People still think the rate of inflation's higher than it is officially, but the good news for the Reserve Bank (RBNZ) is they do think it's reducing and will continue to reduce.

According to the latest quarterly Household Expectations Survey for the Reserve Bank (RBNZ), kiwi households see inflation at 4.3% in two year's time, down from 4.6% in the last survey. All the figures I'm quoting here are mean* figures.

And while 4.3% inflation would mean the RBNZ wasn't doing it's job of keeping inflation in a 1% to 3% range, it's the direction of travel of the expectations that's important in these surveys.

Households have a long history in these surveys of over-estimating official inflation, with for example, the average estimate among survey respondents of the current level of inflation being 8.0%! But that is actually down from 8.1% in the previous survey.

The survey of 1005 households for this quarter started on the same day as Stats NZ’s CPI release on 20 October 2025. Annual CPI inflation for the September 2025 quarter was measured at 3.0%, up from 2.7% in the June 2025 quarter. The RBNZ Household Expectations Survey was re-developed in 2022 Q1 and renamed to Tara-ā-Whare - Household Expectations Survey. The data for this report was collected by Research NZ on behalf of RBNZ. Fieldwork for this survey was conducted between October 20 and October 30, 2025.

This is part two of a trio of surveys for the RBNZ all being released ahead of next week's Official Cash Rate review and all helping to inform the decision of whether or not to go ahead with the widely expected 25 point cut that would take the OCR down to 2.25%.

What the RBNZ is hoping for from these surveys is that they won't show any re-emergence of 'inflation expectations', even though actual inflation has risen again recently to the top of the RBNZ's targeted 1% to 3% band.

The survey released last week was the survey of the 'experts' the Survey of Expectations, canvassing the views of business leaders and professional forecasters. That showed expectations of the future level of inflation have barely changed and remain 'anchored' near 2% despite the rise in actual annual inflation to 3%.

And now the results of the second survey would also be encouraging for the RBNZ and would again give it a green light for the expected cut to the OCR next week.

The final survey in the trio is the one that the RBNZ is clearly looking to become its 'big' one in the future, the quarterly Tara-ā-Umanga Business Expectations Survey, which has a large and broad sample size.

*This has been corrected from an earlier version, which erroneously said the figures were the median figures.

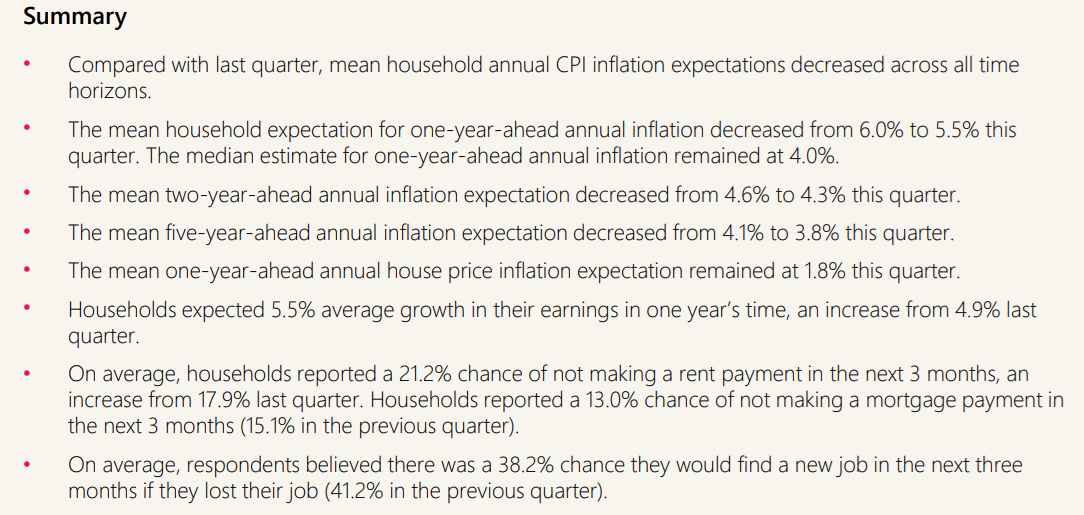

Below is the summary of the main findings in the latest household survey.

3 Comments

People still think the rate of inflation's higher than it is officially, but the good news for the Reserve Bank (RBNZ) is they do think it's reducing and will continue to reduce.

That's because people think based on their actual and personal experiences with price levels and increases. Most people don't think about the "rate of inflation". Only the boffins, bureaucrats, and interest dot co community (who get to cast their jaundiced eyes over the media releases and propaganda) do this.

People think about inflation as it impacts them at the supermarket shelf and how it impacts their share of wallet after the non-negotiable expenses. As many of them know, prices don't come down. The only way that prices come down is for prices to be discounted. After time, they will realize that these promotions work in cycles and they will adjust their purchase occasions accordingly.

This essentially is also necessary from the supply side. Businesses rely on promotions / discounts to meet sales targets or drive incremental sales. Aotearoans may scoff at the idea. But it's reality. My ex-client - Proctor & Gamble - came to this realization in Japan. Best they can hope for is the business unit to maintain profit levels.

That's because people think based on their actual and personal experiences with price levels and increases. Most people don't think about the "rate of inflation".

Yeah, which is why it's a stupid practice to ask households about the broader inflation measure.

Rates

Insurance

Power

Food

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.