Payments are a big part of open banking, a somewhat elusive notion aiming to wrestle money handling power away from traditional financial services oligopolies, to increase competition and lower costs for customers as new market entrants come up with friction-less ways to separate people from their hard-earned cash.

Leaving aside official consternation that open banking is progressing agonisingly slowly and is much delayed in New Zealand (that is what the Commerce Commission thinks at least), there are some new developments to report on.

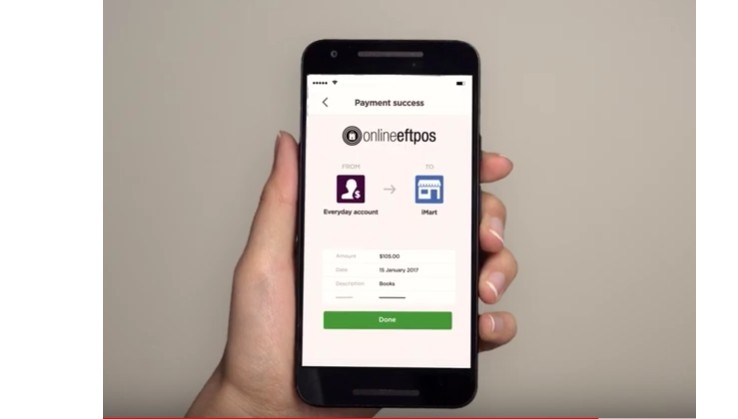

First, there’s the local arm of the global payments company Worldline’s Repeat Pay feature for its Online EFTPOS service.

Repeat Pay is essentially an attempt at replacing direct debits, which are cumbersome and slow to set up, with payment authorisation forms to process.

How does Repeat Pay work for consumers then? What do they need to do?

“It is very simple for a merchant's customers to set up Online EFTPOS - Repeat Pay,” Worldline spokesperson Brendan Boughen explained.

“Customers log in to a merchant's website and set up payments with a few clicks; that is. they approve it in their bank app, and then schedule payments automatically - daily, fortnightly, weekly, monthly, or annually. It is secure and gives customers control, helping them feel confident about their payments to merchants,” Boughen added.

For enterprise merchants, particularly for power companies, telcos, insurers, et al, it’s very easy to get Online EFTPOS - Repeat Pay. They just need to contact the Worldline team about getting started,” he said.

Payments can be fixed or variable amounts, and if they’re declined, customers aren’t stung with dishonour charges. They can also be reversed if there are errors and disputes, Worldline says.

Worldline’s a bit coy on the fee structure for Repeat Pay, but suggests the service will be cheaper for merchants.

“For businesses, pricing is agreed through formal enterprise contracts and varies by merchant but is generally designed to be more cost-effective than traditional options like direct debits and automatic payments,” Boughen said.

“To illustrate: a $400 power bill might cost a business between $0.70 and $4.10 under an Industry Programme or Tokenised Recurring solution.”

“With Repeat Pay on Online EFTPOS, the same transaction could save businesses around 60% of transaction costs. At scale, the savings can be significant."

“For example, if a large enterprise migrated just 5000 customers with average $400 monthly bills from a scheme-based payment to Repeat Pay, the merchant’s annual savings could exceed $30,000,” he added.

Actual results will depend on the negotiating power of the merchant in question.

Last year, Online EFTPOS had 600 merchants onboard, with around 950,000 unique customers. The Big Four banks plus the Co-Operative Bank support Online EFTPOS, but Kiwibank doesn’t yet, and is still not ready with its open banking implementation.

POLi gets open banking deals with the Big Four

One of the original alt-payments systems in New Zealand, which arose from high merchant transaction charges passed onto customers as very unpopular and steep surcharges, is POLi.

POLi was on the banks’ Do Not Use List for the longest time. Escaping surcharges with POLi meant you had to log in to your online banking to do a direct credit to merchants, with the system populating the different fields for you.

This is often referred to as “screen scraping” and handing a third-party your online banking credentials like that to POLi was deemed as a breach of the banks’ terms and conditions.

If something went wrong, tough bikkies, you were on your own.

This has now changed, with RNZ reporting in May this year that ASB, for example, has given the thumbs-up for POLi.

Last month, POLi said it now has agreements with ASB, BNZ, Westpac and ANZ (plus Kiwibank at a later stage) to use its open banking and use application programming interfaces (APIs).

“We will migrate all payments from customers of ANZ, ASB, BNZ and Westpac to be approved by the open banking services offered by those banks. Ditto Kiwibank as soon as they have an open banking service,” a POLi spokesperson said.

POLi said its existing payments service doesn’t use “screen scraping” either.

“A more accurate description of how classic POLi operates pre–open banking is to call it an ‘overlay service’,” the spokesperson added.

“POLi achieves this by essentially tapping into the back-end API’s of the bank's internet banking pages. The customer stays connected in real time throughout the payment session. POLi navigates the bank's internet banking pages in the background, while adhering to strict security protocols and two-factor authentication.”

“Once the payment is complete we terminate the session and return the customer to the merchant. Full transparency is given to the bank of the customer’s IP address and user agent string data, and no customer credentials are stored by POLi at any stage of the process,” the spokesperson said.

“User-Agent” is the data a web browser presents to a server to identify itself and the capabilities it has, like in this example: Mozilla/5.0 (Macintosh; Intel Mac OS X 10_15_7) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/139.0.0.0 Safari/537.36

Customers using POLi don’t need to do anything when the open banking based service is available.

“When POLi migrates a merchant to open banking, the merchant’s customers will authenticate and approve transactions on their bank’s mobile banking app; some banks will also allow customers to approve transactions in the bank’s official internet banking portal,” the spokesperson said.

The migration to open banking is in full swing for POLi currently.

“POLi has recently migrated 1300 merchants to ASB and Westpac’s open banking payment experience, and aims to complete a full migration with those banks in the next month. POLi has just signed bilateral agreements with ANZ and BNZ and is in the early stages of migration planning for those banks,” the spokesperson said.

Switching to open banking has given POLi a direct relationship with banks, at a technical, commercial and customer service level, the company said.

“This has been extremely valuable, both in terms of smoothing the transition to the new technology but also in sharing ideas about the opportunities open banking will bring for our respective customers,” the spokesperson said.

“At a technical level, open banking means that a bank’s customers are authenticated and payments are authorised within the bank’s own digital platforms, which has long been POLi’s desired solution. Customers retain all the existing benefits offered by POLi and can make payments to their favourite merchants in an environment that’s fully supported by the bank,” the spokesperson added.

Pricing won’t change for POLi merchants.

“POLi has for years sought access to bank APIs for transaction authentication and approval. The roadblock to this was the commercial terms including price sought by the banks, which would have required POLi to pass on hefty price increases to our merchants,” the spokesperson said.

“This changed late last year, and now all of the banks are offering low or nil fees for payment transactions. This was the catalyst for POLi concluding open banking agreements with these four banks.”

“We will need to monitor the impact of bank fees and other new costs arising out of open banking, but for now POLI’s merchant fees remain the same,” the spokesperson said.

4 Comments

Baby steps

So to understand , can I set up a repeat pay with, for example BNZ instead of signing up for, for example, Auckland Councils direct debit process? What if Auckland Council says they want direct debit?

I really don't understand how the ASB can be sanguine about users handing over credentials to POLi.

I tried using it once and when I got to the part where it wanted my PIN I decided I didn't want to be involved.

"“For example, if a large enterprise migrated just 5000 customers with average $400 monthly bills from a scheme-based payment to Repeat Pay, the merchant’s annual savings could exceed $30,000,” he added"

So if they move $24m a year in revenue to this platform, they get to save 0.125%?

Margin is good, but thats pretty marginal.....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.