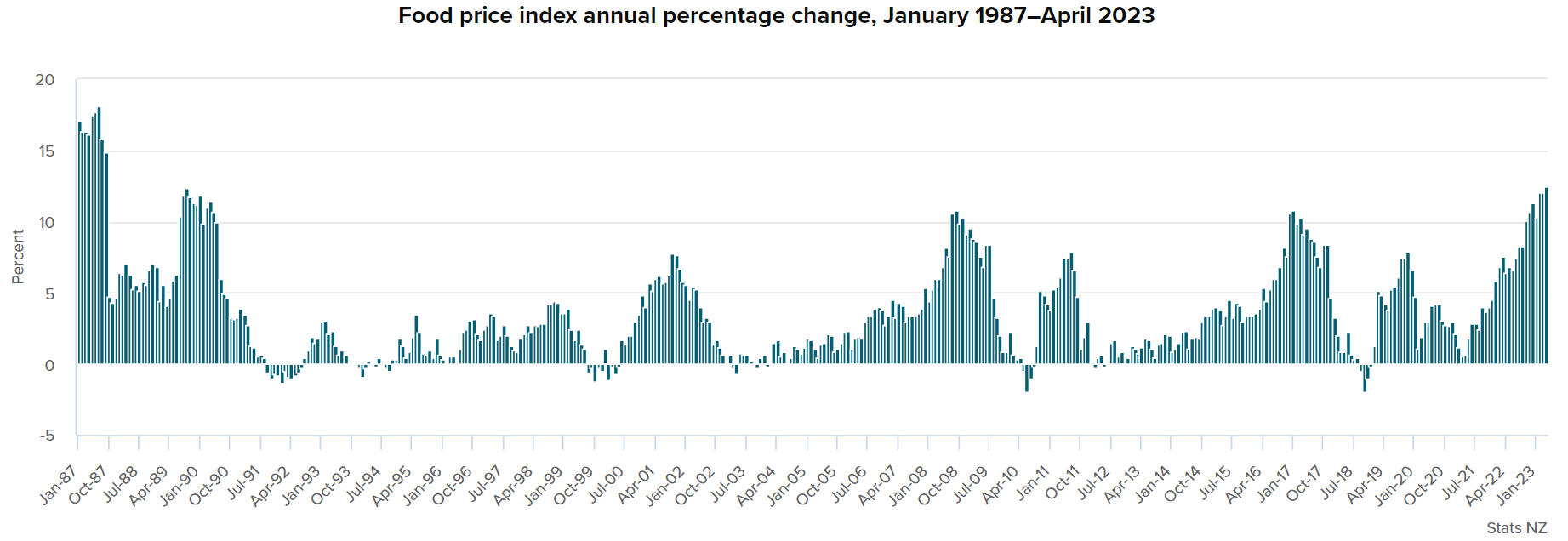

The cash crunch at the checkout is getting even worse, with food price inflation soaring to its highest level in more than 35 years.

The 12.5% food price inflation we've just experienced in the year to April is the highest level in this country since September 1987.

And the even worse news is that the rise in 1987 was heavily influenced by the introduction of 10% Goods and Services Tax in 1986.

You have to go back to late 1985 to find higher levels of food price inflation than we are currently experiencing that were not affected by GST rises.

The food prices make up a little under a fifth of the total composition of the Consumers Price Index, which measures overall inflation. Annual inflation as at the March quarter was 6.7%, down from 7.2% in the December quarter.

ASB senior economist Mark Smith said after the release of the latest food price data on Thursday that food prices were on track to "make a sizeable positive contribution" to CPI inflation in the June quarter. His estimate was "in the region of" 0.5 percentage points towards the quarterly CPI figure.

National Party finance spokesperson Nicola Willis said the cost-of-living crisis is "gate-crashing" Finance Minister Grant Robertson’s Budget (on May 18) for the second year in a row.

"Kiwi budgets are being crushed by the rising cost of everything and there’s still no sign Labour has put together a plan to fix the problem," Willis said. The Government "must prioritise tax relief" in the Budget, she said.

Household budgets had "nowhere to hide" from the widespread soaring costs, Willis said.

"In the next week, we’ll hear the same tired, old lines from Labour. Mr Robertson will desperately try to blame events overseas while doing nothing to fix the underlying drivers of inflation."

In April 2023, the annual food price increase was due to rises across all the broad food categories Stats NZ measures. Compared with April 2022:

- grocery food prices increased by 14.0%

- fruit and vegetables prices increased by 22.5%

- restaurant meals and ready-to-eat food prices increased by 9.0%

- meat, poultry, and fish prices increased by 9.5%

- non-alcoholic beverage prices increased by 8.0%.

"Increasing prices for barn or cage-raised eggs, potato chips, and 6-pack yoghurt were the largest drivers within grocery food," Stats NZ's consumer prices manager James Mitchell said. "These were the same drivers for grocery food last month."

The second-largest contributor to the annual movement was fruit and vegetables. The increase was driven by tomatoes, avocados, and potatoes.

ASB's Smith said price rises were widespread "and remained elevated". About 69% of items (73.4% of expenditure weight) rose in April.

"Plus-10% annual inflation for fruit & vegetables, grocery foods and close to 10% inflation for meat provides little cover for beleaguered consumers," he said.

"It is our hope that annual food price inflation has peaked (or is close to it) given lower global food commodity prices. However, the risk is that the current upward momentum in food prices takes longer to slow."

In terms of the monthly figures, Stats NZ said food prices rose 0.5% in April 2023 compared with March 2023.

However, after adjusting for seasonal effects, the increase was 0.8%.

Restaurant meals and ready-to-eat food increased by 1.7% and was the largest contributor to the monthly food price increase.

"Higher prices for dining out and takeaway coffee drove the increase in restaurant meals and ready-to-eat food," Mitchell said.

These were the significant movements in April 2023 compared with March 2023:

- fruit and vegetables prices fell 2.9% (down 0.5 percent after seasonal adjustment)

- meat, poultry, and fish prices rose 1.1%

- grocery food prices rose 1.0% (up 1.1% after seasonal adjustment)

- non-alcoholic beverage prices fell 1.0%

- restaurant meals and ready-to-eat food prices rose 1.7%.

130 Comments

Yep my poppadoms went up 18% recently....

What you need is an 18% rise in income. No wait... (Who still thinks 5.75% will be a terminal OCR over this tightening? Anyone?)

Smartest move I have ever made was to go rural, firewood for heating - free less chainsaw, vege patch - free less seeds and rotary how, Beef - About $900 processing fee for 200kg of meat plus young cow cost, Mutton process myself and its free as they keep breeding - less drench etc.

Pak n Save now dominates my weekly spend by a long way, hate to think if I needed to buy a lot of meat.

Living the dream! Those who know a farmer and can access a share of the homekill will be reaping the savings.

Vegetarians?

Can eat Cake!

Pretty sure it's illegal to eat vegetarians.

That's such a shame. Like other vegetarians on this planet - they probably taste damn good!

Whats really important is how do vegetarians avoid paying the far tax....?

I've had some good results collecting seeds. About 6 bok choy plants gone to seed provide a few thousand seeds.

Packs of seeds still good value, but also suffering from inflation and can be $4 plus.

Definitely think the OCR will be going higher bw. Pretty clear that monetary policy is not tight enough.

"Highest rate of annual increase since 1987" Yes and those who have been through enough rodeos (with their eyes open) will know what comes next....

"Higher rise since September 1987" and we know what happened in October 1987, don't we? A bit like October 1929.

Kiwi Bonds for one year @ 5% must be looking ever more attractive to the risk averse public with each passing day!

Except there was a bubble then.

Now if we enter a depression sure...

And the government will say, from the Ardern frown, tilt & pout playbook, yes we know it’s tough. Tough luck that is! As matter of interest, in terms of tough and lean times , who would like to estimate the difference in girth of the Minister of Finance, 2017 to present?

Briliant Fox👌 Who picked next 1/4s inflaton at 10%...

I DID,

RECESSION PENDING DEPRESION...

Thats bad as grant cannot spend any of the 1.9 bil depression cure as They are SO USELESS.

And the government will say, from the Ardern frown, tilt & pout playbook, yes we know it’s tough. Tough luck that is! As matter of interest, in terms of tough and lean times , who would like to estimate the difference in girth of the Minister of Finance, 2017 to present?

Frown, Tilt and Pout timed her exit to perfection.

And the hug. Don’t forget to hug!

Straight from the Won Key playbook!

500mm

I cannot afford popcorn anymore.

Corn Glass Gem | Vegetables |Seeds| Kings Seeds

Corn Glass Gem Seeds

NZ $3.95

Amazing rainbow coloured flintcorn with a multitude of uses. It's not sweet but can be ground for flour, popped for popcorn or hung up to dry with its husks pulled back for a beautiful dried ornamental. Each plant produces a slightly different cob to the next with no two exactly the same. Tall growing plants with multi tillers from the base so allow a good 60-90cm between plants. Expect 3-5 cobs per plant.

Hahaha best comment today!

Meh, storm in a teacup. Who really needs food?

It's all the Russian's fault you know said Grant!

Robertsons manipulation of the fiscals is very concèrning.

The covid borrowed billions is being used to rob peter to pay moana to screw john.

The 4 bilion surplus announced today is just vapes and selfies .

Robber son is currently paying of interest on borrowings @ $5billion PA.

So he is loading up your kids and grand kids debt today for decades of pain well past his future.

He is spending your kids and grand kids future ( inheritance) today while satisfying a egotistical demand to stay in power,

The covid borrowed billions is being used to rob peter to pay moana to screw john.

Some of your best work Hemi.

Surely we need a 1% OCR move up if inflation is 10% above target.

Be patient. You've already got a lift of 5%.

It takes quite a while to filter through to some (while about half remain completely unaffected). Those it is affecting - probably about 1/3 - will run out of 'savings' or credit cards soon - and then we'll see some real pain (while the other half remain completely unaffected.)

The solution is to put the minimum wage up so everyone can afford the cost increase of their food.... wait a minute

A Green/Labour/Maori Party alliance could easily come up with the solution to such radical problems... oh wait a minute, they sort of caused all this......

The solution is to put petrol up by 30 cents a litre. Good luck with taming inflation Mr Orr. 50 point rise at the next meeting?

Smart move by the government to not extend fuel excise and RUC subsidies beyond 30 June. The full impact of the phase-out will be felt in the Q3 CPI print, which won't come out until 18 October: 4 days after election day.

Robbo is looking to reprioritise those tens of millions to buy a different set of votes.

I wonder if the RBNZ would "look through" the fuel tax increase like they do for GST increases, seeing as it's a one off

Did they look through the decrease when it was first applied? I don't know the answer but they should be logically consistent about it.

Interesting to see cafes still packed out everywhere...

Yes, seeing that in my area too, and a little surprising.

1/3rd of NZ own outright 1/3rd stopped saving as the price is falling 10x faster then they can save..... its just a little treat.

People will work down through costs - restaurants spend turn to cafes. Next step is to takeouts.

Yep exactly. Small treats (a coffee and a bite) will be the last to be whacked.

Cafes are possibly doing better than ever as more people forego restaurants.

I have noticed more people pulling back on plans for international travel, home renovation, new car, etc. and go for small-ticket items instead. Better we spend more on local cafes in these tough times than splurge big on a trip to Bali or a Japanese import.

Went to a restaurant recently that has just changed hands, most mains ~$45, and I'm not in Auckland or Wellington.

Not going back any time soon, I understand they have higher costs but...............

Old whites balancing the economy

Did you mean flat whites?

How is working from home affecting cafes, especially outside CBD areas? I know folk who work from home, use cafes to hold meetings (involving 1-2 others) in, rather than invite people to their home or make a trip (which for some can be a reasonable commute) to the office to have it. Also see more people using laptops while in cafes. What some folks would be saving on commuting costs, can buy a few 'coffee and cake' sessions in a cafe.

You've been casually observing us.

Doesn't surprise me if I consider my own (and my family's) spending habits at the moment.

Those truly on the bones of their arses with nothing spare in the weekly budget have probably been shut out of life's little luxuries for a while. It's honestly sad going to Pak N Save and watching struggling mum and dad have to put something back on the shelf in front of the kids, I hate it.

However, there are still plenty of people out there with varying degrees of "spare" money each week but with food prices rising, our mortgage payments going up and other expenses climbing like insurance premium increases still have some spare at the end of the week - just less than before.

What this means for the dumbthoughts family (and I suspect many of the others crowding out cafes and restaurants) is that this year we have put on ice plans to upgrade the tired old couch, and get a new TV, and most notably we were going to get a new family wagon but have instead opted to stretch out another year at least on the venerable 2.5L Outback.

I'm biking and walking to client meetings more, my wife does the shopping at Pak N Save instead of Countdown Online and for "date night" money we now have a set amount of cash withdrawn each week. But as long as there is some cash in the pot we can afford to go out for a coffee and slice each, or go out for dinner once or twice a month.

Although little luxuries in cafes and restaurants add up, it's less of a hit and more affordable than buying a new TV or splashing on a new car. So we continue while we can.

This is before you consider there are plenty of truly rich people out there for whom grocery bills are neither here nor there, and perhaps some of the boomers now have enough interest on their TDs to give extra spending money.

It's honestly sad going to Pak N Save and watching struggling mum and dad have to put something back on the shelf in front of the kids, I hate it.

Well said. This is not how NZ should be.

Many put stuff back from the trolley while raising kids, particularly as we adjusted from two income and no kids to one income and kids..and more kids.

And the generation before went to war, many didn't come back.

I would never argue it has not got harder, however there is misguided belief that past generations drifted through life without any sacrifice/hardships at all.

The last 75 years has ben an aberration. Reality check time.

Very true, I guess being fairly young myself this is the first time I can recall so distinctly seeing this type of behaviour on a frequent basis when doing the weekly shop (I was high school age when the GFC hit, so the only price I was sensitive to was Double Brown cans). Honestly, and as lame as it sounds, it's rather confronting when you haven't seen it in person before.

Yeh but now I only buy a couple of coffees and pass on the cooked breakfast. Every time we go into the local café the food prices had gone up. How many other people are doing the same ?

It's not covid.

It's not Ukraine.

It's not supply chains.

It's not greedy capitalists.

More money. Chasing fewer goods. Causes prices to increase.

It's the printer, stupid.

Whats really interesting is broad money is only up 2.27% y/y. So it looks like the RBNZ either advertently or inadvertently is attempting to drive down inflation by slowing the growth of broad money. Doesn't seam to be working though.

Yes, but much higher on average since 2008. I think it was 6% year on year before LSAP but would have to check .

Those chickens have come home to roost.

And yet the big companies (owned by greedy capitalists) continue to make record profits.

Commerical/business income/profit tax payments to the govt increased by 25% last year. Simply put companies have simply put up prices to increase profits.

What about the biggest shrinkflation we've seen in the history of this country? We've seen a big fall in quality of public service despite the Crown raking in tens of billions more each year owing to:

- bumper corporate profits at the expense of consumers

- high inflation pushing up income taxes and GST

- bracket creep

- 2.5% jump in filled jobs in the last year (more wage earners overall), thanks largely to high net migration

Robbo still has the gall to ask middle-earners and small businesses to not expect much from the upcoming Budget.

Profits measured in the same dollars we measure food prices, which is being inflated at record rates.

Finally a commenter who understands the reason for high inflation.

Thank you.

Nothing to do with the wage increase's I guess...as producers, supply chains, just absorb costs and don't pass them on do they.

Nine percent of NZ workers are on the minimum wage. Maybe you should look for something else to blame.

??? wage increase inflation is passed through the economy through goods and services. So when you have food price inflation a part of it has to do with those increase's been recovered throughout the supply chain.

Except when that 9% get a 7% wage increase then everyone just above them wants a pay rise too because they've been working for years so why should they suddenly now be minimum wage workers, so they get a 7% bump (or 10% if they are on the Living Wage), then everyone above them wants a pay rise too because they have more skills and experience so why should they be paid like a junior employee, so they get a 7% increase. All just to maintain parity between workers pay bands. Its never just the bottom 9% who get a pay rise and nobody else. That's why NZ is one of the few countries experiencing wage inflation - something that is not happening in Australia or the US.

Since Labour took over in 2017 the minimum wage has been increased 44%. Over the same period minimum wages in Australia increased 17%.

The consumer depression is almost upon us. The only living that know what comes next are the silent generation. If you haven't already start preparing for the deflationary bust of the 21st century....first sign it arrives is the implosion of the 1.4 quadrillion credit derivative markets.

The 3 B's portfolio:

Bullion, Bullets, Bitcoin. Appropriately allocated.

Please add Beef

The 4 B's portfolio:

Bullion, Bullets, Bitcoin, Beef. Appropriately allocated.

Beans

Balls

LOL!

Beer before Beef

It will only take one of the systematically important big books to fail, and the counterparty risk will make them fall like dominoes.... after that there will be no market to offset risk, so credit will sieze. the flights to safety USD and treasuries and gov debt will print negitive again.... and it will all occur over a 1-2 week period...

This. The size of the amount of money about to be printed is beyond peoples wildest imaginations.

Forecasts for the next OCR rise and new peak level anyone?

50 pts and 6.25%

I recently said a peak of 6%, will stick with that for now.

And I will stick with 3 x 25 BPs

You also said ocr would peak at 1.75%. And inflation would be 4% now.

It was an absolute clanger for sure.

Who hasn’t committed a clanger or two.

most of my calls have been on the money.

cue a nasty old man to have another go at me

No need to drop your bottom lip. For what it's worth I still read your posts because you sometimes have some good anecdotes of what is going on in property construction. But I admit it's triggering me when you daily post an "I told you so" when your hundreds of predictions are no more accurate than TA who you regularly bag.

The more predictions you make the more chance that one will be right.

“When the facts change, I change my mind - what do you do, sir?”

― John Maynard Keynes

0.25% and then pause so they can watch the destruction they've wrought! It's going to be a horrible winter.

50 points with a terminal rate somewhere in the '7's. As I have said on here before, central banks always underestimate the extent to which interest rates need to rise.

0.25 and 5.5 IF Federal Reserve stick.

Watch for these prices to go highr

Power prices

Lpg

Fuel

Phone

Electronics

Whiteware

Water

Rates

1929 here wecome!

THANKS Jacinda, Winston, Orr, and Grunt

Pity we sold or generation, phone companies, refining, manufacturing etc.

If simply importing parts from overseas and assembling them here counts as manufacturing, my son runs a factory in our lounge manufacturing Lego models.

Pity we shifted further away from knowledge (education, training, R&D spending, etc.) and towards selling stuff to one another (migration, housing, inward-focused businesses, etc.). High non-tradable inflation, huge current account deficits, chronic skill gaps, crumbling infrastructure, overdependence on foreign capital and labour, low wages - are all symptoms caused by this shift.

my son runs a factory in our lounge manufacturing Lego models

With that sort of spin, you should be in government...or are you already? XD

I just take my learnings from reading the occasional government report. MBIE spent millions on a plan for NZ's "advanced manufacturing" only to open it with the statement:

The term “Advanced Manufacturing” is used in the ITP to cover all manufacturing in Aotearoa New Zealand.

The term “advanced” refers to the use of modern technologies, processes and business practices in the manufacturing process rather than whether the final products are high-tech. This Advanced Manufacturing ITP therefore covers the making of products as diverse as computer chips and branded chocolate.

Can't believe literally thousands in the public sector earn their living by coming up with these brainfarts!

Well, what do you expect when building Viking longhouses last seen in Europe circa 800 AD is considered "revolutionary" in NZ. https://www.newshub.co.nz/home/new-zealand/2023/04/architectural-experi…

No, not really a pity, but a clear symptom of trying to operate with champagne tastes on a beer income.

The road downhill was gradual and not obvious to all, but climbing out of debt will be much harder

I think we will need to admit that recovery will not mean that we will ever again be able to foot it with Aussy, Canada, etc.. Perhaps the first signs of recovery, after some years, will be a rising standard of education; rising productivity, and gradual return to balanced trade with the world.

Some things will not be obvious as we try to find our feet again. For example, as the late Sir Paul Callaghan said,..."if we want to be poor, promote tourism".

Our real strength is abundant water to grow grass, trees, and produce electricity. Just that it needs to be used smarter and not rely on immigration to do the hard work.

Power companies still 51% owned by the Crown and still institute above inflation increases

Ditto rates

Watch for these prices to go lower:

Stocks

Houses

Bonds

Instant noodles gone up from $0.50 to $1.00.

We battlin out here.

Find a Chinese operated supermarket.

Have't got one near me 🤷

Multi pack gone from $5 to $9 even in the Asian supermarkets.

I love instant Korean noodles

Pak n Save is the best place for Korean instant noodles as they are often on special and much cheaper than the asian supermarkets (e.g. shin ramyeon $6.50 for a 5 pack).

Those shin ramyeon noodles are the shiznit. Chuck a bit of coconut milk in with a bit of chicken and veges to make a laksa was my go to student meal.

🤣🤣🤣🤣🤣🤣🤣😭😭😭😭🤣🤣 feaken classic bravo man!

This sort of fits what we saw in the last round of CPI data. Non-tradable inflation remained high, tradable inflation declined offsetting that.

"Increasing prices for barn or cage-raised eggs, potato chips, and six-pack yoghurt were the largest drivers within grocery food, which were the same drivers for grocery prices last month" : eat less chips

Funny. I could have sworn the RBNZ said that by hammering the young with mortgages we'd see inflation come down quickly ... Do they not know that price setters selling price-inelastic goods don't have mortgages?

Let them eat Cake!

Banana cake? Rice cake? Cheese cake? Carrot cake? Kiwifruit topping?

Flour had no change. Butter down. Banana's down. Rice down. Cheese down. Carrots down (seasonal). Kiwifruit down big time (seasonal).

You might be onto something there, IT Guy. ;-)

Potatoes $40.00 for 10kg's at New World

$11.00 for 10Kg's at producers road side stall

Who is rorting who

Yes, tax cuts. The perfect cure for rampant inflation.

Oddly - in some instances - tax cuts can have very little effect on inflation.

For example, giving tax cuts to the top 5% would have very little effect. ;-)

I know, right? Hopeless on both sides.

The reserve bank used to look through one off events that caused inflation. If this is the result of bad weather, flooding, and no longer treating chickens like shit, should they look through it?

Interesting that rates of increases have been falling since Jan '23.

And yet it's all about the annual rate?

Edited: Just analysing the actual numbers using Stat's spreadsheet. Not all as it seem. A tad better maybe. https://www.stats.govt.nz/information-releases/food-price-index-april-2…

The high prices of good means there is still plenty of spare money with the households and they can spend large?

Because unless people have money to pay for it, the prices won't remain high unless no one can afford it. So guys there is no shortage of affordability.

Sorry, that logic, in this context, is primary school level economics.

Here's a starter to help explain what I'm saying: https://www.investopedia.com/terms/p/priceelasticity.asp

And a bit more advanced but with lots of links to reference material: https://en.wikipedia.org/wiki/Price_elasticity_of_demand

Focus the word inelastic.

It's time for the IRD to earn their money. The supermarkets and their owners need some comprehensive auditing. Maybe they are paying the correct tax. But we will find out exactly where all the money is coming from and going to.

Not just supermarkets!

Also can someone explain to me why the 1kg block of Pams cheese is $10 in the North Island and $13 in the South Island.

I will not stand for it, the people deserve answers.

Must be $3 of fuel to get it down there.

That is common sense and I reject that. I demand blood on the streets and heads to roll.

And the three months of refridgerated container storage before it could get a Cook Strait ferry booking.

Because you cheese is made by two slow old geezers who sit by a river all day and gossip.

Up in the Nth we use fast working freshly imported young things who will work for 80 hours and get paid for 23.

Are liquor store workers now making the cheese as well?

That would be Terry and Kevin and I will not be hearing any slander about them.

Look at that graph. Looks cyclical, some sort of seasonality with it. But it seems to cover long periods of rises then nothing for a while. Maybe a series of growing seasons?

I do not believe that the inflationary food prices are necessary. This is the choice of Foodstuffs and Woolworths who own the supermarkets. Where is the call from the RBNZ and/or the government for the supermarkets to earn their social licence by supporting EVERY kiwi through the cost of living crisis. Stop picking on the banks. Food is a necessity. It is a disgusting duopoly that the government has essentially chosen to ignore despite wasting millions of dollars with a commerce commission investigation. An uprising is coming for sure if this is allowed to continue.

Maybe not just them. Have a look at the suppliers of FS and CD. Many are internationally owned. You'll be surprised at who owns some of the innocuous brands in NZ.

(I was studying the make up of the companies on the NZSE many years ago and noticed there were few food companies, with some recently de-listed. Did some digging into ownership. At the time I concluded it wouldn't end well to have so many food production sources owned by overseas companies - often massive private ones - who don't give a rat's rear end about anything except profits. Was I right?)

"Vegetable oil prices have halved. Cereal prices are Down 20%. Dairy similar. Sugar is one of the few food ingredients that is up (and Ukraine/Russia are not even major producers), but meat is down.

At the same time, international shipping rates have plummeted. The Baltic Dry Index is about 75% lower than its peak in 2022."

That's internationally. So why are food prices up?

Too much rain? But also if you raise minimum wages that will flow through in terms of distribution and packaging costs.

Wage-price inflationary spiral...

Fast track a Costco into ChCh and Wellington, break up the supermarket rort AND offer Aldi tax credits to open up shop. Prices would plummet.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.