Summary of key points:

- Global equities market risk reduces for the Kiwi dollar

- Trump, trade and technicals

- Big week ahead for economic announcements

- Why a constantly weak exchange rate does not help the NZ economy

Global equities market risk reduces for the Kiwi dollar

The risk/reward message from this column over the last six weeks has been the vulnerability of the Kiwi dollar to another major sell-off (caused by a second-leg down in global equity markets) would reduce as time moved on.

On the assumption that the equity market collapse over the second half of March had fully priced-in the worst case scenario in terms of economic damage from the Covid-19 enforced lockdowns, the likelihood was that the recovery back up in equities would be sustainable as the markets looked forward to 2021 company profits being a big improvement on the 2020 results.

The expectation was that the NZ dollar would itself recover back to the 0.6200/0.6300 level provided the determining equity markets stabilised. We seem to be well on track for this to occur with the next phase of NZD and AUD gains against the USD likely to come from the US dollar weakening against all currencies.

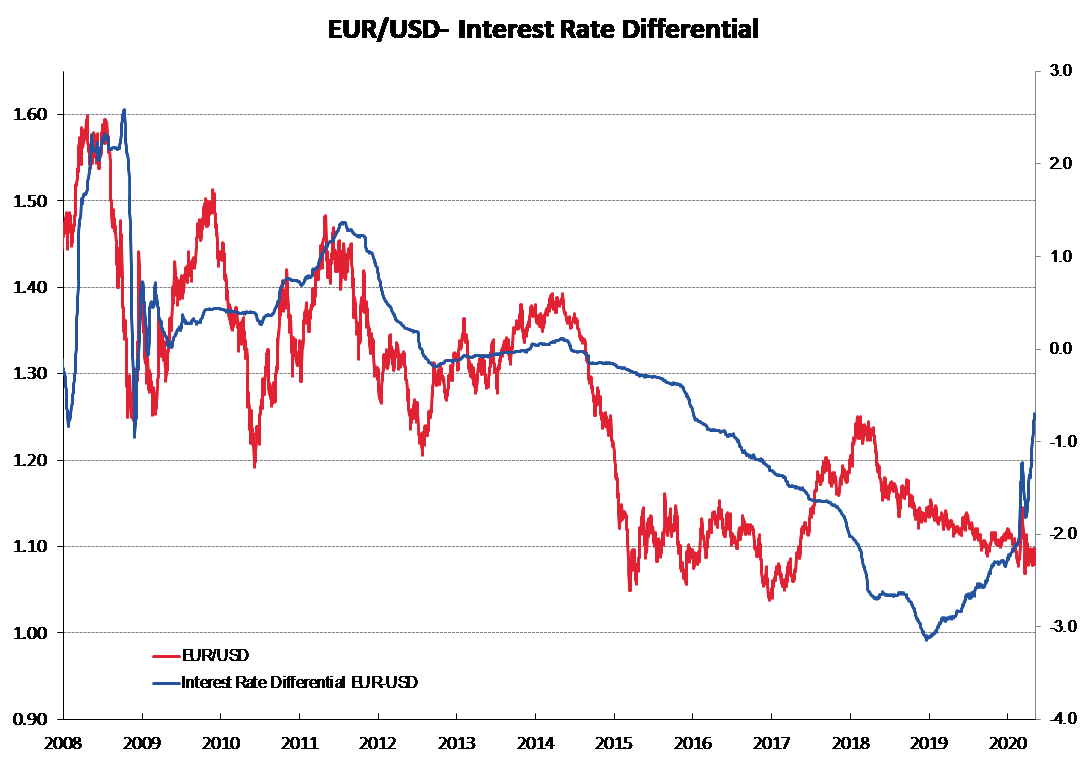

So far, the anticipated USD depreciation has not materialised despite the massive increases occurring with their internal budget deficit, Government debt levels and infinite money printing (Federal Reserve QE). The China/US trade wars in 2019 and higher US interest rates compared to Europe kept the USD strong over recent years, however this has now significantly changed with the cutting of US interest rates to zero (refer EUR/USD chart below).

Perhaps we have yet to see more substantial unwinding of long USD positions entered when global funds took the flight to safety/safe-haven into the US dollar in March?

However, the movement away from the US dollar as the only safe/reserve currency should increase as the forex markets realise that the US economy has been hit a lot harder for longer by the Covid-19 pandemic than other economies who are recovering earlier (China, Asia, Australia and New Zealand). The potential for a second-wave of Covid-19 infections in the US seems relatively high as many States defy the Federal Government criteria and move out of lockdown too early.

Trump, trade and technicals

Whilst there have been contradictory reports on how well the relationship between China and the US has been travelling in terms of implementing Phase One of the trade agreement reached last December, the Kiwi dollar picked up some upward momentum last week from the initial message that China was honouring the trade deal.

President Trump needs to be able to point to a victory he has accomplished for his re-election chances in November. He has lost the positive performance of the economy and share markets under his watch, therefore he needs to show how he forced the Chinese to change on trade and how he secured a better “deal” for America. It is certainly not in Trump’s political interests to scupper the China/US trade agreement due to his predisposition to blame the Chinese for everything. One suspects that the US public will be more in a mood for a sensible, secure and stable President come November than another four years with a flamboyant and unpredictable showman.

In moving above 0.6120 last Friday the NZD/USD exchange rate has traded above its 90-day moving average and in a technical/chart sense has signalled a change from a downtrend to an uptrend. Equity market movements have been a dominant influence over NZD/USD direction in recent months. However, this is forecast to reduce as the equity markets transition into more of a sideways shuffle with choppy market conditions, rather than major uptrends or downtrends.

Big week ahead for economic announcements

The coming week is an extremely busy one on the economic front with the Government’s cabinet decision on Monday the 11th on whether and when we move from level three to level two, the RBNZ Monetary Policy Statement on Wednesday 13th and Finance Minister Grant Robertson announcing the Budget on Thursday 14th.

Implications for the NZ dollar exchange rate stemming from these announcements are likely to be:

- Monday’s level 2 decision – Positive for the NZD if we go to level two within a week. Negative for the currency if we stay at level three for longer (greater business and economic carnage).

- Wednesday’s RBNZ statement – Impossible to forecast the economy with any accuracy, so they will just paint scenarios. Further QE type monetary stimulus on top of the $33 billion already announced does not seem warranted as cash/liquidity is flowing through the system with no plumbing blockages. Neutral for the NZD.

- Thursday’s Budget – Impossible to forecast the economy, therefore perhaps we should have followed the Aussie lead and postponed it to later in the year when the future is clearer. The September general election prevents that, so expect a political/PR statement more about optics than firm economic policy changes. Neutral for the NZD.

The self-imposed (for good reasons) economic shock we have experienced does provide the opportunity for New Zealand to have a major re-set with the economy to give us a chance to generate higher levels of wealth, income and thus taxes flowing into the Government to repay all this extra debt we now have.

As every household knows, servicing and repaying higher debt levels is achieved through a combination of reducing unnecessary costs and increasing income.

Finance Minister Grant Robertson has stated that the he sees the economic re-set as an opportunity for the State to play an increased role in the economy, particularly in respect to the environment and inequality of incomes. That sounds like regulation, retrogression and redistribution policies, rather than a policy prescription for increased economic growth so that we do not send the debt bill to our grandchildren.

Why a constantly weak exchange rate does not help the NZ economy

In his actions and statements to date the RBNZ Governor also seems to display a predisposition that a lower NZ dollar exchange rate value is more valuable for our economy. History would tell us that this is not the case for New Zealand. Commodity exporters rarely receive additional value through a lower NZD exchange rate as the overseas buyers merely adjust the USD offered price downwards to reflect the NZD/USD rate change (otherwise they source from elsewhere).

Our manufacturers are niche exporters selling on quality and service, not price. A lower exchange rate makes them more competitive on price, however often at the expense of complacency and inefficiency.

Many NZ manufacturers would argue that a higher exchange rate ensures they stay cost competitive, drives quality improvement and new imported capital equipment/machines are cheaper and thus provide the necessary return on capital employed. If the exchange rate is constantly weak, manufacturers do not make the capital investment that is required for expansion and thus more jobs.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

Roger,

I am happy to agree with you that export success is not built on a constantly reducing dollar. On the equity market, I fully expect the NZX50 to retreat to at least where it reached in March-some 2000 points below its present level. Only then, will I be interested in some selective rebuying at lower P/Es.

many have predicted a retreat from the US$ and an excellent case can be made for that, but as yet, the question is to where? No single currency is in a position to assume the role. I have heard talk of a China/Russia gold-backed crypto-currency, but I'll believe it when I see it.

NZ took an extreme measure to eliminate Covid19. When it fails, the economy will take harder hit than other nations.

Not necessary to look Dow Jones or NZX50 every minute, but rather just keep an eye on disappearing jobs every day.

https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12…

I commend you for using constraint when describing trump as merely flamboyant and unpredictable. I would use a lot more epithets to describe someone so devoid of positive character traits or lack of education in macro-economic fundamentals.

More pointedly to the article....I would imagine the current US administration will continue to artificially prop up the US equity markets right up until election time in November. trump does not , nor ever has, given one iota of rats arse for investors in his businesses because it has never been his own money he uses, from the very time his father gave him his first million. He screws up with other peoples money and then walks under bankruptcy. It will be the American people who pay for their own lack of IQ in electing him in the first place, once the bill comes due from his absolute inability to responsibly lead. He was leading the US into bankruptcy way before Covid by artificially propping up the equity markets through his totally uneducated corporate tax cuts causing massive budget deficits, even when the economy had been going along well before he was elected. The guy is so economically uneducated it is unbelievable how ignorant the US voter was in electing him. Well done fox entertainment.

And NZX blindly following? Cash, cash, cash......Im willing to give up a little now to be sitting pretty in 6 months.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.