Mortgage lending

First home buyer activity is flat but record numbers are taking out low equity mortgages to get into homes of their own

28th Oct 25, 12:03pm

First home buyer activity is flat but record numbers are taking out low equity mortgages to get into homes of their own

NZ Banking Association says 15,000 first home buyers took out mortgages in first half of year with an average loan size of $507,690

13th Oct 25, 3:30pm

2

NZ Banking Association says 15,000 first home buyers took out mortgages in first half of year with an average loan size of $507,690

Shortcomings in the Reserve Bank's current mortgage lending database should be resolved by new reporting system currently being developed

26th Aug 25, 5:00am

Shortcomings in the Reserve Bank's current mortgage lending database should be resolved by new reporting system currently being developed

First home buyers aren't paying more to get a home of their own but more of them are taking out low equity mortgages

30th Apr 25, 12:36pm

First home buyers aren't paying more to get a home of their own but more of them are taking out low equity mortgages

Latest figures suggest about 5000 people a month are moving into a home of their own for the first time

25th Oct 24, 11:45am

88

Latest figures suggest about 5000 people a month are moving into a home of their own for the first time

Banks are lending more to first home buyers with less than a 20% deposit

The average prices being paid by first home buyers have declined slightly over winter

28th Sep 23, 8:17am

131

The average prices being paid by first home buyers have declined slightly over winter

There are early signs that first home buyer activity could be starting to stabilise

29th May 23, 11:17am

58

There are early signs that first home buyer activity could be starting to stabilise

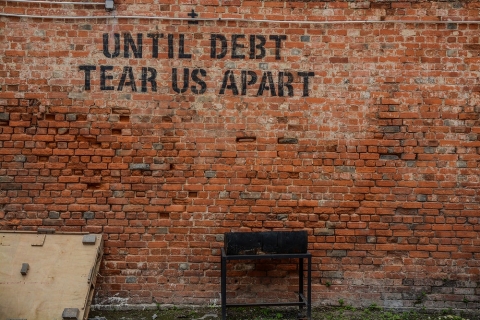

NZ has a long-running housing crisis, house prices have outstripped incomes since the early 2000s. But more than just housing supply and subsidies, we also need policies to make homes affordable and a long-term, apolitical programme for social housing

29th Nov 22, 2:07pm

37

NZ has a long-running housing crisis, house prices have outstripped incomes since the early 2000s. But more than just housing supply and subsidies, we also need policies to make homes affordable and a long-term, apolitical programme for social housing

First home buyers with less than a 20% deposit are paying more for a home than buyers with a full deposit, pushing up their mortgage risk profile for banks

29th Jun 22, 11:44am

66

First home buyers with less than a 20% deposit are paying more for a home than buyers with a full deposit, pushing up their mortgage risk profile for banks

Early criticism of the effect credit contracts law changes are having on first home buyers may be misplaced

8th Feb 22, 1:21pm

155

Early criticism of the effect credit contracts law changes are having on first home buyers may be misplaced

Mortgage lending growth slows, but first-home buyers manage to cobble together deposits big enough for them to remain key players in the market

31st Jan 22, 6:03pm

29

Mortgage lending growth slows, but first-home buyers manage to cobble together deposits big enough for them to remain key players in the market

The majority of new mortgages aren't used to buy houses but the Reserve Bank is keeping the numbers secret for the time being

4th Nov 21, 3:28pm

61

The majority of new mortgages aren't used to buy houses but the Reserve Bank is keeping the numbers secret for the time being

First home buyers borrowed an average of $548,000 during September

Finance Minister Grant Robertson says he moved as quickly as was responsible to give the Reserve Bank new tools to restrict banks' mortgage lending

3rd Aug 21, 2:47pm

71

Finance Minister Grant Robertson says he moved as quickly as was responsible to give the Reserve Bank new tools to restrict banks' mortgage lending