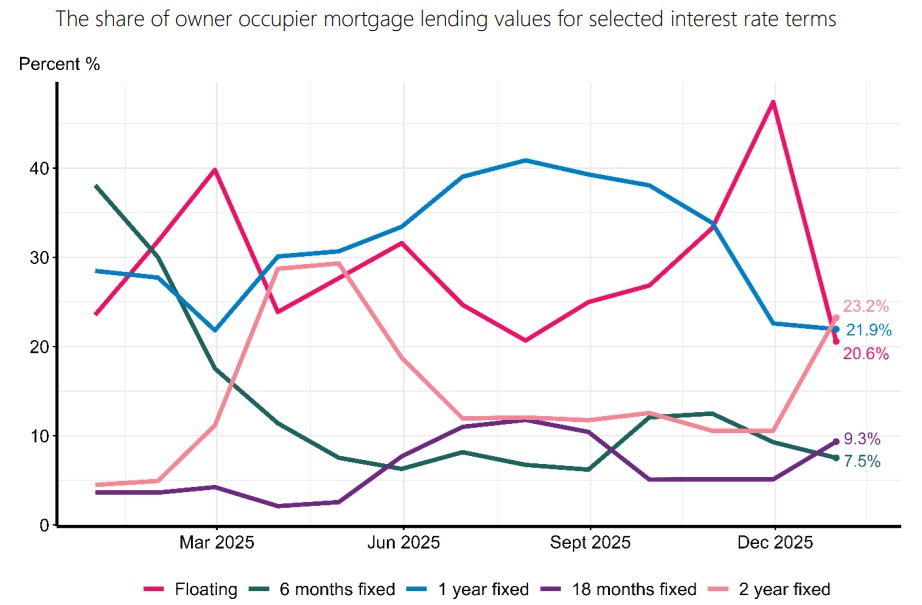

The previously fashionable, but recently deserted, two-year fixed term mortgages roared back into favour with home owners in December.

The Reserve Bank's new lending fully secured by residential mortgage data series, which shows new lending drawn down or facilities loaded in the reporting month, reveals that in December, the most popular option was in fact the two-year fixed rate mortgage.

Some 23.2% ($2.15 billion) of the owner-occupier new mortgage money went into two year rates, up from just 10.6% in November. It was the highest share for two-year terms since April 2025.

One-year rates accounted for 21.9%, slightly down on the November figure.

But the big move was in floating. There had been a huge surge in floating take-up in November, with this accounting for 47.4% of owner-occupier new mortgage money and 49.4% of all of the mortgage money (including that for investors). (Graphs taken from Reserve Bank summary of the figures.)

This move was of course ahead of the November Reserve Bank Official Cash Rate (OCR) review, in which the Reserve Bank was expected to cut the OCR further, and signal the possibility of more cuts in future.

Well, it did cut the OCR, by 25 basis points to a new cycle low of 2.25%, but the messaging delivered with the decision was that the central bank was probably done with the cuts. This was unexpected and produced a big reaction, with financial markets driving up wholesale rates and leading to rises in some mortgage rates in December.

What it all meant was it suddenly seemed a whole lot more like a good idea for people to go 'longer' with their mortgage terms. And so they did.

And this meant that floating was, not exactly abandoned, but a lot less popular as an option in December. Just 20.6% of owner-occupier new mortgage money was put on floating, down from that 47.4% figure in November.

Other longer term fixed rates that have been studiously avoided in recent times found some relative favour in December too.

Over $1 billion (11.8%) was put on three-year terms and that's the highest share that term has had in this data series since July 2023.

As we reported when bringing you news of a different Reserve Bank data set, December was a real busy month for mortgages, with a lot of customers changing loan providers (which therefore then becomes a new mortgage).

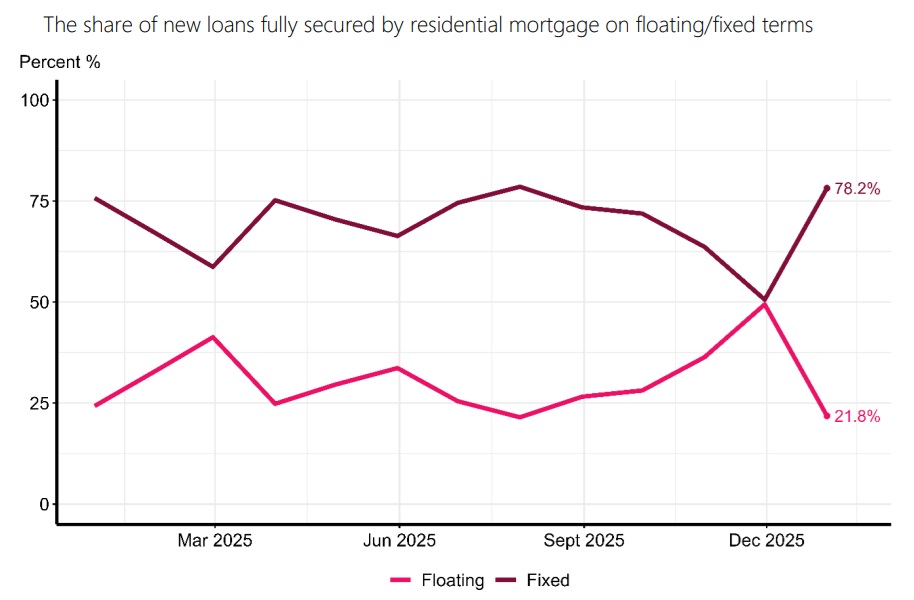

In terms of the overall figures, including investors in December, according to the Reserve Bank summary of the figures, the share of total new residential lending on fixed interest rate terms increased to 78.2% in December, up 27.6 percentage points from November.

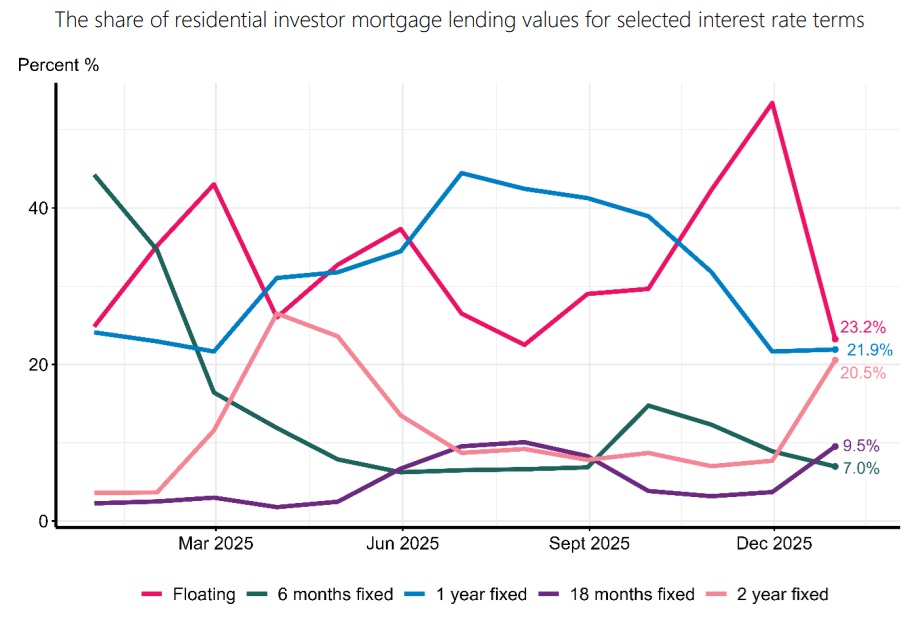

In terms of residential investor mortgage lending, floating terms accounted for 23.2%, down some 30.2 percentage points from 53.4% in November.

The Reserve Bank says the share of new residential investor lending decreased for floating and six-month fixed terms in December. One-year fixed terms accounted for 21.9% of new investor lending, up 0.2 percentage points from 21.7% in November. The share of two-year fixed terms increased to a 20.5% share in December, up 12.8 percentage points from 7.7% November.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.