Westpac economists are forecasting a record fall in NZ milk production this season and say that when combined with weakness in overseas supply, this should ensure milk prices start the following season "on the front foot".

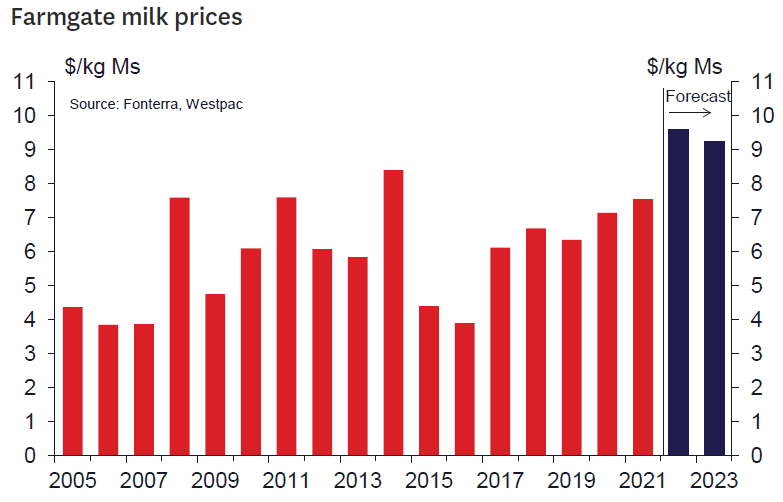

In a Dairy Update after this week's GlobalDairyTrade auction, Westpac senior agri economist Nathan Penny says he's now upgraded his forecast Farmgate Milk Price for this season (which finishes at the end of next month) by 10c to $9.60 per kilogram of milk solids. But for next season he's hiked his forecast to $9.25 from $8.50.

For the current season the giant Fonterra co-operative is currently forecasting an implied price of $9.60 - so, Westpac's forecast now lines up with that.

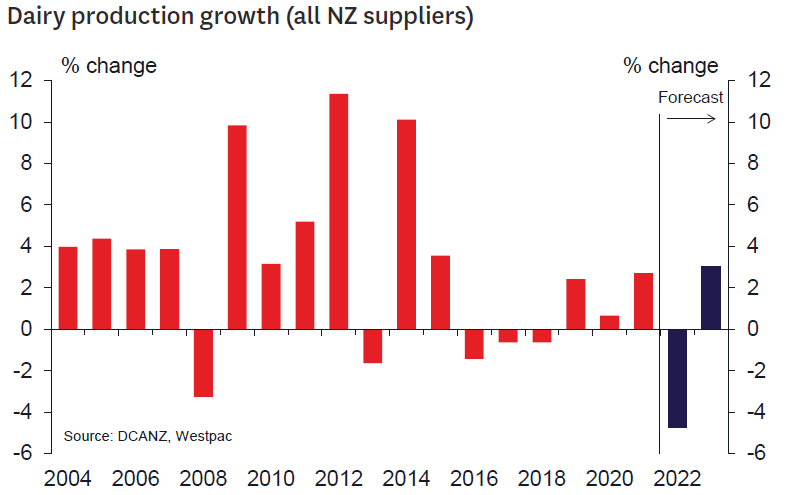

Penny now sees production for the current season falling by 4.75%, after earlier forecasting a 3% fall. And he says if he's right with the new pick this will be a record season-to-season fall and be around 1.2 percentage points higher than the previous record fall.

A farmgate milk price of $9.60 for this season would be easily a record, with the previous best being $8.40 in 2013-14. So, if next season's price is similarly elevated then it will be the second best price ever.

In fact Penny sees a "structurally" higher ongoing farmgate milk price.

"The upshot is that as it stands the boom bust milk price cycles are behind us.

"And unless there is a major unwinding in regulations and compliance around land use, in particular, the milk price has moved structurally higher," he says.

"We expect it to average around $8.00/kg in today’s dollars over the long term from here."

Notably, he says, costs have also lifted structurally.

"But on balance, dairy farm business margins and thus profits have increased."

Penny says the reason for the massive milk price swings previously "was the similarly massive swing in dairy production globally".

Here in New Zealand, production climbed around 11% in the season of the milk price boom (2013-14), and then a further 4% or so the season after.

Dairy farm conversions underpinned the surge in production during this time. For example, between 2007 and 2016, dairy cow numbers jumped by over a million cows. And use of other inputs like land, feed and fertiliser also surged.

"But over recent years, the dairy industry has consolidated to the point where the use of land and some other inputs has actually decreased.

"In fact, we project that the dairy herd has shrunk by around 400,000 cows between 2016 and 2022. The reasons for the consolidation are varied. Regulations and compliance, competition for resources from other users, labour constraints and tight credit have all played a role. But essentially it is almost too hard to convert land to dairy use these days," Penny says.

"As a result, dairy production cannot respond quickly (or at a magnitude that it once could) to surging prices. We expect production to rebound just 3% next season, after the 4.75% slide this season. In other words, production is unlikely to recover to the level that it was back in 2020/21 for at least a few more seasons."

12 Comments

So, almost a 10% reduction in GHG since 2016. Does industry get a medal for that?

Edit. forgot to add re solids price vs total production. Fonterra pre 2018, bloody told you so, 4% growth year in year is the antithesis of high MS price, idiots.

So what's driving this drop, is it simply the dry compared to last year. With the high payout I would have expected imported feed to take up the slack.

Personally we should end the season 1-2% down. We were 6% up but a dry summer stole that. We are also 5% down on the max cow numbers we had 3 years ago and should continue to make progress in that direction.

https://www.odt.co.nz/rural-life/rural-life-other/govt-support-otago-so…

Also land is lost every year from dairy due to land use change - horticulture, subdivision (lifestyle blocks), urban encroachment. No conversions so nothing taking up the loss. We are down around 3.7% for season but that will likely get pushed out further. We don't use PKE but had surplus feed left over from last season, so are in a slightly better position to some. Fonterra has a limit on how much PKE you can feed ;-) I'm hearing $120-150/bale landed, for Canterbury feed sent to Southland.

The drop in RUCs later this month is going to make jack all difference to farmers diesel price - they don't pay RUCs on farm-only vehicles like tractors, harvesters etc, so the price increases still remain in full. An arable farmer paid $1700 last season to fill his harvester with diesel, this season it cost him $4000. Nothing will have changed to his cost structure with temp drop in RUCs because he doesn't pay them. So he is going to need increases in prices he receives for his product ie food prices will still need to rise.https://www.odt.co.nz/rural-life/rural-life-other/food-crisis-coming-fa… As are all farmers income prices regardless of sectors.

With many farms costs before being around $6kg, a 20% increase in costs takes breakeven to $7.20 which isn't too short of the $8 average mention by Westpac. Historically, input costs to dairy don't drop when payout does, despite rising when payouts rise.

redcows,

Questions from an interested outsider. How far do you think you can take herd reduction? How far would you like to take it? How far can you reduce the use of artificial fertilisers?

That's definitely a piece of string question.

Herd reduction, my thinking is based on the idea that we do not get the full benefit of the improved genetics our herds and grasses have been breed with. My guess is around 10%, but it's often held back by poor or inefficient grazing management and my experience is that's a hard thing to teach.

Artificial fertiliser again comes down to efficiency and accuracy. We need way more knowledge and figures on the when why and where so we only place on exactly the amount the individual plants need. Currently most of us biff on a set rate over a set set area as a best guess to get what we percieve as the best result but it's pretty hit n miss. I'd say getting it right would mean a substantial reduction in total use but huge reduction in loses to water and air.

Biggest problem we have is the variables over the whole country are massive. We're talking hundreds of different soil types rainfall variables and topography which all require different management, it's simply not a closed factory with set inputs and outputs. That's all part of the frustration and the challenge.

Why push harder just because the price is good?

It is really easy to get into a mindset of grow grow grow. The numbers look great, the capital gains are flowing, the bank manager is smiling, your mates are impressed. The game becomes all consuming. until someone close asks WHY?

Those previous lifts in production were driven by farmers on a roll, expanding at every opportunity. But many now at either side of 60 have the boat and the bach and with a head wind of regulation and public antipathy don't see the point of pushing any harder.

Why not kick back and enjoy the cash. YOLO

Having run the NZ Monopoly game on capital gains for so long though, are there enough young Kiwi farmers able to afford to buy farms?

Or do we now lose our food production and export assets to foreign ownership?

In reply to what the banks stress-test interest rate was, I was somewhat surprised to hear less than 6%. Especially given their 5yr rate was more than 6%. If I was a young farmer looking to buy, without mum and dad as a backstop, I would be questioning if banks are lending responsibly. If they aren't, then we are likely to see the rise and rise of family corporates and overseas ownership in the future.

I would say the idea of once a day milking is pretty enticing .

"Boom and bust price cycles are behind us"

Might need too screenshot that .

I am just waiting for someone to say "Paradigm shift" and I know the circle is complete.

I wonder if he picked the crash in the farmgate milk payout in 2014/15 and 2015/16. Does he realise the reason for that was because China was stockpiling powder in 2013/14.

Has he in turn been watching what has happened in China over the last 12 months. It is quite widely known that they are stockpiling again.

Now this doesn't necessarily mean a crash in prices next year, if they continue to maintain high stocks of milk powders, but at some stage they are going to unwind that position and then we will see a return to $3-4 per kgMS.

Unless the industry continues to reduce production, of course, which is the sensible thing to do as it is clear prices have lifted with reduced production, even allowing for stockpiling. It is unclear why the dairy industry has focused so much on increasing production over the Key years at the expense of profits and the environment.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.