I've been hearing a lot of mentions of a certain word recently and I'm starting to get a bit bothered about it.

It is a word that I am steadfastly going to refuse to use in this article, although sharp eyed readers may note that I have used it recently. Sorry. I'll try not to do it again.

The word I am talking about begins with an 'R' and is generally used in connection with an economy that is doing the opposite of growing.

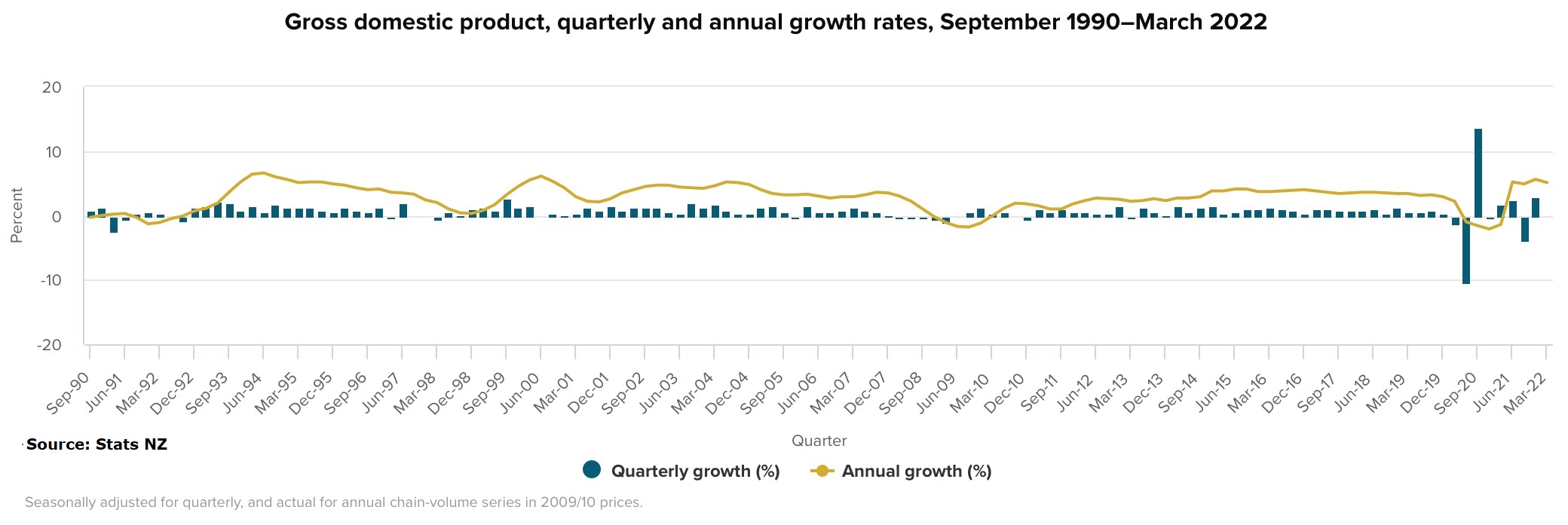

Our economy did take a backward step in the March quarter, with GDP shrinking by 0.2%. But that's actually neither here nor there in the context of an economy that had annual growth at the same time of 5.1%, which for New Zealand is historically right up there.

However, the backward step seems to have set a few people off. You see technically somebody decided that if an economy gets two consecutive quarters where the economy shrinks, it's at that point this 'R' word can be deployed.

And so it is that the mainstream media has seemingly recently got into this kind of 'are we there yet?' pattern where every bit of not great economic news is seen as building us towards this terrible thing.

The first thing I should point out is that all the signs are that the June quarter we've just had will have had a positive outcome, a 'plus sign' in front of the GDP growth figure. But we won't find that out till September.

Because of the reasonably long lag times in release of our GDP figures we won't know the outcome of both the September and December 2022 quarters till March of next year.

So, if things did actually go backwards between now and the end of the year we wouldn't know about that definitively till pretty much the end of the first quarter of next year.

But then so what if it does turn out that we've had two quarters of negative GDP growth by early 2023?

We don't all magically turn to dust. Life goes on. The sun will come up. The cows will keep producing milk.

For the record, the last time we had two consecutive quarters of negative GDP growth was for March and June 2020. That was essentially because we shut the economy down. We did it to ourselves.

The previous occasion in which we experienced a hideous downturn(!) in New Zealand was in the last two quarters of 2010. What a shocker that was, wasn't it?

What, you say you don't remember? No, I don't either. Nobody does. My tongue was firmly in my cheek writing that last paragaph. Quite simply things were not that bad. It actually wasn't until there was some subsequent revision of figures that it became recognised that both the September and December quarters of that year saw (mildly) negative growth. So, only later did we even know that we had technically had one of those things. But it didn't really mean anything.

The economy wasn't flying because we were still recovering from the GFC - yes, THERE was a downturn - but if you look (as one should) at annual growth it was 1.8% for the year to December 2010. Not flash, but actually not terrible by NZ historic standards either.

If we want to talk about historic standards and terrible we should pause on the early 1990s. I've been casting my mind back a bit to that time recently and remembering how awful it was. Unemployment was over 11%. It's currently 3.2%.

It's probably well worth mentioning here that from the start of 1990 to the middle of 1993 we only on one occasion had two consecutive quarters of negative GDP growth (in the first half of 1991) and yet our annual GDP growth didn't get past 2% till the end of the June quarter in 1993.

So, to bring out an 'R' word, living in this country was pretty rubbish at that time. But hey, we got over it.

I do, however, remember how down we were on ourselves at that time. And I'm concerned we are heading the same way.

I've been prompted to opine on this subject because of the very fact that right now, over the next week and a half, we are on the cusp of some further not-great news. This week is seeing us getting the latest (not good) figures from the REINZ, while the Reserve Bank's hiking interest rates again and next week we will likely have annual inflation with a '7' in front of it for the first time in over 30 years.

Consumer confidence surveys are already heading for sub-basement level, this latest news will not help.

We are getting down on ourselves.

I leave myself open to criticism of being overly simplistic, but I think it was foreseeable that the mood of the nation would turn sharply south once house prices did. Our psyche revolves very heavily around the housing market, whether we really consciously acknowledge that or not. It is a weakness for us as a nation because we have such a vested interest in the performance of the housing market.

In the midst of the turmoil of 2020, when at one point things looked bad enough that you could forget about the 'R' word, we were seemingly looking at 'D' for Depression, everybody picked themselves up brilliantly - about the same time as house prices started heading for the sun. Now, goodness me, I wouldn't claim it was all about that - but it sure as hell helped cheer people up.

And now we need cheering up again. It's winter. Okay, it's not cold, but it's a bit wet isn't it? House prices are down. And after we've put up with that darned pandemic for the past two and a half years it's currently more with us than ever. Mortgages are up. Prices are up. Yep, we need cheering up alright.

Our collective mood of course can have a huge impact on the economy in the next year or two.

We did so well, and we've had GDP growth of 5.1% in the year to March 2022, on the basis that Kiwis have kept going out and spending money. That keeps the economy turning.

A key factor has been our near-full employment. And that, for the moment hasn't changed. So, okay things might be costing more. But we are still earning. And there's no doubt that contrary probably to any expectations, the period from 2020 onwards has seen Kiwis able to build up savings. Wallets, within reason, need to be kept open. We spend. It helps.

We really should not then get hung up on the prospect that at some stage next year we may see two quarters in which the economy shrinks. The world will not end.

However, we could, if our attitude is not right, talk ourselves into a longish period of tougher times.

If your economy grows by 0.1% every quarter for say 12 quarters - IE three years - you don't, technically, have one of those 'R' things, do you. But you sure as hell aren't doing very well either.

So, all I'm saying is, we shouldn't be hastily looking to put labels on things at this stage.

We've done very well through this pandemic relative to other parts of the world and can continue to do so. If the mindset is good.

Talking ourselves into something is not what we want to do.

78 Comments

'Recession' is such a nebulous term anyway. We need better measures. Robbo was wanting to change economic measures (which would likely be just as deceptive or more deceptive than what we currently have). Anyway, who's to say NZ is not in an "economic downturn"? All the objective measures and subjective insights suggest that it's heading this way.

The govt, its propagandists, and mainstream media are always going to make spurious comparisons with other countries. And that's part of the problem. Why the fick would it matter if NZ were half a percentage pt lower than an OECD average on inflation or public debt is lower? It doesn't mean NZ is antifragile. For ex, considering that NZ h'holds are living paycheck to paycheck, we're arguably worse than countries like Japan where h'holds have greater cash savings.

Agree it’s a nebulous term. Could have a quarter of negative growth, then a quarter of positive and so on and it wouldn’t be counted as a ‘recession’ but it would be a pretty sickly economy…

Q: and what is a recession anyway?

A: The absence of massive amounts of money printing and ultra easy monetary policies

in NZ, recession is equivalent to less migrants, international visitors, and international students.

so, need I say more about how to avoid it?

Supply of Chinese has dried up hasn't it Xing?

NZ hype is pretty much over for Chinese visitors and students.

As Prof Paul Spoonley pointed about two years ago, there would be a reverse migration in the next 2 decades.

Or possibly more part-time residents with one foot in both countries? I imagine that similar to quite a few Indians that have been here for a long time, their India based relatives are far more wealthier than they are.

Not sure what Xings motive is overall, but very few on here would want to live in totalitarian, corrupt, backward China. I hope Xing lives there.

Audaxes loves China, maybe he should emigrate there

I enjoy Audaxes posts. But he does have an unhealthy crush on China. Ray Dalio is the same.

OK. Not directly related to technical defns of recession, but

Kāinga Ora faces 60 years of unmanageable debt, Megan Woods warned.

Leaked briefing documents show housing minister Megan Woods has been urged to reject new funding requests from Kāinga Ora as the public housing agency faces an unmanageable debt blowout.

https://businessdesk.co.nz/article/public-sector-project/kainga-ora-fac…

What's the alternative? 200000 people rely on Kianga Ora for housing. Tens of thousands more want to. The vast majority of these people have no chance of ever affording private rentals even with accommodation supplement top up. We have made our property bed.

More "signs of our success" and "good problems to have". Our enriching ourselves beyond our means via property really hasn't had great effects on society.

Seems a bit of a beat up since it's all government borrowing ultimately anyway. Which means, the Kainga Ora will keep spending under this term.

The government always spends its own money as it is a sovereign currency issuer, it spends by adding reserves to the banking system. Borrowing is purely an interest rate mechanism as it removes these reserves back out of the banking system again just as does taxation.

It's a public housing agency funded largely by private debt and expected to either make a profit or break-even on the (income) rents it collects?

Well, how stupid is that in the first place?

Very stupid. It’s modus operandi is neoliberal, and it’s a joke.

I'd love to see that budget and see what percentage was actually spent on land, bricks and mortar. I'd wager less than 50%.

In all seriousness, Housing NZ should have had the brakes put on all new spending over the last 18mths as we are in the middle of a building boom and it makes no sense to be competing with private industry for resources and labour.

We really need to be ready to go during a downturn which will support the economy and be more cost effective.

The alternative is to try and avoid these boom/bust cycles in building by having some long term strategic thinking and supply partnerships.

From the Kāinga Ora 2020 - 2021 Annual Report page 144:

We have won New Zealand Debt Issuer of the Year for the last three years.

So are they investment bankers with some social housing tacked on the side?

https://kaingaora.govt.nz/assets/Publications/Annual-report/2020-21-Ann…

We have won New Zealand Debt Issuer of the Year for the last three years.

What a ridiculous achievement.

From reading the text it comes across as a branch of Housing Corp and is financed by the government.

Labels such as Recession are emotive. For the property protagonists who want a U turn on OCR hikes and a rapid return to cheap money then this is a strong headline to get some fear going. Fear stokes opinion, and opinion changes political will - particularly with the incumbents.

Economic indicators signal everything is heading south, so call this patch in the cycle anything you want to, as long as you don't kid yourself we're doing fine. Because we're not.

The printing machines have keep a lot of sleeping beauties in artificial la la land for longer than their memory willfully chooses to remember. Most of wealth in this country is pivoted on speculation based on house prices going up endlessly. What a sham! When all that leveraging unwinds these people will complain they have been short-changed.

The definition of a recession is when your neighbour loses their job. When you lose your job, it's a depression. So for many, this is already worse than a recession.

If you live beyond your means, a day of reckoning will arrive. Just ask Sri Lanka.

Storming suburban Sandringham wouldn't be as fun. I don't think Jacinda even has a pool.

actually she does - every time a good bit of rain hits , like it did today .

Greece is a better ex in the NZ context. The MMTers will say no worries as we have our own sovereign currency.

Private debt is what matters in the NZ context. If Greece had kept its own currency it certainly wouldn't have been exploited in the manner that it has been.

Private debt is what matters in the NZ context. If Greece had kept its own currency it certainly wouldn't have been exploited in the manner that it has been.

Kind of agree. But I still find the "our own sovereign money" argument a cop out. Japan is always trotted out as an example, but Japan has a net creditor investment position and has huge industrial output compared to the likes of Greece and NZ.

Not every country can run a current account surplus though. As long as the financial markets find our NZ Dollars acceptable in the payments system and we do not then have to borrow in foreign currencies to finance our imports. A freely floating currency should always find its own value. MMT defines a sovereign currency as one that does not have a fixed exchange rate and does not borrow in a foreign currency.

Not every country can run a current account surplus though. As long as the financial markets find our NZ Dollars acceptable in the payments system and we do not then have to borrow in foreign currencies to finance our imports. A freely floating currency should always find its own value. MMT defines a sovereign currency as one that does not have a fixed exchange rate and does not borrow in a foreign currency.

I know the story. NZ is accepted as a global payment currency because NZ is denoted as a SWAP nation by the Fed. A bit of devil's advocate, but what if NZ did have to resort to other currencies to pay for imports?

Then we might have to become besties with Russia instead and go back to driving Ladas..

They are not living beyond their means they have massive corruption on an unprecedented scale. You cannot give a country billions of dollars and end up with nothing to show for it.

Great comment. Speculation had soared to great altitude on the endless promise of increasingly cheaper debt. Boom its gone. We have flown to close to the sun and the wings of cheap debt have melted away. Every interest rate increase accelerates specarus's fall back to earth. While i disagree with some of the govts non election agenda,at least they have had the stones to take on the property speculation that is ruining NZ.

On the up

- Interest rates up.

- Brightline window up (tax on flip).

- Future tax payer departures up.

- Listing Up.

- Failed listings for rent up.

- Consents for more supply up.

- CCC for more supply up.

- DTi on the up (in the works)

On the down

- Successful sales down.

- Prices down. Rents down.

- Immigration down.

- Foreign money laundering down.

- Foreign students down.

- Education/immigration scam down.

- Debt based tax rinsing down.

Its a game of up and downs and really its all headwinds for speculation. Two thirds of housing in NZ has no mortgage. The excessive speculation is contained in a overall quite small group of "property to the moon" seminar believers. Well good luck I say.

I will again vote against speculation being bailed out.

Averageman;given that most in here agree that the constant pumping of the housing market has been bad for NZ's economy and the list you provide shows the positive steps taken to alleviate this issue,it seems strange that so many want to vote in a party that will undo all this hard work carried out by reversing these policies.

Entitlement mentality at work.

Indeed. It has been one way in their favour , many owners cannot fathom that leverage can and does move in reverse.

Do ‘so many’ here want to vote in the Nats?

I think many here, including myself, intensely dislike both major parties.

Vote for David Seymour then.

Vote for fossil fuels!

Want to? Probably not. Hold my nose and tick the box because I want this madness to end? Perhaps. Still not sold in the idea that investors interests should be put ahead of aspiring FHBs.

The "2/3 have no mortgage" argument is specious and doesn't lighten negative impacts. It doesn't account for the destruction for wealth directly and indirectly. People should understand that by now.

Agreed, you might as well say 2/3rds were born at a time where you could pay down a mortgage on a family income, which is a much harder ask now even if you've just the one property as a family home. Treating younger owner-occupiers the same ways as the 'doubles every ten years' investor is a pretty callous attitude towards younger Kiwis, who we're supposed to be wanting to encourage to stay and put down roots here instead of fleeing for greener pastures yonder.

Treat them like shit and then tell them they're being selfish when they decide to leave.

At the time, 1992 was a crap year for me. My role was made redundant and the industry wasn’t hiring. It took me in a different direction over the next 30 years and I wouldn’t change a thing. Embrace the changes and work with them but don’t try and pretend they are not what they are. This is a downturn we need to have.

Yep, the expected course of things where capitalism is concerned.

https://en.wikipedia.org/wiki/Creative_destruction

50 billion of new mortgage debt over two years to push residential property value to 1.72 trillion. What could possibly go wrong. Just a 5% drop in values is 86 billion wiped off the wealth effect.

A lot can go wrong, but that's just DGM speak and not welcome among the team of 5 mio.

Had a real estate agent call today offering a free appraisal and claimed Auckland already down 35% but can't find reliable figures to verify or not .

They just want sales and if you list for 40% below peak prices you probably have a good chance of selling at this time. Probably not next year though so depends at what interest rate people need to unload their debt.

In 2010 the entire world rallied around, FED printed, ECB went negitive, Japan continued to endlessly print... even China printed to build infrastructure and supported NZ and Aussie economies....

This time.... Not so much

They thinks its all over.... It is now!

Indeed. We have painted ourselves into the corner over the last two decades. With inflation starting to tear the economy apart, and the Govt/RBNZ only has one brake handle available. INTEREST RATES. It took rates of 20% to turn the ship around last time. Will we end up getting to the heights of the late 70s...

No they have only slightly touched the Interest Rate Brake and we have plunging house prices and nearly a recession, I do not think that rates are going much higher, remember the next 50 by RBNZ already priced in, its their forward guidance that the market is waiting for.

Interest rates 2-2.5% above CPI historically have tamed inflation so 10% maybe what is now required unless the can is kicked down the road again.

R-words come and go. Lots of people make a lot of money in recessions, others lose out. Its part and parcel of our economic cycles. If we try to get clever and really delay R-words for too long then we may end up with a D-word (which is becoming a real risk).. i prefer a shallow Rword and clear the decks ready for the next up bit.

As long as everyone expects the cycle to continue that way it creates better habits like saving for rainy days, not overextending on assets and investments, working on the right careers, also it flattens the asset bubbles (people are more wary at the end of the boom) and so on. God forbid we all think things always go up.

For the younger generations they need to know that things can go bad and experience it (not too bad hopefully) as its been too long and (judging by some of the flash utes the kids are driving) the next generation needs a gentle nudge toward their savings accounts. Government and local government also need a reminder to reign in some of the excessive debt and control some costs in bigger projects)

Yep as Recession bites rates will fall again and the govt can borrow low for 20 years plus to fund a new harbour crossing etc etc etc, its a great thing having your own currency and independant interest rates. Our borrowing is way less then other OECD countries, the tail risk is that private bank debt transfers to public by bank bailout if things turn really bad.remember we and other countries have embraced printing and lending so we will not see another GFC like freeze in short term credit markets, though we may see serious stress on corporate debt.

The downturn has just started, the NZD tumbling around 15% from end of last year rates and inflation climbing, house price’s tumbling in some areas by 4k a week.

Would recession make any difference in the real world? Many companies already have long order backlogs and the employment market remains tight as a drum with very high open position numbers.

Employers are deluded and aren’t seeing the storms ahead.

The labour market was also pretty tight in 2006/2007….

The downturn has just started, the NZD tumbling around 15% from end of last year rates and inflation climbing, house price’s tumbling in some areas by 4k a week. As downturn speeds up overseas property owners who purchased here will give orders to start selling houses while still have profits to take.

Maybe, but I think a lot of Chinese money will stay, it went into NZ housing as an escape from China..... ownership is often difficult to trace, just the way they like it.

I've been thinking a bit about the doom and gloom merchants endlessly trotting out the recession mantra. It all seems intensely political.

All these nonsense confidence surveys are largely self fulfilling - if enough people anticipate a recession, observer bias on a mass scale will actualise a recession through thousands of small decisions leading to a material drop in aggregate demand (or at the very least, make any external impulses which drive recession become more amplified).

I guess it's the flip-side of the wealth effect.

Next you will be wanting to ban short sellers.... remember someone has to be a buyer to help form the bottom of any market. Someone who always predicts doom and gloom is as useful as Ashley Church is constantly predicting an everlasting boom.

The DGM here since Dec 21 have been right, even the ones refusing to buy Real Estate all 2021 are now right. The people like to find someone to blame, Labour happen to be holding the wheel last 5 years.... they will do. It's not going to be an easy next term.

We have long standing lack of investment in infrastructure, health and education. Even policing looks shot here. next term taxes likely to be down, costs up due to inflation, all you can do is tinker.

The confidence surveys are held on regular cycles - not politically driven. Stats are important if you want to know where you are, like a compass or GPS at sea.

The good news is that those propellor property, staircase, txt ladder to.... , silly ads will stop on Newstalk ZB.

Check out the charts on site and note how most have trends indicating NZ is on the wrong track but the shrewd having recognised the trend have already started to cut their cloth accordingly.

Kiwis like a good moan...I try not to listen to Mike Hosking in the morning for this very reason....he never has a positive word (oh,except for housing,which is on the up again,happy days). As the highest rating broadcaster in NZ,I think of all those people waking up to be brainwashed by his negative mantra.As Ms Ardern doesn't come on his program anymore,he is on a personal vendetta to put a negative spin on everything Labour does.

A few years ago he used to bang on about the number of DHB's and local councils being full of unknow people of unknown ability being voted in to manage millions in assets, now we have reduced DHB's under the new authority & 3 waters bringing proper governance and an ability to finance major infrastructure from central government, now he is against all of this. If JK had suggested it,he would have been praising JK for his business acumen....negativity breeds negativity and becomes self fulfilling. That is one thing OZ has over us here,a much more positive approach.

I think we need stricter regulation for the journalists. It really annoys me that some of them push their own political agendas and propaganda over public media.

'Regulation for journalists'.

Perhaps we need a civics system that can teach people about how the frameworks for fascist dictactorships and communist ones can often look identical, because apparently there's a huge gap in our education. "Regulating journalists" is the closest to chilling newspeak that I've read on this site, I almost can't believe I'm reading it tbh.

I just think they should abide to a moral and ethical code like other professionals are required to. But I like where your tinfoil hat took you.

Well given that they are already governed by the Press Council/NZMC, you must be arguing for something that reaches further than a light handed touch.

But it's nice to see the idea of a truly free press (you know, one of those democratic fundamental thingies) is worth being deemed a foiler. Don't really feel too bad for sticking my neck out on this one!

Pay down your debt.

R word?

I'm planning on the D word.

And I don't mean 'dick'.

Depression.

we won't know the outcome of both (GDP figures for) the September and December 2022 quarters till March of next year.

Absolutely shocking, not good enough at all.

David, indeed the R word is just a word and we should not get hung up on it. What is a likely future problem though, is not so much two quarters of negative growth, it's the reality that our disposable income goes a lot less far, eaten up by higher mortgage rates and inflation, and this has nothing to do the "theoretical economy" but bites where it hurts the most, in peoples wallets

I'm amazed people don't remember what happened last time oil prices did what they're doing now. Wasn't that long ago...around 2008. Only this time around it's our housing market that is the biggest bubble in terms of being over-bought. The foreign equities markets seem to be worse than ours, so we will also see some pain when those collapse a further 20-30%.

https://en.wikipedia.org/wiki/World_oil_market_chronology_from_2003#/me…

"I leave myself open to criticism of being overly simplistic, but I think it was foreseeable that the mood of the nation would turn sharply south once house prices did".

I couldn't have put it better myself..

Great reminder of the early 1990’s. The country was down in the dumps. Many people I knew were unemployed. The media was full of companies/government departments shutting down and lying off staff. Had been like that since 1984. Certainly around here in New Plymouth. I used to drive to Motunui at 6.30amin 1990 to start my day shift. The roads were nearly empty. Fast forward to the early 2000’s and the traffic had increased markedly. The population grew until now it is quite busy in the roads at that time of the morning. I was sure grateful to have a good paying job for all of those early years.

Lies, damn lies... and statistics....

If the key measure (NZD$) is being devalued through high inflation (and every year), then GDP is also a false measure of growth as the baseline metric is constantly diluted.... i.e. the NZD$

Stats NZ own definitions:

The production approach to GDP measures the total value of goods and services produced in New Zealand

The expenditure approach to GDP (also known as gross domestic expenditure or GDE) measures the final purchases of goods and services produced in New Zealand

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.