Electricity and gas prices surged in the December year, with food prices up 4%, down a bit from a 4.4% increase in the November year, Statistics NZ says.

Higher grocery food prices, which increased 4.6%, contributed most to the annual food price increase. This was followed by meat, poultry, and fish, with prices up 7.4% annually, Statistics NZ says. However, month-on-month prices brought better news for consumers with Statistics NZ's food group down 0.3%, and meat, poultry and fish down 0.9%.

The new consumer price data comes as Statistics NZ releases its latest monthly Selected Price Indexes (SPI), which ASB Senior Economist Mark Smith is warning suggest Consumers Price Index (CPI) inflation may have ended 2025 above 3%.

Other major annual increases in the SPI came from electricity which rose 12.2%, gas which was up 17.5%, international air transport which rose 6.6%, domestic accommodation which climbed 4.9%, and international accommodation which jumped 14.7%.

The annual electricity and gas price rises were similar to those of the November year, which were 12.3% and 17.3%, respectively.

Risk CPI is higher than Reserve Bank expects

The monthly SPI data contains about 47% of what makes up the Consumers Price Index (CPI, making it a good early indicator of what the CPI is doing.

Statistics NZ's September quarter CPI showed an annual increase of 3%. The December quarter CPI is due for release on January 23. The Reserve Bank has 1% to 3% target band for inflation, which is based on the CPI. The Reserve Bank is due to review monetary policy for the first time in 2026 on February 18. The Official Cash Rate (OCR) is currently at 2.25%.

Smith notes monthly SPI rose 1.3% in December, contrary to ASB economists' expectation of a small monthly fall.

"While a seasonal jump in airfares provided the major upward contribution, upward surprises were evident in a number of key components, including energy and accommodation."

Smith says the SPI data; "points to the clear risk of fourth quarter annual CPI inflation coming in stronger than the [Reserve Bank's] November Monetary Policy Statement projections of 2.7% year-on-year. Our current CPI add up suggests that annual CPI inflation ended 2025 at 3.1% from 3.0% in the third quarter."

"We remain of the view that economic spare capacity remains, which will work to eventually ease inflationary pressures. However, should monthly SPI data continue to remain firm, there is a risk that annual CPI inflation will remain closer to 3% than the circa 2% expectation by the Reserve Bank...Readings for the CPI, core CPI inflation and inflation expectations will be pivotal as 2026 unfolds," says Smith.

He says the Reserve Bank's November Monetary Policy Statement forecast assumes 2.3% inflation by the first quarter this year, with subsequent falls towards 2%.

"We don’t envisage the Reserve Bank will be in a rush to change the 2.25% OCR and have pencilled in 50 basis points of OCR tightening [increases] from early 2027. We caution that the Reserve Bank may step in if the NZ economy heats up too quickly and inflation remains stuck around 3%," says Smith.

'Data flow so far in New Year firmly supports case the next move in interest rates is up'

BNZ Senior Economist Doug Steel says the key takeaway is the SPI supports the view next Friday’s fourth quarter CPI is likely to come in above the Reserve Bank’s November Monetary Policy Statement forecasts.

BNZ's economists expect December quarter CPI to weigh in higher than the Reserve Bank's 0.2% quarter-on-quarter and 2.7% year-on-year forecasts. BNZ's own forecasts are 0.4% and 2.9%.

"At one level, our forecast for annual CPI inflation to print 0.2% above the Reserve Bank’s forecast shouldn’t overly trouble the Bank, especially because the latest wriggle has been driven by very volatile components like airfares. They could just as easily surprise on the downside in due course," says Steel.

"On another level, a hint of some persistence in annual inflation around the top of the Bank’s target band can risk upward pressure on inflation expectations. And especially when it is combined with better-looking growth indicators of late – like from the Quarterly Survey of Business Opinion, building consents, and this morning’s Performance of Manufacturing Index – any upside inflation surprise to the Bank is likely to support the more hawkish tone the Bank took at its November Monetary Policy Statement."

"We don’t think the run of data is enough to have the Bank hiking its cash rate soon. But the data flow so far in the New Year firmly supports the case that the next move in interest rates is up and that the balance of risk is accumulating toward this happening earlier than the first quarter 2027 timeline the Reserve Bank indicated at its November Monetary Policy Statement," Steel says.

"We currently have a first hike pencilled in for February 2027, the market is pushing for September/October 2026 with a hike by December seen as a certainty. We would not argue strongly that the market is mispriced given what we have seen in the data to date. The direction risk is clear."

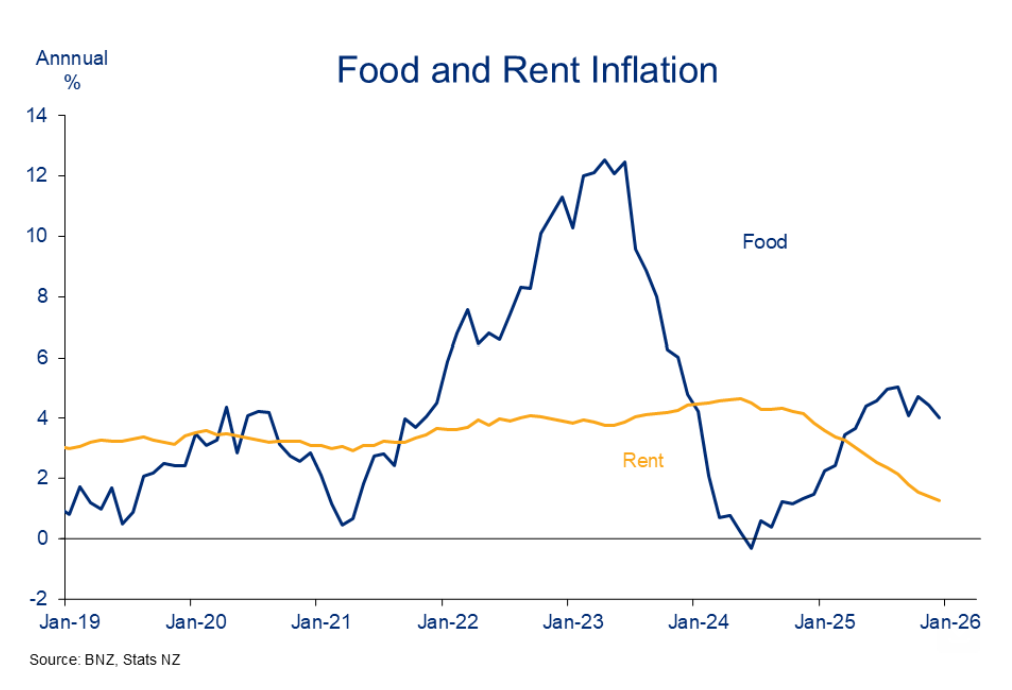

Meanwhile, Steel notes weakness in the housing rental market continues to restrain rent inflation, with rents up 0.1% month-on-month.

"That is soft enough to see annual rent inflation continue sliding, to 1.3% in December. We also think this will ease further over coming months, a view supported by the flow measure of rents - think new tenancies - dipping back below year earlier levels in December (-0.3% year-on-year)."

Average milk and bread prices surge

In terms of food prices, Statistics NZ says its latest figures show the average price for milk, beef steak and white bread - representing the cheapest available options - surged.

- milk was $4.92 per 2 litres (previously $4.25), up 15.8% annually

- beef steak – porterhouse was $44.30 per kilogram (previously $36.39), up 21.7% annually

- white bread was $2.20 per 600 grams (previously $1.39), up 58.3% annually.

There's detail on Statistics NZ's price index methods here.

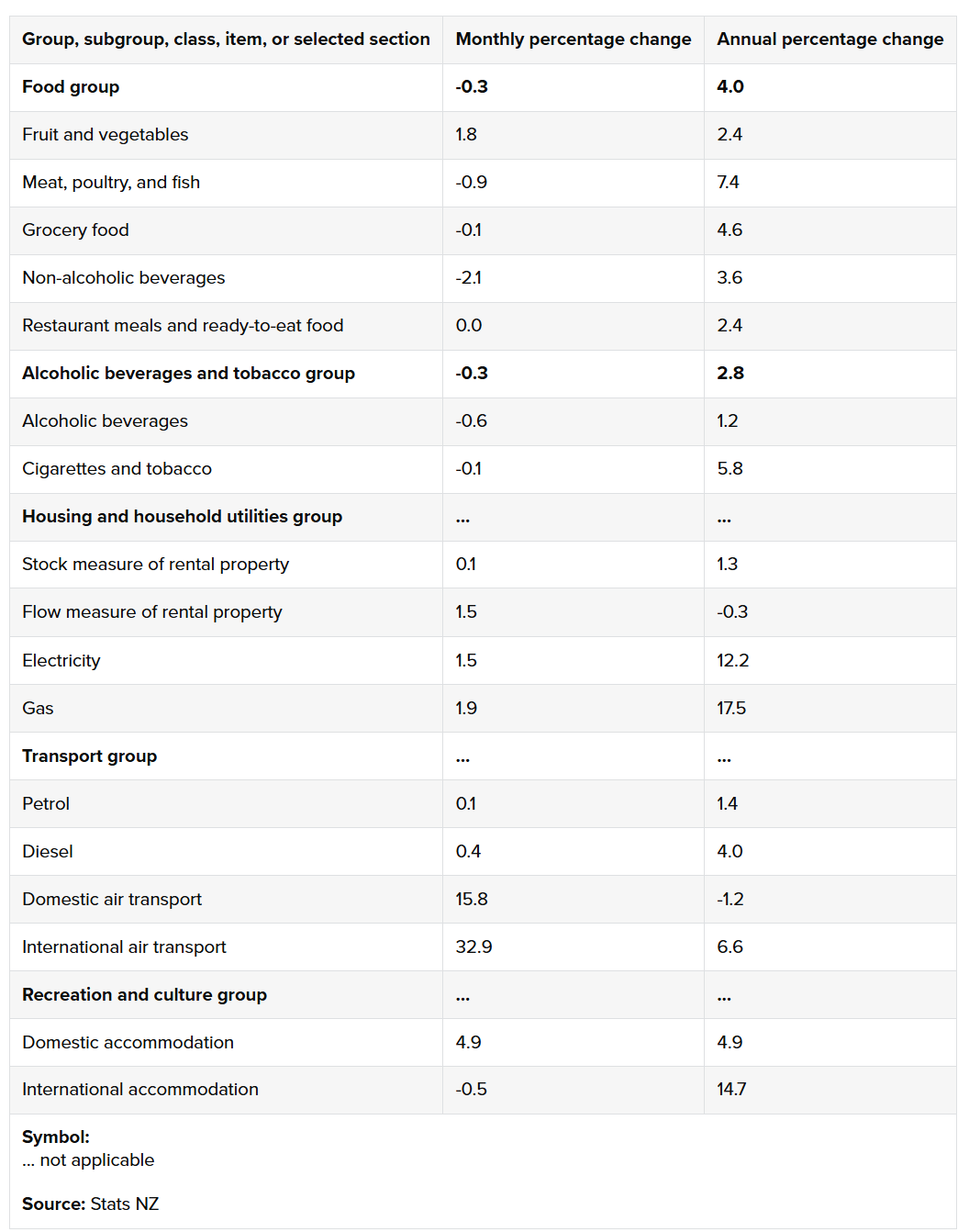

The table below shows key percentage changes in monthly and annual prices. Statistics NZ compares December 2025 with November 2025 for the monthly percentage change, and December 2025 with December 2024 for the annual percentage change.

28 Comments

This is exactly why the economy is not recovering. Consumer essentials are still rising well above inflation and wage growth. It's no wonder the average household still feels broke. Who cares if falling prices for TVs or furniture dilutes the CPI.

Rising above inflation and wage growth isn't going to be near inflation for a couple of years I feel. Never a better reason than this to change jobs if you aren't getting the wage growth needed.

Is called stagflation. Text books say avoid it at all costs. Oh well guess successive goats missed that class.

Muldoon struggled to contain it so put in a wage and price freeze-not popular. Then he was replaced by a Labour Govt and interest rates went to 19% to get the lid back on.

We all saw the ponzi screaming when rates were 7%. Imagine rates were 2x or 3x that. And we still have to pay back the 100 billion The loony Left wasted.

The scary thing this time around is that house values are sitting at twice the income multiple that they were back in the high interest rate era of the 70s and 80s. Anyone with a big mortgage is in considerable trouble if stagflation really kicks in.

Back then wages were also climbing at inflation …. Now corporates will not and can not as margins are eroding … stagflation is end times for fiat

But at least house prices aren't falling.....so who cares if you can't afford to pay your power bill or rates!!! (literally the psyche of many people in NZ including policy makers...'whatever happens rates must fall so that house prices don't drop any further')

how has that worked out for WGTN? -27%

I’d say the 40% of kiwis who are in interest rate sensitive industries and have battled out these last couple of years are just as worried as your spruiker mate at the BBQ…there has got to be a better way than just hiking rates when the inflationary pressure is not demand driven.

High rates will kill price appreciation as yields will be below corp bonds. Over time spectown will bail further killing tax free capital gains

resi is now yield play and right now yields are crap

Diversification of sector will indeed be important.

Consumer essentials are still rising well above inflation and wage growth.

Yes my friend. We think of this as non-discretionary spend (shelter, water, food, energy, transport). When the cost of this rises too much over ability to earn / savings, we have problems. And this is partly related to the Ponzi, even if you think some of the reaction to the economy-Ponzi relationship is overblown. But I don't think so. The Ponzi is not just about higher house price valuations; it pushes up the price of everything. And this has been created simply by expanding money supply by keystroke thereby affecting the cost of production, distribution, etc. You're far better of having credit directed towards production - a productive economy is usually competitive meaning lower prices of goods and services.

Much of our economy is built around discretionary spend or 'nice to haves'. What do you think happens when the non-discretionary spend gets knee-capped? That's right. Discretionary spend must be constrained or wiped out entirely. That means all the nice deli foods and the better brand of butter. Even the winter holiday to Fiji or Queenie.

Naturally, business related to non-discretionary spend falls first and usually harder. But think of the relationship between discret / non-discret as symbiotic - they both feed off each other. And I hate to say, potentially creating a doom loop. This is not necessarily just a DGM narrative. Because everyone knows that in the golden years of the Ponzi, things worked the other way.

Leverage. Great on the up, tough on the down.

Status quo thinking suggests we need more cowbell (leverage).

Meanwhile electricity was free in December. Right now. $0.00003/kWh while I'm billed 10,000x that. Good times.

https://app.em6.co.nz/?stackedgwap.filter.gridZone=15&stackedgwap.filte…

Time to stick some solar panels on your roof.

I use wood for hot water and heat, so it doesn't pay back unfortunately - and up until a few months ago I could pick up spot price electricity.

Gareth - why did electricity price go up in December when the generation cost was rock bottom? Where did the cost increase come from?

Great question

Xmas bonuses?

Line charges Transpower? Seem to recall some warning about that.

Increase the OCR to bring down the price of electricity

😂😂

Nah. Just put up solar.

Does anyone remember the Grocery Comissioner the government appointed at the beginning of their term? What’s he doing ATM? Heard nothing from him since he started.

Probably enjoying some lovely bottle of Cloudy Bay, Mt Difficulty etc and not living up to the talj of first appoitnment. What a life!

rain and flooding about to increase insurance premiums again

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.