There's a very good chance New Zealand's unemployment rate has reached its highest level in eight and a half years.

We'll find out on Wednesday, August 6, when Statistics NZ releases the full suite of labour market figures for the June quarter - including the unemployment numbers, the employment numbers and wage rise information.

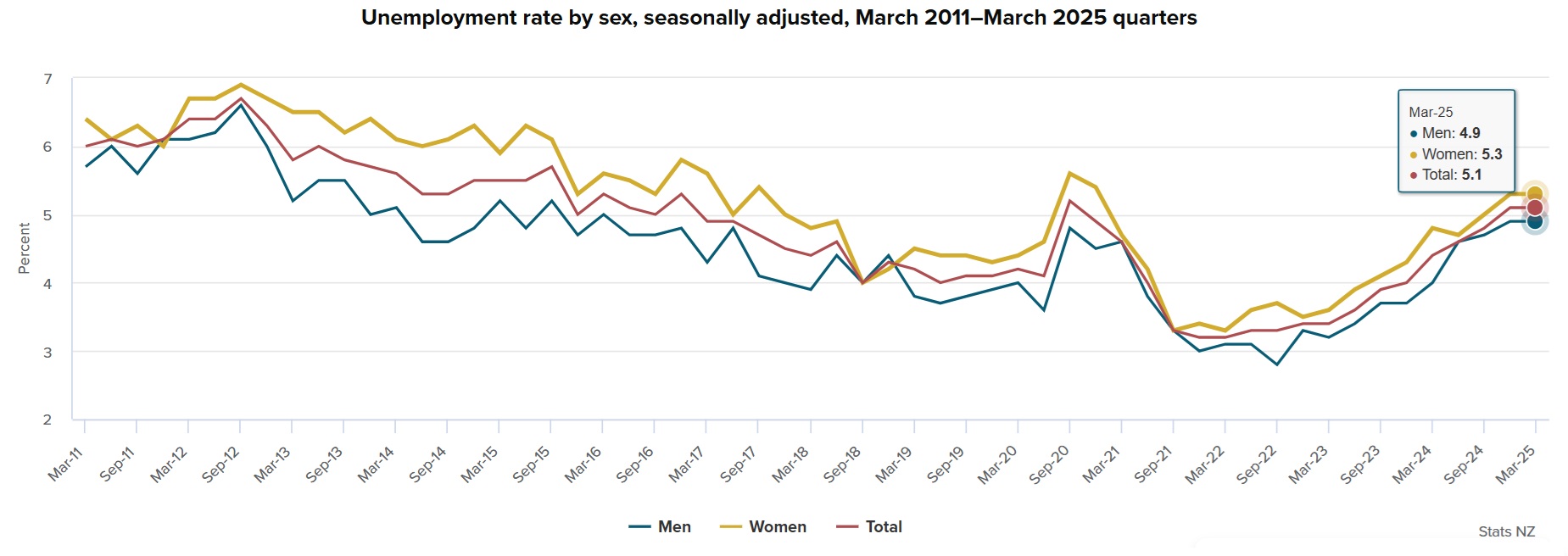

As of the March quarter, we had unemployment of 5.1%, which was the same as in the December 2024 quarter - giving rise to some hopes that the rate might have peaked.

However, it's looking increasingly likely our economy's had another 'June swoon'. High frequency economic indicators are suggesting that GDP, which grew 0.8% in the March quarter might have stalled completely in the June quarter.

And a stalled economy means fewer jobs.

The Reserve Bank as of its May Monetary Policy Document forecasts was picking an unemployment rate of 5.2% for the June quarter, staying at 5.2% in the September quarter and then falling to 5.1% in the December 2025 quarter. The RBNZ forecasts the rate to gradually keep declining next year, down to 4.7% by December 2026.

However, based on more recent information than the RBNZ had when it made those forecasts, economists are now mostly picking a rate of 5.3% for the June 2025 quarter.

If that indeed proves to be the case, it will be the highest rate since December 2016, when the rate was also 5.3%. Should there be an unpleasant surprise and June quarter unemployment actually hits 5.4%, well then that would be the highest rate since September 2015 - so, nearly 10 years.

For much of the time since it started to increase the Official Cash Rate in October 2021 the Reserve Bank has actually forecast that the peak in unemployment will be in this June quarter. So, it will be interesting to see if that's how it turns out. Remember, the RBNZ took the OCR up to a cycle peak of 5.5% before starting to reduce it in August last year. It's currently on 3.25%. If the labour market figures to be released this coming Wednesday are downbeat as expected, this will very much give a green light for another OCR cut at the next review on August 20.

The country witnessed a short, sharp and nasty recession last year, with GDP shrinking by 1.0% in both the June and September quarters. The hope was that once the RBNZ began lowering the OCR - effectively 'taking the brakes of' - this would see the economy start to recover.

Grinding to a halt

And arguably, as per the March quarter, that looked the case, albeit slowly. However, recent economic indicators are suggesting things may be seriously grinding to a halt again, and that is a worry.

We won't see official June quarter GDP figures till September, but the early glimpses we've been getting of NZ Inc's performance in that quarter are not good.

The BNZ-Business NZ Performance of Manufacturing (PMI) and Performance of Services (PSI) indexes are showing results that according to BNZ economists are "consistent with an economy in recession".

Spending is still sluggish, while surging food prices are soaking up more cash than households would want.

So, what of the labour market? What indications do we have there?

Statistics NZ's Monthly Employment Indicators (MEI) have shown continued reduction in jobs, while monthly job ads are falling again. The MEI figures are not directly comparable with the official unemployment figures as they are sourced quite differently - coming from Inland Revenue data - but they have tended to be quite a good indicator of future trends. And they are not indicating good things at the moment.

ANZ senior economist Miles Workman says there’s been some anecdote in recent months that firms holding on to labour are not experiencing the pickup in demand they expected.

"A degree of 'labour hoarding' appears to have suppressed unemployment in recent quarters, and if a recovery in economic momentum doesn’t do the heavy lifting when it comes to 'right-sizing' firms’ labour input, a further reduction in headcount may be needed," Workman said.

"With the high- frequency data currently pointing to a generalised loss in economic momentum, risks around employment growth over the next few quarters are skewed to the downside."

And as BNZ senior economist Doug Steel points out, none of this is supportive of household spending, "which remains critical to a broader economic recovery".

"Weak employment is a headwind on its own but comes with a kicker of raising concerns around job security. Combined with above average inflation in some essential items like food and electricity, it is another factor threatening the timing and extent of the pickup in household spending that many are forecasting."

One of the saving graces around this monetary policy tightening cycle was that we started it with incredibly low unemployment.

In March 2022 even while the RBNZ was starting to crank up the interest rates, our unemployment was just 3.2%.

The 'lagging indicator' that prompts a vicious cycle?

The key thing about that of course was that it gave everybody the best chance of being able to stump up the extra money needed as mortgage rates started going up. Losing your job right when the mortgage is starting to get more expensive is just exactly what you don't want.

Unemployment is, as they say, a 'lagging indicator' - it tends to start rising as other parts of the economic cycle are starting to move into recovery.

And this is where I would be a bit concerned about our current situation.

After being as low as 3.2% the unemployment rate gradually rose to 4.0% by the end of 2023 and then 5.1% by the end of 2024 - the level it was still at as of the March quarter.

With the economy appearing to have stalled in the June quarter and with unemployment appearing likely to have hit around 5.3%, it's difficult to see where the incentives are for people to get out spending again. And of course if people don't spend, businesses struggle to make money, and they have to reduce staff. The classic 'vicious' cycle.

Therefore, while a 5.3% unemployment figure may demonstrate the classing 'lagging' economic indicator factor, the impact of it, the optics of it, on a country short on confidence might be fairly unhelpful. It could get us into a more gloomy mood and actually make things worse.

We probably need something to break us out of the 'cycle'. While an OCR cut next month is looking a near certainty, the odds of a follow-up cut as soon as October must be rising as well.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

34 Comments

It ain't the vibes folks.

First, worth having a look at how wrong the RBNZ and Treasury forecasts were in May. We were supposed to pivot to good times in spring, but we're still firmly in deterioration mode.

Why? Our economy runs on domestic demand, demand relies on spending, and job losses reduce spending. And, so does choked credit flows. And, so does winter. We saw the same winter drop in 2024 and we are repeating it in 2025. Because we never learn.

What about cheaper debt? Yeah, nah, interest costs per capita are still about 20% above the levels we had through the 2010s in real terms, and they will be for another year or so. We are paying mortgage loans off faster than we are taking new ones out (only interest added is keeping the total rising). On top of that we are spending more on services that create next to zero domestic demand (insurance, big tech etc).

Now it could be a damn sight worse. When the economy runs hot, what actually happens is that tens of thousands of people increase their hours into the 50+ hours per week bracket, and young people pickup part-time work. Hell, even people with disabilities find jobs. When things cool, this unwinds so the impact on official unemployment is muted. Watch the labour force participation rate and underutilisation rate figures on Wednesday. They will be grim. Now imagine what would have happened if we hadn't driven tens of thousands of kiwis offshore with our hopeless economic management!

The latest Govt cash movement data actually suggests that Govt is waking up to what they need to do. They are picking up on the fiscal; but they must be paying for stuff that will be accounted for in future years. The forecast deficit spend for 2024/25 was about $10bn, but the data suggests a net transfer of more like $25bn in that period. Weird.

I think sometimes you've probably got to stop trying to rationalize what authorities are doing in a way that marries up with what they're saying. You'll just end up chasing yourself into circles of buggery.

They know what they're doing has some fairly big ramifications with jobs and company closures, that's why they're doing it. They're just not going to flat out tell us they want to knock the stuffing out of the economy. Just take your medicine and thank us later.

The affable and candid, but ill fated, Todd Muller in his brief time as leader of National, probably summed up the depth of thinking with something like - we gotta get things going with China again. That was a direct throwback to the halcyon days of Key’s first two terms. Difficult to identify though, any great initiatives and/or policy by anyone since.

And unlikely to anytime soon. Most of how we operate in terms of governance is more akin to a franchise. You think you have your own business, but all your procedures, marketing and suppliers are dictated to you by a larger head organization.

We know much of what we follow is folly, but because the whole system is interconnected, it's very difficult to abandon the folly and know what the consequences are.

So there's very little in terms of indigenous autonomy with our governance. Little bits of tinkering, but most of our vision comes in the form to being reactive to larger global trends.

I think this analysis was correct six months ago, but Luxon et al placed their faith in a late-2025 recovery that is not coming. They are now scrambling to find ways of injecting stimulus without compromising their stupid commitments on debt.

As you can probably guess I have little time for the whole 'a very necessary cleansing recession' view of the world.

I think this analysis was correct six months ago, but Luxon et al placed their faith in a late-2025 recovery that is not coming

Again, you're confusing what they're pitching the public vs what they actually believe.

We get to quibble over whether they should've zigged or zagged, which helps suit their interests of having our attention focused on all the wrong things.

As you can probably guess I have little time for the whole 'a very necessary cleansing recession' view of the world.

There's a big long list of things we have to abide by in life we don't want to make time for. You can pretend it might be otherwise till you're blue in the face, or you can accept we're just passengers on this bus.

Nothing short of a political revolution will alter the game in a significant way.

I know plenty of people close enough to Govt to know that they are *not* sat in a room saying that this is all going to plan! They are seriously rattled.

Why am I not surprised by that revelation and in turn that is outweighed by the prospect that the alternative(s) as far as government would offer little more purpose and direction. It reminds of rugby, when at its uninspiring and unintelligent worst. Two flat footed teams aimlessly slinging and kicking the ball around, waiting for something to happen

I know plenty of people close enough to Govt to know that they are *not* sat in a room saying that this is all going to plan! They are seriously rattled.

Agents employed within these institutions treat their role as if it's serious. Most of us with jobs are going about them without really knowing the true intentions and motivations of our employers. But this is playing out pretty much exactly true to form - super easy to predict once you understand central bank behaviour.

Their hope is that things will magically have a soft landing, and they won't make a substantive rate drop because they need significant buffer there in case of a future shock event. Which they will also be factoring into their forward decision making as being probable.

That's the key point. We don't know where the next earthquake/storm/pandemic/war/international financial crisis is coming from. When it does come we don't want to be left with no bullets left. Why waste them all now in a vain attempt to keep the real estate market afloat?

I think the recession is deliberate and triggered by significant fiscal cuts by the government in a very short space of time and it is about gearing the country up for foreign and local investors. High unemployment provides cheaper labor and low inflation. Distressed assets and collapsing businesses are attractive to investors. It is these investor that the government is patiently waiting for to step in all the while pushing the NZ economy into further contraction.

I hope I’m wrong but I think it’s too early in the unemployment cycle to say that it’s going to peak in the next quarter or 2. Unemployment creates its own momentum which is a slow moving train wreck and needs a positive shock to arrest the decline. I don’t think the export sector is quite enough for this. My gut tells me it’s still the overhang of personal debt we’ve racked up over a generation as house prices endorsed and encouraged the wackiness. Think we will need to time to inflate out of this pickle.

My gut tells me it’s still the overhang of personal debt we’ve racked up over a generation as house prices endorsed and encouraged the wackiness.

Nothing wrong with the ol' gut feelings IMO. Re personal debt, which should really be described better as h'hold debt, very few of the public and media commentarati influencers have been paying any attention. If increasing h'hold debt were associated with the Ponzi, nothing to fear was the general recommendation.

If we had some indexes showing winter jaunts to Fiji and craft beer sales, I can assume you things would be not as sexy in 2025 as in 2015-2019. Among my networks, it seemed like every man and his dog was in Fiji in 2019. Barely a mention of this at the moment.

I think you're spot on with that analysis. Some of the statements in the article were unbelievable vapid around the impact of rising unemployment on the rest of the economy.

The unemployment numbers don't factor the tens of thousands who pack up and leave, aye?

An OIA request to IRD for the number of individual tax returns files at each 10k wage band would be more revealing.

Let's not forget the underutilisation rate which is now over 12% vs less than 9% pre covid. Growing slack in the labour force means average job applicant numbers will continue to grow.

Pretty hard to determine whether we would've had a recession anyway between 2020 and today. I think all that COVID has done is bring to light a whole raft of other structural issues throughout the global economy.

This is boring now. In an economic downturn you don't get a domestic economic recovery until the government increases spending. Very simple and backed up by decades of historic economic data. But you wouldn't think so reading any NZ economics commentator.

Its very sad.. I am sorry but Willis does not understand what she has to do to restart the local economy

That's right IT, I often wonder how Willis got the finance role in the first place.

I think goldsmith mucked up some numbers?

This is boring now. In an economic downturn you don't get a domestic economic recovery until the government increases spending.

Post-bubble Japan you saw govt spend ramped up - which in a country with an infrastructure surplus didn't make sense to Westerners in particular. They didn't necessarily experience any 'economic recovery' but it prolonged and insulated inevitable pain from the prior excesses.

In the case of Aotearoa, we have no idea even where to start in terms of a public investment in infrastructure. Opening the public purse will not necessarily solve our woes. Few will make out like bandits and some will have near-term job security.

I saw data from the Bank of China that City Rail Link has a cost of USD960 million per km. For comparison, the high speed rail in Indonesia has a cost of USD51 per km.

Conventional railway and urban subway construction costs in Japan range roughly from USD70–350 million /km.

Cannot compare Indonesian rail with CRL. One is high speed, 50% on grade, 40% elevated and only 10% underground, mostly rural. Other 100% underground and urban. And obviously strategically supported by China. And obviously NZ construction industry lacks scale and productivity

Or we need a reset of the cost of shelter.

Having is debt fueled burden maintained is crushing in a downturn. The strings yanked by global banking and leveraged do everything to prevent reality. Youth respond buy taking 20 years of tax funded Healthcare and education and leaving. Most never to pay a cent in tax here.

That a change to a land tax cannot get voted in just shows how stupid the sheep are.

I mentioned 5k per mill cv to someone last night, she looked at me as if I was possessed by the devil...

No exceptions on every property.... 7.5billion there...

I mentioned a poll tax woud be fairer than rates to someone this week...same reaction

Exactly! Completely normal in other countries, and totally accepted as reasonable. But in NZ there is an absolute belief that property is sacred. Until we break this we will never have a productive, resilient economy, just a debt-fuelled ponzi

All that would do is enable the next Left govts next $100B debt fueled waste of other people's money with nothing significant and lasting to show for it (also completely normal in other countries).

Or it would allow a revamp of the tax system with a tax-free threshold, increased spending into the economy and thus drive businesses and jobs, while simultaneously taking the some of the wind out of property as an investment.

Perhaps the answer to all of this is the same as it is for most so-called 'highly developed' Western economies.

The talking heads, spin doctors, and government, who lead us all down the garden path, always obfuscate by concentrating the conversation on public debt and trying to deflect attention away from the total debt figures, as in ... "Oh look, our public debt is only 1/3 of that of the US."

THE GRIM NUMBERS SPEAK FOR THEMSELVES

NZ's 2022 nominal GDP was $397.6 billion

Total debt was $2,360 billion ($2.36 trillion)

Total debt to nominal GDP - Divide $2.36 trillion by $397.6 billion = 594.1%

When we talk about our government debt (AKA public debt) we are only mentioning a small fraction of total debt - it is the total number which is strangling our real economy.

Apologies - these are the most recent Total-Debt:GDP ratios that I can locate - primarily from CEIC and Statista - the NZ data since 2022 is mysteriously AWOL..

I have ranked 6 Western countries that are close to our hearts in order of financialisation - the first number is the Total-debt:GDP expressed as a percentage - (dollars are US)...

[I added in the NIIP figures (Net International Investment Position) because these numbers vary so dramatically, from Japan at +$26,581 per head of population, down to minus $54,223 per head for the US]

#1 US: 722.0% (2024, CEIC) - NIIP minus $18.159 trillion - minus $54,223/head

Notes - ranks as the most financialised, due to its massive financial sector (Wall Street), high debt levels (722.0% of GDP), and global financial influence. Its economy is deeply tied to financial markets, with significant debt levels in all areas.

#2 UK: 581.1% (2022, Statista) - NIIP - minus $614 billion - minus $9,056/head

Notes - The UK is a close second, with London’s (City of London) global financial hub status, a large financial services sector (8–12% of GDP), and a high debt-to-GDP ratio (581.1% in 2022). Its economy is more service-driven than most, amplifying financialisation

#3 Japan: 1279.3% (2024, CEIC) - NIIP +$3.312 trillion - +$26,581/head

Notes - extremely high debt-to-GDP ratio suggests deep financialisation, but its financial sector is less dominant relative to manufacturing and exports. Its ranking is driven by debt rather than financial market influence.

#4 Canada: 652.7% (2022, Statista) - NIIP +$231 billion - +$5,775 per head

Notes - ranks high in debt-to-GDP ratio and significant household debt indicate financialisation, but its financial sector is less globally influential, and resource industries balance its economy. Nevertheless, to me, this is an appalling level of debt given their vast natural resources relative to a small population - this country should be one of the wealthiest creditor nations on the planet.

#5 NZ: 594.1% (2022, CEIC) - NIIP minus $134 billion - minus $25,716/head

Notes - New Zealand’s debt-to-GDP ratio is high, driven by household and private debt, but its small financial sector and trade-dependent economy makes it less financialised than the worst four. Total debt of ~6x our GDP is what is killing our economy.

#6 Australia: 441.0% (2022, Statista) - minus $836 billion - minus $31,452/head

Notes - the least financialised, with the lowest debt-to-GDP ratio (441.0% in 2022) and a diversified economy (mining, agriculture). The same comment applies as it does to Canada. This is an appalling level of debt given their vast natural resources relative to a small population - this country should be one of the wealthiest creditor nations on the planet.

The Net International Investment Position (NIIP) represents the difference between a country’s external financial assets owned by residents and its external liabilities. A positive NIIP indicates a creditor nation, while a negative NIIP indicates a debtor nation.

Canada, NZ, and Australia all enjoyed boom times when each of these countries deployed a public utility banking model - they were all on track to become the wealthiest countries on the planet. Successive governments sold their populations out to the City of London private banking cartel, and we have been digging ourselves into a debt trap ever since.

The US never stood a snowball's chance in hell, because they handed their central bank on a plate to a thieving private banking cartel 2 days before Xmas in 1912.

Australia got off slightly better, and that's why they have arguably the strongest overall financial position of the six countries I looked at. Which is also why we have a giant drain of Kiwi talent taking flight across the Tasman.

Without a major reform of our banking model, from central level bank down to community banks, in how we create money, and until we return to sound money, nothing will change - we will continue down this giant debt trap void.

Successive governments don't have a clue where the problem lies, or don't even want to know, and merely continue to fiddle around the margins while the ship slowly sinks.

The numbers I have quoted are bad enough, but if we were brutally realistic and honest with ourselves, we would calculate our debt and solvency, based on PGDP (Productive GDP), in which case, the numbers are exponentially worse than what I have presented here tonight.

By all means, shoot the messenger if it helps your demeanour - but it won't help the underlying problem. I remain 100% apolitical, and these numbers are independently sourced.

I have no skin in this game - none - only a desire to warn Kiwis about what lies around the corner, in the hope that they can at least make some basic preparations, and help them to try to come to terms with what is the root cause of our financial plight.

Regards to all

Col

Pretty easy to make a cursory glance at global economics and determine that much of the lifestyle and prosperity people take as a give in is dependent on cheap and abundant credit. Very few nations or large entities aren't into large debt and even the ones that don't, have often just passed the debt liability along - the Chinese state for instance has relatively low debt, but that's because it's pushed onto the provinces, or state owned industry, who have very large debt.

At some point, credit won't be as cheap, or future earnings can't fund debt liabilities, or a combo of both. Most people won't be able to insulate effectively against that. They can say something fixed like gold is safe, but in the event of total economic failure, less stuff gets made and the trade value of gold falls.

The best compromise I've found is to have the ability to be as self sufficient as possible. But even that's not safe, if society collapses.

So best bet is to actually just box on.

Colin, thanks for your comment it's probably deserving of an opinion article. Good to see someone calling a spade a spade.

If all money is debt and all debt a promise who or what have the greatest capacity to ensure the promise is kept?

Thanks Colin. Your comment aligns with the thinking of economist Steve Keene. I put it into ChatGPT - here's some of the response:

In short, the commenter is saying:

“You're worried about the wrong debt. It's not the government spending too much that’s choking growth—it’s that households and businesses are drowning in debt and can't spend or invest.”

This aligns with Modern Monetary Theory (MMT) and other post-Keynesian schools of thought, which often argue that private debt accumulation is more destabilizing than public debt, especially in a monetarily sovereign country like NZ.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.