As expected by analysts and fully priced in by financial markets, the Reserve Bank has cut the Official Cash Rate on Wednesday, this time by -25 basis points (bps) to 2.25% following the previous October -50 bps to 2.50%.

This is the eighth cut since it peaked at 5.50% in May 2023, so this latest trim halves that rate. The current cutting cycle started in August 2024.

The first to respond was the Co-operative Bank who cut their floating rate by -31 bps to 4.99%

But Westpac, the first big bank to move, only cut by -20 bps. ANZ has also moved down by 'only' -20 bps.

We will update this review as each change to floating rates comes through.

| Currently | cut | New | effective* | |

| % | bps | % | ||

| ANZ | 5.89 | -20 | 5.69 | 2 December |

| ASB | 5.99 | -20 | 5.79 | 2 December |

| BNZ | 5.99 | -15 | 5.84 | 3 December |

| Kiwibank | 5.80 | -15 | 5.65 | 15 December |

| Westpac | 6.09 | -20 | 5.89 | 1 December |

| Cooperative Bank | 5.30 | -31 | 4.99 | 12 December |

| Heartland Bank | 5.45 | -15 | 5.30 | |

| SBS Bank | 5.99 | -15 | 5.84 | 28 December |

| TSB | 5.94 | -15 | 5.79 | 9 December |

| * effective for existing borrowers. For new clients, most banks have them effective sooner. |

||||

If you are an existing customer, you can ask your bank to apply the reduction sooner than their effective date listed above. They should, because the delay is only because banks are under an obligation to give advance notice of a change. But that is only meaningful in the case of a rise. They will give a new client the lower rate immediately.

What about fixed rates?

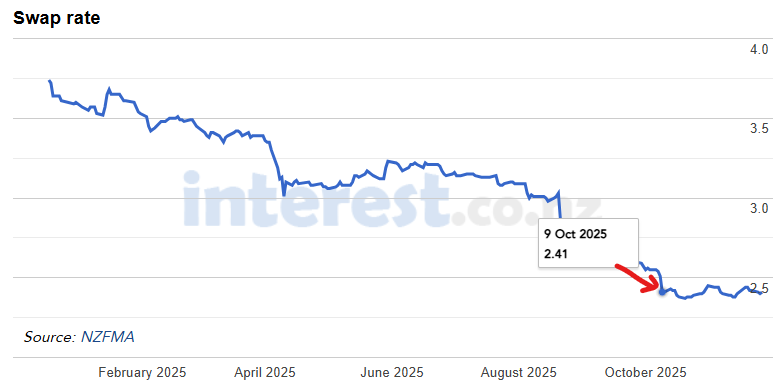

None of these have moved today so far, and frankly none are expected. Wholesale swap rates haven't moved since the unexpected October 8 drop. This time the -25 bps cut was expected and that swap rates haven't responded to that expectation.

But you never know. Of course, if any banks move, we will be the first with the news and implications.

Serviceability test rates

To be updated when details are ascertained. See our tracking page here.

Along with falling mortgage rates, banks are also cutting savings account rates.

Fixed mortgage rates

Select chart tabs

Daily swap rates

Select chart tabs

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.