In all the heated political exchanges earlier this year, it was speculated that potential impost of a Capital Gains Tax was having an impact on the housing market - particularly for investors.

The logic ran that would-be investors were holding off buying houses till they saw what, if anything, the Government might be planning by way of a CGT.

Following this theory, therefore, the torpedoing by the Government in April of any CGT might have been expected to rekindle enthusiasm in house buying - particularly for investors.

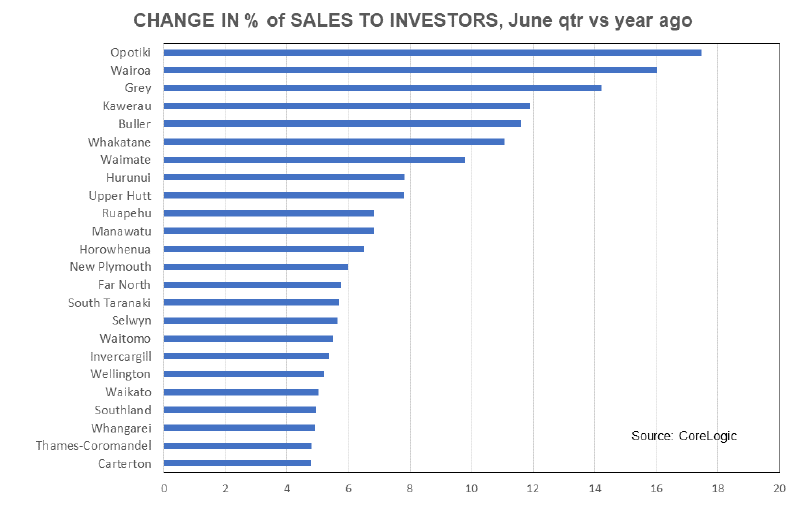

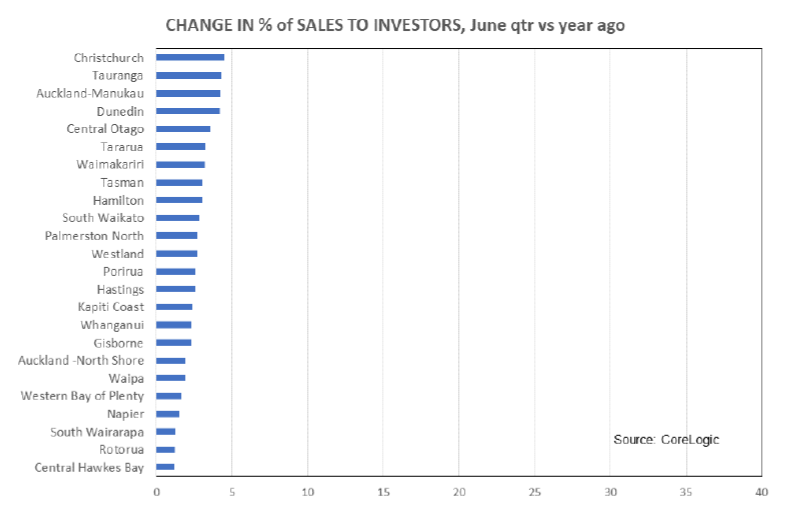

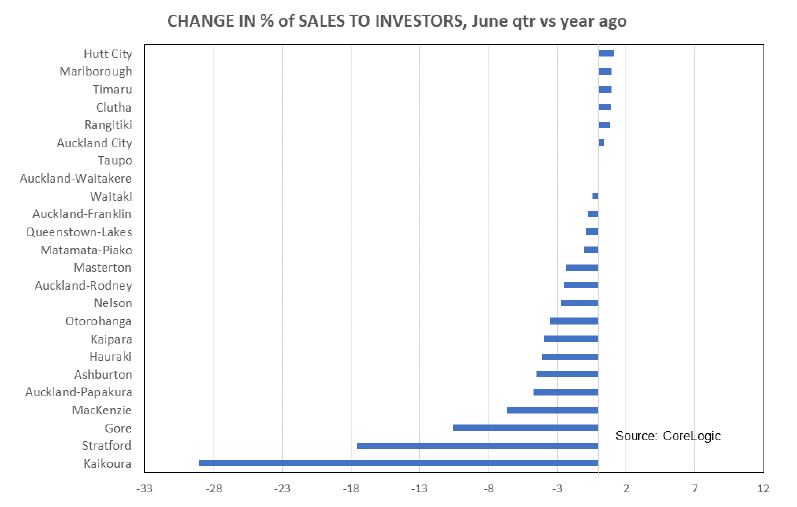

But in his Weekly Overview, BNZ chief economist Tony Alexander has had a crunch of the latest CoreLogic house sales for the June quarter and compared this with the same quarter a year ago.

As he explains: "I have calculated for each of the 72 locations covered, the change in the proportion of sales going to investors between the June quarters of last year and this year." (See three graphs highlighting the results at bottom of this.)

Why? To see if the confirmation of no capital gains tax might have "resurrected" investor interest.

In fact, Alexander's calculations show that in 53 locations sales to investors have increased.

"That is a lot more than the 15 where the proportion fell and four where things remained the same," he notes.

However, he says the figures don't in fact indicate that there's been any "rush of buying" by investors.

"The gains are in the regions where price rises have been strong and remain firm," Alexander says.

"But it is interesting to note that talk about speculators being greedy and such-like has died down as Auckland has flattened."

Alexander says he would expect that if investors were "jumping back in" he would expect to see it in Auckland.

"...And that has not happened."

He says among the seven sections the Auckland market is split up into, in Manukau 4% more sales went to investors in the June quarter than a year ago, and on the North Shore 2% more went that way.

"But these are small changes and in Papakura sales to investors fell 5%, in Rodney they fell 3%, and in Franklin they fell 1%. In Waitakere and Auckland City there was no change."

Alexander concludes therefore that "you cannot run the argument that the striking out of a CGT has reinvigorated investors".

Mortgage borrowing figures are not wholly indicative of trends in the housing market, since they don't take into account the case where houses might be bought without borrowing, but certainly the Reserve Bank's monthly series on mortgage lending by borrower type has not suggested any sharp uplift in investor interest since the CGT decision was made.

Also in his the latest overview, Alexander comments on housing shortages.

Kiwibank economists recently put the shortage of houses at about 130,000, and likely to rise to 150,000 in a year.

Alexander noted that over the past five years the NZ population has grown by 458,000 according to Statistics NZ estimates.

"At an average 2.7 people per house this meant we needed to have seen an extra 170,000 houses built these past five years to house these people. But the housing stock has only risen by 126,000.

"So whatever number you had in your mind as the national housing shortage five years ago in 2014, you need to boost it by about 44,000 now.

"Actually, the rise in the shortage will be even more than that because post-GFC the proportion of housing consents issued which are for retirement units has jumped from 2-3% to 7%. Not many retirement units will house children. Many will have just one occupant."

60 Comments

Some spruikers on this website provided the view that dumping CGT would restart the market. It clearly hasn't.

You can say this because a bank economist says so without any 'real evidence' as to the impact the change has had on investor behavior? Without measuring motivations / drivers related to the existence of CGT on actual behavior, Alexander's conclusion is amateurish and not worthly of much consideration. Bank economist he may be, behavioural economist or researcher he isn't.

Behavioral researchers (and economists) will explore qualitatively and measure quantitatively the extent to which attitudes influence behavior. Highly relevant.

Alexander says that not changing CGT has not reignited investor interest in house buying. He then goes on to make an "assumption" that the "threat" of CGT possilby made investors modify their behavior. Now that the "threat" has passed and investor activity hasn't increased, he makes the "conclusion: that CGT has no influence on investor behavior.

That's not research or a robust evidence-based case. That's better known as stringing together a narrative based on loose and inconclusive evidence.

This just proves what we all knew already. A large portion of investors have been purchasing for capital gains, not for yields.

And once the capital gains party ends (as it has in Auckland) investor interest will dry up across the country. Now that overseas buyers have been neutered (due to capital controls and OBB/AML) it just leaves FHB who are stretched financially. 40%+ are buying with <20% deposits. Approx 50-70% of FHB need parental help for their deposit. How willing will banks to be lend to borrowers with minimal equity with the increasingly likelihood of price falls spreading?

Its not looking pretty.

" A large portion of investors have been purchasing for capital gains, not for yields. "

There were 116,000 tax filers claiming tax losses resulting from their residential leasing businesses in 2016/2017 tax year. That is about 22% of rental properties owned by private landlords in NZ by my estimates. (i.e. excluding Housing NZ owned properties). Most likely to be properties located in the lowest yielding areas such as Auckland, and Queenstown.

Refer: http://tenancieswar.nz/2019/02/11/116000-loss-making-rental-property-ow…

So this is the same guy who was buying an apartment and renovating in central Auckland in mid 2016 (pretty much at peak), and another not long before that. In 2017 he said he only saw Auckland prices keeping on rising at an unpredictable pace over the next few years, and not to be concerned about the Auckland market. Let the record show he’s being proven wrong. It’s recorded in his speech here, about 6 mins in.

https://youtu.be/A-psmZvMT3M

No capital gains on the radar and more likely some capital losses, so specuvestor's are all sitting on their hands. Genuine yield investors probably have trouble accessing more capital and probably a bit put out at the new tenancy regulations and changes. AML laws and capital controls have slowed that part of the world so whats left....Kiwis working and paying tax in NZ.

The failed CGT has probably just caused some of the investor seminar debt stack/tax off set mob to wake up and smell the risk. To be avoided on anything but a rising market which we are no longer in.

I remember a few years back Tony compared the NZ housing market to the All Blacks. This was when Auckland real estate was starting to dip a wee bit. He stated that the Chinese were the best supporters because they got behind their team and supported it even if the team were having a few bad results. Tony needs to get out there with his face paint and flag and start supporting his team! (If anyone recalls or has a link to this particular newsletter I'd love to re-read it)

I'm guessing a tax is not as directly influential as the marginal buyer. (foreign buyers out of the equation) Prices come down, everybody knows. People used to buy anything due to FOMO and now they can be a little more picky and wait until all their boxes are ticked, meanwhile prices are getting cheaper.

"I'm guessing a tax is not as directly influential as the marginal buyer"

Especially when that tax didn't even exist, to begin with. It's like saying that "PAYE rates didn't increase this year, which will bring increased stimulus to the property market". It's retarded.

"Actually, the rise in the shortage will be even more than that because post-GFC the proportion of housing consents issued which are for retirement units has jumped from 2-3% to 7%. Not many retirement units will house children. Many will have just one occupant. "

This seems some bizarre logic. A lot of these retirees will be moving out of their old family homes, freeing up often large 3-5 bedroom houses.

The waive of retiring boomers will free up a lot of under occupied housing stock.

Yeah the retirees will still need/demand maximum price to afford the retirement unit + operating costs.

Only help for FHB is if it results in an over supply and encourages prices down overall.

Give it a few more years after that and there might be a lot of inherited wealth demanding more and pushing up prices again.

Absolutely. A patently absurd analysis of the situation. Just looking at my immediate surroundings, we have 3 houses out of the nearest 6, housing people over 70 who are likely to be in retirement homes in the next few years. Every one of them is 3 beds or over and none house more than 2 people. The one with a couple is a 5 bedroom house! Talk about efficiency - that is 11 bedrooms housing 4 people, probably with only 3 bedrooms in use.

The real situation is that underutilised housing is a ticking time bomb which is likely to see dramatically increased supply over the next couple of decades as the early boomers go into retirement homes.

It certainly hasn’t reignited my interest in NZ housing investment. In fact, apart from traditional safe haven investments, I’m looking beyond NZ and Australia for new investments now. I think the bad outlook for the NZ and Australian property markets is going to impact the sharemarkets, and wider economies heavily. It’s not that I don’t want to invest here, it’s just not a great time to buy most assets here, CGT or not.

I can see why many people are not investors in the housing market!

Investors are still buying around NZ if the yield is good and with upside, which is always what the successful investors do.

As I have said many times, I don’t buy negatively geared property as I don’t believe I should be subsidising tenants living costs, to the detriment of our own.

The capital gains tax not getting approval was only one of a number of things that has been at play in regards to investment in property.

This non performing government has come down hard on many investors to the point that they can not be bothered buying more until a decent government gets back in and supports what the investors are doing.

One of the biggest things that is detrimental to many investors is the ringfencing Of losses and therefore will lead to less tradesmen being employed by the investors as no tax deductablity ever for many.

Was talking to our plasterer this morning and he was saying that he knew many subbies that were quiet and looking for work, and I am telling you it has a lot to do with this ringfencing!

Anyway, I hope Jacinda is having a great holiday in Tokaleu on the taxpayer.

"One of the biggest things that is detrimental to many investors is the ringfencing Of losses and therefore will lead to less tradesmen being employed by the investors as no tax deductablity ever for many. Was talking to our plasterer this morning and he was saying that he knew many subbies that were quiet and looking for work,"

This might ultimately lead to a lower cost of labour in the construction industry - lots of subcontractors looking for work and willing to do work at a lower price. (i.e lots of supply of subcontractors, reduced demand for subcontractors)

'Investors are still buying around NZ if the yield is good and with upside, which is always what the successful investors do.'

Sure, and fair enough too.

When I comment I am mostly talking about Auckland. And in Auckland, it's extremely hard to get good yield (ie. more than 5.5 - 6% gross).

FYI, a valuation comparison of residential property located in Auckland and Christchurch:

1) Auckland - house price to income ratio range is 8.2 - 9.9x, gross rental yield ranges from 2.1% - 4.5%.

2) Christchurch - house price to income ratio is 4.94x, gross rental yield ranges from 5.8 - 6.4%

Refer:

1) https://www.interest.co.nz/property/house-price-income-multiples

2) https://www.qv.co.nz/property-trends/rental-analysis

For an investor web site Interest carries very little traffic/commentary on the stock markets. Its all property, property and property. The NZ market and ATM in particular have been on an amazing run and with the apparent disillusionment in property atm, future interest drops and the largely untaxed gains in shares the stock market is worthy of commentary. Kiwis surely have got over 1987 by now.

Every point you've made is incorrect. Lending on shares held is call margin lending. There are publicly available lists of how much banks will lend against shares. Of course the amount is a lot less than housing, but that is because a lot of mortgage lending is irresponsible and involves banks taking on too much risk and contributing to pumping up house prices.

Shares are ownership in a business, a lot of shares actually produce profits and pay dividends. That is the opposite of gambling. With shares you look at the number of shares owned rather than the day to day price. The price only matters when you sell, and unlike property shares are very liquid and easy to sell.

Given that a lot of Kiwisaver funds are filled with various shares, and ETFs then you must also consider Kiwisaver gambling.

Can I walk into a Bank and ask to borrow money to buy shares and give them a security over the shares being purchased?

I would doubt it, they would want mortgage security over a landed property!

Buying shares from someone else does not really aid any comps y with additional funds, except potentially makes the company worth more on paper, when it actually isn’t worth anymore than the day before.

Of course KiwiSaver is gambling, if it is invested In The sharemarket etc.

At some stage the equities market is going to tank, it is not if, it is when!!

> Can I walk into a Bank and ask to borrow money to buy shares and give them a security over the shares being purchased?

Yes. This is how the banks margin trading system works, I dunno about the walking into the bank thing because it all seems to be a self service online dealie nowadays but when you are given access to margin trading a portion of your shares become unable to be traded and act as collateral for the shares you buy on margin.

dictator,

You are wasting your time with TM2. His ignorance of the stockmarket is profound. Now,ignorance by itself is ok,as all of us are ignorant in many areas of life,but what is not ok is a refusal to learn.

just leave him to wallow in his ignorance and those of us who know something of the stockmarket will just get on with our lives. Like many investors,I have a foot in both camps.

I agree about the lack of commentary, and with a 340% gain for the NZ50 since March 2009, I certainly wouldn’t count on it being anywhere near that over the next 10 years. If/when the property market tanks, the sharemarket will do the same. I still like some US financials and other companies with pretty low PEs and good earnings, but overall the markets are looking pretty expensive. I’m liking the outlook for gold, which has already gained substantially this year after 10 years of lagging.

I agree about the lack of commentary, and with a 340% gain for the NZ50 since March 2009

FNZ is only up approx 183% since March 09. I see how you calculated that the market has appreciated by 3.4x, but FNZ is not quite the proxy you would have liked.

JC, that's an ETF, check the actual NZ 50 Index graph, which bottomed out about 2470 in March 2009. Now 10,878. A bit more than 340% gain. Sure, nobody likely picked the bottom but we're speaking generally here. That's a huge gain over that time for the market, unlikely to be repeated in the next 10.

Are you calculating it including reinvesting the twice yearly dividends.. or are you comparing a gross index (nzx50) with the capital gains but ignoring the yeild of a dividend paying etf?

https://smartshares.co.nz/types-of-funds/smartlarge/fnz only has it calculated for the last five years, but 15% annualised return (after 28% tax and etf fees) is pretty close to the return of the nzx50 over that time. Google tells me nzx50 was 5110 on 1 Aug 2014. 5110 x 1.1501^5 = 10282. And nzx50 is currently 10879.

"No revival seen in housing investor interest"

Why is this a news ?

No amount of manipulation /fake / vested News and Views can change the current downfall for number of reasons already discussed, so many time before in the same website by so many.

Many readers, who comment and are advising that market will move up or willnot fall is actually thinking aloud and trying to convince themselves and not others, who are aware of the ineveitable fall.

If wishes were horses, beggars would ride !

"So whatever number you had in your mind as the national housing shortage five years ago in 2014, you need to boost it by about 44,000 now. "

Developers are trying to build in Auckland, however there have been a number of cancelled property development projects in Auckland.

Insufficient pre-sales levels reached (at their desired selling price level), leading to inability to obtain development financing, leading to project cancellation.

1) https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12…

2) https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11…

3) https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11…

4) https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11…

If there was a housing shortage in Auckland, these projects would have been sold out due to strong demand.

One of the issues is that these projects are too expensive for the local population on local incomes and hence there is no demand at these price points.

If these projects were priced at the $600,000 price range, there might be more demand and the projects might have been sold out. However at that price point, the project is economically unviable for the developer, possibly due to a high price paid for the land.

If a 3BDRM apartment in these projects were priced at say $300,000 each, they would be selling like hotcakes, as they would be affordable to the local population earning the local household income.

This issue is not a shortage of housing, the issue is a shortage of AFFORDABLE housing.

Or if the developer is unable to sell all their units, they might have cashflow problems and the lenders call in the receivers. 17% (16 units / 92 units ) of the units remain unsold.

If the receiver cuts the price on the remaining units in order to get them sold, then the buyers who bought prior to the receivers coming in, might experience an unrealised loss due to the lower comparable transaction in the same building. That is not an issue if the owner can hold on, but if the owner needs to sell for some reason, then they may need to crystallise that loss. If the price fall is sufficiently large (say 20-30%), those owners might even be in negative equity.

https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12…

In terms of TA's arguments on supply, a household occupancy of 2.7 is too low. I don't know what the magic number is, and it will vary from place to place, but I would suggest in Auckland the number should be at least 3 or 3.2.

Why?

Because in Auckland population growth will be coming, to a large extent, from the larger households that characterise PI families, or immigration from Asia. Many people who come here from South Asia live in homestays or live with relatives (I know this from a lot of the voluntary work I do).

Also factor in that many young people are staying at home for longer.

The 2.7 people per dwelling is used to calculate underlying demand for houses in Auckland without any consideration for property prices. It is used by town planners to plan for city infrastructure such as sewerage, public parks, roads, schools, etc

Don't know how you would adjust the 2.7 people per dwelling for changes in property market prices to calculate the effective demand for houses. For example at the current Auckland median house of $850,000, is 2.7 people per dwelling the right number to use? Should it be 3.0? Should it be 3.2? Should it be higher?

How should the 2.7 people per dwelling be adjusted if:

1) Auckland median house price is $600,000?

2) Auckland median house price is $1,000,000?

3) Auckland median house price is $425,000? (a 50% price fall as believed by some commenters on here)

To try and create an effective demand curve (as they do in basic economics with the demand supply curve) would be too difficult and likely to be inaccurate. Perhaps some economist can enlighten me on how they would calculate the effective demand curve.

Given that market prices change rapidly, and infrastructure planning and construction is a multi-year project, this would not be a useful way for town planners to determine underlying demand.

Auckland real estate prices go roughly the same way as my Queenstown investment. In zigs and zags. Both Auckland's and QT's zigs up have been far higher than the zags down over the last 10, 20, 30, 40 etc years. Check the NZ property price graph since the 1800s. All those people criticizing TA, and taking great delight in their false perception of his "wrongness" have their heads in the sand, or are only pulling TA's leg. Myself and TA both expect property prices to carry on with another zig in the near future, as they have done over the last century or so. These people seem to come out at the appearance of every zag, as if this is the zag that will send property values permanently plunging, when history shows that this is just the property cycle. The present is the best time to buy, as any future falls in value will always be recouped over a period of time. Over my last forty something years of interest in the rental property market, this has always been shown to be correct.

"The present is the best time to buy, as any future falls in value will always be recouped over a period of time"

Regarding Auckland and Queenstown residential property markets - that is acceptable if the buyer is a cash buyer, or requires a small amount of debt to finance their purchase, and can hold on throughout the zag down.

What if the owner occupier buyer has the minimum 20% deposit, and needs to borrow 80%, and the debt servicing consumes a large part of their gross household income (say more than 45%)? If there is a recession, does this buyer have sufficient financial flexibility to hold on throughout the zag?

Here is the story of an owner-occupier who was unable to hold on during the last zag down in 2009 / 2010 GFC. https://www.stuff.co.nz/business/money/64093828/

"Now they are living with their 16-year-old son in a rental property."We've lost everything, our whole life's work. Can you imagine being almost 60, and all of a sudden you owe $800,000? What's our retirement going to look like?"

That single financial decision to purchase with a lot of debt has not only caused financial pain and loss of financial security, but also taken a psychological toll on the whole family as well.

Here are some more stories of property owners unable to hold on during the zag down in 2009/2010 - https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10…

We welcome your comments below. If you are not already registered, please register to comment.

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.