One-year fixed term mortgages consolidated their position in July as current flavour-of-the-month among those taking out new mortgages.

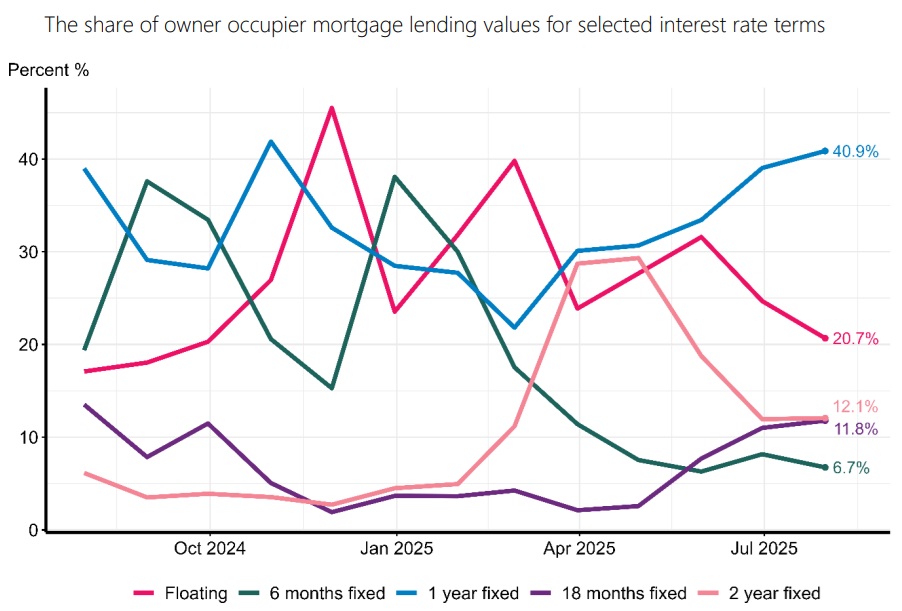

The latest Reserve Bank (RBNZ) new lending fully secured by residential mortgage figures that highlight what terms new mortgage holders are taking their mortgages out for, show that in July for owner-occupiers the one-year fixed terms took about twice as much as the next most popular option.

In July 40.9% (up from a share of 39% the previous month) of the owner-occupier money was borrowed for one-year fixed terms.

The next most popular option for the owner-occupiers was floating with 20.7%, but that was down from 24.7% the previous month and 31.6% the month before that.

It indicates that the desire on the part of those taking out new mortgages to 'wait' for interest rates to go lower is now weakening as the Official Cash Rate keeps getting lower, leaving less room for substantial future falls.

But of course, we did see the RBNZ make a big 'dovish pivot' in August and suggest that the OCR, currently on 3.00% may fall to as low as 2.5% by the end of the year. And it will be interesting to see what if any impact this has on these monthly figures in the coming months.

Remember, this particular data set, unlike other monthly mortgage data series from the RBNZ, shows mortgages as they are uplifted rather than when they are committed to.

The decision for large numbers of new mortgage takers to take out one-year fixed mortgages at the moment mirrors the current preference for existing mortgage holders who are refixing.

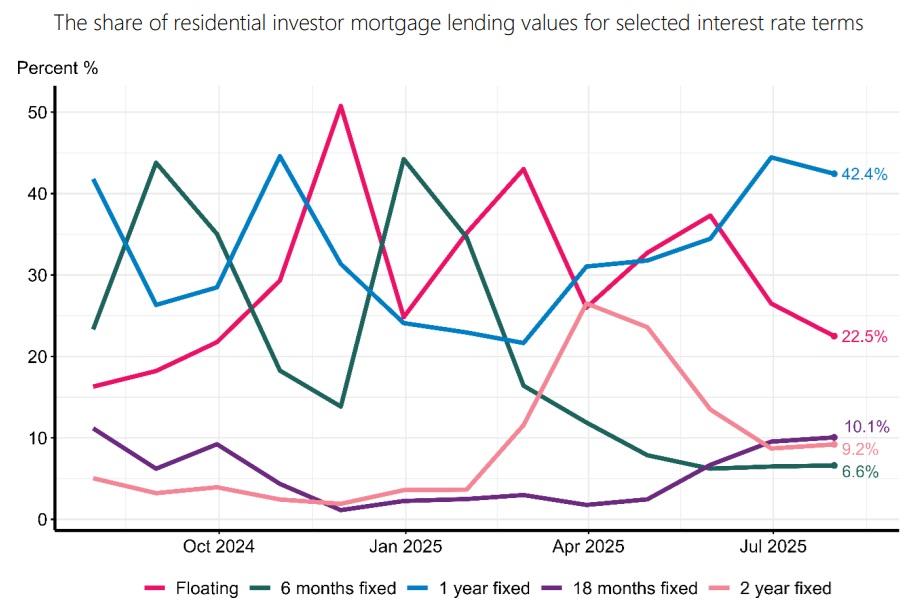

Other highlights during July as outlined in the RBNZ's summary of the figures included that among the investors, the one-year terms were also the most popular, accounting for 42.4% of the new lending by investors. But this was actually down 2.0 percentage points from 44.4% the previous month.

For investors, floating terms accounted for 22.5% of new lending, down 4.0 percentage points from 26.5% in June.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.