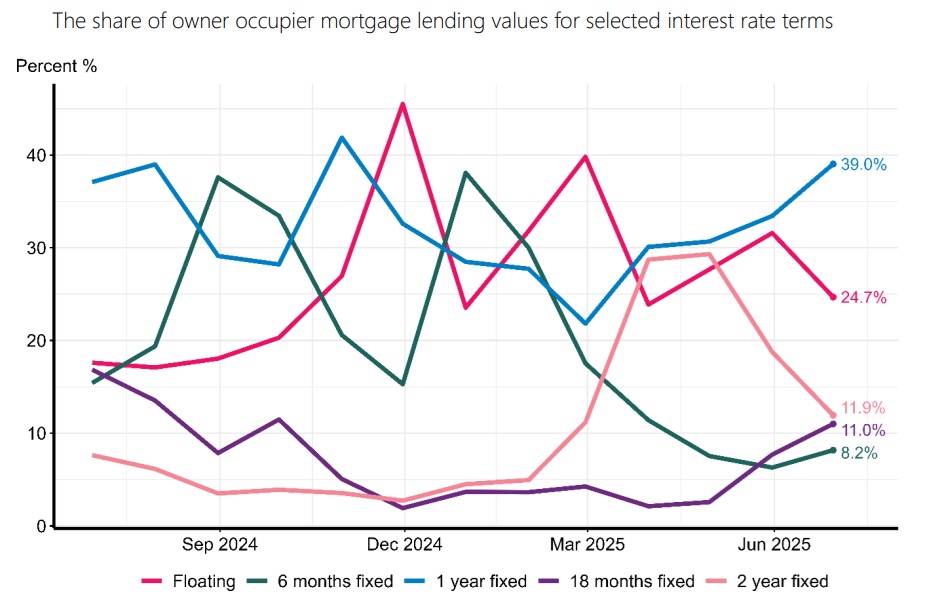

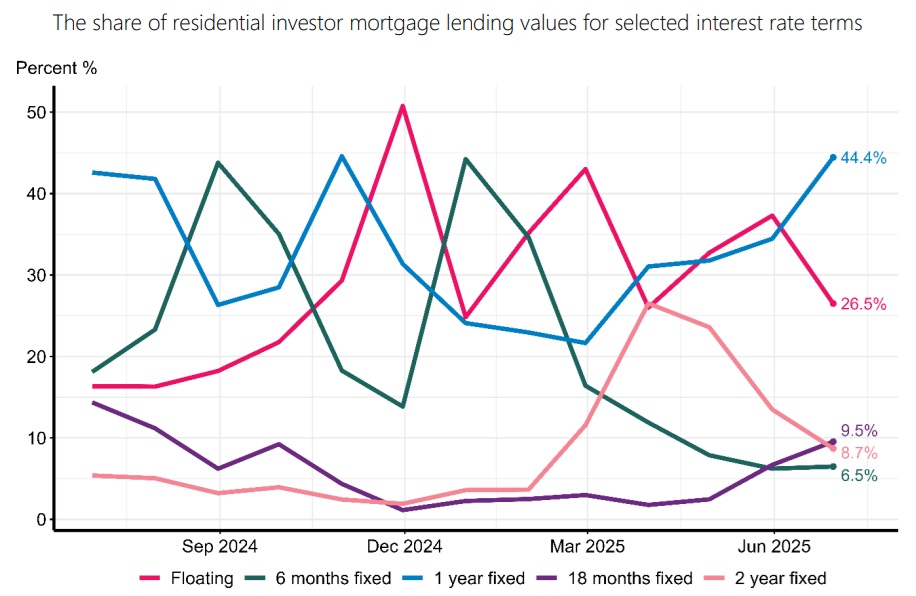

They were long, then they went short, then they went REAL short, and now they've gone longer - but not much longer.

The latest Reserve Bank (RBNZ) new lending fully secured by residential mortgage figures that highlight what terms new mortgage holders are taking their mortgages out for, show that in June the most popular choice by some distance was the one-year fixed terms.

This was particularly true for investors, with 44.4% of the $2.405 billion they took out in June being for one-year terms. In May, the most popular choice for the investors had actually been floating rate mortgages. (The RBNZ's summary of the latest data is here.)

It's significant that there was a cut to the Official Cash Rate (from 3.5% to 3.25%) made in late May and this was sufficient to convince customers to go 'longer'.

But the fact that one-year rather than traditionally popular two-year fixed terms are very much 'the go' at the moment suggests that people still see, or are holding out for, the OCR to go somewhat lower than it already is.

Remember, this particular data set, unlike other monthly mortgage data series from the RBNZ, shows mortgages as they are uplifted rather than when they are committed to.

For owner occupiers, of the $6.136 billion they took out in June, some $2.395 billion (39%) was for one-year fixed terms.

As was the case with the investors, floating was much less popular in June, although 24.7% of owner-occupier new mortgage money was put on floating in June (from 31.6%), while for investors the figure on floating in June was 26.5%, down from 37.3% in May.

If we recall, the country's home owners started to move very strongly to short term mortgages from the start of last year in anticipation of OCR cuts by the RBNZ.

These cuts duly started arriving in August 2024 and have continued, with the OCR falling in that time from 5.5% to the current 3.25% and with another cut expected (to 3.00%) on August 20.

Those taking out mortgages appear to have been keen to push the envelope out by waiting on short terms, or even floating, to see how low the OCR will go.

That's still a subject for healthy debate. Economists at the country's largest bank, ANZ, are now suggesting it's possible the OCR may be forced lower than 2.5% in future if unemployment keeps rising.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.