Giant dairy co-operative Fonterra is allocating up to $50 million to buy back its own shares, as the price continues to flag.

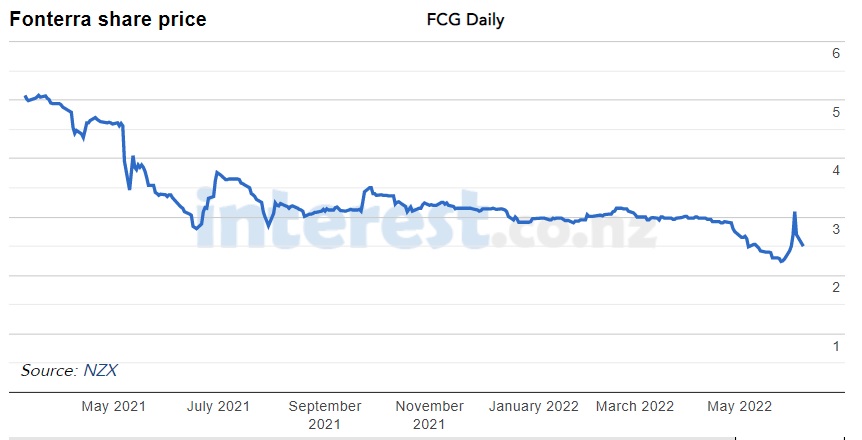

The Fonterra shares, which can only be owned by farmer suppliers (not to be confused with the Fonterra Shareholders Fund (FSF) units, which are open to non-farmer investors), have halved in price since trading at over $5 in March of last year. As of Wednesday this week they were at $2.50.

The price has dropped substantially since the co-op announced plans for a capital restructure in May 2021, having been $4.56 immediately before the first announcements were made. Fonterra is proceeding with an amended version of those plans.

Fonterra chairman Peter McBride said that in making the decision to launch a buy-back from June 30, 2022, Fonterra had looked at prevailing prices in the Fonterra Shareholders Market (FSM) alongside the Co-op's strategy and overall business performance.

"The Co-op considers the prevailing price particularly since late April has undervalued Fonterra shares, which is a key reason for announcing this buy-back," he said.

The buyback programme will be made under section 65 of the Companies Act and may run for up to 12 months from commencement. Fonterra may acquire shares through the FSM at the prevailing market price from time to time in that period.

This programme is separate to the allocation of up to $300 million Fonterra announced last year to support liquidity in the FSM as farmer shareholders transition to the Flexible Shareholding capital structure, through an on-market buyback (Transitional Buyback) and other tools such as the market-making arrangements.

McBride said Fonterra was preparing to implement the Flexible Shareholding structure as soon as possible but has not yet set a date for when it will be effective. In April, the Government announced its support for the structure and has signalled that it expects the amendments to progress through Parliament this year.

The maximum number of shares that may be acquired pursuant to this buyback programme and the Transitional Buyback (should that also proceed under section 65 of the Companies Act) taken together over the next 12 months is 80,667,893 shares. This number of shares is set in accordance with section 65 of the Companies Act and represents 5% of Fonterra’s shares on issue 12 months prior to the acquisition of shares.

“We remind shareholders that even though share compliance obligations remain on hold until at least 6 months after the new structure is effective, shareholders can still buy or sell shares within Fonterra’s current constitutional limits (which is generally 1x – 2x a supplying shareholders’ three-season average milk supply). Shareholders should seek advice from their financial advisor, accountant, lawyer, or rural professional before making any decisions,” Mr McBride said.

The number of shares purchased under the buyback from time to time, and the average price, will be notified to the NZX and ASX on the business day following the date on which those shares are bought back. Shares bought back will be cancelled upon acquisition, so the number of shares on issue will reduce accordingly.

McBride said throughout the buyback period, Fonterra will continue to assess market conditions, its prevailing share price, available investment opportunities and all other relevant considerations. Fonterra reserves the right to suspend without notice or terminate the buyback programme at any time.

The buyback programme will not run during the black-out period in respect of Fonterra’s 2022 annual results, which (for this year) will run from August 1, 2022 until the first trading day after the Fonterra annual results announcement is made, unless Fonterra agrees other arrangements with the brokers who will execute the buyback.

10 Comments

Oops - when there is little obvious productive capacity to fund choosing to buy back one's own shares is the beginning of the end.

The perceived need to buy back shares should be giving the Fonterra Board reason to assess whether or not it is making the right decisions with its restructure. It is somewhat like the canary in the mine.

KeithW

They're on a hiding to nothing trying to maintain a cooperative ethos and principles as well as manage a tradeable share. I think the canary in the mine for the cooperative structure was when the government deregulated the dairy board under the direction of non aligned 'experts' with supportive industry leaders (lapdogs), and re-regulated it with anti cooperative conditions such as tradeable shares.

These decisions are getting to be 'too little, too late'. The damage was done on May 31st and now farmers will have to value their shares in their EOY accounts at the then market price of $2 bugger all.. This buy back should have been announced the week before not the week after.

Not proud to admit it but we bought all the way down to $2.25 with a rolling average buy in now well under $3.00 which assuming the forecast 0.60c - 0.70c capital return per share in the next 2 years means a nett cost of just over $2.00, but many friends average cost close to $6.00.

It says a lot that even after a record payout season McBride can't get farmers to buy additional shares, even after constant reminders of the positive earnings forecast and that you can hold shares for up to 2x production. The last thing they need as they wait for govt legislation is extreme price volatility.

To be successful the new share structure requires buyers as well as sellers. Plenty of sellers - not many buyers.

Declining milk pool is not helping share price. We might see another drop in production next season as there are so many variables thrown our way.

Some commodities easing off.

After peaking at over $500t PKE is now available for this season's delivery at just over $400t.

Big drop in a couple months with longer forward contracts cheaper than nearer dated ones..

Sept 2023 NZX futures indicating a $10.35 payout for upcoming season. We are 50% hedged at $9.849 and will probably leave the balance to take the milk price of the day. If we can contain costs and Mother Nature doesn't have her say too much should be another good season.

You should be hedging 90%+ at that price.

China has been stockpiling for the last calendar year in exact anticipation of these lockdowns and supply constraints.

It is 2014/15 all over again.

The last GDT should have told you that, China will be buying 50% less than last year for the next 10 months.

Of course that will be countered by the Ukraine grain exports sliding but the simple fact is most milk powders can be substituted in industrial food production.

$6.00 kgMS is the max payout for next year, $5.40 is my analysis.

HB we are interested in using NZX futures to hedge our milk pricing, purely as a defensive mechanism - we are not interested in speculating.

How have you found the process? simple, costly, easy?

We have fixed what we could through Fonterra forward fixed but could only lock in less than 15% of anticipated production.

Feedback would be appreciated.

Great to see the chart, but could we see one of the FCG price over the maximum life..

That might be a little more illuminating as to how we see the current situation.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.