Reserve Bank (RBNZ) watching has clearly become a must-do thing for many discerning new mortgage holders these days.

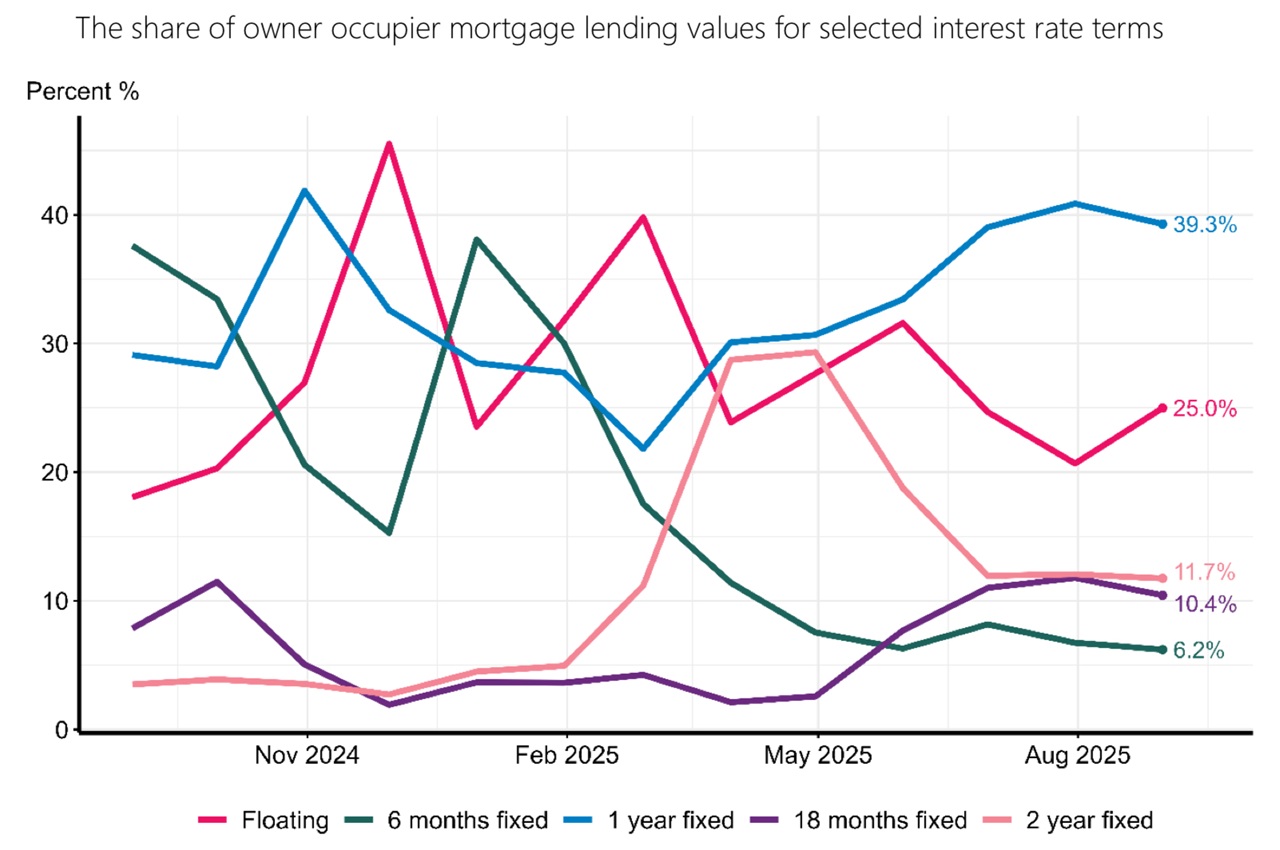

This is being highlighted by a fairly recent addition to the RBNZ's monthly data series. The new lending fully secured by residential mortgage figures showing what terms new mortgage holders are taking their mortgages out for demonstrate how responsive home owners are these days to interest rate changes - before they even happen.

We've previously discussed how from early last year large numbers of mortgage holders began going 'short' with their fixed term interest rate options in anticipation of likely OCR cuts.

Well, the cuts began in August 2024 and since then we can make out discernible patterns of home owners taking their cues from the RBNZ as to what might happen next and being prepared to wait for 'something better' - IE lower rates.

First we saw six month fixed rates become super popular (when they hadn't been before) and then towards the end of last year the wait-for-something-better approach moved to the next level with massive numbers of new mortgages being put on floating rates.

It had looked in more recent times as if the new mortgage holders were turning away from floating rates and toward longer fixed rates - but there's been quite a reversal again with the latest figures, which are for August. Significantly, there was an RBNZ OCR review during that month (on August 20) and the OCR was cut, possibly vindicating those taking a wait-and-see attitude with their mortgage commitments.

In terms of totals, the amount of new mortgage money being signed up on floating rates in August was 26.6%, up from just 21.5% the previous month.

Looking at just the owner-occupiers, the amount on floating rose from 20.7% to 25.0%. Just over 80% of the owner-occupier mortgage money was either floating or on terms shorter in duration than two years.

As can be seen from the above graph, the one-year rate was again the most popular during the month.

But it is interesting to see that the oft-favoured two-year rate is still languishing in popularity in relative terms.

The six-month term is now (relatively) languishing as well, which suggests the attitudes of home owners have hardened between those who see more scope for falls (those taking up floating rates) and those thinking the longer rates are looking reasonable.

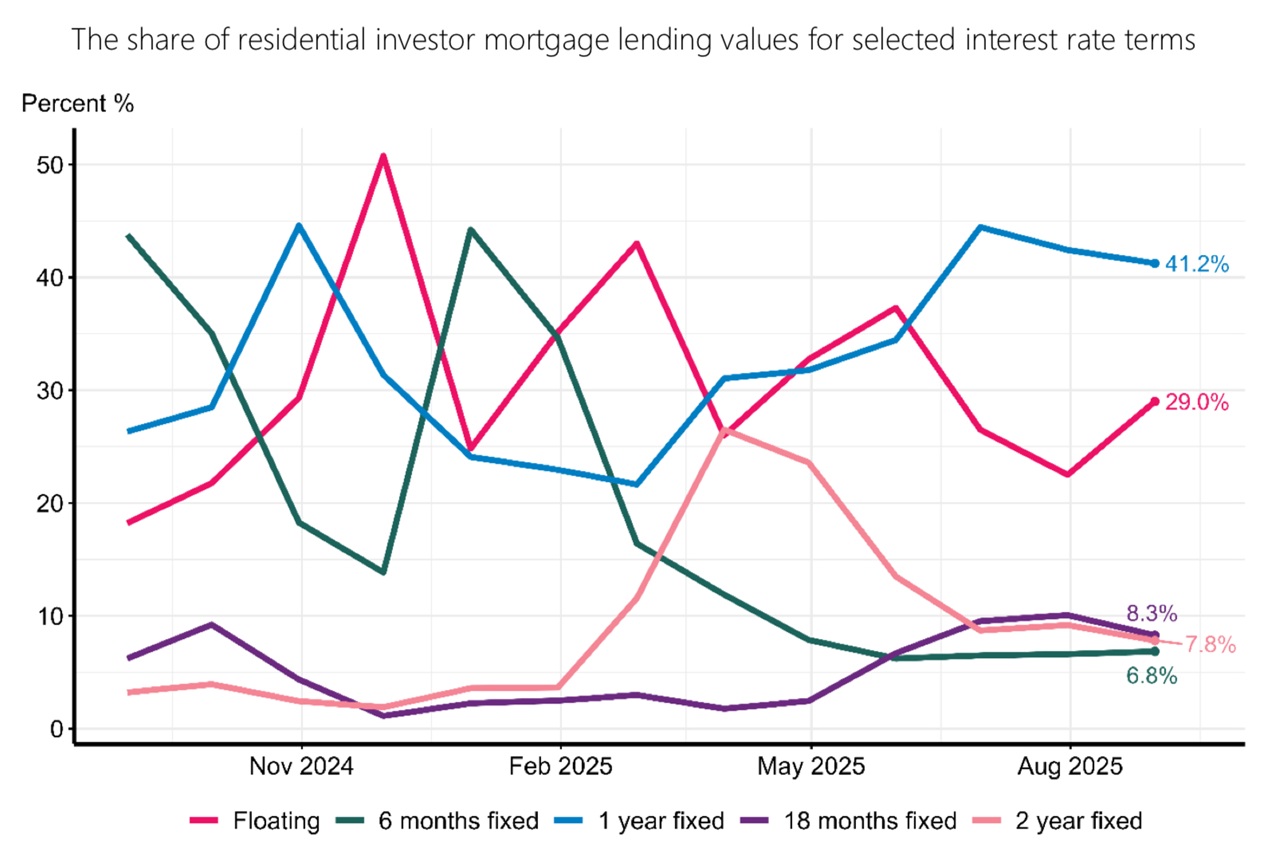

If we look at what the investors have been up to, well, the 'short is great' idea seems to be even stronger with them.

In August over 85% of investor new lending was on floating or at fixed rates of fewer than two years duration. Floating terms accounted for 29.0% of new investor lending, up 6.5 percentage points from 22.5% in July.

It was notable that during the press conference for the August 20 OCR decision, RBNZ Assistant Governor Karen Silk pointed to the 'go short' strategy as being one reason why lower interest rates were taking longer than expected to feed through into the economy.

"...People have opted to stay in shorter terms, on demand, or up to six months at much higher rates in the belief that they [rates] would come lower before they started to move out [their terms].

"So, as that happens it means that your transmission [of lower rates into the economy] is actually slower than you would anticipate."

Anyway, whatever the case, there's no doubt the OCR now seems likely to go lower than was earlier officially indicated by the RBNZ.

There now seems a very good chance the OCR will end the year on 2.25%, which means more mortgage rate cuts will be on the cards - and those who have been waiting on floating rates will feel they've been rewarded for waiting.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.