Households have delivered the Reserve Bank (RBNZ) some news likely to encourage it as it ponders its first Official Cash Rate (OCR) decision for 2026, being released this Wednesday.

The country's households do expect future inflation will be lower than it is now. The only fairly major downside to that though is that they also think that the current rate of inflation is more than double what it actually is officially.

Results of the latest quarterly Tara-ā-Whare Household Expectations Survey, conducted for the RBNZ, show that households are now expecting future inflation to be lower than they did at the time of the last survey. This is the second in a series of three RBNZ surveys with results to be released ahead of the OCR decision.

The results of the household survey will be encouraging for the RBNZ because it comes at a time when actual inflation has been rising - to 3.1%, and outside the central bank's 1% to 3% target as at the December quarter.

And it contrasts ,with the first results in the trio of surveys that were released on Friday. That was for was the survey of the 'experts' the Survey of Expectations, canvassing the views of business leaders and professional forecasters. Those results weren't very encouraging for the RBNZ. They showed expectations of the future level of inflation rising across the board. Expectations for one-year-ahead annual Consumers Price Index (CPI inflation) increased by 20 basis points from 2.39% to 2.59%. Two-year-ahead inflation expectations increased by 9 basis points from 2.28% to 2.37%. Five year-ahead inflation expectations increased by 9 basis points from 2.22% to 2.31% and 10 year-ahead inflation expectations increased by 12 basis points from 2.18% to 2.30%.

While the RBNZ's universally expected to keep the OCR at 2.25% at this review, the fairly strong re-emergence of inflation expectations could have quite an impact on how the central bank positions itself for the future and what kind of rises in the OCR might be needed, and when.

The RBNZ likes to keep itself well up to date with what the public think inflation's doing and where it is heading.

To this end it now has three surveys that all cover off views of the level of expected future inflation. These surveys are generally released days before the RBNZ has an OCR decision, with the idea of informing the central bank's decision.

Inflation expectations are important. If people think inflation will rise, they change their behaviour. Those with businesses, for example and responsible for setting prices, might start to incorporate higher inflation into their prices, IE they will raise their prices. This in itself will then produce higher inflation.

Therefore, quelling inflation expectations is key to taking the heat out of actual inflation.

Generally the RBNZ wants to see expectations of the future level of inflation 'anchored' at around 2%, which is the midpoint and explicit target of the central bank's 1%-3% target range.

So, anyway, after the Friday results delivered a knock to the bank, the household survey is, as said above, somewhat encouraging, but with qualifications.

Households have a long history in these surveys of over-estimating official inflation, with for example, the average estimate among survey respondents of the current level of inflation being 7.7%! But that is actually down from 8.0% in the previous survey.

However, the good news is that they still see inflation falling in future and they see it at lower levels than they expected in the previous quarter.

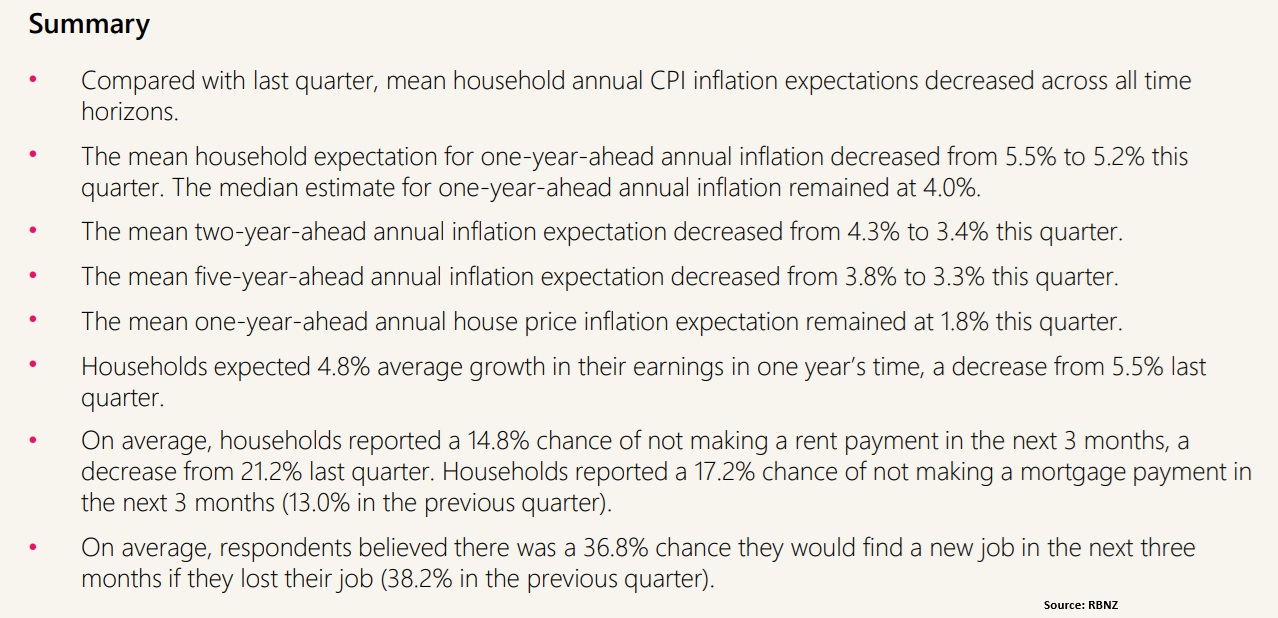

This is a summary, by the RBNZ of the findings from the household survey:

So, while the numbers are not ones that would encourage the RBNZ, the direction in which they are travelling between surveys - IE down - is encouraging, at a time when inflation has been rising. And it might suggest that inflation expectations are not becoming ingrained in the behaviour of households - which is good news for the RBNZ.

The data for this report was collected by Research NZ on behalf of RBNZ. Fieldwork for this survey was conducted between January 23 and February 2, 2026 after the December quarter inflation figures had been released. About 1000 people (1003 to be exact) took part in the survey.

So, of the two survey results released so far ahead of Wednesday's OCR decision, its probably a case of one dose of bad news and one dose of good for the RBNZ.

The final survey in the trio is the one that the RBNZ is clearly looking to become its 'big' one in the future, the quarterly Tara-ā-Umanga Business Expectations Survey, which has a large and broad sample size. The latest results from this one will be out on Tuesday.

3 Comments

Interesting that the survey differentiates between two subjective constructs: inflation and house prices. Given that house prices are a direct result of monetary inflation, this is encouraging. The relationship between how people perceive house price inflation and CPI is an interesting phenomenon among different subsets and the general popn.

For nerds, the ‘net % expecting higher house prices’ series is calculated by finding the weighted percentage of respondents who expect that house prices will increase overall in 1 years’ time and subtracting the weighted percentage of respondents who expect that house prices will decrease overall in 1 years’ time [Non responses are excluded from the calculation].

That is: net % expecting higher house prices = 𝑤𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝑛𝑜. 𝑒𝑥𝑝𝑒𝑐𝑡𝑖𝑛𝑔 ℎ𝑜𝑢𝑠𝑒 𝑝𝑟𝑖𝑐𝑒𝑠 𝑡𝑜 𝑖𝑛𝑐𝑟𝑒𝑎𝑠𝑒 𝑜𝑣𝑒𝑟𝑎𝑙𝑙 − 𝑤𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝑛𝑜. 𝑒𝑥𝑝𝑒𝑐𝑡𝑖𝑛𝑔 ℎ𝑜𝑢𝑠𝑒 𝑝𝑟𝑖𝑐𝑒𝑠 𝑡𝑜 𝑑𝑒𝑐𝑟𝑒𝑎𝑠𝑒 𝑜𝑣𝑒𝑟𝑎𝑙𝑙 𝑡𝑜𝑡𝑎𝑙 𝑛𝑜. 𝑤𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝑜𝑓 𝑟𝑒𝑠𝑝𝑜𝑛𝑠𝑒𝑠

Slightly different to the inflation measure - those who gave a 1-year ahead inflation estimate that is greater than their current inflation estimate, and subtracting the weighted percentage of respondents who gave a 1-year ahead inflation estimate that is less than their current inflation estimate.

Wow, a survey comes to rescue. Same old same old. The people have worked it out that inflation is twice what it has been massaged down to. Food price rose 2.4% in just 1 month and its going to increase. OCR 2.25%, inflation running above 3%, unemployment at 5.5%.

Let's not utter the word " stagflation".

Inflation at 3.2% isn’t high enough for that word. If it gets closer to 4 then yes.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.