The hoped-for rarity of two bumper milk price seasons in a row is coming under increasing threat from fast-sagging global dairy prices.

Giant dairy co-operative Fonterra paid its farmer shareholders a record $10.16 per kilogram of milk solids for the 2024-25 season, which ended in May. For the 2025-26 season we are now in, Fonterra's first forecast was for a $10 price.

The extremely positive impact such a one-two combination of payouts would have on farm finances is very well demonstrated by the excellent DairyNZ Econ Tracker compiled by DairyNZ, the sector organisation representing New Zealand's dairy farmers.

The performance of dairy, along with other primary sector producers, in the past year provided a huge boost for a New Zealand economy struggling along under the weight of a Reserve Bank interest rate hikes-induced recession.

But now global conditions that were very conducive are going south. Fonterra enjoyed a period of low global milk production, getting peak prices for its products - but now global production is ramping up, and Fonterra's own production so far this season is well up too. Increased supply means relatively less demand, which equals lower prices.

And the latest big dairy auction in the early hours of Wednesday, NZ time, was another blow.

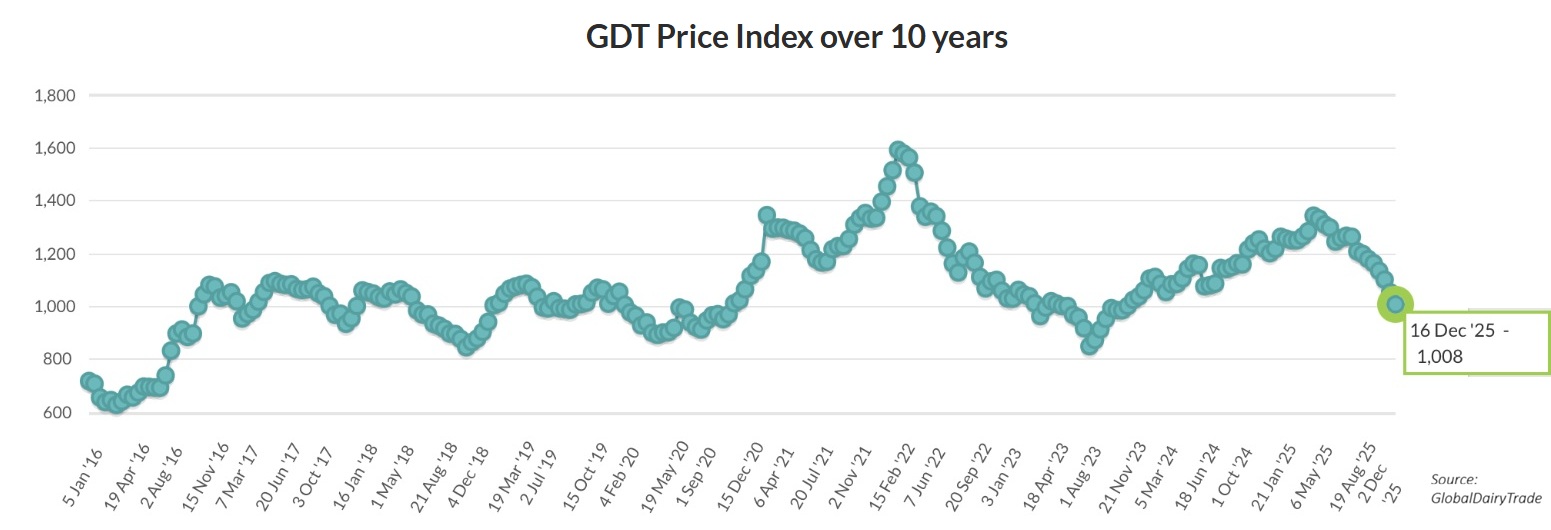

NZX head of dairy insights Cristina Alvarado said the latest GlobalDairyTrade (GDT) auction had "delivered a more bearish outcome than expected", with the GDT Price Index falling -4.4% to an average winning price of USD 3,341/MT.

"This ninth consecutive decline reflects persistent supply-side pressure in global dairy markets, as milk availability continues to run high across several key producing regions," she said.

"Strong milk production in the United States and Europe, alongside continued output from Argentina, has maintained ample exportable supply.

"In addition, China reported a second consecutive month of year-on-year growth in milk production in its latest data release, with October milk production up 2.1%, further reinforcing the perception of plentiful global supply. This supply backdrop was most evident in whole milk powder (WMP), where prices fell -5.7% to an average of USD 3,161/MT," Alvarado said.

Dairy prices as measured by the GDT Price Index are now down by exactly a quarter from the most recent price peak in May of this year. And prices are now at the lowest level in exactly two years.

It's not comparing apples with apples, but it is nevertheless interesting to note that for the 2023-24 season, in which Fonterra paid a farmgate milk price of $7.83, global dairy prices were around where they are now at the start of the season, did, yes, then drop quite a bit (15.7% lower than they are now), but actually finished that season 13.4% higher than they are now.

It's worth noting also that production costs have been rising on the farm. DairyNZ estimates that the 'breakeven' milk price on the average dairy farm is now $8.50 per kilogram of milk solids.

Fonterra cut its forecast milk price for the season last month to $9.50 per kilogram of milk solids - still a historically very good price. But it would not take many more auction results like this week's for Fonterra to be back with another forecast cut.

As noted higher up, the performance of dairy was a big standout in a gloomy economy in the past year.

Just as there are now signs that the economy may be starting to pick up, any marked downturn in the fortunes of the dairy industry would be the last thing we need.

BNZ economist Matt Brunt says there is "clear downside risk" to Fonterra’s $9.50 forecast given current global prices and momentum.

"If current global prices were to remain around current levels for the remainder of the season, a milk price closer to $9 could be expected. Of more concern is the outlook for the following 2026/27 season given global prices’ current trajectory," Brunt said.

"There is a long time before the end of this season let alone next. If current market conditions were to persist for the next 18 months the 2026/27 milk price would be at risk of falling below $8. That is not our current forecast, but the risk must be taken seriously. Even a 2026/27 milk price in the mid-$8s will bring tighter underlying financial conditions than recent seasons (although dividends and Fonterra’s proposed capital return will be an important offset for those that get them)," he said.

ASB economists on Wednesday trimmed their milk price forecast to $9.20 (from $9.50), and senior economist Chris Tennent-Brown said the pace and magnitude of the price declines across all dairy products over December has been "greater than our already pessimistic forecasts that we published in November"

"Futures markets, alongside recent GDT events, are pointing to ongoing dairy price weakness, with product prices showing no clear signs of a lift over the summer months," he said.

This is the dairy industry payout history.

Dairy prices

Select chart tabs

1 Comments

"New Zealand could wind up meeting its 2050 methane targets not because of any deliberate policy choice, but because milk and meat are outcompeted by alternatives that taste no worse and cost less.

Farmers who recently received a large Fonterra payout may consider opportunities for diversification and adaptation, with potential for large changes from the early to mid-2030s. The five-year-old RethinkX report got the timelines wrong, but not the direction of travel. If you, like me, had thought that a non-dairy milk that tasted like milk was still years away – update your plans accordingly."

https://pointofordernz.wordpress.com/2025/12/17/this-bottle-of-milk-may…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.