A 15.4% reduction in the mortgage interest rate bill for the average household helped push down household living costs in the past year, Statistics NZ says.

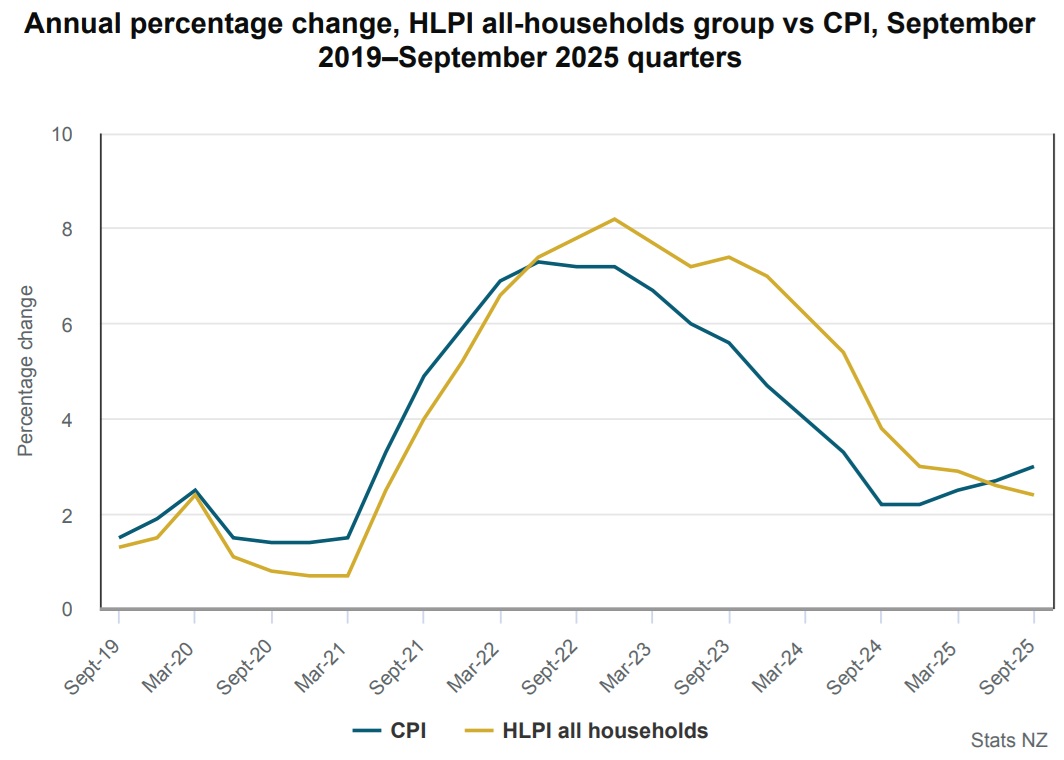

Latest Stats NZ data shows the cost of living for the average Kiwi household, as measured by the household living-costs price indexes (HLPIs) increased 2.4% in the 12 months to the September 2025 quarter, down from 2.6% for the June quarter.

The latest figure is lower that the official measure of inflation, the Consumers Price Index (CPI), in the year to September, which came in at 3.0%, up from 2.7% in the June quarter.

The significant difference between Stats NZ's household living-costs price indexes (HLPIs), and the CPI is that the HLPIs include interest payments, while the CPI instead includes the cost of building a new home.

What this has meant is that while mortgage interest rates were going up the HLPIs were higher than the CPI - but now they are lower.

The HLPIs hit 8.2% in the 12 months to December 2022, while the most recent high for the CPI was 7.3% in June 2022.

This is the first release of the HLPIs following a comprehensive review of them by Stats NZ.

Stats NZ "paused" the household living-costs price indexes (HLPI) for the March 2025 and June 2025 quarter releases while the review was completed.

Stats NZ says the HLPIs measure how inflation affects 13 different household groups, plus an all-households group (an average household). In contrast, the CPI measures how inflation affects New Zealand as a whole.

"The two measures of inflation are typically used for different purposes. A key use of the CPI in New Zealand is monetary policy, while the HLPIs provide insight into the cost of living for different household groups."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.