Tax

Jenée Tibshraeny argues in a changing world the Government needs to balance out the RBNZ's quantitative easing with a bottom-up approach to ensure the most needy don’t miss out

3rd Sep 20, 10:08am

102

Jenée Tibshraeny argues in a changing world the Government needs to balance out the RBNZ's quantitative easing with a bottom-up approach to ensure the most needy don’t miss out

The Week in Tax; COVID-19 related measures for tax losses and AirBnBs; National releases its small business tax policy; and is a capital gains tax back on the agenda?

30th Aug 20, 1:46pm

24

The Week in Tax; COVID-19 related measures for tax losses and AirBnBs; National releases its small business tax policy; and is a capital gains tax back on the agenda?

Buddle Findlay's Steve Nightingale & Amy Cunniffe say any company considering establishing an employee equity scheme should seriously consider whether a phantom scheme will deliver on its objectives

29th Aug 20, 9:21am

2

Buddle Findlay's Steve Nightingale & Amy Cunniffe say any company considering establishing an employee equity scheme should seriously consider whether a phantom scheme will deliver on its objectives

National outlines tax changes aimed at reducing business compliance costs and encouraging capital investment

27th Aug 20, 2:46pm

35

National outlines tax changes aimed at reducing business compliance costs and encouraging capital investment

New Zealand's financial services sector readies for the replacement of the discredited LIBOR benchmark interest rate system as the clock ticks

25th Aug 20, 6:10pm

New Zealand's financial services sector readies for the replacement of the discredited LIBOR benchmark interest rate system as the clock ticks

The Week in Tax; home office payments clarified, Resurgent Wage Subsidy, reshaped Business Finance Guarantee scheme, SME cashflow scheme, and tax pooling

23rd Aug 20, 10:54am

2

The Week in Tax; home office payments clarified, Resurgent Wage Subsidy, reshaped Business Finance Guarantee scheme, SME cashflow scheme, and tax pooling

The Week in Tax; home office deductions, when is development work ‘minor’, and are our tax policy settings right?

16th Aug 20, 9:03am

5

The Week in Tax; home office deductions, when is development work ‘minor’, and are our tax policy settings right?

PSA National Secretary Erin Polaczuk calls for a commitment to universal basic services for all New Zealanders via the Aotearoa Wellbeing Commitment

15th Aug 20, 9:59am

24

PSA National Secretary Erin Polaczuk calls for a commitment to universal basic services for all New Zealanders via the Aotearoa Wellbeing Commitment

In interest.co.nz's Election Series, KPMG's John Cantin asks whether we have our tax settings right as NZ battles the COVID-19 crisis and other 21st century challenges

10th Aug 20, 5:54am

27

In interest.co.nz's Election Series, KPMG's John Cantin asks whether we have our tax settings right as NZ battles the COVID-19 crisis and other 21st century challenges

The Week in Tax: fringe benefit tax, how workable is the Greens Party's wealth tax? And is unemployment insurance on the cards?

9th Aug 20, 10:25am

73

The Week in Tax: fringe benefit tax, how workable is the Greens Party's wealth tax? And is unemployment insurance on the cards?

As the September 19 election looms, against the backdrop of COVID-19, right here is the place for some key public policy debates

7th Aug 20, 2:32pm

43

As the September 19 election looms, against the backdrop of COVID-19, right here is the place for some key public policy debates

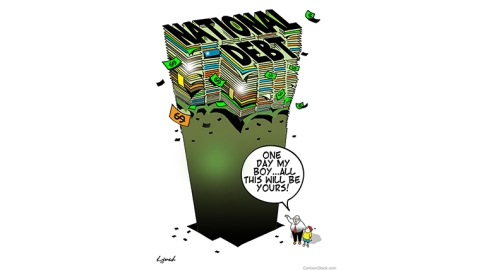

MMT economist Steven Hail argues that, as long as the New Zealand Government remains a monetary sovereign, there can never be a government debt crisis

4th Aug 20, 12:15pm

101

MMT economist Steven Hail argues that, as long as the New Zealand Government remains a monetary sovereign, there can never be a government debt crisis

The Week in Tax: taxing gold, the tax implications of meeting the Healthy Homes standards, and six months to get ready for the new Trusts Act

2nd Aug 20, 5:33pm

10

The Week in Tax: taxing gold, the tax implications of meeting the Healthy Homes standards, and six months to get ready for the new Trusts Act

ACT Leader David Seymour on how slashing tax and government spending will get New Zealand through the economic crisis

2nd Aug 20, 6:02am

243

ACT Leader David Seymour on how slashing tax and government spending will get New Zealand through the economic crisis

Election 2020 - Party Policies - Tax

Election 2020 - Party Policy - Tax - Business Tax

25th Jul 20, 5:56am

Election 2020 - Party Policy - Tax - Business Tax

Election 2020 - Party Policies - Tax - Capital Gains Tax

Election 2020 - Party Policies - Tax - Income Tax

Election 2020 - Party Policies - Tax - GST

25th Jul 20, 5:51am

Election 2020 - Party Policies - Tax - GST

Former head of collapsed Blue Chip group charged with fraud in Australia reportedly after providing tax structuring advice

22nd Jul 20, 12:52pm

13

Former head of collapsed Blue Chip group charged with fraud in Australia reportedly after providing tax structuring advice

ACT Deputy Leader Brooke van Velden argues the Government is on the wrong track borrowing up a storm

20th Jul 20, 11:36am

61

ACT Deputy Leader Brooke van Velden argues the Government is on the wrong track borrowing up a storm

The Week in Tax: proposed changes to the late payment penalty regime for Child Support. Millionaires want tax increases but the EU’s bite of Apple goes sour. And last days to organise a tax pooling payment for the 2019 tax year

19th Jul 20, 12:03pm

11

The Week in Tax: proposed changes to the late payment penalty regime for Child Support. Millionaires want tax increases but the EU’s bite of Apple goes sour. And last days to organise a tax pooling payment for the 2019 tax year

Paul Goldsmith wants to cut 'nice-to-have spending', including NZ Super Fund contributions, saying National 'can’t and doesn’t want to outspend Labour'

16th Jul 20, 6:19pm

61

Paul Goldsmith wants to cut 'nice-to-have spending', including NZ Super Fund contributions, saying National 'can’t and doesn’t want to outspend Labour'

Brian Fallow examines the economic priorities outlined so far by the leaders of the two main political parties and finds 'pious waffle berefit of new policy' with rhetoric that is almost identical

13th Jul 20, 2:36pm

30

Brian Fallow examines the economic priorities outlined so far by the leaders of the two main political parties and finds 'pious waffle berefit of new policy' with rhetoric that is almost identical

The Week in Tax; the Small Business Cash-Flow Loan Scheme is extended, ACC levies are frozen, and Inland Revenue explains the taxation of overseas investment properties

12th Jul 20, 8:49am

3

The Week in Tax; the Small Business Cash-Flow Loan Scheme is extended, ACC levies are frozen, and Inland Revenue explains the taxation of overseas investment properties