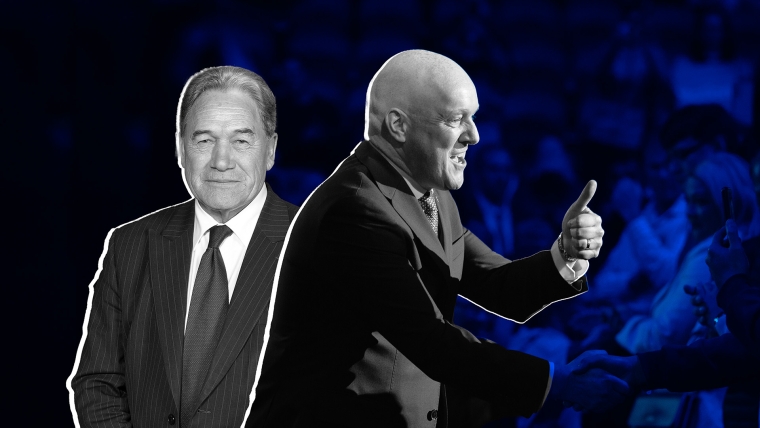

Foreign investors who bring significant capital into New Zealand will be allowed to buy high-value residential properties by the end of the year, Winston Peters says.

The New Zealand First leader has softened his opposition to foreign citizens purchasing homes, and is willing to carve out an exemption for eligible investors.

Peters told Interest.co.nz the Foreign Buyers Act would remain unchanged, but other reforms to investment visas and rules were likely to be completed before the end of 2025.

“We're talking about investment. We're changing those rules and what goes with them. You have to be patient and I’ll tell you what the details are. But the Foreign Buyers Act is not changing,” he said.

“If you're investing millions of dollars, then we’ll seriously look at if you have the right to back that up with the buying of the house of New Zealand at a certain cost — and that cost is not $2 million.”

Prime Minister Christopher Luxon told reporters there were ongoing negotiations between the parties and he didn’t want to comment until a policy was ready to be announced.

“When we come out with an answer, you will hear about it, and we'll be very clear about it all. But right here, right now, we've got ongoing conversations,” he said.

“You've heard what Winston said yesterday, and that's a fair reflection of where things are at.”

Stamp duty stamped out

In an interview on Wednesday, Peters said party consultation was underway on terms that would allow major investors, such as those on the Active Investor visa, to buy high-value homes.

National had previously proposed allowing foreign buyers to purchase homes worth more than $2 million, with a 15% transaction tax to fund income tax cuts.

Peters told Interest.co.nz he wasn’t considering a revival of that policy. His plan would be far more limited, applying only to eligible investors and wouldn’t include any purchase tax.

“No, that was the National Party's policy. It was fiscally never going to work, we said so before the election, before suddenly you guys caught on,” he said.

“We're talking about investors who bring billions to this economy. They're not buyers. You're not going to get a house key just by walking in, the way that other parties believe.”

The coalition government has pursued a series of reforms to attract more capital and investors to New Zealand. However, the foreign buyers ban remains a roadblock.

Changes have included liberalising the Overseas Investment Act, establishing a one-stop investment shop, launching an infrastructure financing vehicle, and hosting a high-profile investment summit.

Golden rentals

Most relevant, however, are the changes to New Zealand’s ‘golden visa’ scheme, which offers permanent residency in exchange for a $5 million growth investment or a $10 million balanced investment.

The growth category covers three-year investments in higher-risk, illiquid New Zealand businesses or managed funds. The balanced category includes listed equities, government bonds, and commercial property, with a five-year holding requirement.

Applicants no longer need to pass an English-language test and must spend only three weeks in the country to be eligible. Nearly 200 people applied in the weeks following the announcement, and could bring in more than $1 billion in capital if approved.

However, many high-net-worth applicants are put off by the inability to buy a home in the country they’re investing in. The luxury rental market has grown but remains focused on short-term stays, not three- to five-year residencies.

NZ First appears willing to let large investors purchase ultra high-end properties regardless of residency status, while continuing to exclude most foreign buyers from most of the housing market.

This will need to be carefully calibrated, however, as opposition to foreign ownership of strategic assets, immigration, and economic liberalisation were founding principles of the party.

31 Comments

Stupid's agreeing with each other. Pumping money into housing (perhaps they are looking for the next Epstein to set up shop)?

Think smarter. "Sell' x amounts of NZ visa's per year at $XX million and be done with it.

Yes. Just sell residency. We've been doing it forever and a day anyway.

But mainly to those prepared to buy it via int'l student fees. And that worked out just peachy, eh?

But mainly to those prepared to buy it via int'l student fees.

Which has created all kinds of fraud; enriched VCs and student placement agencies like IDP (Aussie CEO earned AUD20 mio+ in 2019); and created all kinds of false illusions about the superiority of Western education.

So we sell residency...ad infinitum?

While we are doing that what do we do about providing the necessities that increased numbers of residents demand?

Happy Days for the Sotheby's team

NZ First appears willing to let large investors purchase ultra high-end properties regardless of residency status

So, you don't have to want to live here under the 'golden visa' scheme - just bring the money and park it here in an RE investment only.

These folks are so full of contradiction it's not funny.

This is much less about purchasers wanting to spend time in NZ and far more about hiding assets from purchasers tax authorities.

We have no stamp duty, no capital gains tax, no land tax and a love for trusts. How much dirty money will wind up here with almost no benefit to NZ except to plug the capital account for an undetermined period?

You just knew the 3 stooges would pimp us eventually.

What is Australia for a non-resident purchaser, 15% stamp duty up front and then 7% annually on the land value. Then, if there is any profit left after that shoeing, there is 40% on the way out. The UK is the same, China the same. But we'll lift up our dress.....

Yep, and for what reason? Do they have friends from overseas with expensive homes that they now want to off-load but cannot to the resident population at the exorbitant prices they paid for them in the heyday??

They will absolutely use rising house prices as a policy success.

I wonder how much lobbying has taken place to get to this. Many a $5m plus construction project plus land out there that were never for Kiwis.

Moan moan can't sell and been listed for years. Reopen the flood gates.

Sad.

As expected, the Interest commentariat is against it. Very unsurprising since anything that has the word "house" in it is abhorred and must be sent to hell. Nevermind that it will bring money into NZ and be a good thing for most of us.

As expected the Interest specuartie are all for it.

The super wealthy can visit and lease, rent etc. It would be pocket change especially if they arrive in a private jet. Why do the have to own and use their $$ to push up price or bail the over leveraged here. If they bring the global tax of their no doubt largesse then fine.

Example. Will Avatar tax be paid in the US or NZ?

I suppose it's unsurprising that the average man does not understand why it's beneficial for most Kiwis.

Wyvil,

I know, it's such a pain for huge intellects like yours to have to mix with us lesser minds. So, humour me and tell me-in very simple language of course- just why it will be so beneficial to most Kiwis.

Because inflation is good. Isn't it?

O ly for the leveraged. It's a kick in the jewels for everyone else.

Keynes gets it:

"The government is hoping to attract 'passive' capital - foreigners will use high value assets to park capital and keep it out of reach of countries that do have capital gains tax or land taxes. No CGT is a feature not a bug for attracting FDI. This is the playbook Ireland used after the GFC."

Just feels like we are out of ideas to actually get any real growth and progress for the country. So we resort to any old method of keeping the house price monster alive. Dropping the bright line, lowering interest rates, immigration, now overseas investment.

I'm a property investor and find this disappointing. Not because of the property side of things, it just reflects that they truly have no real initiative.

The US is in equal parts shunning or repelling international students. Australia is full. We should be out there promoting the absolute living hell out of our tertiary education sector. But here we are again talking about who can buy and sell houses.

I think I'll abstain at the next election.

Well, as a property investor, you should vote Labour at the next election for your own benefit

They are probably going to campaign on partial removal of interest deductibility. Replace a spectacularly bad idea with half of one.

We should be out there promoting the absolute living hell out of our tertiary education sector.

International education is consistently ranked as one of New Zealand’s largest export sectors. NZTE has dedicated education teams selling it.

I wonder if this includes a nod and a wink to a residences visa?

I've been trying to understand the reasoning behind the governments deliberate contraction of the domestic economy and I asked ChatGPT for other examples where austerity and FDI were used into an economic downturn. This is spookily similar to what we are doing now in NZ.

ChatGPT reply:

Ireland as an example similar to NZ. On the surface, Ireland's post-2008 recovery looks like a success story after austerity, but it’s important to unpack what really drove that recovery and whether it can be applied to a country like New Zealand.

“Leprechaun Economics” and Phantom Growth

-

In 2015, Irish GDP grew by 26% in one year — not because of real domestic growth, but due to the relocation of intellectual property assets by multinationals.

-

Ireland’s Gross National Income (GNI) — which strips out repatriated profits — grew much less.

-

Housing, health, and infrastructure remained under strain long after headline GDP rebounded.

Labour Migration

-

Many young people emigrated (to UK, Australia, Canada) during the worst years — reducing domestic pressure on unemployment but also hollowing out domestic demand.

Ireland didn’t recover because of austerity — it recovered despite it, through a mix of tax arbitrage, EU support, and global capital flows.

If anything, the domestic Irish population experienced prolonged hardship, inequality, and underinvestment — much like what austerity risks causing in NZ now.

I'm all for it. Now, tax the heck out of overseas owned land!

I think the government is hoping to attract 'passive' capital - foreigners will use high value assets to park capital and keep it out of reach of countries that do have capital gains tax or land taxes. No CGT is a feature not a bug for attracting FDI. This is the playbook Ireland used after the GFC.

Had to ask ChatGPT about the economic impact of $1 billion in FDI:

So even under more optimistic investment impact scenarios, we’re still talking about:

-

Under 1% of total GDP uplift over 3–5 years

-

Spread across the economy, so not transformational — unless targeted into sectors with wider productivity spillovers (e.g., energy, housing, tech exports)

F*ck me. This government are actually as stupid as they appear. I thought they at least had some twisted, right-wing strategy to sell all the countries assets to overseas hedge funds to 'balance the books'.

But no - this is 'Family Boost' level economics and no-one in NZ is calling them out for it. WTAF.

NZ's economy is flat because credit conditions are too tight and govt is being fiscally restrictive. This govt's thinking seems to be we (the govt) don't want to spend money, the RBNZ doesn't want to release credit controls or lower the interest rate (because they're busy fighting the last war on inflation), the govt doesn't want to give the CCCFA a bullet because Chris Bishop wants house prices to fall - but the govt still wants to be re-elected.

So why not get credit into the economy by using foreigners money. Foreigners are quite good at seeing opportunities that Kiwis can't get credit to have a go at.

Bernard Hickey keeps saying the NZ economy is housing with bits tacked on. He's right. So let the housing market breathe and let the economy rise again because no-one is trying to tack any more bits on. Exports won't do it on their own and if you let the boost from exports be wasted then more fool you. It's like trying to get up the hill without using the accelerator. Doesn't work.

"So why not get credit into the economy by using foreigners money. Foreigners are quite good at seeing opportunities that Kiwis can't get credit to have a go at."

As a rule 'foreigners' have the advantage of demand for their FX that the local government facilitates through various methods....not exactly an even playing field.

The lack of opportunity for 'growth' is underwritten not overcome.

There is something odd going on between the OIA and property investment for very high value foreigners. Is something not being slipped through between OIA and some other Act such that it does not just include very high value, say > $5mill residential property but could also include non forest farms which could be later converted as well as lifestyle blocks?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.