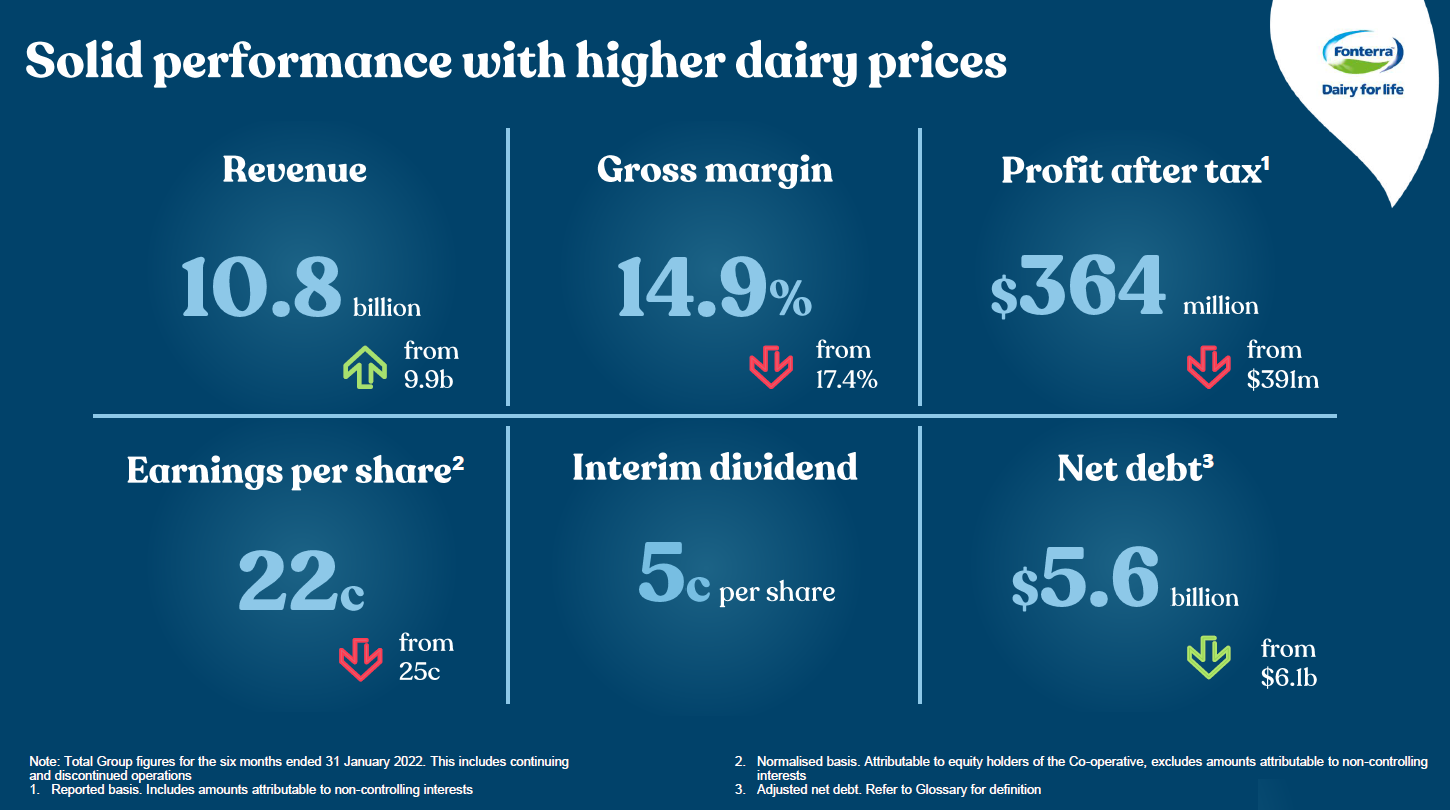

Giant dairy co-operative Fonterra has reported a profit after tax of $364 million for the first half of the year, down $27 million on the same time last year.

It has also reported "normalised" earnings before interest and tax (EBIT) of $607 million, down $77 million, reflecting the "significantly higher milk price".

The co-op estimated its cost of milk was about $2 per kilogram of milk solids higher compared with the same time last year.

Fonterra is forecasting a record price for its farmer shareholders for their milk this year of between $9.30 and $9.90 per kilogram of milk solids. But while that's great for the farmers the high price the co-op is having to pay for the milk puts pressure on its operating performance.

Fonterra chief executive Miles Hurrell said margins in the co-op's "ingredients channel" improved in the first half.

"However, the higher milk price put pressure on our margins in Foodservice and Consumer, and we also felt the impact of COVID-19 in many of our markets. Lower New Zealand milk collections reduced our total production and this impacted our overall sales volumes."

Fonterra has decided to pay a 5c a share interim dividend.

Commenting on the second half of the year, Hurrell said the forecast Farmgate Milk Price range of $9.30 - $9.90 per kgMS and forecast normalised earnings guidance of 25 – 35 cents per share remain unchanged.

“While the milk price is at a record high, pricing in our Ingredients business, for both reference and non-reference products, has been supportive of both milk price and earnings and we expect this to continue in the second half.

“In the medium term, we expect the supply and demand outlook to go some way towards underpinning a strong milk price next season.

“There are a number of risks we are continuing to watch closely. The conflict in Ukraine has added to an already complex Covid-19 operating environment, impacting global supply chains, oil prices and the global supply of grain.

“However, our lower debt levels mean we are in a stronger position to weather the heightened levels of uncertainty and market volatility the world faces right now.

“We will also continue to use our co-op’s scale to ensure we are putting our co-op’s milk into the products and places where we can deliver the most value under the circumstances.”

Separately, Fonterra announced on Thursday that chief financial officer (CFO) Marc Rivers will be leaving at the end of 2022 following its annual meeting. Hurrell said Rivers joined Fonterra in 2018 and had "played a critical role in resetting the financial health of the co-operative".

"We are moving from reset to a new phase of creating value, and Marc has decided that this is a natural point in time for a move."

A search for a new CFO will begin shortly.

These are the highlights as presented by Fonterra for the first half:

Summary of numbers

• Total Group Revenue: NZ$10,797 million, up 9%

• Reported Profit After Tax NZ$364 million, down 7%

• Normalised Profit After Tax: NZ$364 million, down 13%

• Total Group normalised EBIT: NZ$607 million, down 11%

• Net Debt: NZ$5.6 billion, down 8%

• Total Group normalised Gross Profit: NZ$1,607 million, down 7%

• Total Group normalised Gross Margin: 14.9% down from 17.4%

• Total Group Operating Expenditure: NZ$1,062 million, up 1%

• Normalised Africa, Middle East, Europe, North Asia, Americas (AMENA) EBIT: NZ $250 million, up 25%

• Normalised Greater China EBIT: NZ$236 million, down 20%

• Normalised Asia Pacific (APAC) EBIT: NZ$158 million, down 33%

• Full year forecast normalised earnings per share: 25 - 35 cents per share

• Interim Dividend: 5 cents per share

• Forecast Farmgate Milk Price range: NZ$9.30 - $9.90 per kgMS

• Forecast milk collections: 1,480 million kgMS, down 3.8%

See dairy payout history and economists' price predictions.

6 Comments

The departure of Marc Rivers as a CFO is a significant loss. Ever since he took office in 2018 I have taken considerable comfort from knowing that Fonterra had an independent thinker at the top table.

KeithW

$2.8 billion dollars extra over the previous 12 months injected into the NZ economy is an outstanding result in these turbulent times.

Well done to all concerned

The key reason has been very high commodity prices which have been driven by factors out of NZ's control. It is a good time to be a producer of commodities. Fonterra's value add continues to struggle but that is typically what happens when dairy commodity prices are high.

KeithW

I wonder how the investor owned processors are managing with the high milk price?

It's a shame milk price is defined by a generic manual as presumably there's no way of differentiating pasture rich from concentrate rich milk, which would reflect value add pre processing.

Nearly all NZ milk is pasture-rich but most is sold as an ingredient to international standards and there is no differentiation for the type of feed. Although purchasers know the source of their purchase, (i.e., that it is NZ sourced and hence pasture rich) it would be highly unusual for this information to flow through to retail purchasers of consumer products. The reason it does not flow through is that, despite what some Kiwis might claim, it is not perceived as adding value to the brand. As a side issue, most NZ WMP and SMP has internationally-purchased lactose added to it during processing to bring the lactose up to the international standards. So it is not pure NZ product.

KeithW

Thanks Keith.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.