Here's our weekly currencies outlook and review with HiFX's Senior Dealer Dan Bell including a look at the Green Party's call for the Reserve Bank to embark on quantitative easing, or money printing, in an attempt to take some heat out of the consistently strong New Zealand dollar.

Bell says given the Official Cash Rate (OCR) at 2.5% is relatively high compared with most developed country economies, the Reserve Bank still has room to cut it, therefore offsetting any immediate need for a kiwi round of quantitative easing (QE).

The big global central banks that are printing money such as the US Federal Reserve, European Central Bank, Bank of Japan and Bank of England all have official interest rates at, or near, 0%.

"We're in a situation where we are being impacted by these global central banks," says Bell.

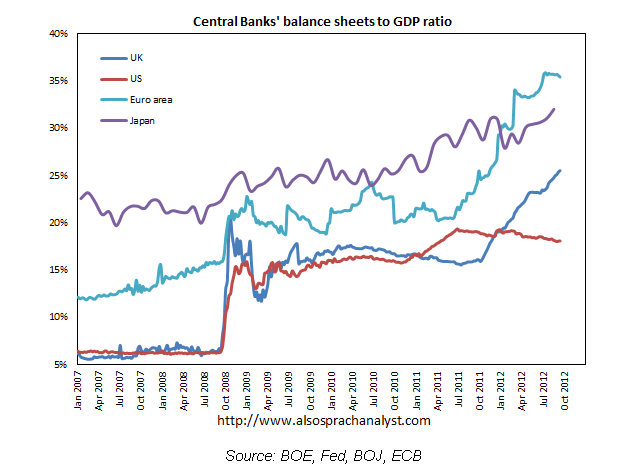

"People have a prejudice towards the US dollar and for the activity the Federal Reserve has been undertaking, with QE to infinity and the rest of it. But the European Central Bank actually have expanded their balance sheet more than the US, (and) the Bank of Japan have a bigger balance sheet than the US as a percentage of GDP."

"So trying to push back against what these other global central banks are doing is going to be incredibly difficult. But I think there are some interesting points there particularly if the New Zealand dollar was to continue to rally, which is going to have a big impact on our productive sector."

"[But] at this stage I think we have room to use the OCR to add a little bit more stimulus if we need to and put the brakes on the currency," Bell suggests.

See more on central banks' balance sheets here.

The first OCR announcement from new Reserve Bank Governor Graeme Wheeler is due on October 25. BNZ economists noted this morning that the market is pricing in around a 70% chance of a 25 basis points OCR cut in the next six months, although they themselves don't expect cuts, but rather an increase at the end of 2013.

US non-farm payrolls and RBA cut

Meanwhile, data released on Friday night New Zealand time showed the US economy created 114,000 jobs in September, and the unemployment rate dropped from 8.2% to 7.8%.

"Initially you would've thought it would be positive for risk, ie that currencies would've rallied against the US dollar and stocks would've gone up, and that was the initial reaction. But late into the New York session on Friday night, Saturday morning New Zealand time, that started to fade and we actually saw the New Zealand dollar under some selling pressure,' says Bell.

This saw the New Zealand dollar down around US81.50c and US stocks reverse earlier gains, ending down. Bell describes this as a little bit of a confusing reaction to the US employment figures.

"I think perhaps suggesting that maybe some of the better news out of the US that we're seeing at the moment is starting to benefit the US dollar a little bit more than it had previously."

After the Reserve Bank of Australia (RBA) last week cut its OCR by 25 basis points to 3.25%, the New Zealand dollar has had a boost against its Australian counterpart, reaching a 12-month high of A80.80c.

With most economists expecting the RBA to cut further, there may be further upside against its trans-Tasman cousin for the New Zealand dollar.

"Some are calling for the cash rate in Australia to go all the way down to 2.5% which would be in line with ours. Interest rate differentials have a big impact on currencies with the New Zealand dollar (for now) seen as a little bit more attractive," Bell says.

Another factor supporting this theme is prices for New Zealand's key commodity exports being helped by the US drought just as prices for Australia's iron ore exports come under pressure from a slowing Chinese economy.

Corporate earnings in focus

The third quarter corporate reporting season, kicking off in the US, is likely to impact stock markets and the international appetite for currencies like the New Zealand dollar.

"Last quarter was pretty strong for the New Zealand dollar and we got to a high of around 83.50c against the US dollar and ended up being quite subdued in terms of the underlying volatility. This was in contrast to the second quarter of this year which was when we thought Europe was going to fall off a cliff again, and the New Zealand dollar against the US was trading down at 75c. Now I think the fourth quarter is going to provide probably more uncertainty and more risk and in my opinion that will weigh on the New Zealand dollar," Bell says.

He expects corporate earnings to struggle given a slowing global economy, the weakening Chinese economy story to remain a focus, and Europe - and its sovereign debt woes - to be back in the headlines in the next couple of weeks.

"That'll (all) have an impact so I think right now the New Zealand dollar continues to look vulnerable to further downside."

To subscribe to our free daily Currency Rate Sheet and News email, enter your email address here.

---------------------------------------------------------

Dan Bell is the Senior Dealer at HiFX, a UK-headquartered foreign exchange dealer with significant operations in Australia and New Zealand. It has a dealing room in Auckland. See more detail here.

No chart with that title exists.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.