Average households benefited from a 17.3% reduction in interest costs in 2025, according to the Household Living-Costs Price Indexes (HLPIs) for the period to December released by Statistics NZ on Monday.

The impact of the interest rate reductions was such that the increase in the cost of living for the average household in 2025 was just 2.2%, which is considerably lower than the official rate of inflation - 3.1% - in the same period, as measured by the Consumers Price Index (CPI).

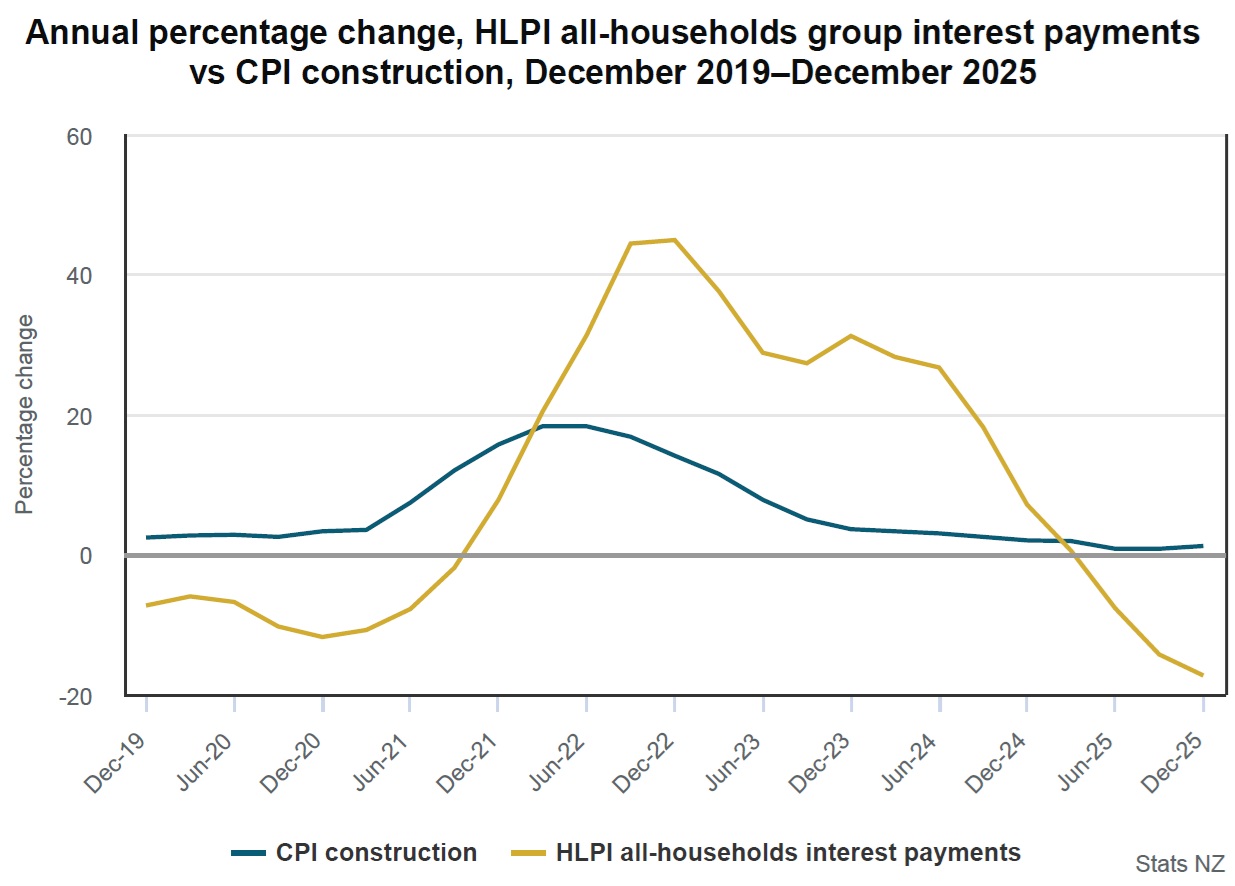

The significant difference between Stats NZ's household living-costs price indexes (HLPIs), and the CPI is that the HLPIs include interest payments, while the CPI instead includes the cost of building a new home. The cost of building a new home rose 1.2% during 2025.

What this has all meant is that while mortgage interest rates were going up the HLPIs were higher than the CPI - but now they are lower.

Stats NZ says the HLPIs measure how inflation affects 13 different household groups, plus an all-households group (an average household). In contrast, the CPI measures how inflation affects New Zealand as a whole.

The HLPIs hit 8.2% in the 12 months to December 2022, while the most recent high for the CPI was 7.3% in June 2022.

Stats NZ's prices and deflators spokesperson Nicola Growden said superannuitant households experienced the highest inflation rate at 3.8% (as measured by the HLPIs).

"The main contributor was local authority rates which increased 8.8%. This contributed nearly one-fifth of their overall inflation. Electricity, which increased 12.1%, and health insurance, which increased 20.3%, were the other key contributors to their latest increase.

"Superannuitants are more likely to own their own homes and not have a mortgage. Higher prices for local authority rates have more impact on superannuitants than on other household groups," Growden said.

Among superannuitants, 85.7% own their home and 8.5% have a mortgage.

Stats NZ said that the highest-spending households recorded the lowest inflation rate at 0.8%. The main contributor was an 18.6% decrease in mortgage interest payments.

Among highest-spending households, 82.3% own their home and 57.2% have a mortgage.

"Since these households spend a higher proportion of their expenditure on interest payments, particularly mortgage interest, falling interest rates have kept their living cost increases comparatively low," Growden said.

Rent increased 1.9% over the year and was the main contributor to rising living costs for beneficiary households. Rent contributed 18.4% of their annual inflation rate of 3.1%. Māori households were similarly affected, with rent contributing 17.3% of their annual inflation rate of 2.2%.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.