ANZ's economists see history repeating, with the Auckland house market now starting to demonstrate the under-performance it had relative to the rest of the country in the mid-2000s.

In ANZ's latest Property Focus publication, in an article headed 'who's hot and who's not', chief economist Cameron Bagrie says the "clear take-away" from looking at the regional markets around the country is that Auckland is bearing the brunt of the recent slowdown in housing market activity.

"...Numerous other regions [are] still performing well and playing catch-up; although unsurprisingly, some are doing better than others," Bagrie says.

"This Auckland underperformance is a story that will persist if the 2005-2007 experience is repeated.

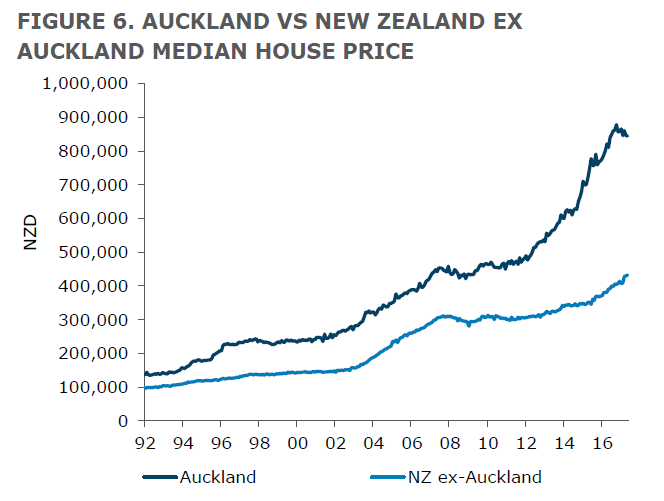

"Capital (and people) naturally flow to regions where valuations look more attractive - and the gap between Auckland house prices and the rest of the country is extreme."

In commenting on the country generally, Bagrie said the property market was softening, but particularly in Auckland "as the combination of a turn in the interest rate cycle, less credit, LVR restrictions and severely stretched affordability act as headwinds".

"There is still incremental support for prices to lift after a lull courtesy of population growth and a fundamental mismatch between supply and demand. We think the former factors will be the key influences over the coming year and expect house price momentum to remain subdued."

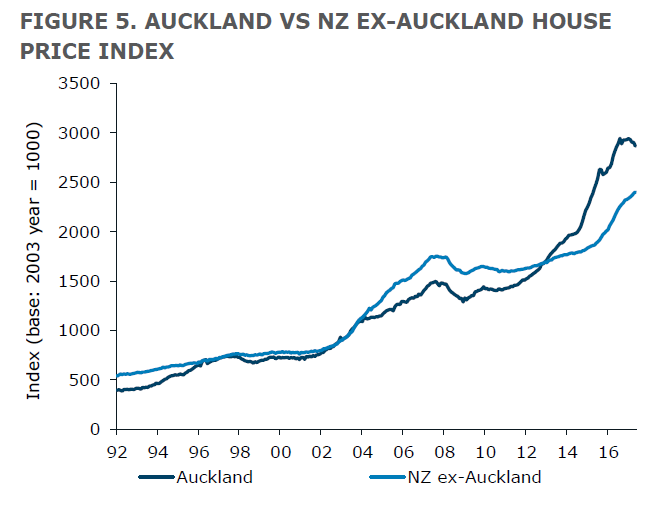

Bagrie said Auckland house prices had been "the main talking point across New Zealand’s housing landscape for some time", having increased at unprecedented rates since 2011. The Auckland region House Price Index doubled from the start of 2011 to the end of 2016.

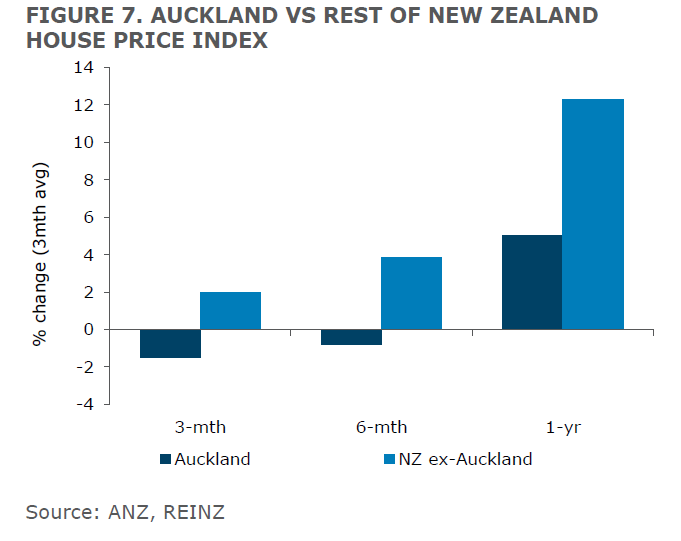

"Recent LVR restrictions have had a direct impact on investor lending and the HPI is now moving backwards, with prices lower than they were six months ago.

"When compared with the rest of New Zealand, it looks like 2004-2006 all over again, with Auckland underperforming the rest of the country."

Bagrie said there was "still daylight" between the median sales price in Auckland and the rest of New Zealand.

"...That’s a huge incentive to buy somewhere outside of Auckland if you’re an investor, and cash up and move if you’re retiring."

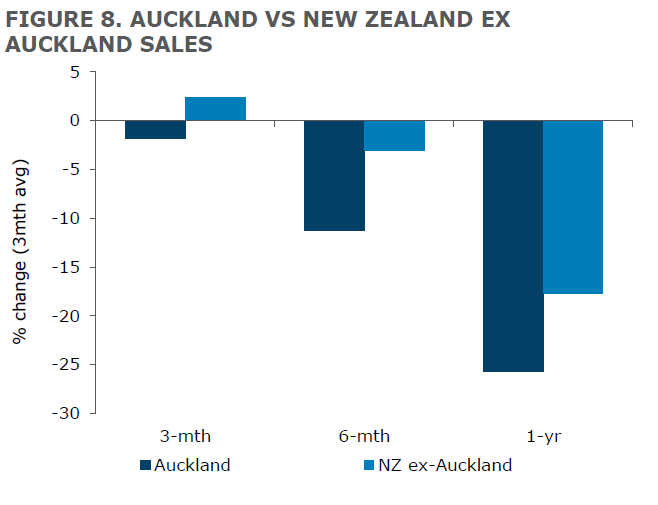

Bagrie noted that the volume of Auckland house sales "has been thumped", down 26% since this time last year (on a three month average basis).

"The rest of New Zealand is down also, but by far less (-18% y/y)."

71 Comments

Well if Bagrie is correct and the two trends in the index will possibly "switch", then provincial house prices need to boom like wildfire or Auckland house prices have to crash. I'm no economist, but if the latter happened, I would say you could forget the "provincial boom" as the negative impacts of decreased consumer spending would smash the national economy, not just Auckland in isolation.

The provinces do boom like widlfire in these times, far outstripping even Aucklands recent growth on a YOY basis.

Some regions went up 40-50% in a year in that period. Auckland has never done anything like that. Keep in mind that we are talking about going from $300k to $450k in some regions. It's a big percentage but not a massive absolute jump. Still better DTI rations than Auckland.

Hold on tight.

OK, if you say so. I'm not Gandalf so I cannot say if a.) what you claim is a law of nature; or b.) what happened before is part of a recurring phenomenon.

Furthermore, with this provincial boom that you foresee, that will be wonderful for consumer spending.

Where did I say anything was a law of nature?

I'm telling you what happened last time in that 04-06 period that they are talking about in this article. Those are called facts.

You didn't. You said The provinces do boom like wildlfire in these times without qualifying anything you said, except a reference to it happening in the past.

Exactly.

An observation of what's happened in the past in these situations and also what is happening now. Places like Nelson and Gisborne were up over 20% YOY in last months stats. Napier just over 15% and Auckland at 5%.

These are facts. You don't have to like them. The provinces are booming right now, whilst Auckland is not, just like the 04-06 period.

Not disputing your "facts". I'm questioning whether or not it means anything.

Some regions went up 40-50% in a year in that period. Auckland has never done anything like that.<

Auckland 2014 - 2015 and there is actually a graph showing the change on this page.

no, there's a graph showing auckland going up 50% over 2 years. That's not 50% YOY growth.

The Auckland 2014 median was circa $600k. It wasn't $900k 12 months later.

Regions booming is a function of affordability. It is simply Aucklanders who need to put 40% down with limited equity buying what they can and what they can is not in Auckland. Yes there is better potential for capital growth at the moment because this is happening enmass but if Auckland were to correct I believe the "lane you don't want to be in" will drop too and take a lot longer to bounce back especially given the concentration of employment opportunities.

Actually there's population growth and economic strength (relative to where they have been before) in many of these regions. To claim it's 'simply Aucklanders' driving up prices through specuvesting is overly simplistic and divorced from reality.

I'm more than happy being in the lane with 20% capital gains, rental growth and 6-7% yields. Do you know why? Because Aucklanders don't understand the regions and miss out on a lot of value because of preconceived notions that aren't based on facts.

Oops

Auckland specuvestors always overshoot in the regions at the end of each cycle. Direct quote from Tony Alexander at a Barfoot cool aid session at the end of last year.

yep 100%

Was selling luxury electronic goods into developments in Northland and western BOP in 2007......property values skyrocketing..you just cant lose...

Out of a job 6 months later

I agree. Look at what is going on in Rotorua and Palmerston North, you can't tell me those places aren't overshooting right now.

.. economists are much alike fund managers ... they graze together in the same paddock ... few are willing to stick their necks out and predict a strongly contra view to the mooing masses ...

Bagrie and Alexander are chewing their cuds contentedly , knowing that if they are proven horribly wrong ... they'll be in company together ... we're all wrong , sorry folks ... you lost the shirt off your back ... we're all very sad and sorry 'bout that ...

None of them will go way way out on a limb as our former editor Bernard Hickey did ... because you can spend years looking like a complete plonker ... even if your theoretical premis is correct ... as the Hickeysterical one was ... and as per Steve Keen was too ...

Come on now, history has resoundingly shown how terribly wrong our good friend BH was! Just because I used to agree with his premise, doesn't make it correct. Fool me once, shame on you, fool me long time shame on....... you can't fool me again! - Dubya

Yeah, this is one of the things that normally happens at the top of a boom. However this time the inversion of Auckland to the rest is likely to last much longer than 2 years, try maybe 15 - 20 years.

During 2000-2006 Auckland was almost the fastest builder of housing in Australasia, which meant after the boom ended rents became attractive to young people and they moved in, got jobs, started businesses. The city kicked off again by generating even more wealth.

During 2010 - 2016 Auckland was the slowest builder of housing in Australasia. Instead of housing Auckland has built hugely expensive sprawling suburbs far from the City. There are going to be continually high rents in Auckland. The young people of Auckland are soon going to become very attracted to all the other places in Australasia with low cost rents. The young people will move away and the city economy will falter as the next generation of growth will be elsewhere.

Lets face it , unlikely to crash , maybe revert to 2014 or 2015 price levels and then remain level as the revised immigration settings slow the tidal wave of migrants .

Reverting to 2014 prices mean the Auckland median is around $600k. That's about a 25%-35% drop depending on exactly where you fix both of those data points.

You wouldn't call that a crash??

Yup +25% seems like a crash to me. That would probably put a lot of new borrowers in negative equity straight off the bat, and with interest rates flagged to go up over the next few years it would put some real strain on the system.

"... buy somewhere outside of Auckland... cash up and move..."

Sounds good, but how, and who to, if ...

"...the volume of Auckland house sales "has been thumped", down 26% ...." ?

Agree with you on this bw. Without the easy credit and hot overseas cash money, NZ is now only left with local buyers reliant on how much banks are willing to lend (related: we're also seeing apartment developments fall through due to insufficient funds).

There's no "meeting-in-the-middle" here either as buyers CANNOT pay more than what the banks are willing to lend them, so sellers will have no choice but to reduce prices to meet the market.

But then investors shouldn't sell unless they're prepared to make a loss. So what should investors do? They should hold onto their investments! Rightfully so, you should be able to enjoy your paper wealth. Good for you, no one is forcing you to sell. That's the most sensible move. Hold on to your houses, don't be forced to sell.

Which would be good in theory, IF all investors thought the same. Not all investors are in this for the long haul. Easy come, easy go, and if Chinese investors are known for anything, it's that they're known to do things en mass and that they're not afraid to take a haircut as to cut losses. https://en.wikipedia.org/wiki/2015%E2%80%9316_Chinese_stock_market_turb…

It only takes a couple distressed sales to devalue the whole street, a couple of devalued streets to devalue the whole neighbourhood, and a couple of neighbourhoods to devalue the whole city. Maybe not the beloved Central suburbs - those might take a while to go down (need to put this disclaimer so I don't upset the spruikers).

Last time TradeMe had 20k properties on sale? Back in 2008, when house prices were around $500k http://i.imgur.com/tIz5dGA.png

quote: "It only takes a couple distressed sales to devalue the whole street"

indeedy

and, it only takes a couple of bolt-hole money-laundered buys to re-value a whole street

Aucklanders could sell up and move down to Cambridge or Hamilton and spend 700 to 800 k on a brand new four bedroom 750 square section and still have plenty left for an investment or two.I'm picking up an ex aucklander every two to three months in my business

As I asked above, who are Aucklander investors going to sell to to make that move?

Arguably, the time to make that kind of move is well in the past ( stats are always lagging indicators). Personally, if I'd just escaped a sinking ship, I'd prefer to spend a bit of time on dry land ( forgive the pun) if it was available, rather than swim to another ship close by?

(NB: "The cheap money era is over.....the greatest financial experiment of all time (is over)." http://www.afr.com/markets/equity-markets/rate-hikes-from-central-banks… )

Still thirty percent success rates at barfoot auctions so I suppose those thirty percent could cash up and leave if they wanted

What caused the uptick in the Provinces over the last 4 years? Auckland investors heading out of town to hit the lower LVR's etc! They aren't going to be buying more, they are going to be cashing up, counting their winnings and thanking the Provinces for their increased bank balances. If anything, the retreat of Auckland investors will have a bigger impact on regional New Zealand, than it will on Auckland.

Low global interest rates have fuelled the boom all over the world. Melbourne, Toronto, Brisbane, Tauranga, Vancouver, Seattle, Hamilton - all of these places have had price growth. Auckland investors are just as irrelevant to Hamilton as they are to Seattle. Global property is a hot investment in lots of the world.

No one needs Auckland investors.

The only thing Auckland is now bringing to the table is capital flight.

Actually that's not really true. Maybe places within a few hours drive out of Auckland. But the regional economies have been going reasonably well in most places.

We know half of our immigration is kiwis returning back home, particularly from Aussie. A lot of those were non-degree types from the regions who left to go drive a coal truck in Perth for $120k a year. Many of those people are returning back to the regions where they came from, and finding work because houses need to be built, timber prices are good, lamb prices are good and there's lots of work on. Of course they aren't on $120k a year any more, but they often return home with a bit of money saved away and can afford a decent house for a reasonable price.

The whole 'Auckland specuvestor' thing is overblown once you get to towns more than 3 hours drive from Auckland in my opinion.

to first home buyers

From what I'm finding its not investors that are moving down here but owner occupiers that have done well and just want to move somewhere quieter and cheaper

Many people can only move when they find employment. A huge proportion of the home-owning population isn't mobile for this reason. And many of the rest won't move for family/personal reasons.

Further, many people are reluctant to sell up in Auckland/Wellington, because they know they'll never be able to afford to buy back in.

if you really want to leave Auckland or Wellington, much wiser to lease your house there and rent in a smaller centre. That way you can avoid "burning bridges".

Despite the above, there's superb value housing to be found in cities like Palmerston North. PN's local economy is robust/bouyant, with a fairly even mix of public/private sector activity. But first you need to find a job there - though that's shouldn't be impossible.

There is a chronic shortage of develpment land in the best area of PN (Hokowhitu) but plenty of nice houses at very affordable prices around the city.

Wrong, sold in Waitakere's 8 months ago and current prices are >10% below the price level 8 months ago...

Why out of curiosity is the Auckland/ Ex Auckland price index rebased to 2003. Two decades in the making , I can smell the fear. 45-55 percent falls dragged out over years. Auckland is not different

@Cowpat here's the latest market update for you! Just received it in my inbox ;-)

https://gallery.mailchimp.com/e266f4550b7f78201f4893f85/files/db7d9816-…

Thanks DGZ,

Seems a pretty solid result.

Double-GZ , appreciate being included in Barfoots list . Somewhat outdated information for a man of your IT skills. 38 days to sell at auction, whats not to believe there. The last Barfoots ( Remuera ) junk mail came in the letterbox today. One T. Farmer expousing to be the next generation selling real estate in your neighbourhood . He has a wealth of experience apparently , looks very pale though. My latest numbers show a shocker of a June month for Barfoots etal. 220 sales at auction for month of June up to Tuesday. 65 percent failure rate. Barfoots underperformed

LOL his name is Thomas Farmer. He is a Property Manager turned RE Agent. A nice young chap...give him a chance! He managed my portfolio well and I hope and believe he will make it in the RE world.

Letterbox clearly states no junk mail with large dog attached. Maybe he was chased by the dog.

Are you in Vicky Ave? We could be neighbours Cowpat! I also have no junk mail sign but they always ignore it as if Remuera real estate is everything but junk lol

In keeping with the theme of historical parallels, we are apparently soon due for the next GFC.

http://www.afr.com/markets/equity-markets/get-ready-for-the-next-financ…

GFC2 is likely to result in a financial 'freeze' rather than the QE lZIRP response of last time.

Seems like a pretty simple equation. Domestic credit is decelerating. Chinese capital influx has declined. However, baby boomers are still retiring and moving capital to their retirement destination. Nothing can stop the latter driver.

Check out the RV market. Not a few retirees are simply:

- Selling the old fambly home (or even the newer model after downsizing). In Awkland that'll net maybe $600K (common taters can argue this one...)

- Buying a humungous RV, 5th-wheeler plus ute or similar mobile living arrangement. Even the top range is under $400K .

- Stashing the rest for toys, rent, passive income or hooking into it for a few glorious years

- Living an 'active retirement' complete with toys, new view every week or three depending on proclivities, and - don't we all - making the most of whatever's left to them

That is, they're outta the market permanently - the only plot these ones need is the urupa....

Actually I have heard that quite a few AKL retirees are opting for the cruise ship lifestyle rather than RV's since they get much better in house(Boat) service and apparently you don't need to be that wealthy, they need the old folks to keep going. Must be a lot nicer than living in an old people home. :)

Anything with views over the Hauraki Gulf could buck the trend. Just put the key word "Americas Cup" into TradeMe property and look how many houses come up.

Anything with excellent school zones could buck the trend. Just put the key word "DGZ" into TradeMe property and look how many houses come up.

Surprisingly the search phrase Elitist Dribble comes up with exactly the same results.

Double GZ and Americas Cup

http://www.trademe.co.nz/property/residential-property-for-sale/auction…

OMG it's a LUCKY home! TOP location, TOP home, TOP school zone @@

What is DGZ? A $2m premium for heavily over crowded schools, that are about to be more over crowed with mass appartment construction underway. How does year 8 classes of 40 kids and teachers bailing because they cant survive on teachers salarys sound....not that great?

Private schools are booming.Lets face it, whats 5% per year of $2m, how many kids can go to one of the many private educators for that? If your in AKL earning and paying tax, its a no brainer.

The premium was driven by overseas cash. No kiwi is going to pay that. How many years of no overseas money will it take it to correct? Lets see if the election brings a door slam on that money because paper equity could dissapear faster than you think.

once they did away with sc exams ue exams where you were measured against your year as to how bright you were that's when the value of going to certain schools went up.

in the old days school was less of a hurdle getting employment in fact sometimes in worked in favour,

i.e two kids one from Auckland boys one from mangere same marks, employer used to take the mangere one because he must have worked harder to achieve the result.

now hardly any understand what NCA means so look for part time work history and school

How many kids are getting employed straight out of high school these days? Very few.

The real old boys network is not in DGZ state school. You'd be better off looking at certain private schools.

dp

Anything near Ponsonby Road is likely to continue doing well.

Just try buying a house in that area. There's virtually nothing on the market - except a handful of "not very appealing properties" that have been on the market for weeks.

Yeah laugh it up boys! I mean HONESTLY! What do you think is going to happen here!?? Your TOP END BUYER ARE GONE! You're are STUFFED, really, really STUFFED!

Form the article "Auckland is bearing the brunt of the recent slowdown in housing market activity". Yeah no sh#t! To me it hilarious, because we all know what's going to happen, prices are even now ebbing away in Auckland and why, simple; National allow foreign buyers to plunder the market tax free! What idiots!

How is that the rest of the world can see what's been happening but the National stalwarts can't?

Better Dwelling article: China’s Massive International Real Estate Buying Spree Is Officially Dead

https://betterdwelling.com/chinas-massive-international-real-estate-buy…

that's a really good article, CJ099, I found this paragraph interesting:

"Real estate markets that saw locals scramble to cash in on foreign buyers are now noticeably cooler. Toronto is seeing new listings hit an all-time high, coupled with a massive dip in sales. New Zealanders that were complaining about a “flood” of Mainland Chinese buyers, are now complaining about the market cooling faster than expected. Australia’s leading property analyst is now telling people to prepare for a 10% drop in prices soon."

I've said this since last year - once we have a Wikipedia Page of the Great Housing Market Crash of 2017, it will be very obvious that the 2 things that fuelled this is 1) cheap credit and 2) China capital flight.

All this talk of "record-high" immigration or under-supply of new property developments are just a few examples of how the Government is trying to distract us and convince the problem is all local even though we can clearly see the same trends happening all over the world.

Even if top end house prices collapsed, why are we stuffed? If we own family homes in these areas and are living happily ever after i.e. have no plan to sell why are we stuffed? You're just saying for no obvious reasons, as you want to see us wealthy people get screwed over, but you're using the wrong excuse.

because new debt is what keeps commodity producers viable. ie incomes are in trouble

Central Amsterdam would NEVER go down, everyone thought... It did... Desperate (paper) miljonairs had to reduce double diggits having their houses on the market for months if not years...

Wow Auckland realty boss caught in elaborate sting!

http://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=11883833

ah yes, wetting the bus ticket now, turn to the right please, slap,

let that be a lesson to you.

letting RE police and punish themselves is a joke, they committed fraud and should be in front of a judge

Why lesson to me? What have I got anything to do with RE? A big fat ZERO.

"This Auckland underperformance is a story that will persist if the 2005-2007 experience is repeated.

Did the rising cost of foreign funding negatively impact bank lending to the already over indebted in Auckland first? UST10 year notes were starting to price an unfortunate outcome.

.

Well said.

he had a good point

Thing is the current slow down isn't caused by a resession. Things will pick up again before the next economy down turn. People are taking about its nearly time to look for good deals in the Auckland market but yet are too busy booking overseas trips and spending money.

The boom started in Auckland China kicking it off Aucklanders with large amounts of money moved out starting with Hamilton then tauranga and on, stupidly low interest rates etc, things were left way to long, clamp down, Aucklands slowing 4 or so years will tell us by how much, Tauranga is next to slow down and is, Hamilton not sure, will tho, buyers are making lower offers and some sellers see want going on and taking lower offers, out of Auckland sales are still ok, there's been a pick up ,if Auckland keeps slowly coming down seller that brought over the last 2 years will sit and buys will buy of others but life will go on, soon outside Auckland will come down too . Things are changing now, listings getting higher, selling time longer, auctions changing to price by negotiating because the price is to high, starting to get a few with the dollar figure

This downturn might course a resession

Amazing things going up don't worry about anything, things change everyone gets all technical , old trends will save the day, supply and demand, the supply is and his been over priced for a long time for locals of (pick any town or city) , barring outside influence and over achiever, and demands which is now the poorer locals, fun times ahead,

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.