker thou

Only because we have record high migration again. It is like filling up a bath, but not increasing the size of that bath when it overflows. Same thing happening in Australia. It is very intentional, because it creates extra demand and reduces supply, causing increasing rents and house prices .

I guess at it looks like Winston may get back in and he knows all this and may try and keep National in check, as N-Act will unlikely get a majority by themselves without NZF. It is why National aren't ruling out NZF. This is my election prediction.

Exactly. How can anyone qualify for the million dollar mortgage that's required? I'm picking the current bounce is more related to border reopening than increasing activity from locals.

Yes, selling your home and upgrading to another. I suspect that's where most of the action is.

Bank has indicated fhb family member can borrow over 1 mill. He will try and do it on $400k loan.

What sort of slavery are these banks trying to sign our young up to?

Disgraceful lending that we have allowed to develop - to enrich the banking industry only.

I was always told by a real estate agent to ignore the stress tests and current interest rates, and look at whether I could afford to service a mortgage between 8-10%.IMO it is so risky to get a home loan for 30 years on what is effectively a variable rate, as you aren't able to lock in the interest rates for 30 years, the full term of the mortgage. Where in the US or Japan you could lock in a 2.99% rate for 30 years. It is also preventing a lot of people selling in the US, because if they do they will be having to service a far larger interest rate. But that isn't an issue if they don't plan on moving, and potentially there is less risk of their housing market crashing like New Zealands has from the peak. Many would have purchased investment properties at the peak because they thought house prices would never fall.

Segment the market (of buyers). Assume the basic sentiment of the pleb is that inflation is almost tamed, interest rates and prices likely to stabilize. That national will get in and mumblemumblemumble house prices won't fall.

The well supported FHB or home-upgrader can and will be prepared to move if they no longer believe prices are crashing, but there's no rush.

The seasoned investor is alert and ready to go active on good deals, but definitely not FOMO. They might anticipate lower interest rates, but not in the immediate future.

The potential victims of FOMO (investors and FHB) might get itchy feet at the thought of foreign buyers, interest deductibility, 7-house-Luxon in charge. But the bank still has calculators that up and down the country are saying NO to them.

so, we'll see no change til RBNZ moves interest rates down.

Fun Fact.

In jurisdictions that have the right land use policies, the housing market is far more stable, and there is far less FOOP or FOMO.

But under our Govt. artificially contrived restrictive policies, these are the only two choices we have.

Such wasted emotions, and money.

It certainly does take a whole lot of policy support to get and keep house prices so high. Including:

- Tremendous tax privilege vs. work

- Restrictive zoning to prevent adequate supply

- Welfare subsidies for rental yields and prices

- Monetary policy handouts when hard times hit

- Taxpayer handouts when floods or other natural disasters hit.

It'll eventually be FOGB (GoingBankrupt)...leading to FOBH..(Being Homeless)

I think it will be FOOS first

F#$ked Off Overseas

Young kiwis scared National and Chris Luxon going to throw them under the bus again like JK.

This is what's coursing the spike.

Hold tight guys they are not in and the way they are going a very high chance they wouldn't get back in on the back of trying to start the ponzi again and their cynical con job of a tax package.

Young Kiwis should be praying that National get in and reverse the Brightline back to 2 years. This will bring a flood of cheap ex-rentals to the market, so FHB will be able to have their pick. Of course, if these FHB still have the ridiculous mentality that they are entitled to a 4 bedroom, butlers pantry, media room, triple car garage home, all within 5 minutes walk of a bus stop, then they might still be out of luck.

Like the sense of entitlement that 'specvestors' have that one must never,ever pay tax,hence waiting for the brightline before selling.

Property collection is all about minimizing tax at any(bodys) cost. It's pathetic and amusing.

Yes. They act like it's their inalienable right. So much anger. "It's MY hard work, why should I give my hard-earned money to the government [in tax]?" Verbatim quote from someone who can't afford to hold their investment and has moved to interest-only, so they can sell in 18 months once they pass the 5-year brightline. I mean sure you've had to do some work in the past 3 years managing this one investment property as a 'mum and dad' investor on top of your day job, but did you really 'earn' $100k from that? Normal businesses are used to paying tax as a cost of doing business, but these people act like it's a personal attack on them.

And if they get flooded and are no longer insurable they'll be there queuing up for a taxpayer buyout.

@Vamn why dont you become a landlord if it is that easy?

@afeshuoses...not sure where I said it was easy,but in honesty is it harder than any other endeavour in life...my comment was around tax 'avoidance'.

I have seen folk I know screaming about how much they have to top up their 'investment' these days...but I can't see it as being any harder than being an owner occupier with a mortgage,kids etc who have no ability to raise rents, or claim ever increasing amounts of interest deduction as interest rates rise,taking evermore from the countries tax take,no interest only option for the owner occupier or having to come up with a deposit when the 'investor' just revalued their existing property essentially getting a tax free capital gain to purchase their next 'investment....but carry on bleating how hard it is..we as a country should be making noise about how hard it is for youngsters to get ahead,with student loans,cashing up their kiwisaver that was meant for retirement,not to pump the property market, 2+ incomes minimum just to afford rent,let alone a house...cry me a river cos you have had a couple of tight years...

Preach vman 😁

Plenty of property investors accept it should be a long term investment, if National do what they say and enrich the 1% a lot of tenants become homeless and have to revert back to the insecurity of short term tenancy.

I’d settle for a 2-car garage.

FHBs don't actually have that mentality. But they do compare what they can get overseas for the same money.

but National hasn't got in yet, is FHB partying in the housing market? the fact is it's tougher for FHB to get on the ladder, and the homeowners are stuffed too.

get a clue.

Basically, what National have discussed behind closed doors is - We have a population in NZ that just can't afford property at these elevated levels. What is the solution? Simple, we open the market to the world. Get the votes we need by giving tax relief to the mid NZ population.

...Here's the kicker! If National can't get enough buyers for the +$2m sector, they'll drop the threshold to the +$1m sector, then finally ditch the foreign buyers ban altogether. They then can say they kept their tax promise.

Absolutely 100% guaranteed.

I agree that if there is not enough foreign demand to pay +$2m for a NZ house (and hence not enough tax income to pay for the tax cuts) the deal will have to be improved. My bet is that foreign buyers may be offered direct residence ("a golden visa") with their house purchase. Portugal has resorted to something similar to prop up their housing market.

NZ already offers that. Currently nobody is interested. Seems word got out that IRD was demanding full disclosure of assets so they could implement a wealth tax, and just like that, no-one wanted to move to NZ anymore (except unskilled people from the third world who don't care where they go, so long as they go).

https://www.newshub.co.nz/home/politics/2023/07/immigration-just-one-vi…

Well, their MPs' property portfolios cannot be allowed to shrink in value. They're dependent on others paying the debt.

There are whole sectors with RE, law, finance, developers etc. working out how they can benefit from, or scheme their way legally around this.

And the private sector can mutate quicker to take advantage of this than any Govt. can react without using a sledgehammer approach.

And these decisions by the private sector will have nothing to do with the result ending in more affordable housing or not.

From what I can tell, any jurisdiction in the world that has tried this has only gained money to feed the greater social housing problem the policy caused in the first place.

An ideal scenario for me would be if National Coalition got in then became deeply unpopular so that they didn't push their polices.

True story...I asked someone at work who they are voting for, she said Nat/Act,

I said "but don't you want to buy a house?"

she said "I'll never be able to afford a house"

I said "Well National want to pump up the housing market again, by bringing in foreign buyers"

She said "Well, that's what NZ needs isn't it"

Someone slap me around with a dead fish...I give up!

Like this: https://i.imgur.com/WGENMU9.jpg

I agree she is talking nonsense. But to be fair I don't think a small amount of buyers in the 2m+ range will pump the 1m- range of market. It would be best to see the 2m+ policy implemented (then raised to 3m if markey prices increase) then probably get rid of it or raise stamp duty to even 100%+ (in terms of overall effect on the economy) although I don't claim to know it all.

Like yeah you can buy a house here, but were going to make it worth our while. For those objecting note that there are already significant loopholes that attract no stamp duty.

Perhaps she thinks Labour, who have presided over the biggest increase in house prices ever (yoy 32.5% May 21) might not be her best bet?

I'm not keen on labour or national. But labour has introduced DTI, tax deductibility, MDRS. The RBNZ increased LVR during covid. Labour had to put brakes on National policies which are starting to take impact. National want to add all these back, why?

I think if Luxon has a $16 million portfolio would he want $32 mill or $8 mill. The old adage follow the money.

I volunteer !

If you focus on WHO the foreign buyers might be, she would be correct. Does NZ need surgeons, film producers, software engineers, CEOs etc to move to NZ? Obviously the answer is yes. All of these people earn $1M+ a year, and clearly they need somewhere to live. If you tell these people that they cannot buy a house in NZ while they are working here, but must rent one, are they likely to still come? Do these people want to put up with 3 monthly home inspections and be limited to renting a less than premium home for their family? How many premium homes are for rent in NZ, not many I'd bet.

Everyone reads "foreign buyer" and thinks it means a person who doesnt live in NZ. But the FBB actually prevents foreigners living and working here from buying houses. This is where lifting the ban will help NZ attract skilled workers.

She has given up. Seems pretty rational to me - the situation is totally hopeless for those of us who have been on the losing side of govt/bank induced wealth creation that has been running for years.

For me it is entirely entertainment now with popcorn. Bring on $2m price tags on average AKL shitboxes and ZIRP - I'm sure it will end up just fine.

A mixture of high inflation (and this high OCR), blended with Labour policy changes and talk of a recession have dampened the appetite to spend as was the intention of the RBNZ.

The future “looks” like inflation peaking and possibly responding to the RBNZ, a change in government and with it policy, and a soft landing with swaps indicating an OCR drop in 24 months; with a sprinkling of high immigration.

The initial brakes that changed the equilibrium between demand and supply post the Covid party are shifting again. I personally don’t believe there will be a property rally for the next 2 years if at all, and I don’t think August will be the start of a revival. I think we will get monthly variations that will look like a period of stagnation in 12-18 months, but only when we anticipate an OCR change will we see a meaningful and sustained uptick in activity - hopefully contained by a DTI.

I don’t actually think the election result will be that influential on the housing market. Sure, if National win their policies will provide some support for the market. But at the end of the day, it’s the cost and availability of credit that is the most important factor.

Totally agree. And interest rates are going to remain high for a very long time. In fact, its likely that this is the "new normal" which looks very much like the old normal pre-GFC before every central bank decided to continously juice the system with cheap credit and quantitative easing. Those days are over. There is no more free money.

Investors of all types will rediscover that Cash really is King. And the financial strain of holding cashflow negative assets will wear people down, and they will sell up. This is already playing out in the sharemarket, as cash burning companies' share prices spiral towards zero.

And its looking like global OCR rates are going to go higher, US and Canada have inflation around 3% and are still warning that rates are likely to go up further. The disinflation that has happened as Covid disruptions have unwound is over, and now global inflation is creeping back up again. NZ CPI has only gone down due to this disinflation in imported goods, but domestic inflation has been over 6% for almost 2 years now and shows no signs of heading back to 2% any time soon. Now add back imported inflation and the RBNZ is going to have to raise rates again. Buckle up!

https://wolfstreet.com/2023/09/05/gasoline-prices-rise-year-over-year-f…

Agree. And long-term swap rates agree with you too. Higher for longer (a few years at the very least) is definitely the most likely scenario, by far.

It will also dawn on the central bankers that if they can maintain rates at the 5-6% level without sending the economy into recession, then there is no reason to cut rates at all. This then gives them ammunition for when the next crisis hits. They have seen what happens when 3% rates are cut to zero (or even negative) and its not something they will want to repeat. Far better to hold at 6% and be able to cut to 3% if the need arises. Money should not be free, it results in perverse outcomes that damages ordinary people in the long run.

The single best option to implement - to prevent future problems - is to put in place a mandatory minimum stress test of 10%, for owner occupied homes, and 20% for secondary dwellings/rentals. Its a very simple solution. Requires no new govt dept nor any major law change. The RBNZ can just make this a new lending rule.

This would solve two problems

- It would prevent people from borrowing too much in FOMO situations.

- It would prevent property investors from competing directly with FHB, or owner occupiers, all things being equal (deposit, income etc).

Failing that - we should preload the tax into property investment. i.e buying a second house = 15% tax on the purchase price. Buying a 3rd and 4th house = 25% tax. This would not apply to commercial property but would apply to farms.

Agree. I still wouldn't be able to afford an investment property. Banks just won't lend much at over 7% interest rates.

Bitcoin is a completely worthless nothing yet speculators are paying billions for it because they believe it will go up. If National win it probably will stimulate a similar type of speculation in houses. How much and for how long I am not sure.

I think affordability and yield are the biggest factors. Low interest rates have made very expensive houses affordable / profitable. High interest rates are reducing affordability and the tax changes are seriously reducing profitability.

Bitcoin is a completely worthless nothing yet speculators are paying billions for it because they believe it will go up.

Not sure you understand ratty that well. Believing that the "price will go up" because there is a potential money relationship with the supply of fiat money is a similar narrative that most people believe about most assets. Something is not "completely worthless" because that's what you heard at the BBQ. The more interesting thing about the value of BTC related to is not its price; it's the fact that most of it is "not for sale." If it were worthless, it would be for sale or given away.

It has a worth in a speculative market, just like Tulips did. When the speculation disappears (could take decades) it has no worth (unlike Tulips). Unless you think it will actually be used as a currency - but why would it when there are much better cryptos for that.

Exactly. Why would Governments (apart from Central Africa) allow it to be used as a formal currency? Will they just roll over and go "oh well you got us Crypto-Bros" and make it legal tender? Doubt it.

Sure, I imagine it'll still be used between die hard users. Pay someone in BTC for their Labour, that person can then buy beer down at the local BTC market. But there comes a point in that small economy where the BTC will need to be converted into legal tender. E.g. paying fines for tax evasion.

Kind of like property.

Are you saying bitcoin isn't worthless because its scarce...?

Well at least rents will go down according to Luxon and Seymour. Has anyone asked Luxon how much he plans on decreasing his 7 rentals?

Where does he live as he has 7 properties.

Mr Luxon does it,but he is not the only one from both sides...nice little earner for himself...remember,it's only a rort if you are not in on it..

https://www.newshub.co.nz/home/politics/2022/11/national-leader-christo…

National leader Christopher Luxon 'very comfortable' with $45,000 taxpayer top-up from renting office back to Parliament

Luxon's moral code when it comes to claiming taxpaper money is "I think if I can pay, I should pay".

I guess that only applies to the $5 prescription charge and he's happy to dip into our collective pockets for larger amounts.

Sounds like it was more an admonition for the poors.

The cost of credit is only important when there are restrictive land use policies.

Land use policies are the most important factor.

Well, if Nat/Act do get in power, then I know that NZders have voted for high house prices to stay.

At the end of the day, everyone is looking after themselves and their own self interests.

You could say standing on heads to keep above water.

National are going to repeal or change the CCCFA. That will have a major effect on the cost and availability of credit for many potential borrowers.

For the first time in a long time, interest rates have gone up not down. This should mean a significant reduction in prices, they are still way too high to make any sense. This could be a dead cat bounce - the usual spruikers who are still in "property can only go up" mode will buy thinking this is the bottom and cause a small rejuvenation, and some FHBs will buy because they just want a place to live in. But it seems unlikely that house prices will defy affordability and yield for too long (but who knows really)

Yes, that’s my view.

A proper uplift in prices is probably at least 2 years away, and reliant on interest rates being significantly lower than now.

August saw 800 houses sold but 1579 houses listed. If the pool of listed property has continued to grow wont that continue to put downward pressure on selling prices? Or am I missing something? Everyone seems to be excited and I don't understand.

You and me both

Joke's on you as the rest are no longer on the market, they're just delisted lol

I think there are a lot of property investors, or wannabe property investors, who think the future will look like the past, with housing doubling every 7-10 years and huge profits for everyone.

Even if National jump in with their heroic Atlas pose, holding the market in place for a while longer, I think those days are over. Prices are too high, yields too low. The future for property investors is high-risk mediocrity.

The past was supported by systematically falling interest rates, and that track has run out unless we go to seriously negative rates. Possible, but would I bet the house on it?

I was hoping the current price drops would be sharp enough to shock Kiwis out of the collective obsession with property but it seems to be running out of legs. Looks like investors will suffer a long slow death of enthusiasm instead.

100% agree! Even if interest rates do go down from here (a big gamble), the best possible scenario is not much better than the previous market high.

I guess there is also the fixed supply argument ("they don't make more land mate") or the increasing demand argument (immigration). But I have a feeling the market is much more empowered to increase supply than it was 15 years ago thanks to planning changes.

The higher prices go and the more home ownership falls, the louder the calls for opening up supply will be. If the Nats/ACT really go hell-for-leather boosting property prices with no attempt at restraints, I wouldn't be surprised if they are a one-term government.

Even if interest rates do go down from here (a big gamble), the best possible scenario is not much better than the previous market high

That's simply not true. Incomes are already up 10-20% or more since pre-covid and they'll continue to go up approximately inline with inflation. Rents are also up and mostly follow income. So as interest rates stop increasing, DTIs start falling or prices go up.

Property is embedded in the kiwi DNA.

Yep, people on here keep on trying to apply "Logic" to the housing market, well it doesn't apply. Its a National lead government from October guaranteed and then its away we go again.

You do realise it can't keep going up in excess of inflation forever, right, regardless of the government? Like if houses double in the next 10 years they will be an average of 2 mil in Auckland. They will go from being affordable for the upper middle, to being affordable to almost no one. And 10 years after that they will be $4 mil in Auckland. In 100 years time the average Auckland house will be $1 billion if they double every 10 years. Unlikely I reckon...

And yet, people will look at the 20-30 years they've been active in the market and assume that's representative and will continue. No consideration of the underlying features that defined that time period.

Longer term analysis tends to show property rising at roughly the rate of inflation, exactly as you'd expect in a sustainable society.

I actually wonder if property has been as good as people think. Our family house has gone up in value lots since we bought it 20 odd years ago, but we have also pumped a lot of money into the mortgage along the way. I'm not sure we would have been much worse off had we put the money directly into shares instead. I guess we would have had to pay rent too...

It's been a pretty knock-out investment given the ease of getting leverage. If the future is flatter or more volatile, or with higher interest rates, the leverage could become an anchor rather than a sail.

Buying your own home comes with a whole host of other benefits in stability and freedom which you've probably enjoyed over the years.

You do realise it can't keep going up in excess of inflation forever, right, regardless of the government? Like if houses double in the next 10 years they will be an average of 2 mil in Auckland. They will go from being affordable for the upper middle, to being affordable to almost no one.

As mfd said, the long term average for the market as a whole should correlate pretty closely to the rate of inflation (though wage inflation, not CPI inflation).

But, the value of existing houses in city centres, non flood-prone coastal areas and other desirable locations can continue to increase at a higher rate than inflation as long as the overall population increases. How? There's more competition for those areas so the sales go to increasingly wealthier demographics and/or property developers who knock down houses and build apartments.

"Like if houses double in the next 10 years they will be an average of 2 mil in Auckland. They will go from being affordable for the upper middle, to being affordable to almost no one"

This is consistent with what National's backer's want. An ever increasing concentration of wealth into the hands of the very few.

Luxon has been crystal clear on this. He has 7 houses. He doesn't see an issue with one family owning 7 houses while other families cannot afford to buy a house. He is proposing policies that will mean new houses are only affordable by rich people like him who have 7 houses. His policies want ordinary people to not be able to afford houses so that they have to pay tribute to the rich.

This is the actual gameplan FFS.

Worse National leader in living memory.

There were people who got burnt in the late 80's that found salvation in property, and property "rewarded" them handsomely. Massive confirmation bias from the belief that property generates its own wealth and value, rather than it being a proxy by which debt flows through.

Dunning Kruger syndrome plays a part in it too. People who own property when interest rates fall are such experts.

Yep it's trippy that people don't get this.

The need for secure shelter is embedded in every humans psyche. Housing investment? Yeah nah only became a thing in NZ in the 90's and really took off early 2000's. It's interesting to know how that "market" was created and the various influences? You'd think that's what economist's and governments should really be understanding if they want to implement better policies rather than continuously pumping the debt bubble.

Let's call it properly too... It's not housing investment, it's purely tax free gains. Negative gearing to pay less tax and have someone else pay the mortgage is neither "wealth" creation nor a productive business. And it's funny, many "boomers" got in early, not only making homes more expensive for their children, they then believe "I paid taxes all my life I deserve to get it back as my super". Yet their sitting on tax free gains funded by tax refunds due to inequitable tax law.

It's certainly not helped when one can just keep their first home as a rental and leverage themselves into the 2nd home, much like my mortgage broker was eagerly suggesting I do. Resulting in less entry level homes to be sold to FHB.

So FHB end up buying apartments off the plans, and if they're not lambasted for "wanting everything new" they're screwed over by the market when interest rates triple during the build time.

If I were paying $1m for a small property, I would want everything to be pretty good standard too. Either that or a family home. That's still a hell of a lot of money to pay back for the FHB who wants to actually live in their home. So good for them sticking up for the value of their hard earned money and not accepting a million dollar sheetbox. I'd imagine most people who claim that FHB want it all are the same people who bought at 4-5x the average income for a suitably average home. This country has forgotten the value of work, only knows the price of leverage.

In the wild, there is a breed of monkey that actively eat their young to keep alive and by the video footage they enjoy it. Maybe that’s what we are seeing with boomers - financially eating gen x, y and z.

I wonder if there's a breed of monkey that hoards all the food at feeding time leaving but scraps and husks for their young? There probably is, and what happens is the young leave the nest find somewhere else to hunt and raise their offspring. Meanwhile the elders are left to fend for themselves until they're too frail to do so, and another tribe of young monkeys arrives to hunt in that area. They co-exist but the younger monkeys are very protective of their food, will strike and lash out at the frail elders leaving them with no choice but to feast on scraps and husks.

This is what happened in China, only supercharged to the max. Their citizens paid huge deposits and waited literally years for them to get built while paying off the loan, and now China has vast cities of empty buildings, abandoned when the property downturn hit.

People weren't buying the homes to live in, they were buying them as an investment because that was the only investment available for them. The question should be asked, why do ordinary people feel the need to invest.

Bloody good question, wouldn't it be better to have a society that valued it's workers and in return they provided for the young and old. That'd be a great investment.

I think the Nats/ACT are just trying to hold the ponzi up for a little while longer,wind back the brightline,give all their supporters time to get their affairs in order,flog off their properties and bank all that tax free capital gain...then retire living off the interest,relaxing in their bach,travelling or move to Oz.B*gger the next generation.

The fact that a decrease to brightline applies to investments bought before the decrease, yet an increase only applies to investments bought after the increase, is a bit crap.

There is a possibility that National's plans backfire - investors sell up once the brightline is removed and flood the market causing a crash.

The fact that a decrease to brightline applies to investments bought before the decrease, yet an increase only applies to investments bought after the increase, is a bit crap.

Entitlement Mentality embodied, really.

I'm wondering if they even need to wait for the brightline to be decreased?

The market's been unusually restrained this year in terms of listings, mind you in a falling market

How many are going to simply list after election in the hope that sentiment is enough to make the sale?

Patience grasshopper. A property crash does not happen overnight. Its a long slow grind to a bottom, and last many years. We are but 18 months into it, and we have another 18+ months of 7% interest rates to go so the hangover hasnt even kicked in yet.

There are a number of listings with the wordings "vendor is moving to Australia".. this is a case of FOMB (Fear Of Missing the Boat)!

David, your article seems to infer that more listing and more sales could lead to increased prices. I think that's heck of an assumption. Firstly I note the number of new listings (1577) far exceeds the number of sales (879). Then, I'm of the opinion that an increase in the number of sales makes the trend stronger and steeper (no matter if the trend is up or down). My interpretation of an increase in sales and listings is that more vendors are not prepared to ride the downtrend any longer, and more sales will precipitate the drop in prices, not the other way around.

I don't know much about property, I've only got 3.

It is my experience that being a landlord is a pain the arse, & that's just dealing with the tenants. Even relatively good tenants can be a pain. Financially, it doesn't stack up in the current interest rate environment, so I've got to underwrite it as well. Sure, they went up in value by 40% during covid but have come back 20% since. Where's the RBNZ financial stability here? The political decision-making by the west during covid was utter incompetence, in line with our rapidly declining education standards, and in our case, a huge school dropout out rate that went straight to crime instead [ram raiding].

Putting back the 2 year bright-line will initially be a huge negative on lower end house prices. The upside is that a lot of 'younger' ones will enter the market. That's good long term. I can't see interest rates coming down either. I'm picking high single digits for longer due to the massive global debt, already unable to be repaid.

I also want a new government but am old enough to have low expectations of them as well. This Labour Govt has done so much damage to the fabric of this small nation in such a short time frame it's unbelieve-able.

This Labour Govt has done so much damage to the fabric of this small nation in such a short time frame it's unbelieve-able

Is it Labour really that's done the damage or the right whingy media complaining all the time and stirring up stuff? I'm wondering if this "Labour destroyed the fabric of NZ society" isn't just a self fulfilling NZME prophecy. I don't see the past Labour government having done much more structural damage than the Key government tbh

"Is it Labour really that's done the damage"

YES !!!

Careful, the only logical reason why would you ask that sort of question is because you're a Labour fanboy and you deserve to be grilled.

I too question how much emphasis should be on Labour for what we see, when you look at what's happening globally. Apparently a National led Government would have had inflation below 3% consistently.

Dear God, what kind of bubble are you living in? Please let me know, I'd love to move there. Clearly you don't have kids at school, havent required medical attention for years, live in a secure gated community that you never leave, and don't pay any of your own household bills.

Financial stability is the main mandate of the RBNZ (not inflation fighting, that's their second most important, despite what they say, its just their main way to ensure financial stability). It's the reason for their existence.

They conveniently forgot that their main mandate is financial stability over COVID. Many of us wrote letters telling them they were going to make our financial system unstable through their actions. They thought they knew better and here we are, with financial instability.

Don't worry though, they are fully accountable for their screwups and the leaders have all lost their jobs (if only, Orr was patted on the back and told he did well by his boss who also screwed up). Foxes guarding hen houses at this point.

You should read a bit more widely Wrong John, and you'll find the same headlines about the same issues in every country.

The "damage" Labour has done is minor compared to the Key government's record.

Thats because they all did the same thing - and as a result they all have the same outcomes. The excuse "everyone else did it too" does not excuse them. It simply highlights the lack of intellectual rigour in this country that Govt and central bank policy is dictated by overseas operatives. As your mother said "if everyone jumped off a high bridge would you do it too?"

Yes, let's invest in one of the most overpriced residential house markets in the globe, in an environment of relatively high (and still rising) interest rates, and with many fixed mortgages still to be refinanced at a much higher rate than before. What can go wrong?

Let's also base the most important financial decision we'll ever make, on emotion (fear). I'm sure that will go well.

Anyone who bought in 2021, did that go well?

I suspect many who bought in 2021 were not doing so in fear, and some of them didn't have the benefit of hindsight like you have today. They would have been just buying a house because it's the right time to do so. Believe it or not, there are a lot of people out there that are not financially savvy and don't put their life on hold for macroeconomic reasons.

So what you're saying is, those who lack financial sense still deserve to own their own home....

What I am saying, is why does the burden of knowledge fall on the borrower? Isn't that part of the banks deriving an income from lending, to provide prudent knowledge and advice? If you hire an electrician, do you study an electrical pre-trade and then run over their tools & materials with a checklist? If you're going in for surgery, do you study for 3 years and then peer review their surgical planning routine?

Imagine if your insurance company could just decline a claim for a house fire because while your electrician was qualified, you lacked electrical sense and "don't deserve to own a home".

You seem to think the bank owes you something. It's quite the opposite. Unlike the electrician, the bank gave YOU money. They now own your soul.

The more people void personal responsibility for things, the more strict rules are introduced, the worse off we are in the long run.

The bank didn't give me money, they gave me title to a house for which the derive a profit from over the next 20 years. The bank paid funds for my house, and the electrician paid funds for the materials. Sure, one costs $500k and the other is $10k. But at the end of the day, both entities are providing a product, service and expertise.

For the record I don't think the bank owes me anything, I'm doing just fine. But I think the bank owes a little more diligence when benchmarking & approving borrowers, particularly how frivolous they were with lending to investors. How much of their own money are they lending anyway?

That's a very unusual view to me, and I'll have a good think about it.

Apologies for the aggressive manner in previous posts I had a bad night. I think you're right in that banks these days are out to bleed their customers dry, and given banks, by design, look after customers money I think that's a conflict of interest.

No offense was taken. It's an online discussion, everyone has different views. Sometimes I like to throw a few...sort of...out of the box thought experiments on here and see what responses come back. Sometimes it triggers people, sometimes it opens up some continued dialogue.

I think we often forget that while we take a daily interest in finance, there are people out there who don't. Maybe they don't have the time between working long hours, commuting, family & trying to cram in what little enjoyment they can into whatever time is left. That shouldn't make them less deserving of a home because the bank did a poor (or malicious) job at benchmarking their loan application.

As always, there is a lag to these figures. Most are focusing on the apparent fact that prices stopped falling around 4-6 months ago. That may be true, but it is also the case that 4-6 months ago, there was much more of a consensus that interest rates had peaked and would start falling toward the end of the year. That is no longer the case; if anything there seems to be more upside risk to rates.

Upshot, as I see it, is that as long as rates stay at this level or higher, we will continue to see house prices fall. Nothing goes straight up or down.

Agree that is the logical outcome. Let's see if the Govt really serves NZ citizens, or has another master.

Excellent comment, the recent sales settled between 1 and maybe 6 months ago, depending on the sale and purchase conditions, the longer term interest rates are firming up, everything is with a 7 in it now, but the current optimism is defying gravity.

At a guess, i would say we are in the 2009 period and its a long time until its 2012.

https://www.americanactionforum.org/wp-content/uploads/2018/06/Case-Shi…

Perhaps it's dangerous to draw conclusions but it suggests a fair few people are expecting National, with its housing market-friendly policies, to win the election and that in any case the worst is over with the housing market and the recent string of falls in prices we've seen.

interesting choice of language David. Many many people view Nationals policies as landlord friendly but certainly anything but housing market friendly.

Likewise the fall in prices is made to sound like a bad thing - the worst is over? For many of us this is the best thing that’s happened in decades and we desire to see heavy further falls until Nz becomes a place the average working man can buy a house and raise a family again

Well said frank.

Kiwis finding it to expensive to raise a family, National has plan for that too.

National vows to boost immigration

https://www.newshub.co.nz/home/politics/2023/09/election-2023-national-…

Look at the numbers on this property pieces 128 comments

Kiwis need to get a new focus.

The residential property market is for Kiwis to have a home.

It is not a business, or a great investment at the moment and we don't want another Ponzi.

There are heaps of other things to invest in, Commercail property, Business, Farming, Shares, a start up or maybe a young kiwi starting in business.

Come on Kiwis stop the greed and start contributing in a positive way we are better than this.

In case the National party don't know elections are won and lost on property decisions.

I for one left the National party in 2014 after 45 years because JK was turning residential homes into a Ponzi what a mess that has created.I guess bankers alway have their own interest at heart.

"central banks could be "justified" in using interest rate rises to combat high house prices."

I think that another good way to combat high house prices would be for ordinary banks to offer better deposit rates to savers!

Had banks consistently offered high yielding deposit rates to savers (a bit higher than inflation let's say) then we probably wouldn't have so many people NEEDING to invest in real estate (or other riskier investments) in order to "get ahead" in life.

Good afternoon! I've noticed some discussions about Bitcoin here, and I'd like to offer some friendly guidance. Sometimes, it seems that there are individuals who may not be well-informed about the topic. It's completely understandable if you're not deeply involved in international economics or don't have a thorough grasp of how money functions. From a surface perspective, Bitcoin might appear perplexing, especially if your focus has been on New Zealand property (which, interestingly, has its own complexities).

In an effort to help you enhance your understanding and contribute more effectively to these discussions, I suggest exploring the following topics:

- Bitcoin Stock to Flow Ratio: This concept provides valuable insights into Bitcoin's scarcity and its potential as a store of value.

- BlackRock Bitcoin ETF Filing: Understanding the involvement of major financial institutions like BlackRock in Bitcoin can shed light on its growing acceptance in the traditional financial world.

- Bitcoin Fair Value Accounting Decisions: Learning about how Bitcoin is accounted for in financial statements can provide a clearer perspective on its valuation.

- Bitcoin Halving: This essential event in the Bitcoin network's protocol has significant implications for its supply dynamics and price.

By delving into these subjects, you'll likely find that your contributions to these forums become more informed and insightful.

Have the bots finally arrived?

The elephant in the room is that the reason for historic house price rises is not just ZIRP aka easy money for those with collateral.

Perhaps, instead, a world where the only way to plan for retirement is to utilize property as a store of value to keep up with inflation. All the property heads point out, for good reason, that the only way to plan for retirement is to leverage up, take on debt and wait for others to join the party. Australia, NZ, Canada, US, Lebanon, Argentina; whether you are stacking flats or stacking rentals, the lack of any other monetary vessel (perhaps other than the greater fool S&P index fund) means bricks and mortar are the best scarce and thus monetary asset around. The government can’t print houses so easily, whereas political units, they are easy to conjure up.

Monetary premium + value = number go up. Why? Because saving our economic energy astutely is key to our survival. Such a shame we are reduced to doing it with such unwieldy vehicles, causing all sorts of disruptions to our need for shelter.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.