Something that has only happened twice in the past 20 years may be about to happen again.

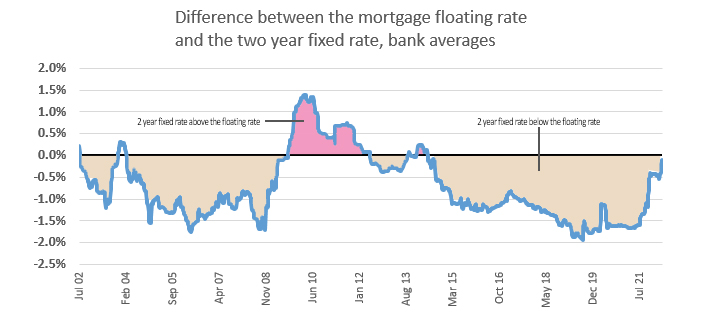

The average interest rate on popular bank two-year mortgage rates may rise higher than the average bank floating mortgage rate. As the chart below shows, since 2002 this has occurred twice before, between 2009 and 2012 and then briefly in 2013-2014.

Interest.co.nz's charts show the average bank floating mortgage rate at 5.05% and the average bank two-year mortgage rate at 4.812%. The average three-year rate is almost neck and neck with the floating rate, at 5.048%. The average one-year rate is 4.074%.(Note, since this article was written both ASB and Westpac have increased fixed-term mortgage rates).

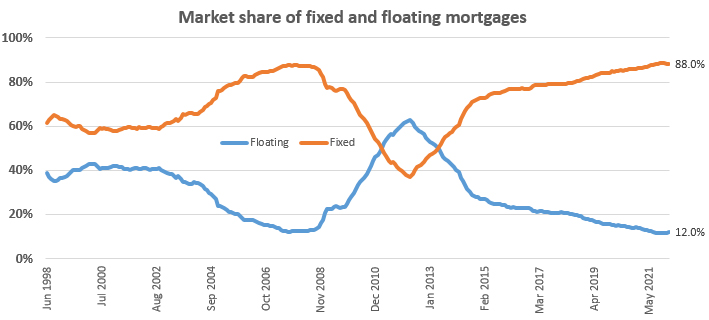

Typically New Zealand mortgage borrowers prefer fixed-term loans over floating rate loans, as demonstrated by the second chart below. Reserve Bank fixed versus floating rate data dates back to 1998. The only period since then when the market share of floating rates was higher than the share of fixed rates coincides with when the average two-year rate was higher than the average floating rate.

The latest Reserve Bank figures show that as of February, just $40.138 billion, or 12%, of $334.055 billion worth of mortgages was floating. In contrast $293.917 billion, or 88%, was on fixed terms. Of the fixed mortgages, at $73.511 billion, the biggest chunk was fixed for between one and two years. A further $68.762 billion was fixed for between six months and one year.

If two-year rates push above floating rates and stay there for some time, will we see borrowers switching to floating mortgage rates in significant numbers?

The backdrop of all this is a rising inflation and rising interest rate environment. Regular bank mortgage rate increases come at a time wholesale interest rates such as swap rates are steadily climbing and the Reserve Bank is increasing the Official Cash Rate (OCR). The OCR is now at 1.50% having been at just 0.25% as recently as October last year.

BNZ Senior Interest Rate Strategist Nick Smyth highlighted on Wednesday just how significant recent global interest rate increases are, with the 10-year US Treasury rate having surged 115 basis points in just six weeks. Smyth pointed out this type of move had only happened twice before during the past 30 years, with the 115 basis points increase comparable to the average annual trading range in the 10-year rate over the past 20 years.

Inflation is at decades long highs in many countries including New Zealand, where the March quarter Consumers Price Index due out Thursday is expected to show annual inflation above 7%.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

14 Comments

A real dilemma for borrowers, isn't it? If fixed-term rates keep on rising as fast as they have been, the question might go from "should I fix?", to "can I afford to fix?".

When Interest Rates go to 7 and UP the Housing Market will Completely Explode into Flames and Smoke. Watch how the Vested Interest Brigade (VIB) will still run around trying to extinguish the flames.

https://www.youtube.com/watch?v=NIBQPVYGktY

They may and probably will reach 7% on the 5 year but like you said, as the housing market rolls over so will everything else taking inflation and interest rates with it and then back down to new all time lows. It wouldnt surprise me to see negative rates in NZ within 5 or 6 years. Once the disinflation starts demand destruction will be well well under way, this will allow the supply chains to catch up which will allow for more and more disinflation.

The Pendulum Always Swings.

So Interest Rates will go High for a very long time.

Rising interest rates and inflation, double whammy.

Say that the expected 50-50-50 bps rise in OCR does not happen, then what.

We're seeing interest rate curve inversion between 6 mo and 1yr rates highlighting the perception of short term risks. Yield curve inversion is rarely a good thing...

I think relying on floating rates staying where they are while all fixed rates are moving is short sighted

Things are unlikely to 'explode' as it takes time for the new rates to roll over into the new rates but we will start to see highly leveraged borrowers get squeezed as they do roll over onto new rates and mortgagee sales increase...

What bothers me is that the banks lending criteria only starts to tighten when interest rates rise - and by then most of the future problems are already in their books....

Inversion of what? Retail mortgage rates? If so, the 6 month rate is a funny one.

Swap rates are pretty flat, but actually there isn't any inversion at the moment.

We all float down here.

Floating or fixing... either option is a pathway to hell

6.9% Cpi... About 50% of reality. We are in a bad place when even manipulated numbers are bad.

I'm still stunned that 95% borrowers don't know about breaking and refixing.

We obsess about any move in house prices but loan strategies are just as crucial

It is interesting to see the graph of market share of fixed vs. variable interest rates.

It seems that if most home owners have a fixed rates of 1-3 years and if a global financial crisis (GFC) was to take place in the next few years, many borrowers would be able to remain solvent and avoid the rising rate debacle with strained discretionary income in their household budgets. If rising rates were to persist longer than this and the RBNZ fails to effect lower/ emergency interest rates thereafter, this could have a negative impact on the housing market with forced sales and a liquidity crisis.

What re the long term inflationary pressures???

I'd be asking the bank for a deal on 6 month or 12 months.

What's funny is that the government and RBNZ treat interest rates like a game. One day it's "doom and gloom" and they urgently plummeted the interest rates to near ZERO. Then next day, it's like oh shoot we overshot ourselves, let's urgently raise interest rates again, then we go up to 5-6% within a matter of months.

Clear example of purposely shooting yourself in the foot, then crying to the doctor to patch it up quickly.

Honestly, what's the point of having those people lead the government and RBNZ when anyone of us can do that job. Always reactionary, never proactive, and just turning the interest rate on/off like a dang light switch.

Anyone can do their job. Just save their salaries and donate it to the lower wage earners.

-7

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.