Fonterra has bowed to the pressure of swiftly falling international dairy prices and chopped its forecast milk price for farmer shareholders to $9.00 per kilogram of milk solids from $9.50.

The announcement from Fonterra on Thursday followed a strikingly weaker international auction result on early Wednesday morning our time. Global prices are now down by exactly a quarter from their most recent peak in May, while the prices are also at a two-year low.

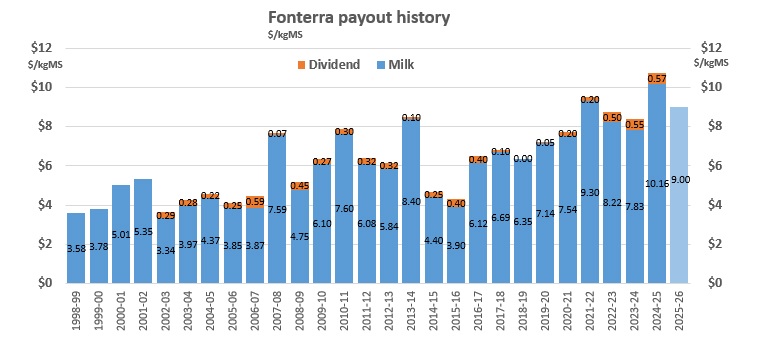

The forecast cut by Fonterra on Thursday was its second within a month (the first was on November 25) and means it has now dropped its forecast by a cumulative 10% from the season start point of $10.

Last season Fonterra paid its farmer shareholders a record price of $10.16 as the co-op enjoyed highly favourable international conditions, with a shortage of supply offering Fonterra the chance to get top dollar for its products. However, that's turned completely and a number of key producers have ramped up production, while Fonterra's production is up also, and this has all inevitably quickly tipped the supply and demand equation.

Fonterra forecasts its milk price by use of a range and then refers to the 'midpoint' as being the explicit forecast price.

The co-op has adjusted the forecast range from $9.00-$10.00 per kgMS to $8.50-$9.50 per kgMS with the midpoint changing from $9.50 per kgMS to $9.00 per kgMS.

The sagging international prices will be a big disappointment to those hoping for the rarity of two very strong milk price seasons running back-to-back.

The very strong performance of dairy in the past year, along with other strong primary sector results, was a key factor giving some support to a faltering New Zealand economy. Now as the economy is just starting to look to recover properly, so, some of that support is ebbing away.

Fonterra chief executive Miles Hurrell said that with half of the current the season still to complete, the co-op continued to experience strong milk flows both in New Zealand and globally, particularly out of the United States and Europe, "and this continues to put downward pressure on global commodity prices".

"Combined with a rising New Zealand dollar since the last milk price update in November, we are required to further adjust the forecast range for the season and lower our midpoint."

Hurrell said Fonterra started the season with a wide forecast range of $8.00-$11.00 per kgMS and the new midpoint of $9.00 per kgMS "remains within that range".

"We remain committed to maximising returns for farmer shareholders through both the Farmgate Milk Price and earnings, strong customer relationships and a firm focus on margins, product mix, and operational efficiencies."

This is the dairy industry payout history.

Dairy prices

Select chart tabs

3 Comments

Tanking

There goes (the equivalent of) half the Lactalis windfall.

The scariest part is the reductions are happening when the exchange rate is 57c-58c USD.

Where would the payout be at closer to long term rate in the mid to high 60s.

Another dollar lower again?

Because with current input prices that would really hurt.

I'm hearing first farm buyers in the market earlier, are now withdrawing from looking due to uncertainty, of payout, exchange rate and the fact that farm input costs are higher now.

It's a pretty messed up market atm. A number of farms sold before the price drop and a large number of cows were sold for next season at over $3k. Some of those contracts might come under severe pressure. Closer to home the farm were on is currently for sale but I can't see it happening and really expect to be here next season, we'll see.

dp

But considering where the country is economically and moreso where it's been surely the exchange rate should be well below $0.57.

Dp

Ddp

Comments software is on holiday I'm guessing.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.