Economists are cautioning that the unstable geopolitical situation may yet cause inflationary disruption - even as new figures due out this week are likely to show our inflation rate coming down significantly.

In their latest First View publication, Kiwibank's chief economist Jarrod Kerr, senior economist Mary Jo Vergara and economist Sabrina Delgado say that in the war against inflation, "we face further setbacks as actual wars disrupt shipping".

NZ inflation figures for the December 2023 quarter are out this week (24th), with the Reserve Bank forecasting the annual rate to reduce from 5.6% to 5.0% while economists from most of the major banks are tipping 4.7% and Kiwibank are picking 4.6%.

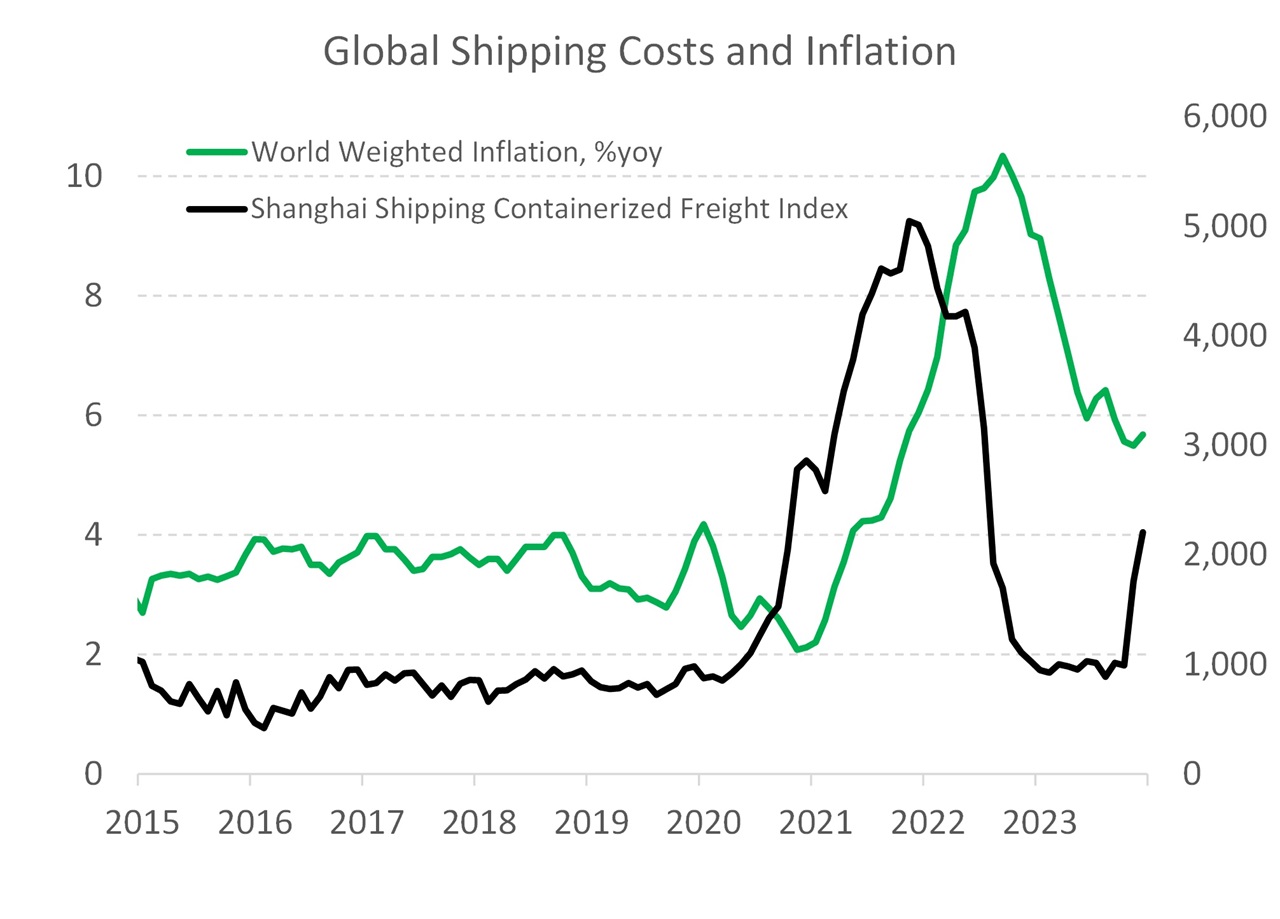

A key driver of the fall is expected to be lower imported inflation as the previous supply chain spikes unwind.

But as the Kiwibank economists point out, Houthis attacks on ships in the red sea are causing shipping rates to spike, and delivery times to lengthen.

"According to Veson Nautical, it takes an extra nine days at sea to avoid using the Red Sea and Suez Canal, and chugging around Africa. Inflation will be higher because of the skirmishes on the red sea. We are unlikely to see the same sort of spike caused by the Covid crisis. But any spike in costs is unwelcome," they say.

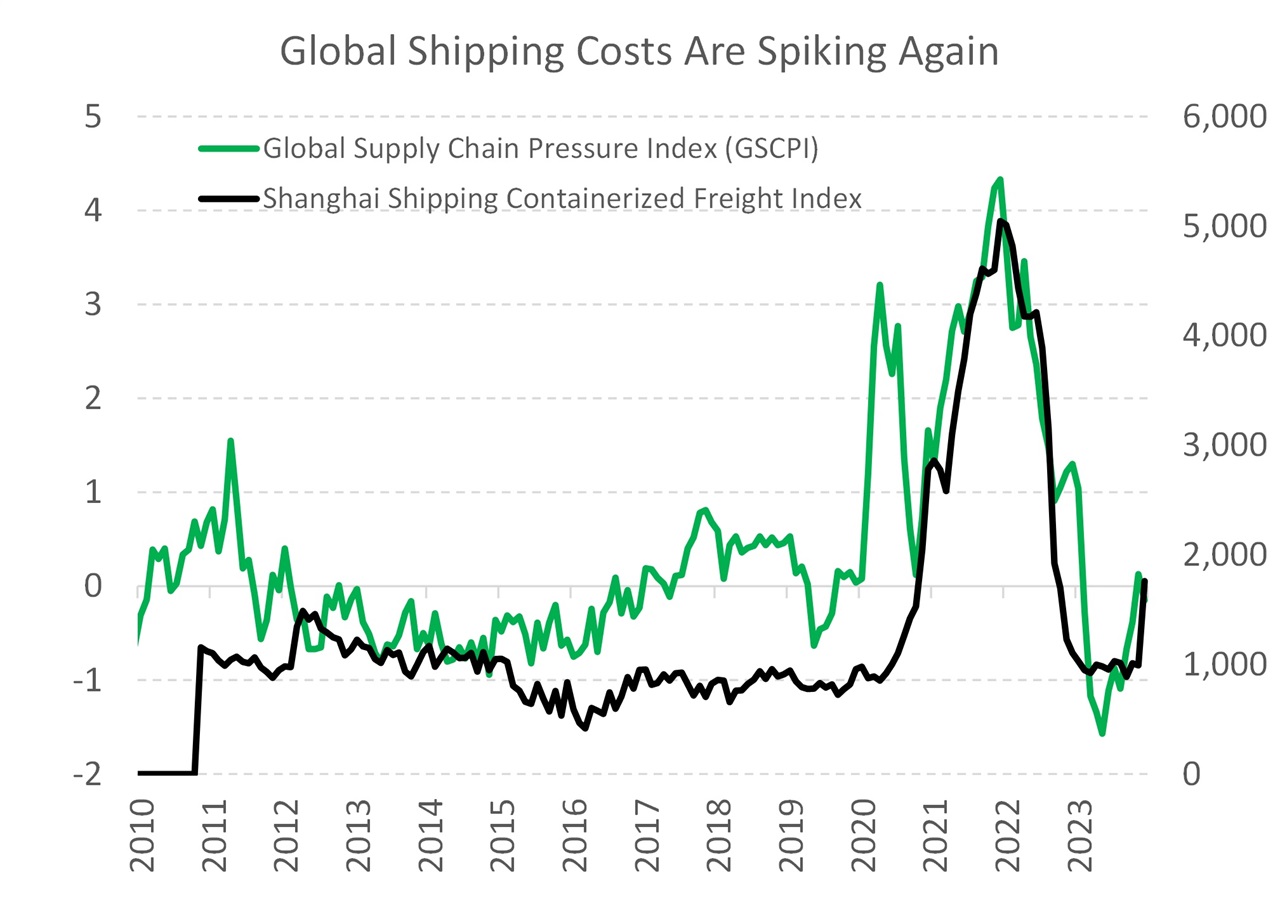

"We thoroughly enjoyed watching the pressure on global supply chains, mainly shipping costs and delivery times, return to normal following the disruptions of the Covid pandemic. The decline in freight costs was a big driver in the easing of global inflation. Now they are spiking again. It’s impossible to know just how long it will take for the Houthis threat to be contained. But we will see added inflation pressure, at a time when we’re desperately trying to contain prices."

The Kiwibank economists say there are "dozens of freight indices out there".

"But we focus on four. The first is the ‘World Container Index’, reporting the spot USD cost of a 40 foot container (weighted) across eight key shipping routes. The average cost has more than doubled from $1,300 in December to $3,000 now.

"The second is the ‘Shanghai Shipping Containerized Freight Index’, reporting on 15 routes out of Shanghai, and is the most important for New Zealand. And the bad news continues, with the cost out of our largest trading partner jumping from a little over $1,000 in December (with a recent low of less than $800) to $2,200 now.

"And the third is the Baltic dry index. Why? Just because. The index has yet to move, but it will. Lastly, we like the ‘Global Supply Chain Pressure Index’ from the New York Fed. It obviously sounds the coolest. And it is the most comprehensive. Unfortunately, the index has jumped from -0.6 to -0.15 and is set to continue higher."

In Westpac's Weekly Economic Commentary, chief economist Kelly Eckhold rated geopolitical issues and their effect on inflation as one of the four issues to look out for this year in determining the timing of any Official Cash Rate cuts by the Reserve Bank.

"2023 was a year of serendipitous disinflation," he says.

"We saw the full benefit of eased supply chains and lower energy and food prices reflected in tradables inflation (and a couple of core inflation elements such as construction costs and domestic airfares).

"2024 looks set to be a much more turbulent year given the US presidential election (and the impact on already tense Chinese relations), the ongoing Russian war, and now significant trade disruptions from tensions in the Middle East.

"Disinflationary tailwinds could turn into headwinds and frustrate the RBNZ even if growth remains weak. The performance of the weak Chinese economy will be a key factor to watch," Eckhold says.

"We remain much more cautious on the potential for near term and significant rate cuts than markets. We continue to see as a base case the OCR remaining at 5.5% through 2024 as we think inflation will continue to prove sticky, and we don’t think the RBNZ will have much scope for taking risks of not reaching 2% CPI inflation in the second half of 2025. Given the policy lags, the work done with interest rates over the next few quarters will be most relevant to those H2 2025 outcomes."

The other three key issues Eckhold sees are:

Significant deceleration in core inflation indicators. "An enduring feature of 2023 (at least before Q4) was the stickiness of core inflation indicators such as non-tradables inflation. These indicators need to sustainably decline to make the case for OCR cuts. We suspect we won’t see such evidence until the middle of the year at the earliest – although this week’s data will provide a critical starting point."

Ongoing economic momentum. "Growth went backwards in 2023. The year seems to have been bookended with a technical recession at the start and potentially one at the end. Growth likely ended the year weak and might have picked up a bit right at the end. The extent of any growth pickup (or not) in 2024 will be critical in providing confidence that the RBNZ’s inflation goal will be met. The housing market will be key - it will be interesting to see how housing responds to lower mortgage rates through 2024."

The strength of the labour market. "Even though growth apparently went backwards the labour market continued to move forward in 2023. The extent to which this continues through 2024 will be key to the assessment of wage and inflation pressures."

In ASB's Economic Weekly, senior economist Kim Mundy said although things look like they’re moving in the right direction, "we still think that the RBNZ will be wary of the risk of CPI inflation being stuck above 3%".

"For example, there’s still a risk that some pockets of domestic inflation will prove sticky. We also acknowledge that the inflation outlook is still inherently uncertain, especially at a time of heightened geopolitical tensions. Bringing it all together, we expect the RBNZ will maintain restrictive OCR settings for as long as it takes to push inflation below 3% on a sustained basis. We are not expecting OCR cuts until August, with the risk tilted to a later start."

4 Comments

Once Oil Supply disrupted, as the Middle East gets Hotter, expect increasing Energy Costs.

Will Israel retreat to Cool the Middle East Down? Not for a long time...

Will Ukraine negotiate to Cool Europe Down? Never

Will China Heat the Western Pacific Up? Probably

Will the Not so U S of A and the Brits stop their $$$$ and Weapons support of Hot War to Cool the World down so Negotiations can move the World forward? Nope

An energy driven Inflation spike is likely given those Geopolitical Risks

Agree on all counts, unfortunately. And once oil prices start going up prices of all other goods follow quickly. So hard to see OCR cuts before Q3

Keeping the OCR high throughout the year because of shipping issues on the other side of the world sounds like a ticket to some bad outcomes locally. I think the RBNZ will blink first.

I think it won't be that bad as the post covidsupply shock. The US/UK seem ready to squash this and not let it develop into another wage/price spiral

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.