New debt-to-income ratio (DTI) figures released by the Reserve Bank (RBNZ) are showing clearly what the RBNZ has already said - the pending introduction of DTI restrictions by our central bank will make no difference whatsoever to people's ability to borrow - at least initially.

That's because the numbers of people borrowing on high DTIs have dropped to levels well below the proposed new limits. High interest rates are 'doing the job' of controlling high borrowing levels.

This RBNZ data series has tended to focus on DTI ratios of over five - that's people borrowing over five times their annual incomes. These are regarded as relatively high ratios and ones for the central bank to keep an eye on.

Well, as the RBNZ's summary of the latest data covering the three months to December 2023 says, in this period less than a third of new mortgage commitments had a DTI of over five, which is the lowest share since the data collection began in 2017.

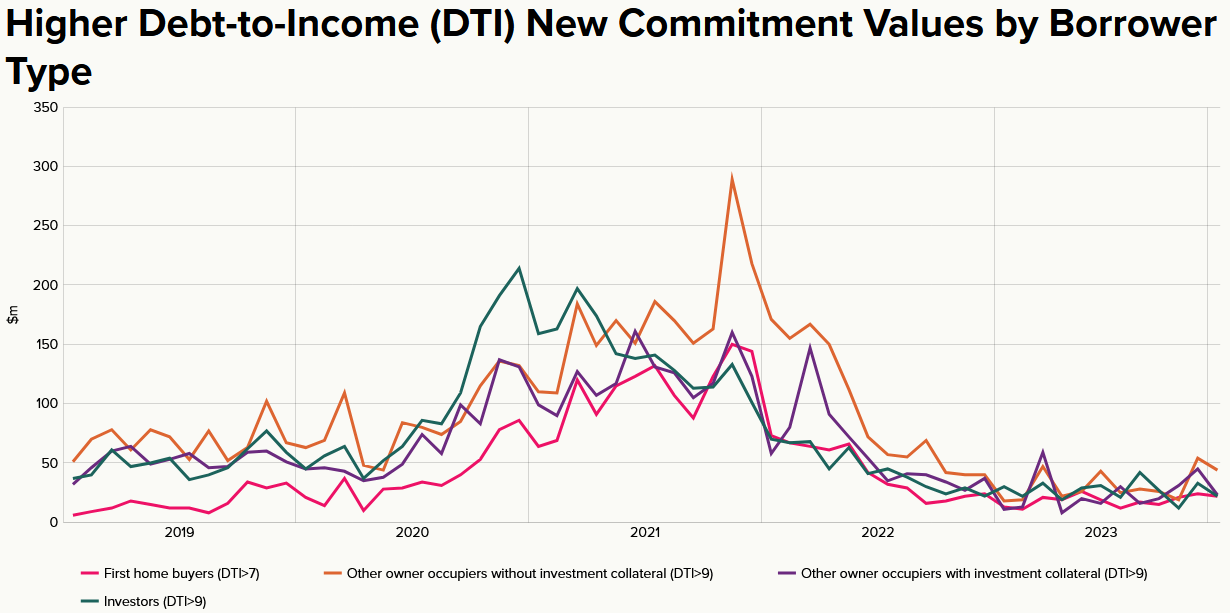

Since absolutely soaring to highs in the 2020-21 period, the high DTI figures have been markedly dropping. Interestingly, though, it looks as though we've now seen the 'bottom' of the market. While the high DTI figures for the first home buyers (FHBs) have kept coming down in the latest quarter, those for other owner-occupiers and investors have just crept up a little.

So, some context.

We are now about to get official limits on how much can be borrowed at high DTIs.

As we know after a build-up not exactly bigger than Ben-Hur, but certainly even longer, the RBNZ announced last month it is consulting on proposals for DTI limits with plans to implement them around the middle of this year. The RBNZ has wanted a DTI measure in its macro-prudential toolkit since at least 2016. Now it is finally getting it, but as the RBNZ concedes itself at a time when the limits won't be 'binding'.

To refresh memories, the RBNZ proposes initially setting the DTI policy to allow banks to lend:

- 20% of their residential loans to owner-occupiers with a DTI greater than 6; and

- 20% of their residential loans to investors with a DTI greater than 7.

These percentages refer to new lending, not the total bank lending book.

They also announced they are proposing easing the loan to value ratio (LVR) settings at the same time as activating DTIs. The RBNZ proposes easing LVRs to allow:

- 20% of owner-occupier lending to borrowers with an LVR greater than 80%; and

- 5% of investor lending to borrowers with an LVR greater than 70%.

Of course, the RBNZ's intent is getting these DTI measures stashed in its 'macro-prudential toolkit' and ready to have an impact when the housing market heats again. They might not be binding now - but they will be be binding at some point, be sure of it.

To that end it is informative to have a quick look at how the proposed DTI limits, and the levels they will initially be set at, would have shaped up against borrowing trends when the market was super-hot in the 2020-21 period.

If we look at the December 2021 DTI figures, when the housing market had just gone past its peak, we can see that if the proposed DTI measures had been in place they very much WOULD have been having an impact.

Remember, the RBNZ's proposing limiting banks to just 20% of residential loans to owner-occupiers (including FHBs) with DTIs in excess of 6, while for investors (which I am assuming includes those in the category of 'owner-occupiers with investment collateral') the banks will be limited to just 20% of residential loans to investors with DTIs in excess of seven.

As per the RBNZ's data for December 2021 this shows that among FHBs over 26% had DTIs in excess of 6 at that time, while for owner-occupiers without investment collateral, over 28% had DTIs of in excess of 6.

With regard to investors, as at December 2021, 34% of owner-occupiers with investment collateral had DTIs in excess of seven, while for investors, this figure was 35.5%.

The upshot is that the proposed RBNZ DTI limits very much would have required the banks to trim back lending to all categories of borrower as of December 2021 in order to get under that 20% limit figure.

But as of now, with the much lower DTIs being seen generally, those limits will not be even close to being tested. And this is the RBNZ's intention, to introduce those limits at a time when they won't be binding, but have them available when the market heats again.

So what then of the RBNZ's latest quarterly set of DTI figures - information it has been compiling since 2017?

We've been following these from the start and compiling our own tables, looking specifically at for FHBs and other owner occupiers, borrowing at DTIs of over five, while we've been looking at investors with DTIs of over seven.

Fortuitously for us, of course the RBNZ's actually targeting DTIs of over seven for investors, but for the FHBs and other owner-occupiers the official target is going to be a DTI of over six.

Okay, for old time's sake here's an updated version of our FHB/other owner-occupier table showing the latest figures for ratios of of over five.

As we've done since the start of this data series we are comparing the latest month's figures (December 2023) with the last month from the previous release (September 2023) and we are also comparing both these with December 2022 and December 2021.

The table below shows the percentage of new mortgage money for first home buyers and other owner-occupiers that is on debt-to-income ratios of over five times:

| Group | Dec 23 | Sep 23 | Dec 22 | Dec 21 |

|---|---|---|---|---|

| FHBs nationwide | 23.9% | 29.6% | 35.2% | 58.3% |

| Auck FHBs | 34.1% | 44.1% | 49.6% | 72.9% |

| Non-Auck FHBs | 15.9% | 17.4% | 23.8% | 46.6% |

| Other owner/occ nationwide | 20.9% | 19.7% | 26.5% | 48.5% |

| Auck other owner/occ | 30.4% | 27.9% | 37.3% | 62.2% |

| Non-Auck other owner/occ | 14.0% | 13.5% | 18.6% | 38.1% |

Please note that our calculations here exclude the (small) amount where the DTI size is unknown.

Well, okay, that's DTIs of over five.

But of course, as we now know, the FHBs and other owner-occupiers are going to be controlled on the basis of DTIs of over six. The banks won't be able to lend any more than 20% of new mortgage money for owner-occupiers at DTIs over six.

So, on this basis, how are we looking based on current trends as at December 2023? Well, no sweat. No worry. If you can service the debt at all (surely the bigger worry at the moment) you can get the loan. No worry about being cut off by that 20% bank limit. Not even close.

The table below shows the percentage of new mortgage money for first home buyers and other owner-occupiers that is on debt-to-income ratios of over six times:

| Group | Dec 23 | Sep 23 | Dec 22 | Dec 21 |

|---|---|---|---|---|

| FHBs nationwide | 6.1% | 6.2% | 10.6% | 26.2% |

| Auck FHBs | 9.6% | 11.0% | 17.1% | 40.1% |

| Non-Auck FHBs | 3.3% | 2.1% | 5.3% | 15.0% |

| Other owner/occ nationwide | 7.8% | 6.2% | 9.8% | 28.2% |

| Auck other owner/occ | 11.0% | 8.3% | 14.2% | 39.7% |

| Non-Auck other owner/occ | 5.4% | 4.7% | 6.6% | 19.5% |

As you can see, even in the world of expensive taste in Auckland, things are looking fine and dandy, with the other owner occupiers on DTIs of over six making up just 11% - well below the 20% limit - as of December.

So, that's the FHBs and the owner-occupiers. Our second table that as explained above we've been running for a while - but which now takes on greater relevance given that we've accidentally picked the 'right' DTI number of seven - looks at the investor and those owner-occupiers with investment collateral with debt-to-income ratios of over SEVEN times. Again our calculations exclude the (small) amount of mortgage money where the DTI size is not known.

The next table shows the percentage of new mortgage money for both investors and owner occupiers that have investment collateral that is on debt-to-income ratios over seven times:

| Group | Dec 23 | Sep 23 | Dec 22 | Dec 21 |

|---|---|---|---|---|

| Investors nationwide | 5.9% | 7.6% | 11.7% | 35.5% |

| Auck investors | 9.5% | 10.0% | 16.4% | 45.2% |

| Non-Auck investors | 2.5% | 5.1% | 6.7% | 26.2% |

| Owner/occ + investment collateral nationwide | 8.1% | 6.0% | 8.3% | 34.0% |

| Auck owner/occ + investment collateral | 9.2% | 5.0% | 6.8% | 43.4% |

| Non-Auck owner/occ + investment collateral | 7.3% | 6.6% | 9.6% | 26.4% |

So, again, no sweat at the moment. But as you can see, looking at the far right numbers in all of the three tables - you only need to look back to December 2021 to see a time when the new DTI rules would have very much come into play.

With the apparent 'bottom' of the market now having been reached (note that some figures in the December columns are higher than those for September 2023) it will be interesting to see what happens in coming months as we do get toward introduction of the new limits.

47 Comments

Bank wouldn't budge our max lending above about 4.3 DTI the other week for a idea how FHBs might be fairing in the current environment.

Do you know what stress test rate they were using?

Hearing 9% at the moment - not sure if low 9's or mid to high 9's.

we were tested at 9.5% in April 2023

9% was what the broker said. They were 8.75% in November and then pushed up a little in January

Banks have demonstrated they were woefully incompetent at setting benchmark rates. A whole load of borrowers already well outside these parameters in such a short space of time. Oh well, why not just let the borrower decide how much they can afford to borrow, you'd be a proponent for that aye ;).

"During 2021, major banks tested new borrowers' ability to service mortgages at interest rates of 5.5% to 6.5%. These test rates are used to assess customers' maximum borrowing capacity, and most will borrow less than the maximum.

www.interest.co.nz/personal-finance/120682/big-banks-mortgage-serviceab…

Is it just a bank's new lending in a period that has to meet the proposed new DTI limits?

Or do the percentage limits apply to a bank's total loan book?

New lending.

I don't believe that is correct. The DTI limits will apply to each bank's overall book and any above the limits will need to fit within the speed limits. It is the new LVR threshold that applies to new lending.

It’s new lending - have a read of BS20

The speed limits are typically measured over 3 months for big banks and over 6 months for small banks.

If you read the consultation document you can see the RBNZ are also proposing a 6 month period for the bigs banks initially too

Thanks for the article. I think impact of the DTIs on FHB has been overhyped for reasons you outline. They would have more impact when mortgage rates are very low ( less than 3%) but not sure if we will get back to that scenario anytime soon…

Was talking to a mate who, like me, lives in a reasonably large terraced housing development that is about 4 years old. We have both noticed a sudden bounce in listings where we live, which we both anecdotally understand to be largely about stressed owner occupiers looking to exit. To be clear, not mortgagee sales but owners who just can’t live with the financial stress at higher mortgage rates.

Although I think house prices will probably be flat this year, I am starting to get a feeling that IT Guy’s 10% decline prediction is a real possibility. Although I would say 5% is more plausible, simply because of the relative ‘stickiness’ of house price declines.

"We have both noticed a sudden bounce in listings where we live"

Just out of interest, which suburb is that?

I noticed a lot going on the market near us a few months back, but no more since and they all have sold signs now. Anecdotes can be dangerous!

Actually one hasn’t sold and that is a terrace (the rest were stand alone). Maybe too much supply of terrace at the moment (at current prices).

One that sold really quickly was a good development opportunity (800m2 corner site with crap house). So developers must still be around.

Anecdotes can be dangerous but also very useful.

Anecdotally, I heard around the watercooler was that 2 out of 5 guys have warts, they also watch a lot of YouTube videos, it's possible that there could be a link!

Another anecdote: around my brothers place there are a bunch of rural lifestyle blocks all ip for sale with large 5-6bdrm homes and large sections. All appear to be boomers downsizing due to inability to manage the maintenance etc or looking to downsize and live closer to amenities. I see pressure on more central housing coming from these types which i’d imagine is a national trend

"I see pressure on more central housing coming from these types which i’d imagine is a national trend"

Just trying to understand you. Can you clarify further?

1) do you mean more buyers of central housing due to boomer demand - so shortage of supply of these types of housing?

2) are you referring to house price pressure due to boomer demand?

3) are you referring to downward pressure on house prices in centrally located areas? as boomers move out of the inner city to the suburbs, retirement villages, etc?

A:

1./ I am seeing and predicting an increase in demand for more central city and town properties by baby boomers downsizing to smaller 2-3bdrm properties to live closer to services and healthcare. Supply is dependent on location and demographic spread per region so difficult to gague.

2./ I've not noticed any price pressure locally due to this demand, however it would be interesting to track this.

3./ Local trend in my area tends to be still subtle downward pressure from interest rates, however low maintenance properties (less green, more concrete) still tend to sell ok. While some choose to move into retirement villages early, many simply will downsize to smaller properties. This trend was what I initially picked up when looking at housing 2022-2023 and got chatting to folk at open homes. Also speaking to family friends in the baby boomer age group the downsizing mentality as a preference to retirement villages was common.

Ironic that you use the term boomer as the boomers are not the major investors in most areas. Older & younger sure, but that generation still has little of the market overall especially when compared to overseas investment. Or are we still trying to pretend there are no property sales to investors who reside overseas or recently visited on visa these days. Mind you I know so many who have their hole in the Cayman's still it is no surprise. A couple gens and NZ housing is pretty much out of reach for many at median or below wages. Yes we did it to ourselves but we also let them get away with a fire sale of bumper boosts to the market during covid; while the line of govt being responsible no matter the colour is still going strong.

It's not such a big deal, maximum house prices will drop 20-30%

hahahaha

I doubt they’ll drop more than 100%.

I am struggling to see who will be constrained with the proposed settings? I can only assume its a Trojan Horse. Get the policy over the line at an innocuous setting and then crank it up.

As I say further up, it’s only really a constraint if mortgage rates go super low again. Mortgage rates are by far the bigger constraint.

RBNZ were pretty open about this. Not many affected at this point, it only really has an impact if interest rates fall significantly when it acts as a ceiling on lending. Would have acted strongly to stop that ridiculous Covid pop in prices, promoting financial stability.

I'd like to see lower limits, especially for investors, but it's a start.

It makes a lot more sense in context of the link to RBNZ stats at the start of the article: https://www.rbnz.govt.nz/statistics/series/lending-and-monetary/residen…

Look through figures between 2020 and 2021...

Personally I think we are entering phase 3 in the economy. 1) Inflation kicks in. Everyone is affected a little. 2) Interest Rates go up to tackle inflation. Some with a mortgage are impacted a lot. 3) Organisations with reduced demand reduce staff levels affecting a few significantly. In the last 2 months I know of a number of people including myself and others outside of the organisation I work for being made redundant. What value is DTI ratios on these people if they cant get a job paying the same or more than previously? I think DTI ratios is over considered. They should be asking 1) Are you neutered (VAS, Tubes tied). Often a young couple on double income no kids can buy a house based on DTI. They move in and want to start a family (one income increased costs etc). What's you parents financial situation and are they likely to bail you out if you hit financial hardship? Have you in the last 15 years borrowed money for a car? Don't ever believe banks are concerned about your situation. They will lend you an umbrella only to take it away when it is raining

DTI also assumes your costs are a fixed percentage of income but they aren't. We currently nail our mortgage paying in 65% of our after tax income each month, we can afford to as we have a good income. Someone on a much lower income will have similar costs, so how could they possibly afford to pay the same percentage of their income as us?

You could probably be paying even more, was paying much more than that on a single income low wage to the amount left over was hopeless but most people don't want to push it, not much fun for 10 years. You probably have more left over on the 35% than I was earning total.

Sorry to hear you lost your job Lime, I hope you will find ways to earn money soon. Indeed I have long stated that higher interest rates will hurt many "common folks" who don't have a mortgage, yet some only see the effect on house prices.

Thanks Yvil. For me I'm thankful that the company I work for (until April) have taken this action and given us notice. I suspect there will over the next 12months be a number of companies where workers rock on up to work one day and the gates are locked and a guy with a clipboard telling staff to go home and they will be in touch if they get their last pay, holiday pay, tools etc. It almost happened to me in 2008. I know of one person I worked with that lost 40k in wages, holiday pay, expenses and tools. A number of good people I work with are rightly concerned about their financial future. Adversity can build resilience and character. That maybe the best thing to come of this situation

Well said, I join Yvil in wishing you the best for your next steps.

Having recently been through a version of this process I know it can be an anxious time but I was very happily surprised by the support of my network and hope the same for you.

Sent ANZ bankmail this morning asking what my max weekly repayments would be without incurring any penalties.

In the past, increases that I have initiated had all been requested and actioned all via bankmail.

Today however, I'm now required to ring up and speak with one of their "Home Loan Coaches" before increasing payments ffs!

Never made me speak to a home loan coach when dishing out a mortgage...

Interesting. Let us know the outcome.

My cynical side can see lots of shennanigans going on here.

100% they're trying to talk people out of increasing mortgage payments so to keep creaming that sweet interest.

My response:

"Why do I need to speak with a so-called "home loan coach" to increase payments? In the past this has never been required and payment increases were requested and actioned via bankmail, what's changed?"

Yet to receive a reply...

ANZ reply:

"Due to a change in legislation we are required to arrange your request over the phone. We need to provide disclosures, outline loan changes for you to accept on the phone and then complete the repayment change."

You can do it on the app with ASB, up to $500 a fortnight increase.

Frustrating that you can only increase it for length of term. You cant pull it back down should you suddenly need to.

Savings account on the side and then lumpsum it. ASB let's you hit your mortgage with 10k lump sums. Note once you do so you cannot pull it back out. Alternatively have an overdraft type loan. In and out as you want.

Sounds like the Bank's want a Bob each way. Don't want to lend to risky borrower but ,also don't want good lenders to reduce their indebtedness too quickly

Would be good to get to speak to a loan coach when the customer wants too and not when the Bank's are managing their profits

Looking forward ...

Lets say in a few years retail mortgage rates are down to averages seen over the previous 10 years, say 5%. The RBNZ ratchets up DTIs to constrain lending on houses.

If that leaves banks with lots of spare cash to lend - where will it lent?

Businesses? That'd be a very good thing in NZ's seriously unproductive landscape.

But it could be lent to support another bubble over which the RBNZ has zero control. Shares maybe? Lots on NZ IPOs?

The table showing the percentage of new mortgage money for both investors and owner occupiers that have investment collateral that is on debt-to-income ratios over seven times has data points that are useful.

I think DTI ratios are unnecessary as we already have the new credit contracts act imposed in 2019, LVR ratios, high stress tests, strict lending criteria so seems like redundant and duplicating red tape.

We had all of those when the market went insane during COVID, so it's quite clear our current settings are insufficient. DTI is the missing piece that would have damped down that frenzy.

Standard RBNZ, too little and too late

Would have been far better in 2019 than today, but better to do it now than after the next crisis.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.