Summary of key points: -

- Trump’s trade deals potentially opening greater market access for our exporters

- Why China is now a positive for the Aussie dollar

- US Dollar plunge approaches critical chart levels

Trump’s trade deals potentially opening greater market access for our exporters

A global trade scenario is emerging that could be of real benefit to New Zealand as an export-reliant economy. As quintessential free traders, us Kiwi’s naturally think that most other countries we trade with have low or zero barriers of entry for foreign goods into their economies, just as we do. What Donald Trump has reminded us about over recent months with his tariff negotiations, is that many countries have dropped their import tariffs to US goods, to secure a lower tariff for their exports into the US economy. Japan bent the knee and have allowed in US rice imports for the first time ever. The Australian will now allow the importation of US beef. Greater access for US exports into these previously protected markets must surely open the question for our international trade representatives “you are allowing US goods in, what about our goods coming in on equivalent terms.” Under the description of “unintended consequences,” President Donald Trump, in attempting to reverse globalisation and free trade, may have inadvertently promoted and increased it. For us free traders anyway!

Separate to Trump’s tariff negotiations, New Zealand scored an important trade win against the Canadians last week with them now allowing access to our dairy products after a long-running trade dispute under the CPTPP trade agreement. The Canadians finally relented as they are being pressured about access of us goods into their markets. Trump’s protectionism policies are weirdly reducing protectionism elsewhere as everyone still wants low tariff access to the lucrative US market.

Instead of tariffs and trade wars being viewed by most local economic commentators as a negative for the New Zealand economy, what is transpiring is the opposite. If our beef exports to the US stay at a 10% tariff against the 60% tariff the Brazilian beef exports are required to pay to supply the US market, we gain a competitive price advantage in the US marketplace. The RBNZ and bank economic forecasts, to date, have all included lower global growth and lower international trade (due to tariffs) leading to headwinds for our exports. However, that is not what is happening with increased export prices and volumes dramatically reducing our trade deficit over the last six months.

In our 22 June FX Commentary report we proffered a potential scenario of the US agreeing import tariff percentages in July/August with Europe, Japan, China, and other nations at the lower end of expectations, which would allow the Fed to gain some long-awaited clarity of the tariff impact on inflation. So far, the trade deals agreed with the UK, Japan, and Vietnam the tariff percentages have been at the lower end of Trump’s earlier threats and previous expectations. Agreements with China, Europe, India, and Korea are not far away from being announced by the Americans. All the risk and uncertainty associated with Trump’s tariffs over the first half of 2025 is now deescalating and the trade playing field is becoming clearer.

Our 20 April report headed “A Sino-American trade deal would send the Aussie dollar skywards” pontificated that the AUD exchange rate would benefit when the currency traders around the world finally worked out that the Chinese economy would not be negatively impacted by Trump’s tariffs. The AUD/USD exchange rate has already moved up from 0.6350 in April to 0.6570 today. The rally is looking like it will be extended when we have the final US/China trade deal agreed this week.

Why China is now a positive for the Aussie dollar

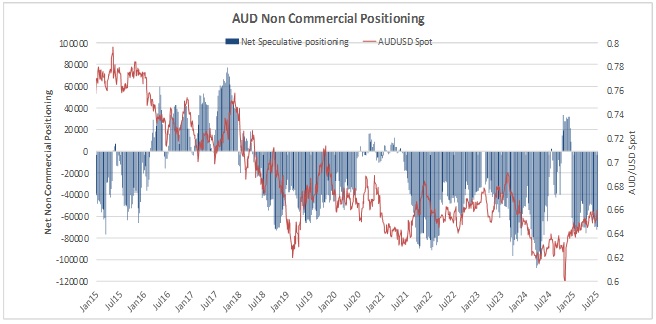

Over recent years the Australian dollar has been held at cyclical lows against the Us dollar due to having much lower interest rates than the US and the Australian economy being highly dependent on all things related to China. Around the world, the Aussie dollar is traded and speculated with as a liquid proxy for being positive or negative on the Chinese economy. Trump’s tariffs/trade war with China was widely expected to hurt the Chinese economy, therefore there was little interest to buy the Aussie dollar. The currency speculators who trade US futures markets have held large “short-sold” AUD positions against the USD since January, laying down repeated bets that the AUD will depreciate further against the USD (blue bars in the chart below). The problem is that the AUD/USD exchange rate is no longer going south. Further gains for the AUD from this week’s US/China trade deal will likely see these FX punters being forced to close their “short sold” positions by buying the AUD back – adding further upward momentum to the currency value.

The western financial media have a bad habit of underestimating the size, strength and robustness of the Chinese economy. They did it again with Trump’s tariff threats. It needs to be stated again that China’s exports to the US is only 15% of their total exports. Recent Chinese export data confirmed exports to the US reducing 30%, however being more than replaced with increased exports to Europe and the rest of Asia.

The chart below from Macquarie Bank confirms that Chinese exports to the US (gold line - left hand axis) have been reducing since 2022, the tariff threats this year further decreasing the figures. On the other side, China has seriously increased their exports to the rest of the world from US$240 billion in 2022 to US$280 billion this year (blue line – right hand axis).

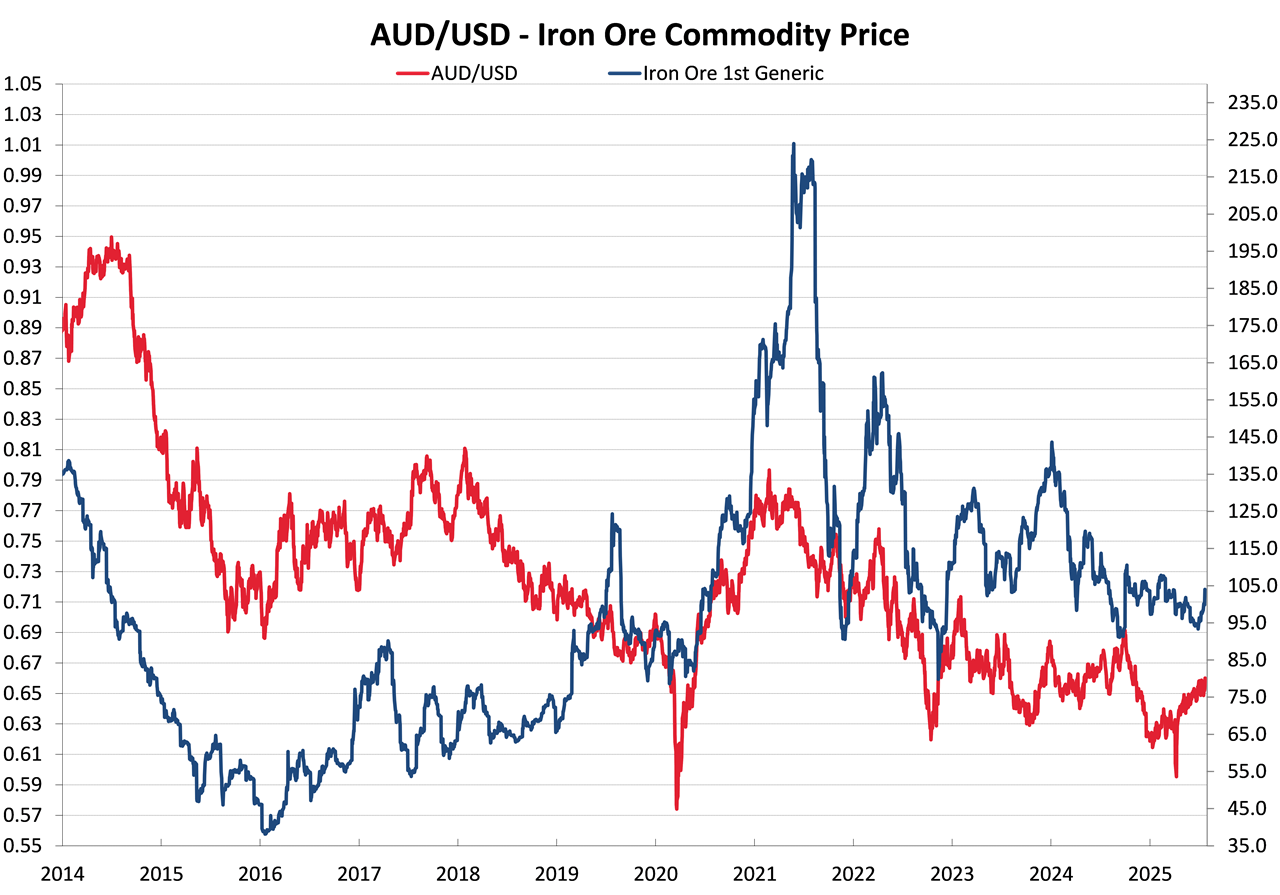

A further significant Chinese development directly related to the Aussie dollar was the Chinese announcement last week of the construction of the world’s largest hydropower project in Tibet. The US$170 billion mega-dam project is on the Yarlung Zangbo River in the Himalayan foothills (the river is also known as the Brahmaputra as it flows into India further downstream). The announcement confirming to the markets that China is back to its old tricks of fiscal economic stimulation through massive infrastructure builds. The iron ore price shot up on Singaporean futures markets from US$97/tonne to over US$104.tonne. Iron ore, as Australia’s major export commodity, was languishing in price over recent months. The price lift is positive for the Australian economy and the Aussie dollar.

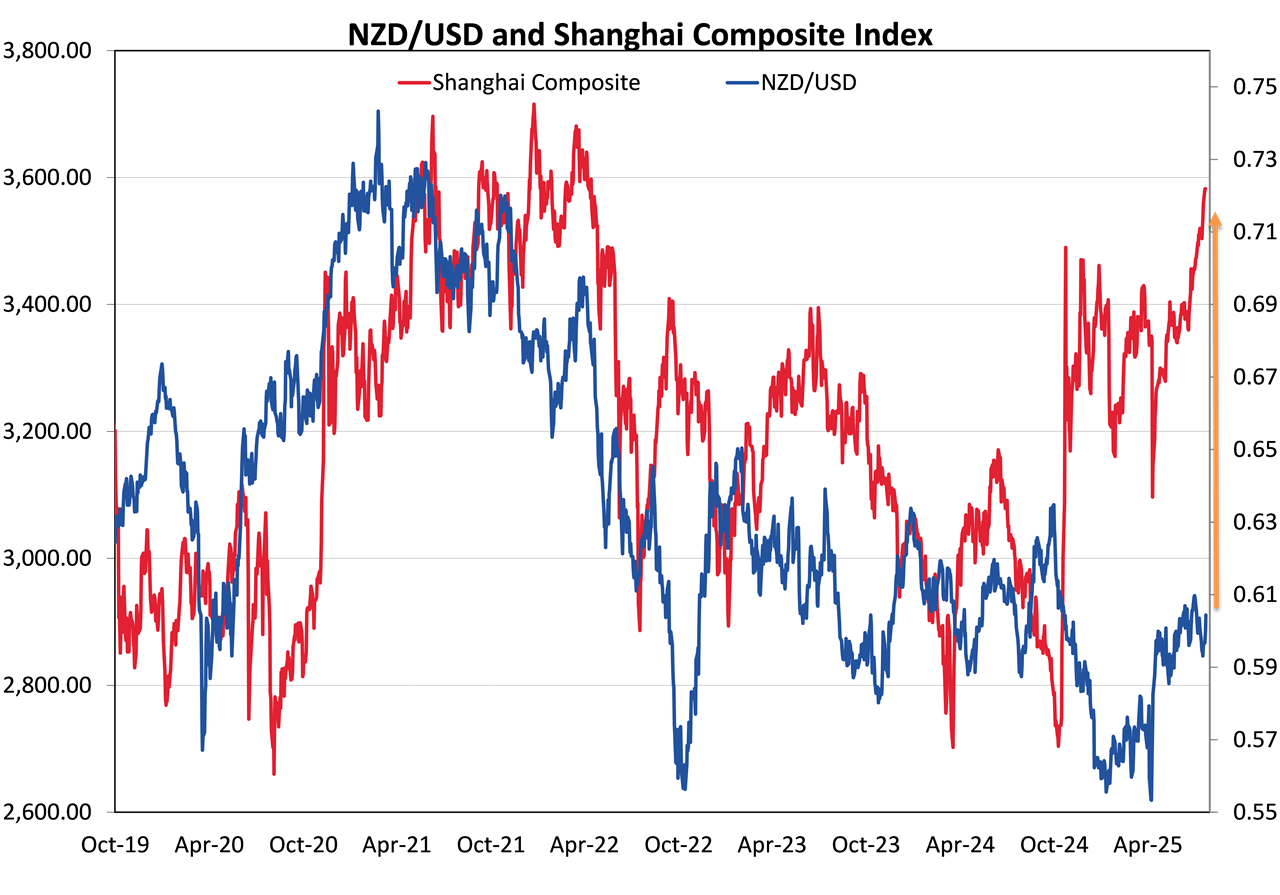

China is well on track to achieve its target of a 5.00% GDP growth rate this year. Foreign capital is again being attracted back into the Chinese equity markets after pulling out when Trump came to power last November. If the Chinese equity indices are a fair representation of their economic fortunes, the markets are signalling a return to robust Chinese economic growth ahead. Since 2019 the Kiwi dollar has been closely correlated to the movements in the Shanghai Composite equity market index (refer to the chart below). The NZD/USD exchange rate has lagged the Chinese equity market gains this year; however, the Kiwi dollar is likely to catch up as it follows the AUD gains for the reasons covered above.

US Dollar plunge approaches critical chart levels

In the short term, the direction of the US dollar will be determined by the messages from the Federal Reserve as they calculate the impact on US inflation from the tariffs. Offsetting the increase in price of some imported goods is continuing decreases in the larger services sector of the CPI Inflation Index. If the labour market weakens more than the Fed are estimating, they are also more likely to cut interest rates earlier than what the markets are currently pricing (two x 0.25% cuts over the remainder of 2025).

US economic data this week the FX markets will be focusing on will be: -

- ADP Employment Change on Wednesday 30th July – a bounce back up or another decrease?

- GDP growth rate for the June quarter also on 30th July - +2.50% annual rate is forecast.

- PCE inflation rates for the month of June on Thursday 31st July - +0.30% forecast.

- Non-Farm Payrolls jobs for July on Friday 1st August - +110,000 forecast.

If the inflation, GDP and employment data is softer than forecast, the US dollar will be sold lower from its current 97.40 level on the USD Dixy Index. A weaker USD would see the NZD/USD rate re-testing it previous high of 0.6120 reached on 1st July.

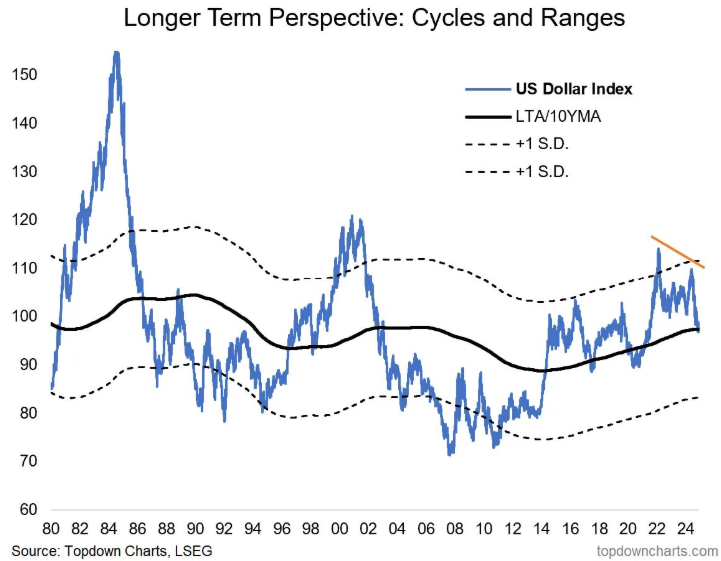

In the long term, the 11.50% US dollar depreciation this year from 110.00 to 97.50 is rapidly approaching a critical chart point for the USD Index (refer to the 45-year chart below from Topdown Charts). The 10-year average line is about to be breached to the downside. The question is whether the US dollar only depreciates to 90.00 (its 2018 and 2021 lows) or to the multi-year lows in the 70’s of 2008 and 2011?

Either way, the NZD/USD rate appears destined to higher levels in the mid-0.6000’s by year-end due to the continuing US dollar depreciation.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.