BNZ is making a series of changes to its mortgage rate card with some reductions to short-term fixed rates, and increases to longer term fixed rates.

The opportunities to lock in especially low five-year fixed rates are fading.

The BNZ six-month fixed rate is now 2.99%. That's 40 basis points lower than its prior rate, which wasn't especially competitive. Now it matches the offers from ASB, and Westpac, and has a clear rate advantage over ANZ (3.99%) and Kiwibank (3.55%).

What is interesting about these 'new' levels is that the short-end rates are coalescing around the levels ASB set back in late April. But ASB's longer term fixed rates are now looking 'low' and may also be about to be hiked.

The rate curve for mortgages is getting steeper.

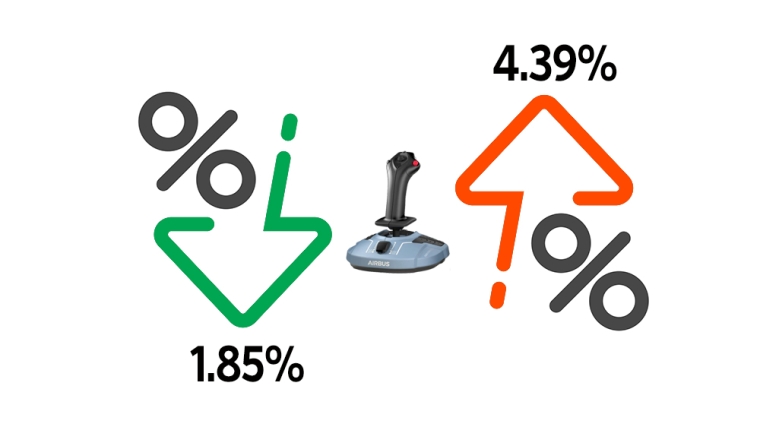

The lowest rate for any fixed term is still Heartland Bank's 1.85%. And the highest rate for any fixed term is ANZ's new five-year rate of 4.39%. That is the widest/steepest since 2012.

One useful way to make sense of these changed home loan rates is to use our full-function mortgage calculators. (Term deposit rates can be assessed using this calculator).

And if you already have a fixed term mortgage that is not up for renewal at this time, our break fee calculator may help you assess your options.

Here is the updated snapshot of the lowest advertised fixed-term mortgage rates on offer from the key retail banks at the moment.

| Fixed, below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at June 10, 2021 | % | % | % | % | % | % | % |

| ANZ | 3.39 | 2.19

|

2.35

|

2.59 | 2.99

|

3.99

|

4.39

|

|

2.99 | 2.25 | 2.49 | 2.59 | 2.89 | 3.19 | 3.39 |

|

2.99

|

2.25 | 2.45

|

2.55 | 2.99

|

3.39

|

3.69

|

|

3.55 | 2.19 | 2.55 | 2.99 | 3.39 | 3.69 | |

|

2.99 | 2.25 | 2.45 | 2.59 | 2.99 | 3.39 | 3.69 |

| Bank of China | 3.45 | 2.15 | 2.15 | 2.55 | 2.75 | 3.05 | 3.35 |

| China Construction Bank | 4.70 | 2.65 | 2.65 | 2.65 | 2.80 | 2.89 | 2.99 |

| Co-operative Bank (*FHB only) | 2.25 | 2.09* | 2.45

|

2.59 | 2.94

|

3.24

|

3.54

|

| Heartland Bank | 1.85 | 2.35 | 2.45 | ||||

| HSBC | 2.79 | 2.19 | 2.19 | 2.45 | 2.69 | 2.99 | 3.19 |

| ICBC | 2.89 | 2.25 | 2.35 | 2.35 | 2.65 | 2.89 | 2.99 |

|

3.39 | 2.19 | 2.39 | 2.49 | 2.79 | 3.09 | 3.39 |

[incl Price Match Promise]  |

2.89 | 2.19

|

2.35

|

2.55

|

2.79 | 3.09 | 3.39 |

Fixed mortgage rates

Select chart tabs

13 Comments

You only get an umbrella from the bank when its sunny. This will be a game changer for all concerned

Meaning…?

Meaning when it starts pouring with rain and hail the size of golf balls (interest rates rise) they take the umbrella off of you.

"The rate curve for mortgages is getting steeper"

At the same time the rate curve for bonds is getting flatter, someone is wrong… we should know who in12 months time

QE is still working it's magic, that's why the rate curve for bonds is still flat.

Under FLP, banks can get mortgage funding at .25 percent for fixed term loans. The floating rate at trading banks is 4.45 vs the 90 day bill rate of 0.32. Plainly consumers / borrowers are being ripped.

I was listening to a recent podcast interview talking about NZ banks vs Oz ones, and how NZs pay quite a bit more for mortgages than in Oz. Are NZers just too laid back, or don't we care, or don't people understand?

I think the majority of Kiwis are under the impression that the Government knows what they are doing, and that banks are there to help us with our financial goals. Neither is true. And any mortgage broker worth their salt can get a lower than advertised rate. So can we if we just ask.

I hear yah. Just FYI the FLP is only up to max 6% of their balance sheets (as at 31 Oct 2020) so limited impact on banks overall cost. Look at all the issuance they've been doing locking in funding at historically low rates for terms such as 5yrs etc. Curve steepening then lock in your term funding now...FLP is still there until end of 2022.

Also I believe the massive US trade deficits are causing a lot more demand as foreign countries buy US bonds with their USD surpluses.

Once the US economy gets back into full stride, this should ease back on demand and lift yields

@audaxes, your thoughts?

Days of low interest rates are near the end.. they are expecting inflation to be at a 28 year high in the US

High inflation is already here, everyone knows it. Price increase everywhere and prices will not be dropping anytime soon. Our government better wake up and fast. There is no such thing as "Look through" this, that is total BS, inflation is inflation. They slashed rates without any supporting data that told them they need to and now its clearly going the other way and they are doing nothing. I can see why some people out there are getting really really pissed off.

Yep an own goal still counts.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.