Kiwibank economists say the shortage of houses in New Zealand may reach as much as 150,000 by this time next year despite the residential house building boom going on.

Despite the shortage, however, they see further short term weakness (prices down another 3-5% into next year) in Auckland house prices, with the regions continuing to show short-term strength before slowing too.

In a Property Insights publication Kiwibank chief economist Jarrod Kerr and senior economist Jeremy Couchman said their estimates showed that at this time last year there was a shortage of 100,000 homes across New Zealand.

As of right now, they now estimate the shortage has grown to 130,000.

"Our population growth has outstripped housing supply, again," they say.

"The construction sector has boomed. Supply of homes has increased sharply. But we’re still falling short. Kiwibuild has yet to have an impact."

They estimate that if things continue the way they are, the shortage "will balloon to 150,000 this time next year".

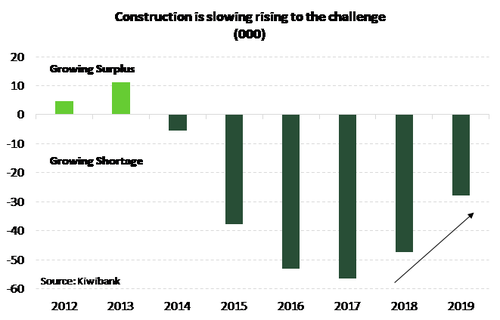

They do point out, however, that the growth in the shortfall of housing in the last year was the lowest since 2014 (see chart below).

"So, things are getting worse, but at a better rate. Not really that comforting. But given the rising run-rate of building consents we expect to see a slightly smaller shortage next year."

They say that with housing in such short supply, material house price falls "are unlikely from here".

"Material house price gains are also unlikely in aggregate. But the regions will continue to outperform the cities, for a while yet."

Kerr and Couchman say the bulk of the housing shortage is in Auckland, but many of the regions are feeling the pinch too.

"Auckland’s property market has proved to be a reliable, but loose guide for the regions. The dramatic run up in Auckland house prices between 2012 and 2016 has filtered down into the regions.

"Because several cashed-up, or disheartened Aucklanders are moving for more affordable lifestyles. The great migration out of Auckland has boosted regional house prices. But the slowdown in Auckland will eventually feed into the regions."

'Auckland has cooled but not collapsed'

They say developments in the housing market have largely played out as they anticipated.

"Auckland has cooled, but not collapsed. Auckland house prices are down nearly 5% from the peak with more downside expected near-term. House sales have slowed across the country. And there has been a lack of listed property.

"Nevertheless, we don’t expect a major correction like that seen in Australia. Auckland’s housing market is in payback for previous excesses but remains fundamentally under-supplied. A lack of housing supply is a key feature across NZ."

When combined with further interest rate cuts, Kerr and Couchman expect the national housing market to lift between 5-6% over 2020-21.

They expect Auckland to experience further price declines, in the magnitude of another 3-5% into 2020.

"But given the chronic shortage, continued population growth, and slow supply, prices should stabilise next year. Affordability issues will keep an anchor under future price gains thereafter."

'Loss of momentum' in the regions

Across the "fast-paced" regions, Kerr and Couchman expect a significant loss in momentum into 2020/21. Across the nation, prices will rise a little this year. And they expect aggregated price gains to pick up towards 5-6% into 2021.

"It’s a mixed picture, as it was this time last year. And as it will still be this time next year."

One rising risk on the horizon, Kerr and Couchman say is the "ratcheting up" of bank capital requirements.

The Reserve Bank has proposals on this that are awaiting a final decision in November.

"What we worry about, is the potential restriction in mortgage credit growth into 2020, as the banks prepare to load more capital.

"Should the financial system experience a rationing in credit, as in Australia, then the wind will come out of the sails," Kerr and Couchman say.

164 Comments

Why is that, if there is to be credit rationing, the bank economists say it will be cut from investment in building new houses rather than in lending for "specuvestors" to buy existing houses?

Specuvestors are the sacred cow of the financial industry?

It is happening across every sector.

Very mixed messages between this report and what is apparently actually happening.

Plans for 68 new homes ditched

http://nzh.tw/12249960

There is also a mortgagee sale at 42/44 Atkins Avenue in Mission Bay. Chinese owners walked away from a planned development and bank are now selling the site which has resource consent for 20 apartments.

Perhaps the start of the real slide.

We are also starting to see some Chinese owners looking to exit investments purchased in 2016/7.

Maybe Kiwis need a little more knowledge about the tiger they trade with

https://youtu.be/15pCyhL_9wA

This is just the start. Just watch the fire sales are coming.

Shaky times ahead. So predictable

.... better ramp up Kiwi Build then... new target , 1 million homes in ten years . ..

It's so much easier tossing out idle promises when you're in opposition... than actually getting stuff done when you're in government , isn't it , Jacinda !

When the alternative is this:

"Prime Minister John Key is standing by his statements that there isn't a housing crisis in Auckland"

"Finance Minister Bill English was not convinced there was a housing crisis either, and said people threw that word around loosely."

I prefer the guys who actually don't lie about there being a problem.

Source: https://www.stuff.co.nz/business/money/68621964/

Let's not forget Michael Woodhouse's (Housing spokesman) "It depends on what you define as affordable. If a house is purchased, it's certainly affordable for someone."

It's like Johnny setting a house on fire, watching it burn for 9 minutes without doing anything. Then a bystander, let's call her Jacinda, arrives, saying "I'm gonna extinguish this fire, just give me a bucket". She gets a bucket, fills the bucket with water, but spills all of it on the sidewalk.

Then the friends of Johnny drive by in a Ford Raptor, laughing at Jacinda, while Johnny hops on the back of the ute and they drive away.

I'm looking forward to the sequel where Johnny is driven off in a prison van

Gummy I don't think you get KiwiBuild. The idea was to copy the Chinese policy. There was an article that they were gearing up to provide 3 billion apartments for people to live in, and potentially more. China, if they follow that policy, would end up with 3 apartments for every person in the country. So the new Twyford target would be 15 million homes in 10 years.

On a more serious note (I hope) everyone is running at or over capacity in the construction sector now. If there's a push for more construction things will start going seriously wrong.

. a cheaper option to Kiwi Build , would be to offer $ 50 000 to any family who leaves NZ for a minimum of 2 years.... that should clear the country of 100 000 or more in no time flat... and to slap on a $ 100 000 levy for any individual or family wishing to emigrate to our fare land ...

Housing shortage solved ....

.. 70k arrivals per annum, charge for the residency. Make the cheque to NZ inc.

Exactly correct ! .... we currently value Kiwi citizenship so lowly that we give it away for free ....

... charge the blighters : they arrive without paying a penny for the existing infrastructure ...

Wanna come to our fare land ? .... $ 200 000 please !

GBH,

"our fare land'. Is that airfare,welfare or bus fare? Lots of Kiwis go on their OE and a significant percentage stay away for many years,before returning. Should they pay this charge,or a proportion of it? Perhaps we should start our own deportation scheme. What do you think?

Since they already have citizenship, why would they be paying this charge?

the 70,000 new residents are surely the tip of the ice berg - where do the 250,000 "temporary" visa holders this year live? - how come their numbers never seem to get a mention?

Have the folks at Kiwibank not read this comments section? If they did they would know that there is in fact a substantial housing surplus, including in Auckland. I’m also told there is however a shortage of cheap houses (which there actually is, but in the same way that there is a shortage of 5 Cent avocados).

DD as you suggest the issue is price not supply. If these newly built homes were being priced at 300~ 500k we wouldn't have half the problem we have at the moment.

Obviously we would have the exact same problem because every house ultimately gets sold.

300-500k homes are available but of course not in top streets or best neighborhoods of of Auckland. Maybe not even in Auckland. But they are available in reasonable locations.

David, thanks for the article. I don't have access to the original. Is there any mention of numbers of vacant properties that might help alleviate supply issues ? Thank you. G.

Shortage or No shortage - How many FHB on NZ wages afford million dollar house ?

Why would a FHB buy a million dollar home, wouldn't they start at the bottom of the ladder?

Which is 700k+ for a 3br house in Auckland. Nope, still not affordable.

Bottom of the ladder and pay $700000 Plus for a dingy 2 bedroom unit........

Pay through your nose to stay in slums........atleast in Auckland

Over 600 2+ bedroom homes for under 500k in Auckland, for sale. What drugs are you on?

Your comment has half the likes, so on this site it indicates you are twice as accurate :-)

Or maybe they went to Trademe did a property search in Auckland for 2 bedrooms under $500k and came up with some 320 or so listings, with 24 to a page, the first 5 pages were mostly houses for removal, then there were all the listings with no price, all the apartments, then if you have the time you can search for all the 2 bedroom units from what is left.

subtract the leasehold crap too.

Indeed. Once you subtract the removals, leaseholds and demolish jobs, there's not much left.

I cant say what he means by 2 bed 'home' but if its apartments, units, townhouses and houses then realestate.co.nz thinks he is approximately correct.

Hmm I just went there and got 283

Just did the calcs, its only $1000/week to service the mortgage.. surely thats easy right? right? I mean, sure, you both need to be earning about $90k or above and have your student loan paid off for that to be reasonable, and the small matter of a $100k deposit.. No problemo! Kids? What, you want a house and kids? greedy bloody Millenials!

my daughter 21 and her partner 22 just bought one at 930K -- they had 50K between them on Kiwisaver and savings -- topped up to 20% by both sets of parents admittedly to get them over the line and a good interest rate--interest on mortgage is $600 a week -- and they are repaying another $400 on top

They have 4 bed home -- have taken in two lodgers at $250 a week + Bills -- - neither of them earn more than 50K -- but they had no debt - no loans - no HP - Both have been doing 8% kiwisaver since they started work -- and savings on top -- they have always lived to their means - after saving - make pack up everyday -- lift share to the train station - dont smoke, and wait for it -- dont drink coffee!

It can be done if you are still willing to be smart - and yes they did register for kiwibuild houses --but felt the 2 bed boxes at 600K were shitty value - as opposed ot a 4 bed with ensuite - detached where they could easily rent out two rooms to cover $500 of teh $600 interest costs !

Kpnuts - Nice to here a sensible good outcome story. As your youngesters have proven it can be done if some smarts are put in the mix. No doubt there will be the usually negative comments re ponzi scheme, market going to crash 40% look what happenened to Ireland etc blah blah blah. Decision made, deal done getting on with their lives great stuff. We have done the same re helping offspring settles next month $700k in this case both working offshore currently back in the next year or 2. I did exactly the same in the early 80's it was never easy first time round. We just bought another investment apartment in Kapiti yesterday settles next month still great buying down there, all the best !

So your saying, when people could pay houses on one income only 30 - 40 years ago, its OK now because FHB can get in lodgers, use 2 incomes and get their rich parents to pay for them.

That sounds like housing affordability is definitely going in the right direction, so they may be able to put in bunks, maybe you could have 4 in a bedroom, could even squeeze them into the lounge, maybe a few tents in the garden as well.

NZ rocks, lucky new generation, we have made the country better.

Now young Kiwis, get out there and work hard to pay the pensions of those who got more affordable housing through the efforts of successive governments!

Amazing that you believe "a sensible good outcome story" involves parents gifting almost 3 times the deposit saved. When you say "smarts" I think you actually meant to say "inherited wealth".

When 45% of FHB are buying with sub 20% deposits. And when 50-80% of FHB need outside assistance to get together a deposit, I think its safe to say we are in the middle of a bubble.

Okay, so what you're saying is that people with $50k equity should buy $930k houses. Because that's "being smart". Oh, and it's a really "smart" move to have parents who can give you a few hundred thousand, no questions asked.

Yeah...correct and than you need rich parents to pay/top up for deposit...is everyone that Lucky.

One thing you agree that FHB cannot buy now without external support be it rich parents or relatives who are ready to help. First World Countyry and two hard working people jointly cannot afford to buy a house on their own is the story.

topped up to 20% by both sets of parents admittedly to get them over the line

Wow. So basically they couldn't have done it without family help. That seems to be a common theme in all of these 'success' stories. How long would it take them to save the deposit if had they just worked hard themselves and hadn't bludged from mummy and daddy?

"How long would it take them to save the deposit if had they just worked hard themselves and hadn't bludged from mummy and daddy?"

Not sure of the income for a couple aged in their early to mid 20's . Likely to be way below the median household income in Auckland.

At the current median house purchase price in Auckland of $850,000, and an LVR of 80%, a median household income family in Auckland, would need to spend 46% of their gross income to service a P&I mortgage at 4.0% for 25 years. Furthermore, for a family on a median household income in Auckland, saving 10% of their gross income each year (in addition to paying rent) to save for a house deposit of 20% or $170,000 - it would take almost 18 years to accumulate this amount.

to save for a house deposit of 20% or $170,000 it would take almost 18 years to accumulate this amount.

And there we have it... Thank you for crunching the numbers. They were certainly 'smart' and 'worked very hard' to choose wealthy parents. Why don't all kids do that?

I heard a story of a young Auckland couple aged mid 20's, early 30's who are looking to buy a house in Auckland. They are able to service a 4% 25 year P&I mortgage, but unable to get the required 20% deposit of $150,000 to $200,000 to purchase.

If buying a house in Auckland is only possible through some sort of financial assistance from the bank of mum and dad, or estate windfall from an elder relative, then assuming house prices keep rising, this is going to increase the wealth gap between those that can buy and those that cannot buy in Auckland. This has potential social consequences if there is a large proportion of the population that are unable to buy, which widens wealth inequality

On the other hand, if residential property prices in Auckland fall substantially, then this will potentially narrow the wealth gap in Auckland between those that own real estate assets and those that don't own real estate assets. Those that have bought residential real estate in Auckland at high property valuations financed with high levels of debt may find themselves in negative equity and need to work themselves out of a hole. Those from the bank of mum and dad who borrowed against the equity from their home, to lend to their children as a deposit on their first home, may find that when they sell their home, pay off their mortgage and downsize, there is a smaller sum available for retirement.

First home buyers should not be expected to buy the median house and median household earners should not be saving from $0 at a compounding rate of 0%. You guys have no shame.

Laminar

FYI, the example was in reference to Kpnuts' 21 year old daughter and 22 year old partner having just bought a property for $930,000 (which is above the median house price in Auckland of $850,000), with financial assistance from Kpnuts.

Many 21 year olds are not earning a median household income in Auckland by themselves. To earn a median household income in Auckland would require a couple in a relationship. Very few of that age in Auckland are in sufficiently stable relationships where they are able to buy jointly, so possibly overstating income for a period of time which would more than offset for the compounding at 2% p.a rate of bank interest not counted above, as well as using a lower median house price than was actually the case for Kpnuts' 21 year old daughter. If the individual / or couple is flatting then saving 10% of a median household income per year may also be overstated.

If the 21 year old has gone to tertiary education such as university and paid for it themselves, they are likely to have student debt and be in a negative saving starting position - my 21 year old relative is certainly in that position.

That is still incorrect. If that couple had to save by themselves they would not be buying a median house. When someone buys a median house they have on average already been home owners and thus the compounding rate is enormous, assuming a 20% deposit, about 19% pa. You are completely misconstruing how reality would play out for the couple had the parents not helped.

Student debt is a cash flow only on a bank servicing assessment and is not counted against equity. If the tertiary debt does not result in an income promptly much higher than 50k then id suggest they have wasted the money and that is probably the parents fault.

Youd have to present numbers to support your claim that 10% of median incomes are not able to be saved if you are flatting, sounds like a person who has had no financial literacy breed in to them as kids growing up.

You've completed missed the context as CN points out.

The spruikers have that down to an art form..

A very young couple , who earn less than 100,000 per annum, with no Kiwisaver or savings remaining , take on a $744,000 mortgage , after two sets of caring parents gifted 136000, apparently not to be repaid. Notwithstanding the potential legal issues , which bank provided 3/4 million interest only loan for your daughter on the basis of bringing in lodgers and bank of Mum and Dad. .Recent studies have shown coffee to be beneficial.

This story beggars belief. Parents donate 130k+ so that kids can somehow borrow over 7x combined income and live with lodgers ?

Seriously this is the most insane true story I've ever heard.

Best of luck to them. I don't drink coffee either but at least I have a choice.

Meanwhile that $130k would almost clear our entire mortgage.

The home loan, after boarders, is $25,0000 pa. Itll be paid of in a couple decades, when they are barley 40. The after tax on 2x45k is 70k joint assuming 8% kiwisaver, or 45k after the loan, or $850 per week to live on, yeah they are going to be fine.

After rent rises and pay rises these two will be hilariously well off by 30. Maybe they can even buy some coffee and the benefits of that as well, horay!

I did some calculations and found that if their parents gave them $1 million up front they would pay zero interest and have their house paid off immediately. They would be set from their early 20's! Wow!

Hahahaha. My sort of calculations. I like it!

As everyone has pointed out, your idea of 'see it can be done' is farcical.

Did bloody Mike Hosking masquerading as kpnuts write this comment???

"have taken in two lodgers at $250 a week + Bills "

FYI - https://www.ird.govt.nz/topics/income-tax/types-of-income/rental-income…

What is your point? Your link literally states the standard deduction is 270 per boarder per week? they get 250 plus bills which is about exactly correct... Above that level you are allowed to deduct some home ownership costs as well so id suggest they are okay. Id think the more likely problem is this: "They also get meals".

Many owner occupiers who take in boarders or flatmates may be unaware of potential tax reporting requirements & potential tax consequences.

$600/week interest.. you also need to pay the principal down. Ffs, what a bullshit story. Here, this is what a couple of privileged little shits did, why can't everybody else just put their hand out to mum and dad for $130,000.

Jealous much?

Oblivious much?

Personally, as a FHB (in my late 20s), I could afford a million dollar house on NZ wages. However the fear of taking on that amount of debt is over whelming.

A housing shortage... Maybe something to do with very high population growth?

It is a pity no-one can slow the rate of population growth.

We can make it as difficult as we want for new immigrants and need to do just that - yesterday.

So, ignoring the current immigration numbers, what would you do about the 60,000 new babies coming through Auckland DHB every year? That is 30,000 new homes needed right there. This has been the same for many years. With our declining death rates for baby boomers our population has a galloping increase already built in. New Zealand's birth rate is much higher than replacements needed for a static population, just that at present babies cannot yet build houses, so we need immigrants.

Immigrants have more babies than natives.

I guess natives are having less fun all round then.

And babies do not need their own houses until they become not babies, like really not babies.

Not Baby age is currently about 30.

""Auckland has cooled, but not collapsed. Auckland house prices are down nearly 5% from the peak with more downside expected near-term. House sales have slowed across the country. And there has been a lack of listed property."

"Nevertheless, we don’t expect a major correction like that seen in Australia"

"They expect Auckland to experience further price declines, in the magnitude of another 3-5% into 2020."

So if Akld is down 5% and expected to be down another 3-5% that equals down 8-10%.

Australian house prices have dropped only 8%, so it looks like they are expecting a correction like seen in Australia.....

Compare this to Westpac's "7% up nationwide" prediction for this year and you'll quickly realise that the so called top economists are just as clueless as the average person.

I think they are comparing house price falls between NZ and Australia rather than Auckland and Australia.

"So if Akld is down 5% and expected to be down another 3-5% that equals down 8-10%"

8-10% price fall in Auckland is the same magnitude as experienced during the GFC in 2009, and currently the economy is in a very different situation from 2009 (GDP is currently growing, & unemployment is low) What happens if the economy goes into recession or unemployment picks up? The RBNZ has already started to cut the OCR, suggesting that they are seeing a low risk to inflation reaching target levels. The trade dispute between the US & China might have a flow on impact on the NZ economy, as well as international capital flows.

Recall that during 2009, the NZ economy was in a recession, finance companies were going bankrupt, property developers were going bankrupt, unemployment exceeded 6%, the government had to give guarantees so that the banks could get financing from international wholesale funding markets.

http://worldpopulationreview.com/countries/new-zealand-population/

Maybe in 10 years time when that bulge of 20yo move into fhb age or thereabouts?

Stop importing people and ban Air BnB other than for a spare room or two in the house you live in.

Ban air bnb other than the spare room??? Excuse me, why not let the homeowners themselves decide whether they want clean and tidy tourists or offensive and self entitled tenants. Apologies to those tenants not like that and there are many, but also too many tenants you wouldn't want. What other leftist control freak ideas are you coming up with Pocket

That remark is exactly why our tenancy laws need shredding and re-writing. I am advocating our tenancy laws look more like European ones and that people who are doomed to rent for their lives are still able to make a home. If you think that is leftist (and it probably is but I don't take the title as an insult as hard as you might try), tough, it is what is going to have to happen.

I see the situation we are now in as pretty much a chicken and egg one. I was there for the change when people started reading Robert Kiyosaki Glenn Robbins and Bob Jones and slowly home ownership began to decline. Personally, I reckon society began to fall in on itself from there, and I think the egg in this situation was the dawning culture of the rentier.

People who have no stake in anything don't give a rats, and that is what you now encounter.

Yes, ban Airbnb for whole houses, absolutely. Or at the very least make them have to comply to every single thing any other accommodation provider has to.

I make no apologies.

And there's something many don't see and Will be shocked when democracy kicks them in the balls. A majority of adults now live in rentals (read it here at some time) and the percentage is growing.

I would be interested to know what other hard left policies you support

See Scandinavia and/or Germany, add a financial transactions tax and you might be getting somewhere.

Given what I suggest is nowhere near hard left, I would have to say, none.

"We’ve updated our model and our estimates now show a chronic shortage of around 130,000 affordable homes."

I'd be interested in seeing more detail on how the modelling was done. As estimated shortage is of AFFORDABLE homes, not necessarily total homes.

Good point. The assumptions made would affect to outcome hugely. eg With a couple living in a shared flat, would they prefer to be on their own in a separate house? Maybe. Depends on price and their long term plans. eg Do they want to continue living in that city? Or become a landlord if they buy and scarper. Or maybe they think its madness to buy now, so they don't want to. How would a model deal with this sort of uncertainty?

30,000+ empty homes in Auckland, a declining housing market and we're still talking about a housing shortage?!

If you look at the calculation of the housing shortage - it is based on underlying demand vs underlying supply.

If you look at the current effective supply in the property ownership market - there are currently 6,676 residential dwellings (with 3 bedrooms or more) listed for sale on trademe.co.nz. (9,494 total listings in Auckland).

Of the 6,676 (with 3 bedrooms or more):

1) 710 are priced at $600,000 or below. (FYI, the $600,000 price point represents a house price to income of 6.4x, just slightly above the median for the country of 6.2x)

2) 3,722 are priced between $600,000 to $1mn

If you look at the current effective supply in the property rental market - there are 2,349 residential properties (with 3 or more bedrooms) listed for rental and looking for tenants. (total listings available for rental are 4,619)

Of the 2,349 residential properties with 3 or more bedrooms, 834 are priced at $600 / per week or less. (note that $600 per week is approximately 33% of the median household income in Auckland - 33% of a household income is considered affordable by banks for debt servicing so hence we use the 33% level that they use)

I thought the housing shortage was extrapolated from historical stock data of individuals per dwelling not current real estate listings or pricing . . Usually individuals are counted in whole numbers but for any housing shortage meme , (which seem solved just last week) ,individuals can come in varying percentage quantities from 0 - 100 , whatever may provide our banks with the better headline.

"I thought the housing shortage was extrapolated from historical stock data of individuals per dwelling"

Yes, you are correct. The UNDERLYING housing shortage is calculated in that way and represents the houses needed for the population.

The listings on the market represent current EFFECTIVE supply of houses available for purchase or available for rent.

The difference between underlying housing demand and effective housing demand.

Many property market participants and property market commentators are using underlying housing demand to develop their expectation of future property prices, when in fact they should be using effective housing demand. You can also apply this approach to the supply side in the housing market - underlying housing supply and effective housing supply

A 2009 / 2010 report by the Dept of Building and Housing recognises two types of demand:

1) underlying housing demand

2) effective housing demand

1) Underlying housing demand

‘Underlying demand’ refers to the number of houses needed to accommodate households in the population. Population increase in the age range of 20–40 (which is when people tend to form independent households) leads to smaller household sizes and more single-person households. Further, positive net migration increases underlying demand for housing. A ‘household’ means either one person who usually lives alone, or two or more people who usually live together and share facilities in a private dwelling.

Natural population growth rates, internal migration, housing preferences and household formation rates all tend to change relatively slowly, and therefore changes in underlying demand caused by these factors are reasonably predictable. By contrast, the level of external migration depends on policy rules and incentives, as well as on wider domestic and international economic conditions, and it therefore tends to have a more volatile, less predictable impact on underlying housing demand

2) Effective housing demand

Effective housing demand is the combined effect of both 1) the desire to rent or buy a house, and 2) the financial ability to rent or buy a house. This aspect of demand is what shows up in the housing market statistics for sales, prices and construction. It also largely accounts for the changes in housing and tenure choices over time.

The New Zealand housing market has not only experienced increased underlying demand from population growth and higher net immigration; it has also (until the recent global financial crisis) experienced an increase in effective demand as a result of higher incomes, lower unemployment, cheaper and easier access to credit, and the preference of New Zealanders, for various reasons, to invest in housing over other forms of investment.

The difference between underlying and effective demand is a function of:

• buyer wealth and income

• the cost and availability of finance

• the state of the economy

• individual consumer preferences (for example, location, or between renting and owning)

• the attractiveness of housing as an investment good.

Refer - https://www.mbie.govt.nz/dmsdocument/1087-nz-housing-report-2009-2010-s…

Very helpful summary

Isn't it simpler if you just think of supply and demand as functions (or curves if you like), as opposed to fixed quantities? Then the current price and volume levels are simply where the S&D functions intersect.

Also, with respect, I'm not sure "underlying housing demand" is the greatest concept. I really don't agree with your definition above. Clearly the current number of houses already accommodates the population (more or less). Of course if supply increases then we may move towards historical levels of occupants per dwelling. But it's possible we could even move past that to fewer occupants per dwelling if the supply curve moved far enough. Because I bet at historical levels there were still plenty of people who were constrained by price. And of course many folk would buy a holiday house (or two) if they could afford it!

Overall I think we agree though - just a slightly different way of looking at things.

The basis and purpose of the underlying demand calculation is for town planning purposes. The underlying housing shortage has been taken out of context as justification that house prices will continue to rise in Auckland by those with a vested financial interest such as real estate agents, etc

How you can have a housing "shortage" and a fall in property prices at the same time.

Note that this is underlying demand for housing in Auckland. Factors which impact effective demand (on which the market prices of residential dwellings are based) are not accounted for.

Note that for the basis of this calculation for the housing shortage for underlying demand, no adjustment is made for changes in demand due to changes in house prices.

The calculation of underlying demand is used for the purposes of long term town planning, and infrastructure needs (such as sewerage, parks, roads, schools, etc) due to an projected future increased population. It is fixed due to the long term planning and construction of the infrastructure. Underlying demand is not useful for estimating future property market prices, nor does underlying demand change for changing property market prices.

For example, the housing shortage number calculated for underlying demand would remain unchanged in the following 2 extreme situations, (assuming current household incomes, current population, current population growth & the number of residents per dwelling of 3.0).

1) if the current median house price in Auckland was $10,000. In this case there would likely be a huge increase in the number of active property buyers which would increase effective demand (and would be above underlying demand). People who were not owner occupiers would buy at this price. A large number of people who are already owner occupiers would also become active buyers and buy at this price - buy a house for their children, grandchildren, parents, holiday homes for out of towners, etc as they are cheap. People who could afford it from all over New Zealand and abroad (such as Australians and Singaporeans who are exempt from the foreign buying rules, and New Zealanders living overseas), are likely to become active buyers in the market. The underlying demand calculation does not incorporate this.

2) if the current median house price in Auckland was $10,000,000. In this case, there would likely be fewer active property buyers in the market. The number of effective demand would be fewer than that for underlying demand. The underlying demand as calculated above would remain unchanged - after all there is no change to population estimates or the assumption of the number of people living in each house. There would still be a "housing shortage" as calculated by economists using the population numbers, but in reality there would be few buyers active in the market if the median house price in Auckland was $10,000,000. Very few would have the deposit necessary to buy, and very few would meet the bank lending criteria particularly on debt servicing.

This is the reason why the underlying housing shortage is a misleading number (as calculated by economists, etc, and quoted by mainstream media, politicians, property market commentators, etc) as a justification for future house prices to continue rising. It is used as a convenient justification by those in the real estate industry to persuade those to enter the residential real estate market.

Economists in their calculations of the underlying housing shortage, and talking about future property market prices, have failed to incorporate the fact that:

1) as prices rise, effective demand falls

2) as prices fall, effective demand rises.

This is introductory economics and the basics of demand. Underlying demand is unchanged, yet effective demand changes. This is how there can be a housing shortage (due to underlying demand vs underlying supply), yet property prices fall (due to an imbalance between effective supply and effective demand).

So when talking about a housing shortage, there are two numbers to understand for their own specific purposes:

1) Level one supply and demand - this is underlying supply and demand - this is the most commonly referred to and discussed by most property market commentators, media, politicians, etc. This is useful for long term town planning purposes for local councils to determine infrastructure needs.

2) Level two supply and demand - this is effective supply and demand - and this is the key determinant of property market prices - and this is how property markets can go from being a buyers market to a sellers market (and vice versa).

The 150,000 "shortage" referred to in the headline above is based on underlying demand and underlying supply - many who do not understand the basis and purpose of the number, misinterpret this number as a shortage of effective supply over effective demand, then use this to argue that property prices will go higher due to the shortage. This is a very common misinterpretation of the 150,000 number by many. There was a recent news article about the higher risk of a property price crash in NZ - many of the comments made on the article stated that a property price crash was not possible due to the widely reported and well known housing shortage in Auckland.

This is very commonly confused by many who don't have a deeper knowledge of prices in free markets with respect to residential real estate. Here are some economists who also missed this point:

1) in New Zealand - https://www.interest.co.nz/property/97513/auckland-councils-chief-econo…

2) In Ireland - https://www.independent.ie/business/irish/there-is-no-property-bubble-t…

3) in Australia - https://www.smh.com.au/business/nsw-housing-shortage-at-unprecedented-l…

Excellent post and perfect examples of how there is always a "shortage" of housing while a bubble is inflating. Its the same pattern every time. When people expect the price of an asset to rise in the future it is in more demand than an asset that is expected to fall in price.

During a bubble retirees delay downsizing. Investors buy with low yields. Owner occupiers and happy to hold that second property to use on the weekend. FHB over leverage to get a foot in the door. And when it turns, all those trends reverse.

"When people expect the price of an asset to rise in the future, it is in more demand"

That recent upward property price movement reported in the media attracts non owner occupiers of real estate and influences the future price expectations of these new entrants. These include capital return oriented property investors , as well as short term property traders with the buy, renovate, resell strategy, as well as speculators. It creates a positive price feedback loop. This was clearly evident in 2015-2016 when there was lots of bidding competition at property auctions in Auckland. This created a fear of missing out (FOMO) by owner occupiers, so they felt compelled to bid even higher prices where they could. These conditions create what is commonly known as a sellers market where the bargaining power sits with the seller of the property due to the large number of interested buyers.

This article also uses the reported housing shortage in Auckland in justifying why there is a low risk of property prices in Auckland falling by much.

"Fourthly, our population growth from migration has been twice as fast as Australia, Britain, Ireland and America over the last decade. Other countries with flat to falling house prices, such as Spain, Japan and France, also have flat to falling populations.

Fifthly, we started the Global Financial Crisis with a structural shortage of houses built up over 30 years of systematic under-building connected to the end of state house building, the end of Government subsidies for home loans and house building, the onset of restrictions linked to the RMA and a growing reluctance by both the Government and councils to fund new infrastructure for houses."

https://www.newsroom.co.nz/2019/07/18/686320/our-armour-plated-housing-…

For Auckland, taking 33% of a median household income (which is considered affordable by banks for debt servicing), or $600 per week, means they could service a P&I mortgage of $486,544 at a 4.0% interest rate for 25 years. With the current LVR of 80% for owner occupiers, this means a purchase price of $608,180 in Auckland - this "affordable" purchase price is 28% below the current median house price in Auckland. Furthermore, for a family on a median household income in Auckland, saving 10% of their gross income each year (in addition to paying rent) to save for a house deposit of 20% or $121,636 - it would take almost 13 years to accumulate this amount.

At the current median house purchase price in Auckland of $850,000, and an LVR of 80%, a median household income family in Auckland, would need to spend 46% of their gross income to service a P&I mortgage at 4.0% for 25 years. Furthermore, for a family on a median household income in Auckland, saving 10% of their gross income each year (in addition to paying rent) to save for a house deposit of 20% or $170,000 - it would take almost 18 years to accumulate this amount.

" a median household income family in Auckland, would need to spend 46% of their gross income to service a P&I mortgage at 4.0% for 25 years"

And become a mortgage slave

The absurdity of running a high immigration rate which is one of the highest per capita in the world.

People living in garages, rent going through the roof, housing shortage, an infrastructure deficit and a carbon emissions targets that are total CO2e not per capita.

And so many renting those garages off immigrants. I never thought landlording was an area where there was such a shortage we had to start importing them

You gotta say the comments section of interest.co.nz is such an extravaganza of xenophobia and a magical display of filling up gaps in one's theory with thin reasoning.

Because mentioning that NZ has an extraordinarily high immigration level is xenophobia. Right.

Some are but some just have bad reasoning and believe low immigration = housing shortage solved or mitigated. The rest is both.

Blowjoy,

Your comments are out of place.

I have no problem with immigration and I made no comment about excluding any specific people from immigration.

I simply stated that the immigration rate is very high and is thus having adverse economic effects.

The immigration rate could be managed down to a more sustainable rate that benefits everyone.

Managing down to the required level s good in theory. It is more complex than installing a counter at the airport, as you would know.

A red stamp with application declined... even you could operate that.

That equation needs to be 'net immigration' = 'housing shortage solved' but there is another solution - remove all housing consent process (but that has many ramifications).

Many of the comments that simply point out that NZ's unusually high rate of immigration (it has been high for 70 years) is not helping NZ keep up with other countries economically are made by people like myself: an immigrant with a visible immigrant family. True I do find some of those who agree with me are xenophobic and that is very exasperating. Those who want more immigration are predominately out of touch with reality or wealthy and looking for services provided at 3rd world prices or lazy businessmen unwilling to train Kiwis.

Xenophobia is not an accusation that should be thrown around willy-nilly, lest it's used as a silencing tactic.

Which posts would you cite as showing xenophobia, and how would you explain that they are?

It is used in attempt to silence, but it has worn very thin

Too many people, not enough houses that they can afford, maybe stop adding people for a while. How is that thin reasoning?

And throwing around words like xenophobia will only induce mass yawning. Explain again why we cannot decide how many come into this country.

This is what National would do anytime Labour mentioned immigration, accuse them of being xenophobic. Cheap cynical tactic to distract from the money National and it's mates were hauling in. What's wrong with questioning the quantity an quality of immigration. Why shouldn't we be wanting to grow each NZer's share of the pie, instead of just growing the pie?

I'm so sick of people attempting to stifle a discussion about the rate of immigration by trying to claim xenophoboia.

The vast majority of people concerned about the RATE of immigration are not xenophobes. They are not saying "No immigration". The concern is that the past two governments have drastically increased the rate of immigration with no actual plan on how to provide the infrastructure to support increasing population.

I'm not actually concerned if immigration levels stayed the same IF there was a plan to ensure the housing, schools, hospitals and other services were in place to support the increase in population. While neither government have shown a willingness (or the ability) to actually fund or implement the needed infrastructure required, the only option left is to look at decreasing the immigration levels (at least temporarily) to allow infrastructure to catch up.

Kiwibuild is dead. The reserve bank is now under political control. Get ready for Kiwi Bank to become the New Zealand's answer to Fannie Mae. How else will there be any buyers for all the +$650k new houses already built and soon to be built all over Auckland? Elections are hard work for the government when the property market is going south. Just like Radar I can hear the choppers coming.

This headline should be called out for what it is - misleading advertising. Those that make these statements should be held to account and prosecuted under Fair Trading Act. Exactly the same sort of spruiking is going on in Australia by various interested parties. Its bordering on criminal

I have children that owned property by the time they were 20 and 21.

Rented them out and positively geared and now have equity that will buy them a far better property.

One did it going thru Uni and working at night and weekend.

Property is the best vehicle to get ahead in NZ but you will not get ahead by sitting on your butt and moaning about prices and doing nothing about it.

Take advices from people who have been successful in business or investing and that is how you will get ahead rather than listening to the doom and gloom merchants on here.

Prices will not crash sufficiently to enable you to buy a home, it is as affordable now as it is going to be going forward.

If interest rates do go lower, people including investors will be buying as the rental returns will be even better.

'Rented them out and positively geared" I am finding this hard to believe unless you topped them up with cash or they bought in places like Tokoroa and rent them out to the NZ Govt (aka Housing NZ). Post some figures..

Paid 215k and gv now 395k was rented at 380 pow a few years ago.

Paid 255 now worth 315k currently rented for $380 pw

So saved 40 - 50k deposit working part time by the age of 21 ?

Can I get some advices.

Lived at home and so had no costs apart from own entertainment.

Was working at night and weekends so easy to save.

One has saved another $50k so looking for another although bit harder with the changed LVR rule.

He’s has a student loan to pay but he has paid off a major portion of it now.

Yes it does help having parents who are professional investors, but that is what I constantly say, take advice from people who are successfully investing!

And what about people who don't have wealthy parents? Or whose parents live abroad, so there's no chance of living with mommy and daddy while they save up enough cash for a deposit? Or who don't have parents at all?

It's not fair to assume that everyone has access to the things you mentioned, and blame them for not working or thinking hard enough.

So you are basically (financially) support your children for not charging rent, utilities, internet and food costs. it's a big call to assume that everyone can support their children while they are saving to buy their own investment properties.

If property investors are buying in areas with low valuations, high yields then this a more attractive alternative. Many living in high priced areas are rentvesting and buying in locations with low price points & high yields.

CN, we buy property under true market value!

From sellers with one or some of the 7 D's ...

7 D's. One of them drunk? Saw that years ago in my time in real estate, it was around the time that I realised this was not the place for me

In 2017 the Weekend Herald revealed a tutoring video by Fong was being supplied free to members of the Auckland Property Investors Association (APIA).

It encouraged investors to look for the "seven Ds" - targeting deceased estates, desperate homeowners facing foreclosure, developers on the brink of bankruptcy, divorcees and "dummies" who didn't know the value of their home.

https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=12247644

https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11…

https://www.tvnz.co.nz/one-news/business/property-investment-coach-labe…

Here is one such example of buying under market value that reached unwanted media attention by the buyer (for obvious reasons) - https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11…

Or this one - https://www.newstalkzb.co.nz/news/business/disgraced-former-real-estate…

Someone else's loss is someone else's gain. Seller beware ...

"My children saved up and bought their own home completely by themselves apart from me paying for their food and bills and insurances and washing their clothes and...."

And your point is?

We are parents that want our kids to be financially secure and they are!

Is that a problem with you?

Why is it that a lot of people in the construction sector are now stating that work is starting to dry up. Whereas a year ago firms were crying out for workers. Tradies are now contacting them looking for work. Is this an exception or the norm. Perhaps others can share some insight?

at 4:18 I was advised that a client has just gone into in liquidation. (Electrician)

Kane02, the larger construction projects are bringing in a lot of their own labour from China / SE Asia. The smaller renovation works has to be slowing down as the is no margin in buy, reno and flip in a stagnant market. We have also had an immigration policy fast tracking all trades people in place for a few years (over supply). It's not surprising, its tragic as most trades folks don't want boom and bust, they want steady work like all of us.

An immigration policy that is certainly not helping my son the apprentice builder. Labour from China / SE Asia is brought in because it is both docile and cheap.

Is my comment xenophobic? Does it make a difference that he a very dark PI?

The other issue is that with boom bust cycles, tradies are often on short term contract. This makes life unstable. Hard, or next to impossible to buy a house, or get finance for anything. One minute can be earning a lot. Then next minute out of work.

Some industries are more cyclical in nature & subject to larger boom bust cycles, and impact the people who are employed in these industries.

Commercial real estate development & construction, and mining are two such industries.

There are two different parts of the market in the construction sector from a high level perspective. There is a commercial sector which encompasses everything from residential, commercial, through various Government projects. Then there is the house building sector which is houses and townhouses or similar. I primarily deal with commercial work, and the workload is high. I deal with some housing but I do not have a good sense where the builders and tradies are at, but I suspect that is where there are people running into issues.

The RBNZ lending statistics suggest that everything is fine. Perhaps there will be some bad news in the Q2 statistics? I could only speculate.

Unfortunately, I think things are going to get worse before they get better.

I believe a sizeable part of the problem is structural: NZ is becoming an increasingly sought-after country to live. People see it as a safe haven - away from threats like nuclear, racial, public health, terrorism/bio-terrorism, corruption, environmental degradation etc.

So people will seek to come here in growing numbers, while those here will be less inclined to leave.

We are going to have to get used to sustained pressure on our resources - and not just our housing resource.

A pity - because many of us have liked living in a country with low population density and sufficient resources (including affordable housing). But, in my view, that's unlikely to continue over coming years and decades.

Major challenges lie ahead..........

TTP

It doesn't really matter how many people want to live here, if we limit immigration numbers.

Not sure its any harder then that.

Japan proves that indeed, that's all there is too it. People from a given country have the ability to decide what they want...if their politicians are honest enough to accept that and act on it, rather than pay lip service to it while doing the opposite. Ideally, immigration policy should reflect the will of New Zealanders. But politicians of every stripe probably know better, ah well.

Geepers rickstrauss you cannot compare nz to japan one iota imo

All we are comparing is the rule set around immigration. There's no reason you cannot compare two countries' rules governing immigration.

The sole point I was making is that immigration policy is up to a country and its people. It's not an impossible task.

Japanese and us kiwis have polar opposite views and attitudes about work and work ethic and virtually everything else. Plus we have a comparatively tiny population versus land mass

Well, lucky we weren't comparing those eh.

None of those has any bearing on whether the citizens of a country have the right and ability to drive immigration policies through their politicians. Or...how would you suggest those limit a country's people's ability to drive immigration policy?

It has everything to do with it. You either cant understand or refuse to understand that policies and practises that work in Japan will not fix NZs problems.

Come on swapacrate,

Immigration has been a highly-charged controversial issue and a political hot potato for as long as people have boarded ships and planes!

Were you born yesterday?

TTP

By your comments you were born today. It may be highly charged, but you talk a lot about infrastructure, and everyone wants to come here. So what?

Reduce immigration to highly skilled and the number that is sustainable for our economy and country, it is that simple. The UK has a mandate of 100,000. If a country of 60 million can have a mandate of 100,000 and has the workforce and the businesses that it has, then 10,000 to 20,000 immigrants will be a reasonable amount.

The rest is hot air.

Hi swapacrate,

Just as I suspected........

You were born yesterday.

TTP

Well done TTP, great point I stand corrected by your eloquence.

By the way I have a balloon company if your interested.

As highlighted by the NZ Initiative in their 2017 report The New New Zealanders three of the top occupations in the skilled visa numbers were Chef, Retail Manager, and Cafe or Restaurant Manager. I'm not sure what the theory is as to how importing lower-skilled workers for these jobs will ultimately boost NZ.

At the same time, in a table presented on the same page of the report, three of the top occupations for those leaving NZ were Managers, Professionals and Technicians and Trade Workers. Intuitively, replacing skilled professionals with hospitality / service workers does not seem like a recipe for increasing national productivity.

What have our politicians been doing and who precisely have they been doing it for?

We do limit. Even the most enthusiastic pro-immigrant economist accepts need for a limit. What we do not have is a sensible debate about the limit. Nor any debate about the major difference between low-paid immigrants and high-paid immigrants. The former handicap our economy by leaving Kiwis untrained and underpaid and are a tragic cause of endless cases of rorts and corruption.

We don't limit it by enough. I think we have similar goals in terms of higher skilled immigrants, maybe our numbers may differ.

Businesses want their cake and eat it, but if a business is not sustainable by paying a decent wage and businesses need to pay immigrants low wages and cannot pay NZers enough then maybe they should readdress their business model.

10,000 to 20,000 highly skilled people is plenty, train up NZers and become a highly skilled economy. Would be great to use the internet economy and become of global hub for technology, not to mention other high technological exports.

Hey but we have unaffordable housing driving our economy, what could go wrong.

Youre right on the money swapacrate

We have immigration at an unsustainable rate, only a very small portion of those immigrants have money to buy a house when the arrive, hence why sales rates in Akld are at record lows while the population swells. The vast majority of immigrants end up flooding our contact centres, taxis and coffee shops and in doing so suppressing wage growth.

The government cant pull the pin on immigration as the contribute to consumption growth but as we are seeing that positive is erased by the impact on infrastructure and transport.

We saw yesterday that unemployment is increasing so all these low skilled immigrants are not required.

If we made immigration only for skill shortages, that would restrict immigration to value add immigrants only and drive up wages at the low end, lessen stress on infrastructure and housing. Problem solved!!!

How do we measure a housing shortage? You can build all the 600k homes for Africa, but that’s no use to the battler families with four kids on the average wage. We need a massive state housing programme.

A decently built $600k 3 bedroom house thats not in the armpit of Papakura (or similar) would be fine. Battler family with 4 kids on the average wage.. perhaps they should have tied a knot in it after the first two.

Most did, 4 kids to a family is not that common anymore

Headline for this article should be... NZ unable to cope with high immigration policies.

Fear not, the new government promised they will drastically reduce immigration

Same old tripe. Supply is in excess. But rental in deficit.

Dying to hear Joe Wilks weigh in on this.

According to his thorough investigations, rhetoric of a housing shortage in NZ is the lone voice of the banks.

Calling in here infrequently now but pleasing to see that from 153 comments to date the IMMIGRATION factor is explored widely and garners a high support thumbs up in most cases.

Time for the Gummint to take action.

A recent (11 July NZ Herald) from Gwynne Dyer comments that “a 20% immigration rate over 10 years would generate a huge political backlash in almost any country on Earth”

Why have we not had one already?

Jacinda on Q&A last night. Was very good a coming up with numbers but could't tell us how many houses will actually be built come next election. Well I will do the numbers for them based on what they have done so far which is 200. My prediction is that they will complete 1000 houses before next election when they said they would have completed 16,000. Kiwibuild is a waste of time, there is a reason that only 5% of the homes being built are "Affordable", not enough money in it for developers. Much easier to solve the problem overnight just using the power of a pen, kill the high immigration numbers and the problem is solved.

I do not think it is about the shortage. It is actually all about affordability.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.