By David Hargreaves

The Reserve Bank has, as expected left the Official Cash Rate unchanged at 1.75%, but has noted something of a rise in house price inflation, while it has also revised down the economic impact of the new Government's measures.

In terms of the things the market will be watching closely from Thursday's release, the RBNZ has trimmed back short-term forecasts for GDP growth (it had forecast as much as 1.2% growth for the March quarter) but then sees stronger GDP growth later in this year and into next. For example it now forecasts 1% growth in the March 2019 quarter versus an earlier forecast fo 0.7% made in its last Monetary Policy Statement in November.

In terms of inflation, it has responded to weaker than expected recent figures by trimming where it sees annual inflation ending this year at. Earlier it saw annual inflation of 2.1% by the end of this year, but now it's forecasting 1.8%.

The predicted interest rate path is unchanged from November's MPS. The RBNZ is still forecasting that there will be no move to the OCR till mid-2019. The OCR has now been unchanged since November 2016. The New Zealand dollar pulled back slightly from just under US72.6c before the announcement to US72.2c.

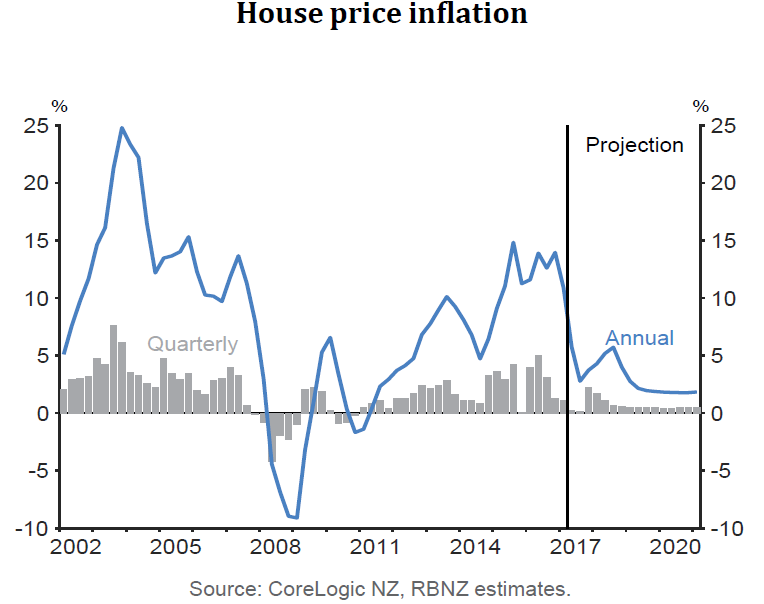

In the MPS document, the RBNZ notes that annual house price inflation slowed to 4% in December 2017, from a peak of 16% in May 2016.

"Changes to loan-to-value ratio (LVR) requirements, a tightening in lending standards, and higher mortgage rates through the end of 2016 have moderated demand for housing. Weaker investor and overseas demand, pressure on affordability, and reduced expectations of future capital gains may have also contributed to the slowdown.

"While monthly house price inflation has increased since July, we expect this to moderate over the projection. Population growth is expected to slow and government policies are expected to dampen demand," the RBNZ says.

It says that annual house price inflation is forecast to stabilise at around 2% in the medium term. The observed increase in monthly house price inflation over the second half of 2017 "is assumed to be short-lived".

However, in what possibly is a less confident view on house prices remaining subdued than was given in November, the RBNZ then qualifies this by saying: "Given low interest rates and excess demand for housing, house prices could rise by more than we have assumed."

The RBNZ says the KiwiBuild housing programme is expected to generate faster growth in residential investment from 2019.

"With significant capacity constraints affecting the construction sector, there is a risk that KiwiBuild has a smaller effect on residential investment if private sector developments are delayed," the RBNZ says.

It says Annual consumption growth slowed to 3.4% in the September 2017 quarter. An increase in government transfers and allowances is expected to raise household incomes and contribute to consumption growth over the projection. Consumption is also expected to be supported by low interest rates, elevated terms of trade, and population growth. Low house price inflation is expected to have some dampening effect on consumption over the medium term.

"In addition to KiwiBuild and an increase in transfers and allowances, higher government consumption is expected to support GDP growth over the projection.

"However, the degree of fiscal stimulus is smaller than assumed in the November Statement. The impact of transfers and allowances on aggregate demand is assumed to be more short-lived and KiwiBuild is assumed to start adding to residential investment later in the projection. These updated assumptions reflect new information from the Treasury’s Half Year Economic and Fiscal Update (HYEFU 2017) and the Bank’s analysis of how fiscal policies affect the economy."

The RBNZ said that as domestic inflationary pressure remains subdued, it is appropriate for monetary policy to remain accommodative.

"Mortgage rates remain at low levels relative to history. Annual GDP growth is projected to average 3.2% over the projection. This above-trend pace of growth is expected to generate an increase in capacity pressure and lift inflation to around the midpoint of the Bank’s target range in the medium term. Survey measures of inflation expectations remain anchored around the 2% target midpoint across all horizons.

This is the statement from Acting Governor Grant Spencer:

Global economic growth continues to improve. While global inflation remains subdued, there are some signs of emerging pressures. Commodity prices have increased, although agricultural prices are relatively soft. International bond yields have increased since November but remain relatively low. Equity markets have been strong, although volatility has increased recently. Monetary policy remains easy in the advanced economies but is gradually becoming less stimulatory.

The exchange rate has firmed since the November Statement, due in large part to a weak US dollar. We assume the trade weighted exchange rate will ease over the projection period.

GDP growth eased over the second half of 2017 but is expected to strengthen, driven by accommodative monetary policy, a high terms of trade, government spending and population growth. Labour market conditions continue to tighten. Compared to the November Statement, the growth profile is weaker in the near term but stronger in the medium term.

The Bank has revised its November estimates of the impact of government policies on economic activity based on Treasury’s HYEFU. The net impact of these policies has been revised down in the near term. The Kiwibuild programme contributes to residential investment growth from 2019.

House price inflation has increased somewhat over the past few months but housing credit growth continues to moderate.

Annual CPI inflation in December was lower than expected at 1.6 percent, due to weakness in manufactured goods prices. While oil and food prices have recently increased, traded goods inflation is projected to remain subdued through the forecast period. Non-tradable inflation is moderate but expected to increase in line with increasing capacity pressures. Overall, CPI inflation is forecast to trend upwards towards the midpoint of the target range. Longer-term inflation expectations are well anchored at 2 percent.

Monetary policy will remain accommodative for a considerable period. Numerous uncertainties remain and policy may need to adjust accordingly.

39 Comments

Monetary policy will remain accommodative for a considerable period. Numerous uncertainties remain and policy may need to adjust accordingly.

Given the prospect of bank depositors enduring compound income reduction, in a risky environment, it is the duty of RBNZ officers to explicitly state the nature of the mentioned uncertainties and what measures they intend to implement to mitigate them in lieu of low interest rates.

The fact that they implemented an OBR policy should be enough of a warning to any depositor, they wouldn't have done it, if they didn't foresee a problem.

It's just timing now, when greed turns to fear and everyone tries to exit at the same time

I think that one of the biggest risks is that many don't understand what OBR is and will only find out on some random Saturday morning only serving to deepen any crisis.

The risk of having one's eggs piled in one basket also applies to NZ banks.

The OBR simply places the onus of a potentially distressed bank onto the shareholders and creditors instead of the taxpayer. It's a result of the mess of the GFC and it's a good thing but it's not a sign of impending trouble.

It also leaves the government of the day free to intervene as it sees fit, and on terms of its choosing. Whilst I think the OBR is untried and seriously questionable, I think this freedom of action could be a real blessing.

it treats depositors as investors, it's like taking you car to get serviced, the garage goes broke and you lose you car.

Depositors have no control over bank behaviour, if they did banks would be more conservative. There would not be covered bonds and we would all be more secure. If a bank goes broke an OBR stops banks calling in mortgages.

"Depositors have no control over bank behaviour"

Neither does your average shareholder, but that is not a bad thing.

A lot of depositers are risk adversed ,so where do they put there coin , property an shares don’t cut if for some.

It’s time to make public more aware of the OBR

Still seems to be broadly & from a simple economic perspective, NZ trims it’s cutter according to however and/or wherever the big ships in the fleet are sailing. Tinkering, tuning & commentating about it, do no harm but NZ has no choice than to go where the tide of world events may dictate. Good governing has though meant that NZ, for quite some time has not suffered the consequences from either a too high or too low tide. Hope it stays that way.

"House price inflation has increased somewhat over the past few months" ... Really ?

no doubt there is inflation in the cost of new dwellings. The sum of local body fees, materials and labour ;-)

Don't worry, Labour is building 100'000 affordable houses

ha-ha! If in the end Labours scorecard is poor it will be way better than Nationals showing as "dismal failure"

https://www.stuff.co.nz/business/97736731/Fewer-than-100-affordable-hou…

Once there was a silly old ram

Thought he'd punch a hole in a dam

No one could make that ram, scram

He kept buttin' that dam

'Cause he had high hopes

He had high hopes

He had high apple pie

In the sky hopes

Credit Frank Sinatra

The REINZ's overall median house prices inflation is up, but is mainly due to the regions house prices up vs the major cities

Nail on the head Foxglove. Moderating influence of current world climate plus the fact that our political environment is relatively benign. Its a kind of weird situation we find ourselves in. Only thing that really rocks my boat is how the Great Deleveraging will occur. Obviously it is not sustainable forever, but I guess it is unchartered territory. Suspect much of what will come will be a fairly gradual process, hard to turn a supertanker around in short order but as long as cool heads prevail at the tiller we may get away with it. However right now it does seem strangely calm, not at all like it felt around 87 or even GFC. I suspect we are all suffering from a collective disengagement and attrition brought about by the enormity of the economic conditions of recent history. Unfortunately there is no magic bullet or cureall, and with so many valid but often conflicting views it is maybe the best course of in/action to go down the middle. Ill leave it to others, eminently more skilled than I, to rock the boat.

I beleive we are still waiting for the so-called affordable home built under the so-called label of”KiwiBuild”

All talk and no substance from the coalition.

The affordable will be terraced box’s that are not suitable for family living, and will only cause problems.

Christchurch has had terraced housing built and they all look the same , stacked all together and are priced at 500k and no one that can afford them wants to buy them.

They are horrible box’s and youwould never be able to reselll them.

Have a little patience, it takes time for a new Government to establish itself and actually get stuck in to delivering houses. Nobody promised houses within the first few months of taking power.

I've lived in terraced housing in the UK, it's absolutely fine. Much more efficient, still plenty of garden space out front and back - we had a dozen fruit trees, a veg patch and a pond. The house cost the equivalent of $250k 7 years ago, it might be worth $350k or so now, in a city the size of Chch. The walls were built solidly enough that noise from the adjacent houses wasn't an issue.

mfd what The Boy is really saying is that terraced housing in Christchurch is helping to create softer rents and house prices and he is not happy about it. He has been making angry comments for some time now especially about the Labour Government. Oh to be diversified.

I think the GFC, not unlike what happened 97 and 01 made us all acutely aware of the extraordinary extent of powers and conversely ignorance of our political and fiscal masters. That said, this time their powers to react are reaching a very finite stage and their apparent ignorance, either by accident or intention, seems unchanged. Not exactly a recipe for proactive management but the conflation of economic dynamics to which we are increasingly becoming accustomed to, along with an ever increasing momentum in the shifting of global power balances makes it very difficult for anybody to claim they can correct anything much. Hence, on a more intensive scale political pragmatism, expediency and opportunism will rule the day as certainty of outcomes is literally a roll of the die. Suspect then the pendulum will begin to swing back toward the rise of political and economic sovereignty over coming decades with more of the same ills that most of us here are familiar with.

Suspect then the pendulum will begin to swing back toward the rise of political and economic sovereignty over coming decades

Agree. That's what's had me troubled about the apparent naivety of many of our recent crop of politicians and their gullibility in over-enamourment with 'globalisation', not recognising that drives ti nationalism and sovereignty are growing elsewhere.

The falling over themselves to court Peter Thiel and throw away the rule book was merely one highly visible symptom of a wider gullibility, in my impression.

Yes that sort of sums it up. Think too about the Cayman style trust fiasco come scandal. “ NZ is not a tax haven” the then PM crowed. But then why, when that government came out of denial & were forced to do some basic tightening up, did all those trusts scatter on the wind? The peasants of this country should just stick to their knitting and pay THEIR taxes on time! Leave the governing to & for the big business cronies. How naive did National take the electorate for as well.

And that explaining NZ's slowness on anti-money-laundering legislation too, vs. other countries. Discussed in earlier articles here on Interest. That - and Key's outright lying over surveillance (discussed recently in the news) just seems like overt shafting of the peasants because those at the top at times think they know better and at other times only seem motivated by their own short term personal gain.

And still the discredited Nats can rely on 40%+ support by the greedy and non-thinkers.

Sometimes it makes you wonder whether 'democracy' really is the 'least worst' system.

.. ask any North Korean citizen whether they'd prefer our version of crony-capitalism or their's of a mafia styled family dictatorship socialism ... which is the least worst of these two examples ?

That's the thing about kool aid. Initially it just something everyone else is drinking, but after a while you pretend to enjoy it just to fit in with the crowd....

Democracy, central plan, laissez-faire, whatever. Still the best, for me, not just on paper. However depends I suppose where you are in the pecking order what your perspective is. I think ‘greedy and non-thinkers’ is a little harsh but I guess that is a sad indictment of the current situation if that is a prevalent view. Political affiliation and ensuing discussion is sometimes a bit like engaging in religious discourse. Relatively pointless if the espousal of differing points of view are anchored in a mindset where a priori beliefs are intractably held.

I agree it's a worry we're getting progressively more partisan, almost following along - as usual - seven years behind the USA.

I can however understand folks' frustration that people are bleating about underachievement in 100 days while at the same time not demanding accountability for nine whole years' inaction on what a party campaigned on. That takes quite some partisan favouritism.

Based on the social media posts I'm seeing I suspect that we will grow more partisan as a society over the next few years. A good example of this is Wiremu'z world g on Facebook with over 74,000 people following his/her posts. Their last post on the PM (which even I thought went way too far) had 5,600 reactions, 3,000 comments and 432 shares. Whether the Left like it or not, dragging >40% of the voting public along as a dead weight is going to slow any progress. Keep it up Basil Brush III, you're making my job as a National Party Member that much easier i.e. I want you to spout pejoratives because I know that is less likely to have National supporters jumping ship.

A long long time ago a revered statesman spoke thus “ government of the people, by the people for the people.” Unfortunately at that time that good doctrine no longer existed in that country, and apart from perhaps the time during the war of independence & not long after, it never really did. Partisan politics far wide & handsome, on all points of the compass! That’s why Burr & Hamilton went at it, and they were even, more or less, on the same side. Apart from the UK maybe, in WW2, politics, partisan at heart, in the western world at least, have burgeoned way out of control . There it is. There is Trump.

I think both the left and right should be put to the sword (the politicians and their supporters) - would make life so much easier.

BadRobot - interesting theory. I wonder if, once this were done and the blood shed had sufficiently pooled, would it all turn out beige.

Having said that though I think all of us here, despite our differences are reasonably aligned on what we would like for ourselves and significant others (as my arrogance doesn’t make me know what is best for everyone). Just that how we get there is obviously the big chewy bone of contention.

Maybe, all of us folk gathered here should sell up and go and live together as FreeMen out the back of beyond in our own community. Free to live and living to be free. I could be your leader...oh crap, its started again. The texts of my misspent school english classes coming back to haunt me, Animal Farm, 1984 and Lord of the Flies. We were doomed before we even started.

Gloriavale

... the residents at Gloriavale remind me that " dill " isn't just a herb ..

I was gonna buy an Island and become Lord Of All I Survey.

But I could not afford the surveillance fees., the rates were abominable,

Someone had sold the water rights to the Mandarins, Fletcher (Christian) had the building rights,

I was atheist, Christ only knows why..!...and they were all head hunters and I did not want a job.as Father Christmas...just for a year.

The Governor was a former Banker, he thought I owed him a job, but I could not gain any interest in that..I told him.

I had sold my House, little did I know, I could not out borrow the banks, a week later so I quit while I was a head and got a Head Masters job in a Public School at their convenience. It was crap job....I had little interest in it, but the Public Purse was strong in those days...held lots of munny, I was so indebted to em...I nearly became a Public Servant...as the pay and the working conditions were such that I never had to work again.

But I though otherwise.

So I became a Politician instead.

You were an atheist simply because you could go about your life without any invisible means of support, one might think?

i find the graph of projected housing inflation strange, have we not had rent rises galore the last couple of months with the extra paid out by the government giving the go ahead to landlords to raise to soak it up and make the numbers more attractive for landlording

that and costs for new builds are not decreasing, same as land so where are they seeing the dropping coming from?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.