There was a massive move to floating mortgage rates by homeowners towards the end of last year.

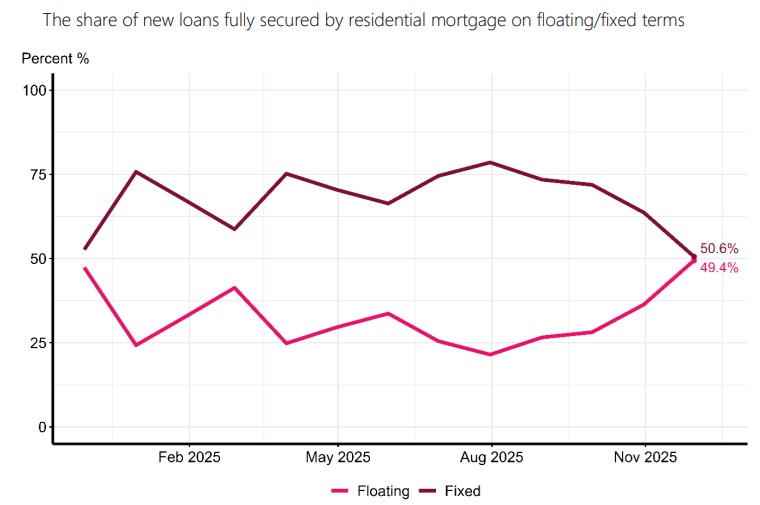

The Reserve Bank's new lending fully secured by residential mortgage data series, which shows new lending drawn down or facilities loaded in the reporting month, reveals that in November nearly half the $7.907 billion worth of new mortgage money was on floating rates.

The 49.4% of new mortgage money on floating rates ($3.908 billion) in November represents a high water mark for the share on floating since the introduction of this particular data series in April 2021. There was in fact also a brief surge in late 2024 to floating rates, with 47.4% of new mortgage money on floating in November of that year. The graphs featured in this article are by the Reserve Bank (RBNZ) and taken from its summary of the November 2025 figures.

Seemingly the intent of home owners in both late 2024 and 2025 would have been to see what the RBNZ came up with in terms of rate reductions in its last Official Cash Rate (OCR) reviews for the year, with the hope this will flow on to meaningful cuts by banks in their mortgage rates. So, in other words go on floating to keep your options open and wait for lower rates to potentially fix at later. IE, save some money.

In November 2024 the RBNZ cut the OCR by 50 basis points to 4.25%, with mortgage rate cuts following, vindicating - it would seem - the decision to go on floating and wait for better rates.

But as we said when reporting on the October 2025 mortgage figures, (which also showed a big, but not as big, surge to floating rate mortgages), even though the RBNZ did cut the OCR in November 2025 (to the current 2.25% from 2.50%) it pretty much indicated it was done with the cuts and there was therefore a quick mood change in the financial markets and wholesale rates began to rise. No further OCR cuts are now expected and banks have actually started pushing up their mortgage and deposit rates following the rise in wholesale rates.

It's a fast change in mood that - based on the mortgage figures we see here - may have caught some people out. And it may be an early New Year headache for some to re-examine just what they would like to do with the mortgages - unless some people are actually just happy to pay more for the pleasure of remaining flexible on floating.

It's not by any means unprecedented to see floating mortgages being popular. We have been there before. In the post-Global Financial Crisis period between 2010 and 2014 the amounts on floating exceeded those on fixed, but that hasn't been the case for many years. And it's hard to imagine this recent surge to floating will last, given the current cost differential between fixed and floating rates.

Indeed, it's worth checking out what sort of a difference this makes. If we were to take roughly the average sized new mortgage - about $400,000 - and put into the trusty interest.co.nz mortgage calculator, just as an example, ANZ's one-year 4.49% fixed rate compared with its 5.79% current floating rate, we would see that the monthly payments on the one-year (assuming 30-year mortgage term) would be $2,024, compared with $2,344 for the floating.

So, the floating rate in that example would cost $320 a month more. That's nearly 16% more.

It's hard to imagine people wanting to put up with such a situation for long.

Anyway, let's look a little closer at the detail in those November figures.

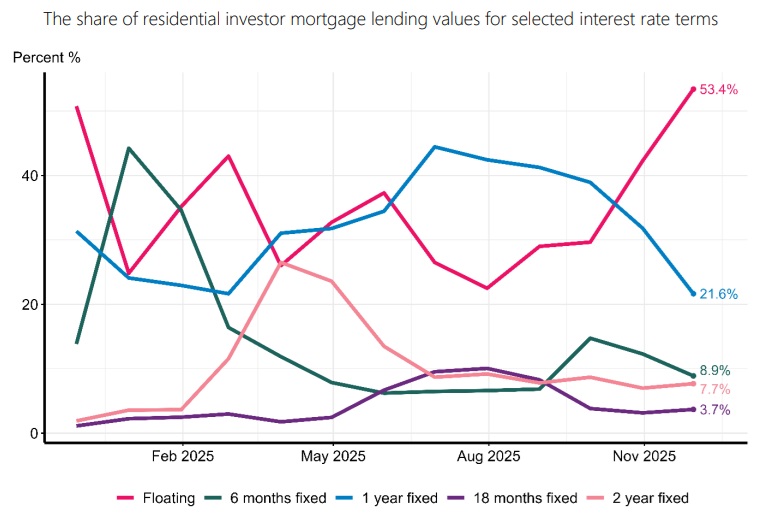

We normally focus on the figures for the owner-occupiers. However, this month it is worth quickly, first up, mentioning the investor figures. That's because, of the $2.284 billion taken out by the investors, some $1.22 billion (53.4%) was on floating.

This is only the second time since the start of this data series that more than half the investors' mortgage money has been on floating. The previous time was in November 2024, when the share on floating was 50.8%.

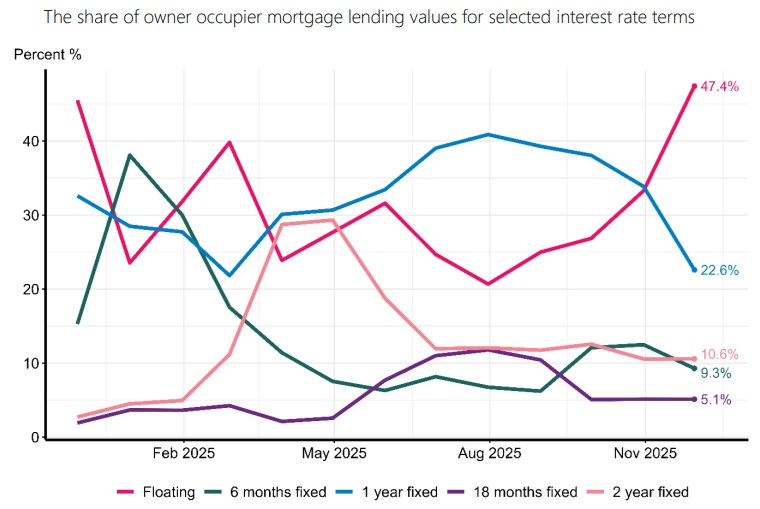

In terms of the owner-occupier figures, these show that $2.605 billion (47.4%) of the $5.494 billion total was on floating rates. The next most popular option was one-year fixed, with $1.241 billion (22.6%).

As we've been commenting for the past nearly two years now, since the end of 2023 the trend has been for people to very much go for shorter and shorter terms with their mortgage preferences. This trend anticipated the start of the OCR cuts, beginning in August 2024.

Long term rates have been largely forgotten.

But one interesting little point to note from the November 2025 figures is that there was a discernible uptick, from an admittedly very low base, in the take up of five-year fixed mortgages.

The amount put on five-year fixed in November by owner-occupiers was a paltry $75 million, which made up just 1.4% of the owner-occupier total. However, the 1.4% share was up from 0.8% in October and just 0.4% in September. And the 1.4% share for the five-year terms is in fact the highest share since November 2023.

So while 'short' was still very much in the minds of most with the November 2025 mortgage options, at least a few people were casting eyes further afield.

With the way short terms have dominated things in recent times, and the fact that the interest rate environment has so abruptly now shifted away from the idea that more falls will be coming, it will be interesting to see what options are pursued by New Zealand home owners over the course of the next few months.

4 Comments

Moral of the story: never make an all-in bet on the direction of interest rates. Always have a hedge in place.

Not always.

My 5 year bet in Nov 2020 earned me 2.99% through Oct 2025, but in early Nov I fixed at 4.49% for 2 years. Already proved to be the right decision.

You're using exceptional circumstances which isn't the norm.

Wasn't all bad, we floated 2.4m for December at 5% before fixing for 18m at 4.45%. The 5% float was less than our previous fix, whatever higher costs incurred for December was just the price of having options

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.