By Gareth Vaughan

Although Kiwibank has retained its lead in retail bank customer satisfaction, BNZ has made major strides into second place and the under-threat National Bank brand has dropped to fourth, Roy Morgan Research says.

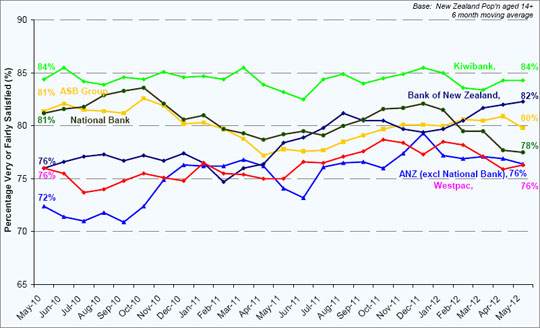

Roy Morgan Research's Customer Satisfaction - Consumer Banking in New Zealand monthly report from May, shows Kiwibank with the highest level of customer satisfaction at 84%. The major banks are defined as sister banks ANZ and National, ASB, BNZ, Kiwibank and Westpac.

"In spite of Kiwibank being the newest entrant to the major bank category, its customer satisfaction has consistently out-performed all other major banks," says Pip Elliott, the general manager for Roy Morgan Research in New Zealand. “Launched in 2002, Kiwibank is the only bank in the top six that is 100% New Zealand owned and operated."

Meanwhile, BNZ has climbed six percentage points over two years to reach 82% and second place, up from fourth equal. Over the same period National Bank has dropped three percentage points to 78% and to fourth from second equal.

ANZ New Zealand, owner of both the ANZ and National banks, has been reviewing its ongoing use of the National Bank brand. The group is currently shifting staff from the two banks onto a single IT platform with this project due to be completed by year's end. In 2010 ANZ renewed its rights to use the Lloyds black horse on a green and white background as the National Bank logo until the end of 2014. Any further renewal on use of the logo would be subject to negotiation with Lloyds.

In the first six months of the year ANZ NZ spent NZ$15.4 million advertising ANZ, more than four times as much as it spent advertising the National Bank.

ASB came in third at 80%, down one percentage point over two years and down one place, and ANZ and Westpac came in last equal at 76%. ANZ is, however, up four percentage points in two years with Westpac unchanged.

This article was first published in our email for paid subscribers this morning. See here for more details and to subscribe.

6 Comments

I am not surprised Nationals is down, their service is very poor, and think it has got worse since it was sold. I am still waiting for a reply to a compliant about a problem. I got an email saying it would be replied to within 10 days. That has well gone, and no reply.

A pity it is only big banks, as tsb probably out performs them all.

Kiwibank customers must be delusional. How can so many people be satisfied with waiting in long lines in run down post offices.

I love how people say NB is going down hill since it was sold. It has been part of ANZ Group since 2003 and only now is its ratings changed. I wouldn't touch kiwi bank with a 10 foot pole. I'm banking with NB ANZ and bnz. Don't have any fees people always seem to complain about and my bank people are pretty good. I think it comes down to brand perception more than anything and ANZ has historically been poor in nz (cough post office savings bank staff cough).

KIWIBANK. The bank where i always get stuck behind a queue of pensioners wanting a 70 cent stamp.

god bless em

Next time don't get a lift there off your pop then.

KIWIBANK would be my preferred bank right now too - mind you 99% of my intereaction with them is via their banking website which has good transactional functionality.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.