Early indications show New Zealand’s vital meat trade with the US might have survived the worst impacts of higher tariffs.

While prices are not rising in line with US averages, they are not falling either.

Tariffs to the US went up from 10% to 15% on August 1, while Australia’s tariffs stayed at 10%. The Government here argued at the time that this was unfair and the Trade Minister Todd McClay and senior negotiators are due to hold talks in Washington to try to get this impost eased.

The industry here has meanwhile knuckled down and tried to make the best of a bad situation. And they appear to have succeeded in a qualified way, according to meat trade expert in Australia, Simon Quilty. The exporters haven't gained but have not lost either.

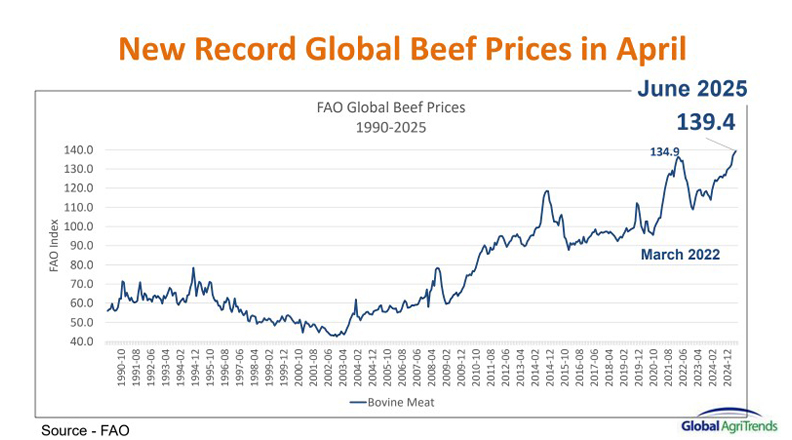

“US global beef prices have moved higher no matter what,” he says.

“What’s happened is that Australian prices have moved higher, New Zealand’s have remained static.”

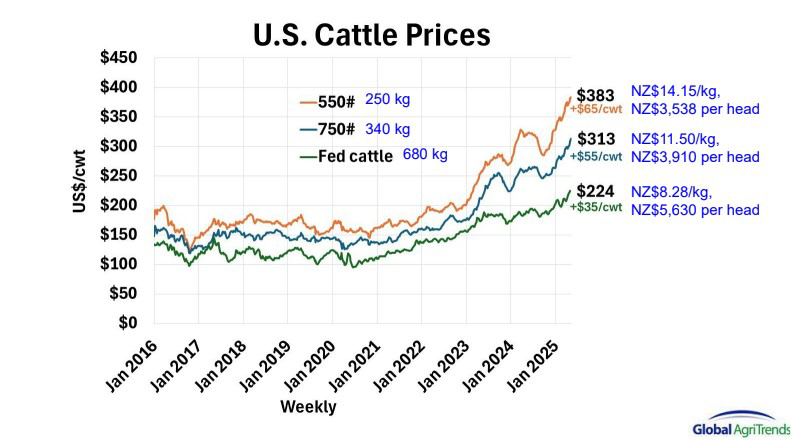

Quilty says beef prices in the US continued to improve after the 10% tariff was imposed in April. But when New Zealand incurred a 15% tariff in August, prices for its sales to America started going sideways, while Australian prices inched up because of its lower, 10% tariff.

Under this principle, New Zealand exporters are paying for the tariff differential, not the US importer. But this does not necessarily mean that New Zealand beef exports to the US are in danger.

“With or without tariffs, the fundamentals are strong,” Quilty told a meat conference in Christchurch, two weeks ago.

Further details on the impact of US tariffs are expected when the Meat Industry Association releases its figures for August in a couple of months.

Quilty adds there is further upside ahead, with beef prices in the US expected to continue rising until next year, after which they should plateau,

He points to several reasons for this. One is that Americans just can’t get enough hamburgers and happily consume New Zealand lean beef mixed in with American product. Another is that herd recovery from an earlier drought is still underway in the US, which means a lot of stock are being kept for breeding, not slaughter, and that shortens the supply of beef from the home market.

In addition, the livestock trade to the US from Mexico has been halted by the spread of the flesh-eating parasite Screw-Worm South of the border. Also helping New Zealand’s cause is a 50% tariff imposed for political reasons on the world’s largest beef exporting country Brazil, although any re-directed Brazilian product to third markets could challenge New Zealand sales in those countries.

Quilty agrees that the practicalities of doing business in America could also work in New Zealand’s favour. According to this theory, a meat importer with a supply contract to a hamburger chain in a large city like New York, and an existing agreement to buy New Zealand exports, would see an advantage in continuity, and upending overnight a system that works would produce more problems than solutions.

Even though beef exports are worth one sixth of the total revenue for foreign sales of dairy produce, they have still risen by 28% for the first quarter of 2025 compared with the same period a year earlier. And prices have gone up even when volumes have been static or falling.

According to the Meat Industry Association (MIA), farm efficiency here has been improving, with prices for farm inputs falling by 0.6% in the year to March 2025, primarily due to lower interest rates, along with cheaper weed and pest control, fuel and fertiliser, lime and seeds. This is a welcome respite for farmers after a 30% increase in prices since 2020.

And prices have been rising internationally now for several decades.

The US market is also vital for the wine industry, with sales of of $787 million.

The main industry body, NZ Winegrowers, says it's hard to assess the impact of tariffs because exports to the US are dominated by sales of particular products to particular importers. But its brand manager, Charlotte Read, suggests history shows rising tariffs are not matched identically with falling sales,

“So, when there was the Boeing - Airbus dispute (over alleged EU subsidies for aircraft), the US put tariffs on French wine, and they applied a 25% fee. That was quite an interesting study in price elasticity of wine, and it showed that sales went down 15%, so that shows that the 25% wasn’t entirely passed on because people absorbed it along the chain, whether it be the wineries themselves, or the importers, or customers.”

The Reserve Bank in its latest statement says it's too early to quantify the impact of tariffs on the New Zealand economy.

But it leaves room for some further deterioration in the global and New Zealand economies because the US appears to have imported more than usual in the lead up to tariffs in order to avoid the extra cost in advance.

This front-end loading appears to account for a subsequent drop in US imports.

It will not be clear for at least another year whether this will gel with higher prices for farm products being sold into the US.

4 Comments

A case of like it or lump it in reality. NZ’s supply of manufacturing beef is both long established and trusted and with the increase in dairying so too has the resultant increase in volume made the USA market vital. It is just as well that American actually requires the product as even with having to meet the cost of the tariff, the return vis a vis tonnage is unmatched. Of more concern is the ever increasing beef exports from competitors such as Brazil.

I am also slightly concerned re market dynamics. Red meat prices where enough of a motivation that a few weeks ago I hooked on the trailer and went down to Waikato and picked up a trailer load of little beef calves. I have seen good beef steers selling up to $150 a calf nuts prices until only recently

$150? More like $250-$300 surely.

I understand that both NZ and AUS easily fill the beef quota that is imposed by the US.

With a home shortage and tariffs for all it would have thought it would require a big change in US consumption habits to hit our beef exports.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.