It's 'Peak Mortgage Shock' time now.

And plenty of shocks are in store. For many it is going to mean increases in monthly payment costs of close to 50%.

The majority of mortgage holders have either one or two year fixed terms. And for anybody having to refix right at this moment the impact and shock value is going to be as bad as it gets.

This is the crunch time and it's going to set the tone for how the economy is looking by the end of this year.

Yes, mortgage rates are going to get still higher than they are now yet, but the actual impact in terms of sheer size of increase is unlikely to be any more harsh than right at the moment.

To explain that a little: June of last year saw interest rates pretty much at the bottom, as the Reserve Bank's summation of the averages of new 'special' mortgage rates shows.

In July of last year the rates started heading northwards in a serious way, by around 25 basis points that month across the range of terms as a number of economic indicators, all topped by rocketing inflation figures, saw wholesale interest rates beginning to head skywards.

The rate rises haven't stopped since.

But in June last year you could have, and no doubt plenty did, take out a mortgage fixed for 12 months at 2.2%, give or take a basis point or two (many of the biggest banks were actually offering 2.19% that month). Note: All rates in this article refer to the 'special' rate offers.

If you now want to refix for another 12 months you will be up for a 5.35% rate. Oh. My. Goodness.

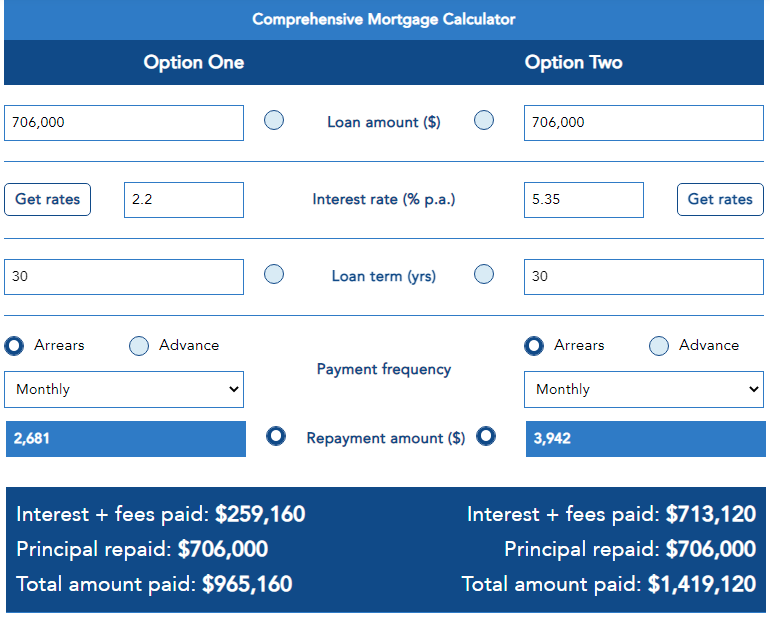

The interest.co.nz mortgage calculator suggests that if you've got your mortgage for 30 years, the monthly increase in your interest payments is a staggering 47%.

Here's a head-spinning Auckland example:

The average-sized mortgage taken out by Auckland first home buyers in June 2021 was $706,000.

This below is a slightly cropped/edited version of what the calculator gives us, but with all the salient information shown.

The left hand side is of course as per the rate taken out last year and the right hand side is the new potential rate, based on what the main banks are now offering.

For ease of reckoning I have not deducted anything from the principal after one year. Obviously anyone who has made significant principal payments may be somewhat better placed. Somewhat. But this example is simple and illustrative and gives you the general idea.

(If for example, though, this mythical mortgage holder had managed to carve $30,000 off the principal in the first year they would still face a 41% rise in payments and be paying over $250 more a week.)

So, anyway, looking at the detail of the above example, this works out at an EXTRA $290 per week on the new rates. Over $15,000 more per year.

Too extreme you say? Not realistic, as an example?

What I can say about that is according to RBNZ figures, Auckland FHBs borrowed $765 million in June 2021 across 1084 mortgages. At least some of those will be getting rates reset now.

And, of course, $706,000 is a simple average. Some mortgages will be smaller. But some will be bigger too. This is getting real, people.

What about two-year rates?

Well, they bottomed at just over 2.55% in June last year (2021). But if you took out a two-year rate in June 2020 the interest rate wasn't actually much higher than that. If you are refixing a two-year rate now you might be coming off just 2.7%. And you would now be looking at 5.69% at best among the major banks (in fact ASB and ANZ are both higher at 5.8%).

Running the same scenario through the calculator gets (if you use 5.69% as the new rate) a rise in monthly payments for all refixing customers of 43%.

So, whether you are refixing one or two-year terms, a very unpleasant shock to the financial system awaits.

As RBNZ data showed as at end of April (most up-to-date figures at time of writing) Kiwi owner-occupiers had $213.386 billion of fixed term and $28.672 billion of floating mortgages. Investors had $89.346 billion of fixed term and $9.753 billion of floating.

Of this, $37.241 billion of owner-occupier fixed mortgages were due to be reset within three months - so, by the end of next month (July), while $15.211 billion of investor fixed rates were to be reset.

If we extend the timeframe out to mortgages resetting within six months, the amount of owner-occupied mortgages to be reset was $60.91 billion, while for investors the amount was $24.869 billion. These totals include the figures from the three-month example above.

The upshot is that well over a quarter of both the owner-occupied and investor fixed rate mortgages were due to be reset well before the end of this year. Add in the amounts on floating and it means over a third of both the owner-occupied and investor mortgage money is going to be hit by the higher interest rates well before 2022 has finished.

So, the great interest rate shock of 2022 is coming home to roost for good numbers of people imminently, if it hasn't already.

How will people cope?

Well, we are about to find out.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

151 Comments

I have tried to model the extra costs properly a few times but ran out of time / steam. It is challenging to work out whether the extra mortgage payments people make will continue at similar levels, and what proportion of people will drop to interest only. My best guess is a 150pts rise in overall yield by the start of 2023 - meaning an extra $5 billion per year in mortgage payments (total payments are roughly $65 billion per year I think).

The question is not “what proportion of people will drop to interest only”. The question is what proportion of people will the banks accept a move to interest only.

IO loans make a lot less sense for a bank in a market where prices are falling.

When prices are rising banks are happy to issue new credit on loose lending criteria, thus creating a feedback loop. The same feedback loop works in reverse when prices start falling - we have already seen high LVR lending being withdrawn. Interest only loans won’t be too far behind

yup... and also

The people forcibly moving away from IO will be mostly investors. The house where that debt is is not the house where they live. The temptation to offload asap (or before) will be high.

They will feel the entire impact of higher interest rates (which is twice as much if you pay only interests)

Impact on IO loan payments is greatest, but not “twice as much”. Besides, whether talking about “twice as much” or payments being “x% higher” is missing the point that %’s can’t be taken to the bank (or paid, for that matter).

It doesn’t matter whether your mortage payment is 50% higher, 40%, 30% or 5%. What matters is whether you have the $’s in your income (and/or flex in your budget) to pay the _$’s_ now demanded by the bank.

As a side note, coming from the UK (admittedly 15+ years ago now) the penny has finally dropped as to the context of conversations around IO mortgages here in NZ,

In the UK, when I was in property there at least, an IO mortgage was only available if the borrower also took out an additional investment product (not necessarily with the mortgage lender) to cover the eventual principal repayment at the term of the load, usually an endowment.

The idea that a bank would accept IO payments alone, without any cover for repayment of the principal other than the security on the property itself never even occurred to me. But then, the UK housing market wasn’t dominated by “investors” or the fanciful delusion that house prices would, and could, only ever continue going up.

Some long-overdue realisations are finally dawning on the NZ housing market, it seems.

It's all of the above - my point is that there are too many moving parts and 'ifs and buts' to model the impact of increasing rates accurately. I could switch to an IO mortgage tomorrow (but I won't). Others will want to move to IO, but they won't be allowed (etc etc).

What I can say is that since January 2017, average yields have tracked just below the 2-year fixed mortgage rate. If they converge back to anything like this, we will see a 200pts increase in yields within one to two years. Painful.

Using the example in the article:

$706k at 2.19% and 30 year repayment = $2,677/month

$706k at 5.35% interest only = $3,148/month, an increase of $471/month or 18% with no capital paid off.

Doesn't seem too bad overall. A good investor will be fine to absorb that. Can imagine some will not be so fortunate, however.

A reminder that this all comes out of net income (given we don't align our income tax rates for inflation, this is quite relevant atm) and all our other inflationary costs that have risen over the same time-frame. Gross income isn't real but people tend to spend like it is.

We hear a lot about rate sensitisation by banks when approving a mortgage, but do they take inflation into account as well?

Yes (at least when I was building the software for modelling this for ANZ). They would examine UMI over the term of the loan and include forward inflation predictions.

Yes (at least when I was building the software for modelling this for ANZ). They would examine UMI over the term of the loan and include forward inflation predictions.

I would love to have been a fly on the wall watching you taking instructions from ANZ and listening to their modelling methodologies

It was really just one person. Of course they had the whole banks instructions behind them, their "head lender" type person. Who had both advised on and written the lending policy, which would evolve over time. He was someone who had decades of experience from both frontline right through to the top, so knew all the ins and outs and politics involved. We basically built in all of the variables and calculations, then they would input the scenarios by putting in the actual values. It was tested pretty thoroughly though (as you would expect) and using different lending environment conditions (modelling what it would look like with high interest/high inflation rates, for instance). I would expect all banks have a similar software set.

just came off a 2.19, (2.99 for 5 would have been the right thing to do in glorious hindsight) now at 4.23, luckily my bank lets you lock in a refix 5 weeks in advance of the expiry that has saved me about 1%! I had kept my repayments much the same as interest rates dropped, so no hit to the wallet as such but estimated freedom day has slipped! Using any extra cash to pay down the mortgage now seems like the safest, risk free investment one can make.

Don't feel bad about not locking in the low rate for longer.

Not long ago BANKERS were publicly stating that inflation is transitory, BANKERS were also saying that interest rates would be low for a long time yet.

The bankers should really have checked in with Vladimir Putin first before making the transitory predictions.

And OPEC.

Oh dear, someones been drinking the Biden juice

Inflation was going up before Russia did anything.

Bingo.

You touch on an important point. The rate shock may be somewhat limited to those with newer loans, who were not paying higher-than-minimum repayments. A good part of the stock are those that left their payments higher, so may not need to increase, or the increase will be a smaller delta.

Of course, it means more interest over the life of the loan and a later repayment date, but in terms of being able to absorb the higher interest rates, it may not be as dire as some might call out, at a macro level anyway.

You can always sell the boat and or truck.

You'd think it would make sense for banks to work hardest to help more recent FHBs to get through, as they have a long time in hand to pay the mortgage off.

Yeah, I expect they'll guide them, and in theory, the stress testing should allow for rates at least of 6% (not sure test rates ever got lower than that)...

They also though will have already committed to 30yr loans... so hard to push out term etc.

Ah...so this will be the impetus for them to push to be allowed to make mortgage terms even longer! Thus enabling even them to pay higher prices to enrich others.

Longer and transferrable to dependents.

Could resolve our labour shortage, extra shifts for everyone!

A silver lining! Two or three jobs for everyone. Stop them from getting up to mischief.

lol thieves don't work, no need!

Don't forget unemployed REA, I'm sure some of them can transition to productive work.

The most affected are first home buyers, with no equity derived from house ownership. Income has to increase, to maintain the "status quo". And over the years, I cannot recall that wages declined.

Existing mortgagees with a portion of their loans paid, are likely to be alright.

Investors and renovator/traders, don't know.

I'm sorry, this is absolute bulls**t. FHB's are in the drivers seat (if they're patient), all they have to do is sit on their hands throughout the rate hike / inflation cycle, stack cash and watch equity / price gains be erased in epic fashion.

So what if rates are higher when the principal is eventually half, that's a bargain and rates will be cut one day, your principal won't.

To me this sounds like fake empathy in the hope the status quo will return, and I'm seeing a lot of this "talk". "Oh no those poorly FHB's, won't somebody please cut rates so we can continue the greater fool ponzi. My "business" is going backwards...

Sorry bud, not happening and others would do well not to fall for it either.

How can a FHB 'stack cash'?

Rents and expenses are increasing, inflation is eating away savings, Kiwisavers are diminishing...

If we have dramatic falls in house prices, unemployment will rise.

Bank credit is tightening and will likely further tighten if the market heavily contracts. We're already seeing this with high LVR lending, CCCFA etc.

It's not an easy position to be in if you're a FHB... really you're screwed either way. No doubt why many are looking overseas for other options...

Rents are hardly moving, with more rental stock coming to the market, so rents are under pressure and good tenants have leverage.

Interest rates on the other hand have doubled and we're not at the peak yet.

So FHB's are in a far better position to stay renting, with no capital at risk

Their only risk is that prices take off again… and what are the chances of that in the next few years while rates are rising, and values are falling?

If they did their numbers they would realise they pay less than 10% principle back in the first 5 years of a 25-30 year table loan.

So they have far more downside risk, in the next few years while prices are falling.

They need to sit tight, be patient, build a greater deposit and thank their lucky stars they didn’t take on a mountain of debt to ‘get ahead’.

Their time will come, but for now they also need to stop listening to the utter BS from all the 'property coaches’ out there taking commissions from developers and getting them into new builds to ‘build wealth’.

They should ask these ‘property guru’s' instead what they have bought in the last few months while "it’s been a great time to buy" in their eyes.

As Taleb rightly says ‘don’t tell me what you think, show me what’s in your portfolio’.

Yes the idea that inflation is “eating away at your savings” doesn’t really apply if you are saving to buy a house - and housing is depreciating (based on last 3 months) at around 20% per year.

Thank you both Miguel and DDDDebt, both very well put.

I really do think people act intentionally oblivious to seem more credible and hope people fall for it.

You're still not addressing how an FHB is meant to 'stack cash' in this environment?

Can you also advise when a FHB should time getting into the market? What are they waiting for exactly... house price drop of what %? Will they be able to afford the rates at that time, will they be competing against more buyers, will their savings in Kiwisaver have earned them a return, will they still have employment?

Stack cash / Save money in a savings account. (You had to ask that?)

What are they waiting for? Maximum Pain / Maximum Interest Squeeze on leverage and heavily depressed prices.

My assumption is based on a household with a strong income and decent deposit with significant reductions in house prices. (30 - 50%)

Interest rates will be painful, but I'd happily wait / take $500k @ 8%+ over 1M @ 8%+.

One thing is for damn sure. I wouldn't touch houses for at least 6 - 9 months.

Stack cash / Save money in a savings account.

Oh right, yeah I forgot with those returns on savings accounts your cash will be stacking up big time!

Interest rates will be painful, but I'd happily wait / take $500k @ 8%+ over 1M @ 8%+.

What would the economy look like at that time... what would bank lending criteria be then?

They can wait all they like, but things aren't getting easier for a FHB...

The realty is that FHB compete with investors (owner occupiers buy/sell in the same market, so we can largely ignore them).

if prices fall by 25% +, and the predicted interest rate track is borne out, it will hit investors far harder than FHB. A fall in prices reduces the amount of equity available to expand their portfolio. Rising interest rates hit yields very hard, as many use interest only. Rents are now starting to flatten/ fall.

A potential FHB should be saving money each week to increase their deposit (if they don’t have spare budget after expenses, they sadly won’t be buying in any market)

as for “what to wait for”, the vast majority of housing corrections are followed by a period of relatively flat prices. At this point a FHB will be in a far more advantageous position, relative to investors, and their deposit will go a lot further. The most important part is they will need to take on less debt which is undoubtably a good thing.

100% agree Miguel.

FHB’s have the advantage over investors, and OOs have little impact.

If they were smart FHBs would boycott the market and really bring it to a screaming halt.

I actually think this is what will happen in about 6-12 months time when they realise it’s cheaper to rent than buy… and they’re in a safer place to be renting in a tough economic environment, with the flexibility to move reduce costs and find work opportunities etc.

1) Stack cash by saving. Pure and simple. If you've already been saving for a house, just keep going. Even if you have to save less in nominal terms because inflation is cutting into your budget, if house prices are falling at a rate higher than inflation is eating into your budget (which is the case right now), you're getting more bang for every buck you squirrel away.

2) When they can afford to purchase a house without having to take irresponsible financial risks.

3) They are waiting for house prices to fall into a range at which they will be able to purchase a house with sensible income to debt ratios, weekly repayments as a % of net income, etc.

4) If they are able to afford the house without taking irresponsible risks, they will be able to afford the rates at that time.

5) Don't know - impossible to predict buyer demand.

6) Kiwisaver is a long-term investment. It's normal for it to fluctuate in value in the short-term. IMO whether it dips or increases a little shouldn't impact your decision to buy a house.

7) If they don't have employment, they shouldn't be buying a house. If you think it is a good idea to buy a house now, because you might be unemployed next year and therefore unable to buy one then, you are insane and should never be giving financial advice.

The DGM's here are acting like house prices are going to drop 40%-50% in value and the economy's going to be sweet...

The reality is, if this happens - FHB's will be completely screwed and unable to buy property...

There will be pain all around, not denying that.

We shall find out soon enough how "the poorly FHB's fare" once everything washes out.

Those who position themselves in the strongest possible terms will be rewarded.

Some FHBs would be completely screwed but plenty wouldn’t.

much less likely to be screwed if you work for the public good - education, healthcare etc.

Much more likely to be screwed if working in the FIRE sector or related.

if you work in retail or hospo you might be screwed but also unlikely to be able to buy a house regardless

"DGM" moniker is so 2021. Get with the program.

DGM have been replaced by the BATs (bitter and twisted) due to interest rate hikes and impending property crash.

That’s rubbish Nifty. FHB's have all the leverage - they are the fresh capital the market needs.

It will always come down to your deposit (the banks security) and your income (your ability to pay them interest, their margin to service your debt)

Yep - the economy will be hurt because it’s too dependent on housing - but that’s the medicine we need to take, to rebalance the economy and society.

This graph should tell you exactly what’s going to happen to property.

https://www.opespartners.co.nz/property-markets/otago

Let me know if this doesn’t tell you what happens in the next 5-10 years and I’ll post response tonight.

The obvious clues are:

Oct 94 - $105k

Aug 02 - $110k

Sept 05 - $260k

Aug 13 - $260k

Right now I need to get some work out the door!

BTW, I’m not A. Church, the property historian fwit.

DDDDebt - with someone of your view, it's ironic that you're lurking on Opes Partners website? Lol linking me to a property investment companies website to try and support your argument? The article only reflects Otago aswell... I'm sure if I could be bothered I could find an article/s on Opes Partners that would be stating it's a great time to buy property...

Nifty

Yes, somewhat ironic, but the only really good thing Opes do is provide decent data - the rest is annoying noise for their model to clip the ticket on Mom’s and Dad’s buying a new build investment using existing equity. It’s what they specialise in and have built it into a very slick commercial model.

So you’ll find plenty of content to tell you property is the best thing to build wealth. All true if you get your timing right. But now is not the time.

Which city/region are you after? - they have them all.

The big giveaway that the sustained falls are really happening is that Opes have not updated their graphs since Jan - when they are producing tonnes of new sales content everywhere else. I get all their spam.

In short to answer your previous question - What’s the market going to do etc?

The most likely scenario (the one I would bet the farm on) is it’s going to continue fall to a level where it finds support and buyers (no one knows what this will be) and then flatten for a very long time - for the same reasons we had sometimes nearly 10 year periods of no price growth after previous booms.

The more it has gone up in previous cycles, the longer it’s stayed flat inbetween.

So the ideal time to buy as an investor is just before the next upward leg. So that will depend on how far back it falls this time.

For a FHB/homeowner it’s when prices have stopped falling, and stabilised. It will still be a buyers market then, those long flat periods are.

But the numbers need to stack up for you where it is cheaper than renting. Otherwise put your hard earned savings elsewhere.

If you really think it’s a great time to buy now, please talk to someone that you trust that has been through a few cycles (40+ years in property investment) and made and lost money along the way.

Yes there will be consequences, but the hardest hit is going to be the housing Ponzi - and by far. So, considering all factors, if I was a FHB I would wait until the big correction to housing prices, well overdue, has done its work. I would not touch housing for at least one year.

Amen.

It doesn't apply full stop. My savings is doing nicely thanks with TD rates doubling every 12 months while everything else is tanking.

Your purchasing power from your savings is diminishing by the day. Also good luck with your savings held in a bank if sh*t hits the fan...

Sure inflation might be chipping away, but don't forget we are saving into tightening vs saving into loosening.

There is absolutely zero upside to buying a house right now with rates all but guaranteed to continue climbing aggressively.

Pretty content with that tbh.

Dont forget debt is one of the best hedges against inflation...

Yes, but only if your income is rising

Tell that to a landlord who’s rent is static or falling with rates, maintenance and everything else going up.

The strategy this cycle will be to accept inflation for 2-3 years while values fall and rates are rising before using it to your advantage to erode debt.

So again, it’s all about timing.

No it's not because it depends on what your purchasing. My outgoings are insignificant. Banks going bust ? Didn't they just post record profits? Not going to happen. The banks only concern is new lending and they are already covering their asses with higher thresholds and 20% deposits.

Are you a real estate agent or otherwise affiliated with the industry?

The bank comment clearly forgets it's banks that hold the security to your properties as well.... a little bit one sided eh? Given they are allowed to call in their loans, what makes you think they wouldn't if the situation was so bad that savings were at risk.

Your purchasing power from your savings is diminishing by the day.

Not while property price falls are more significant.

This is true, rents are static. We have always followed a policy of minimum disruption for our good tenants, we have just resigned one of our tenants at the same rent they have had for the last 24 months.

Given the law change around tenancy, good tenants actually have significant leverage, which was the aim of the legislative changes.

I have been reading a growing number of posts here and on other sites suggesting high house building costs will prevent a substantial (over 30%) drop in house values.

This article precipitates out very well why that logic is flawed. For big ticket items that require lending (i.e. houses), people can only spend what they can a) afford, and b) are able to obtain. Those two have changed rapidly and significantly. Demand drops and the same economic principles that drove prices up will let them fall.

Those principles will not bend to developers that go bust or people who are recently heavily indebted that go into negative equity. Suggesting otherwise is putting the economic horse before the cart.

The only sliver of hopes for housing lies in the recession biting hard and fast allowing Orr to level off the OCR early and possibly being able to pull back and immigration adding some demand into the equilibrium.

Are the high building materials "costs" just a result of the market meeting the market? I.e. people paying silly sums for property because they can through loose lending conditions. If house prices go up 30% in a year, why wouldn't the wholesale price of a sheet of GIB also rise 30%?

100%. Loose monetary policy facilitated a spike in demand and the price rises in keeping with those basic principles of supply and demand. My point remains, if less people can access or afford loans to buy properties at current prices demand drops. Less new builds. Less GIB in demand. QED.

Probably not as directly as that. As prices increase, the nature of construction normally follows. So the price of a bathroom vanity doesn't double, but increases in values encourage second or 3rd bathrooms.

Because house prices have a very considerable land value component. Those stupid prices developers were paying for adjoining sections in Te Atatu don't affect the price of Gib, but they do affect the price of "building" through a developer

Great post

I enjoy your posts HM and have learnt much so I consider this high praise. Much appreciated.

If the cost to build goes up, and the price people can pay goes down, the variable left that will adjust is the value of land.

The majority of the price appreciation we have seen in housing has been the increase in land values.

The people who will be hit first are those that overpaid for land, figuring house prices would keep rising and that they could build for x amount.

Well the people who get hit first might be those that put money into a second tier lender offering a first mortgage security…..

I’m expecting a whole tranche of failed finance companies… again…sigh

You dont see them advertised but they are out there and more than you think…taking funds from experienced investors, friends and family

At least it's not Hanover and their like. Taking money from anyone with a pulse and using it to pay dividends to shareholders on profits that would never be realised so they could install gold taps in their bathrooms.

Hi Miguel,

This assumes that the margins for profit and gain are rigid.

When I go to Waihi Beach there are an awful lot of UTE's with fishing boats in the driveways of the second homes. I would suggest that if demand drops there is another area where costs can be reduced.

Absolutely. The big gold rush for ‘good’ development properties through 2020-2021 has long gone.

I suspect those kinds of properties will see some pretty big falls in value.

Surely though the RBNZ has to follow the FEDs (very hawkish) lead or our currency will be decimated and tradable inflation increase significantly?

Yes. People lose their minds when they think about building costs.

Building is expensive because we've been in the middle of an epic credit-fuelled boom. Builders have been able to increase their rates. Supplies have been short because of excess demand. A lot of that demand is artificial, in the sense that it's not even new housing, it's renovations etc.

It might cost half a million dollars to build right now. Does anyone really think that will be the same in an environment where no one else wants to build? That there's some kind of market-agnostic permanence to building costs?

Building is expensive for a whole bunch of reasons, it's only times like this anyone pays much if any attention. Builders in general aren't actually making money at the moment - it's taking 2-3x as long to complete projects in 2022 than 2019. They're putting rates up, but still going broke and/or going backwards financially. The whole industry is a basket case and incapable of handling the changes bought on since covid, you only need one process or product delayed and it has a large ripple.

Based on what I know, it might be that if the market totally dies, you could see prices fall in order to secure work, but I wouldn't expect more than 5-10%. But most of the increase in building costs is baked in, and the nature of standards and regulations only adds to the cost of any construction in NZ. Even just the recent existence of the Christchurch and Kaikoura Quakes has added a premium to the cost of construction in NZ. Now coming onto the scene are costs to mitigate inland flooding, and coastal erosion.

You would need to see more than just market forces changing, in order to reduce costs in a meaningful way. I think we could drop house building prices 70% overnight by removing any density, build quality and standards rules, health and safety and environment rules. Slam places up lickity split.

It is the land price which is the biggest factor, that is where the value decline will be the greatest.

This is a big deal for a small number of households. 1,084 in Auck in July, so say, maybe 3000 across the country. Out of what, 1.8m or 1.9m households? So, 1 or 2 in every 1,000 households has this significant/serious/worst case scenario impact each month?

This from Interest earlier in the month "According to RBNZ figures, as of April there was nearly $297 billion worth of fixed-rate mortgages around the country. Of this, $239 billion (just over 80%) was due to reset within two years. Well over half of the money ($160 billion) was due for a reset within 12 months."

Look at the RBNZ c40 DTI data set for the lending over the last two years . Tell me it's not scary

NZ added 57 Billion of new mortgage debt since March 2020. Everyone was leveraging up. To "invest" to trade up and to just get in.

Now the system is going to have a reset.

The thing is that the price indicators for houses are derived from the trades that happen, not the ones that don't.

So 1 in 10000 of people "deleveraging" by starting to accept what the market can get now from the banks (which is 50% of what it used to be) is enough to keep driving homes even more down.

Kind of a spiral of death.

The cycle will revert once the buyer can obtain more from banks again (but at that point, and for a while, people will finally take in consideration that shit-hapens apply to home prices too)

I would not feel relaxed in being too much exposed to the housing market right now.

I agree 1 in 1000 deleveraging will drop house prices. And they need to drop significantly.

But 999 out of 1000 NOT having to deleverage that suggests to me lesser impacts for the wider economy, than for the housing market? Still in their job, still paying mortgage or rent, still buying food etc...

Don't forget back in my day we had 21% interest rates, 3 mortgages, no carpet or driveway and fed 6 children on $45 per week.

Nah mate, saved for 3 months for the deposit, house paid off in 2 years.

Truths sitting somewhere in between.

How high was the snow? (actually with global warming, it's probably a relevant question)

They had cocaine in their Coca Cola, hence they could walk 15 miles barefoot in the snow to school.

If I recall correctly back in the late eighties. Two full time incomes. House in poor part of Glendene, Auckland, cost 63k. 10k deposit. Paid off in six years. No kids. Sold for 97k after eight or so years.

We had 21 per cent rates for months only. Then they started to go down and quickly. My loan was $45,000.00. Don’t listen to dumb selfish boomers who think they had it hard. I had no student loan, my biggest house loan was $100k. I have only had 3 homes and the one I live in is worth at least $3m. Of course that will drop somewhat from here but who cares.

I'm definitely not looking forward to my refix in 2-3 months.

Thank you to the incumbent a**holes pretending they don't want house prices to fall (but go sideways) and RBNZ (and FED & ECB) which claimed inflation is transitory until everyone felt in their pockets it wasn't!

There is quite a good chance that recession will be locked in for the next 12-18 months, even if the RBNZ starts cutting rates in their pathologic rear-mirror overshoots.

The banks are taking way to large profits! The sector needs regulation with a cap on how high retail rates can go above the OCR. The bank's cost overheads are fixed and minimal.

The most expensive part of lending is vetting the customer in the first place. The monthly transactions & remortgaging is mostly an automated process that can be run very cheaply.

So once a customer signs away his/her soul it's just riding that gravy train!!!

You have had at least 6 months notice to break and refix. My partner ignored my advice on a 5 year fix back in November and went 3 years. The writing was on the wall and it was only a couple of people on here giving bad advice that rates could never rise.

Whos to say your partner wont be correct?

Great question. 1 year into a 5 year bet and the clear evidence is that interest rates environments can change dramatically in a period of months.

Me. Not long to go and almost a year gone already. Not a snowballs chance in hell that it's going to peak and drop to 3% anytime soon.

Who said soon? Your partner has almost 2.5 years to prove you wrong. That's an eternity given the most recent economic events

The rates went up so fast and the cashback + lawyer fees I would have to repay doesn't make it worth it.

They know too well how to hold you by your balls!

There are no cashback and lawyer fees to pay if breaking and refixing at the prevailing rates. There shouldnt be ERA either, as rates have increased. But you need to work out if exiting to pay a higher rate now vs an even higher rate later is worth it.

I have noticed quite a few houses coming on the market now in Auckland that were bought around April/May last year.. I suspect the new reality may be hitting some of these buyers pretty hard.

https://www.trademe.co.nz/a/property/new-homes/new-townhouse-terraced/a…

Urgent sale!! You expect someone to put down a deposit and commit to pay $1,070,000 for a townhouse that might be finished in Q1 2023. But more likely will never be built. These developers are in dream land now.

Sick of highly stylized marketing photos/renders that do not properly show the small size of internal spaces, cramped and jammed nature of overall development, lack of utility/storage.

Be quick!

Why would I want to buy from a developer that lists implied warranties and 12 month defect periods as selling points? These are guaranteed by the Building Act. And double glazing as a selling point? It's in the friggin' Building Code!

Building Act implied warranties

10-year implied warranty period

All residential building work in New Zealand, no matter how big or small, is covered by the implied warranties set out in the Building Act.

The warranties:

- last for 10 years

- apply whether they're in your contract or not — and your contract can't state that they don't apply

- also apply to work done by subcontractors employed by the main contractor.

The implied warranties are:

- all building work will be done properly, competently and according to the plans and specifications in your approved consent

- all the materials used will be suitable and, unless otherwise stated in the contract, new

- the building work will be consistent with the Building Act and the Building Code

- the building work will be carried out with reasonable care and skill, and completed within the time specified or a reasonable time if no time is stated

- the home will be suitable for occupation at the end of the work

- if the contract states any particular outcome and the homeowner relies on the skill and judgement of the contractor to achieve it, the building work and the materials will be fit for purpose and be of a nature and quality suitable to achieve that result.

12-month defect period

The Building Act also gives you an automatic 12-month repair period from the date of completion. Get your building contractor to confirm the completion date in writing to avoid any confusion.

So long as you provide written confirmation of the defect within 12 months, your contractor must put it right within a reasonable timeframe. If there is a dispute it is the contractor’s responsibility to prove that the defective work or products are not their fault.

Farting in the wind. Give it some Gusto Fella !! (but watch the follow through!)

Anyone who has gone through the whole leaky-building pantomime (I had two) knows that all the contractors regularly (every couple of years max, at the end of each main development almost certainly) close their contracting companies and are therefore unable to be sued. The building materials companies are wise to this and are clear to state all over their warranties that the contractors must be primarily responsible for using them in the right way on only the right type of buildings.

When we bought one house we looked at was by a private builder who'd had 16 companies in 6 years. We didn't buy that house.

How does one find prior company info, companies register?

Yes. The company name was on the Sale & Purchase agreement, so we went digging around that and the director. One man band builder who had been spinning up and shutting down companies for different builds. Talked of "implied warranty" but I did not fancy trying to chase the builder after he'd closed the company again.

Absolute dream land!

$1,070,000 in Westgate, bargain!!!

sarc

Does anyone know what is happening with DuVal group and the other developers (Williams Corp as well, they did a video that hasn't aged well at all, explaining how their WACC was under 10%) who were offering 8-10% on their development funds?

https://www.duvalpartners.com/build-to-rent

I am tempted to register my interest on their website and see how aggressive the sales pitch is...

The Duval owners have taken their brand and moved to Singapore

Kenyon is about as charismatic an individual as you will find in NZ. Not a fan personally, but he certainly has been successful.

In the last residential complex completed in Manukau he held on to most of them, he will have 100's of units under management. I had not heard they had moved to Singapore but that is a good call, great point of access to developing markets.

Would be interesting to know how many buyers who took out a mortgage in 2021 split their loan total over several terms (to reduce rising interest rate exposure) versus how many put the whole loan on a 1 year fixed term. Its the latter group who will be facing some uncomfortable times

I still can't work out why everyone only fixed for 1 year. We obsess over house buying and values and sleepwalk into mortgages

I always fix for 1 year and put as much on revolving credit as I think I can pay off in a year. This is how I paid $600k off my mortgage in 5 years while rates were low (we have 2 good incomes and live frugally)

My most recent fix at 2.49% is up in August and will go onto revolving credit currently at 4.75% but this does not worry me as the balance will be gone by March.

Total interest paid on a $650k mortgage will be $79k

Thanks for your very intelligent and sensitive comment kiwimm. Not. The majority of the young buyers in recent times would not be earning anywhere near your joint incomes. What makes you think your comment will help them. You are simply saying”look at how clever I am”.

Just showing that there is a different way from the conventional wisdom of borrow all you can and take 30 years to pay it back. In a time of low interest rates, it was a good option to go hard and reduce debt. We have spent a lot of time building our careers and minimising our expenses - we save 75% of our after-tax income so live on less than people earning much less than us.

That is very smart, congrats!

You are not living when you live frugally. You never know when the grim reaper will come calling. I don’t know anyone who died wishing they had more savings or equity in their home. We need to have fun while we live but have funds available for those times when we need a new car or appliance. How does living frugally affect your children and the kind of activities they would like to do? What fun do you have when you are no working?

Depends what you mean by living frugally.

We live pretty frugally, but get what we enjoy. We buy whatever food we want but don't often eat at expensive restaurants because we get little value from it. Occasionally, but usually find it...just okay, and not really worth the money. We prefer discovering out of the way food places from different cultures.

We don't really buy stuff because there's nothing much we need. We don't need to buy more stuff to put in the house - future op-shop or landfill stuff - and the only things that really tempt me are better versions of what I already have. Clothes last a long time, and neither of us like "fast fashion".

We travel occasionally, and spend on those trips, but not to an ostentatious level because we get little utility from that.

We save most of our income because there doesn't seem to be much worth spending on. We are conscious we are incredibly fortunate in this compared to many.

No extreme frugality for us but we only spend money on things that really make us happy. We use the philosophy that we can have anything we want but not everything we want.

Also invest into things that save us money - solar, EV, replaced a car with an e-bike, fruit trees

Does solar and an EV really save you money given the massive initial capital investment?

Yes, solar has been the best investment I have ever made. I saw a return of 58% last year. It will also keep saving/making me money for the next 40 years. I also invested heavily in my house which is a certified Passive House so very low energy. I ran the figures for coming year and my electric bill for the year will be $77 ad that includes charging the EV.

Now that's one thing I would like to spend on in the future - a passive house.

Sadly Rick your in the minority. NZ is full of people trying to live the champagne lifestyle and trying to keep up with the Jones's.

Pretty much how we live too. Except holidays, we don't normally go away. I have so much leave I just ask for it to be paid out.

do you have any children? I rekon not. They are incredibly expensive.

We have travelled all over the world with my children and partners and we now have two grandchildren. Better than having more money in the Bank. All of them add richly to our lives.

We travel with our kids too - next trip is for a month to the UK

That doesn’t sound very thrifty kiwimm. I don’t think you would be admitted to a thrifters club if one existed.

It's not about thrift, it's about focusing your spend on what is important and eliminating wasteful spend. I make my own lunch everyday and don't buy coffee but I will happily spend on family holidays. Long holidays are also better value than multiple short holidays and we will stay with family for part of the trip.

I have two boys aged 8 and 10. They do cubs, music and swimming plus the occasional holiday programme.

Hi ex agent, I think that you maybe suffer from tunnel vision, kiwimm made 2 good points.

I always fix for 1 year and put as much on revolving credit as I think I can pay off in a year.

Live frugally.

There are many catergories of first home buyers, some may just be able to put a deposit together and at the other end of the scale the young professional who is on $80k and maybe was living at home has other options.

Because interest rates were trending down and RBNZ required banks to prepare for negative OCR.

People don't sleepwalk into a mortgage they go for the lowest rate without thinking about the long term trend. Even now people will still be going short term in the hope it will turn arround because they cannot face a 5 year rate that is higher than a 1 year rate. The problem is that 1 year is nothing and rates are still trending up and you would have been better on a 5 year. The real pain has still been delayed at least a year or two. If rates now stay high it will get ugly but not immediately. 2023 as predicted by a few on here is shit meets fan.

What effect does the ability of the average marginal FHB have on prices?

They could previously borrow $706k at 2.19% for a repayment of $2,677

They can now borrow $479k at 5.35% for a repayment of $2,677. A drop of 32%.

Add in increasing petrol and food bills and this is likely to drop further if wages do not keep up.

Extending further to a peak mortgage rate of 6.75% (based on OCR peak predictions and typical bank margins), the amount that could be borrowed to keep the repayment at $2,677 is $413k, a drop of 42%.

The Reserve Bank together with the government lured people into buying homes when the official cash rate was 0.25% by removing lending restrictions for buyers with low equity. Now the same Reserve Bank is crushing those buyers, by aggressive interest rate hikes when the property market is already in severe decline.

Our economy is unfortunately overindebted and property-dependent. I hope the Reserve Bank will cut the OCR back, before we enter a great depression of which are at the brink of.

The massive inflation we are facing was caused by COVID support, money thrown around by our government, and by ultra-low interest rates previously. This wave cannot be stopped by OCR hikes.

All that OCR hikes will achieve is economic hardship. We are seeing the beginning of it already.

I hope the Reserve Bankers will come to their senses and stop further interest rate increases.

So just let inflation run wild? You want nzd to become paper?

Well that was what I was picking them to do but I was wrong. I like everyone else wasn’t expecting the war, which has been very inflationary.

I think they will keep hiking, and I also think it’s the wrong move as:

- it will lead us in to a deep recession

- it will have fairly limited impacts on inflation

however, while I was wrong on how high the RBNZ would hike, I still think I will be right that they will start cutting, and potentially quite aggressively, in 2023 to try and dig the country out of recession.

but I guess time will tell.

My prediction is that the RBNZ will now try and perform a balancing act. They will push rates as high as they can without crashing the housing market and if that's not enough then inflation will let rip from there. Pretty logical isn't it ? Would you rather have a bottle of milk double in price or the value of your house go down by half ? Ask anyone with a mortgage. Do the math.

For all the talk of politicians leaving the Reserve Bank alone, their decisions now are unavoidably political.

Do we:

-smash the asset values of property owners (the top 50%) and cause some unemployment? or

-smash the $NZ and let prices rise continually (bad for everyone except the heavily indebted, especially bad for the bottom 50%)

I think they would like to do the latter, since Nat/Labour both huff the farts of the propertied with extreme vigour, but the wrinkle is that currency stability is very explicitly their mandate.

Can only talk away their primary mandate for so long, surely, before having to actually act on it. Even if all their mates do have property portfolios.

Yes agree their decisions are unavoidably political. The RBNZ's 'independence' is BS really.

We all know there's discussions and negotiation in the background.

Let the dollar crash and inflation will go through the roof. They will have to put up rates twice as much.

They took all the easy decisions…now only hard choices are left.

if you want an idea of where’s this is going look at Australia yesterday….CBA up 1.4% on fixed rates.

IMO inflation won’t be tamed until we have an increase in real rates, that is rates abover inflation, and that will cause house prices to revert to the long term mean of three times income….so about 65% to fall.

Buckle on up everyone.

Totally agree. Cheap credit caused some inflation. But the inflation caused by cheap credit is significantly overshadowed by the inflation caused by increasing energy prices, food prices, and shipping prices, which have come out of the war.

The RBNZ can hike all they want; they aren't creating any more oil or grain. My bet is the RBNZ drive the demand side of the equation down until something breaks, and then freak out and pump liquidity back into the market when a deep recession is confirmed six to twelve months from now.

A recession will come but RBNZ would destroy the NZD if they don’t keep in line with rates and chances of going back to emergency rates is zero, with inflation high the complete financial system will crash if they do anything as stupid as having low rates again. What will happen is house prices will crash and people will either stay put in negative equity for a number of years or sell at huge loss, this problem was 15 years in the making and will take 15 years to resolve. You can’t have a small 3 bedroom house on tiny section costing 12 x average wage couples annual income and think all is well.

Interest rates are not that high and its good now for buyers as they will have smaller mortgage but higher interest rate for 2 or so years. Those who purchased at high prices in last 2 years or so should have been vigilant on the interest rates where it will head in near future. I had fixed mine at 2.99% in Feb 21 for 5 years and at IO. Mortgage advisors only want you to fix for 2 years so that you will need to go back to them in 2 years time. Clever ones (very few) fixed at historical 2.99% for 5 years and will ride the market better than most.

Wow. You've fixed for 5 years at 2.99% INTEREST ONLY? Okay I assume you are investing the principal payments elsewhere to generate a guaranteed better return.

And you've factored in that once your 5 year IO period is done, you're now on principal payments for the remaining loan period which are effectively double your payments if the interest rate stays the same? I.e. 30 year mortgage, first 5 years IO, remaining P&I payments are over 25 years.

Whatever works for you I guess?

Yep bad move. The smart thing to do is smash the mortgage. Low rates were the ideal time to kill the principal. The sooner you get debt free the better and this is a highly predictable outcome it's guaranteed and just math. Any other path is pure speculation and highly based on the likes of the house price doubling in 10 years or else your screwed.

Couldnt agree more! And smashing the mortgage when rates are low reduce rate shock when higher. Am a 2019 FHBer, and I set the repayments then as though it was already 5-6%, so even though some of my cheaper stuff just rolled over with a 2.40% lift in rates, the payments didnt need to change upwards (although still increased)

I'm curious as to the logic in fixing 2.99% interest only for 5 years - that's a wasted opportunity to slam the principle.

Probably investing the savings elsewhere and will dump their returns into a lump sum payment when they come off the fix term. Maybe a believer that Bitcoin will hit $100k next year, so piling in.

I fixed mine for 5 years at the end of last year in the 3s, so, one of the few I guess. At the time everyone on here was laughing at people suggesting this because 'next year rates are going to zero'. Well I guess it worked out well for those guys, they don't seem to be around any more. I also took the opportunity to double my payments, so my mortgage should be gone after the five year term has expired. I do agree, IO was not a good plan probably, unless you are committing a significant amount into an account each month that you will then use as a lump sum payment against your mortgage when your 5 year 2.99% term expired.

Just the start of downturn once value of house decreases by 20% people will panic as deposit disappears and negative equity takes hold

Isn’t this reversion to standard long term interest rates?

Its just that its an increase on 1 in a 100 year pandemic rates.

I get the sad thing is the people who bought in to the ‘experts’ view that interest rates will be low forever.

I would say over the last 20 years or so the average rate is about 6% so if you didn't factor that in and maxed yourself out with debt it's your problem.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.