BNZ economists are warning of "the increasing likelihood" of a global recession and say the Reserve Bank (RBNZ) should do nothing to suggest it has raised its view on how high the Official Cash Rate might get.

The RBNZ is due to have another OCR review on October 5, and in a preview of this in the BNZ's latest Markets Outlook publication, BNZ head of research Stephen Toplis says it is difficult to see why the RBNZ would be convinced the medium-term risk to inflation is sufficiently high to demand a substantial shift in its rate view.

At the moment the OCR is at 3.00%, having been hiked aggressively in the past year from just 0.25% as of the start of October 2021 and in response to surging (7.3% as of the June quarter) inflation. The universal expectation is that the RBNZ will hike the OCR to 3.5% on October 5 and then to 4.00% on November 23, the last review for this year.

The RBNZ as of its August Monetary Policy Statement forecast a peak OCR by the middle of next year of a little over 4%, but it has since publicly indicated that 4.25% is at least possible. However, market pricing is now getting a long way ahead of this, and ANZ economists are forecasting a peak of 4.75%. Fixed mortgage rates, which had been falling, are now rising again.

Toplis says "taking into consideration the balance of risks", the BNZ economists have formally introduced a further 25 basis point rate hike into their OCR forecast track for the February RBNZ meeting, taking the OCR to 4.25% at that time.

"The cash rate stays at this level through 2023 before progressively moving back towards a neutral rate [neither stimulatory, nor restrictive], which we have lifted to 2.25%," Toplis said.

"The risk around these forecasts is balanced."

He said "the hawkish scenario" is the falling Kiwi currency drives inflation higher than anticipated for longer "but the downside is a crippled global economy".

"We can’t stress enough our fear that the rapidity of rate increases globally, coupled with the disastrous consequences of Europe/UK’s energy crisis, means things could well and truly turn to custard."

Indeed, Toplis said the way things are going it’s increasingly looking like a “when” not an “if”.

"When it becomes clear central banks have “over-tightened” there will be a rush to forecast rate cuts. The higher rates go now the bigger will be the reversal."

Toplis believes the RBNZ will be well aware of these risks and will, ideally like to buy itself time.

"It does not publish a rate track within a Monetary Policy Review. We doubt it will formalise a more aggressive stance in the text of its statement, certainly not one which would encourage fixed interest markets to sell off any further but in reiterating its August stance it might offer some suggestion that current pricing is a tad overdone. Given New Zealand’s leverage to global demand it tends to suffer more than most during downturns. The RBNZ will not want to exacerbate that process."

However, the "big unknown" is how does the RBNZ think it should respond to the recent "surprising aggressiveness" of the US Federal Reserve?

"The Fed is now suggesting the US cash rate could move into a 4.50% to 4.75% band. Was this the case it would make it harder for the RBNZ to keep its cash rate peak near 4.00%, as specified in the August MPS. Were it to do so this would put even greater downward pressure on the NZD especially given that the NZ market is currently pricing in a 4.8% terminal cash rate," Toplis said.

"At this juncture, it is difficult to see why the RBNZ would be convinced the medium-term risk to inflation is sufficiently high to demand a substantial shift in its rate view.

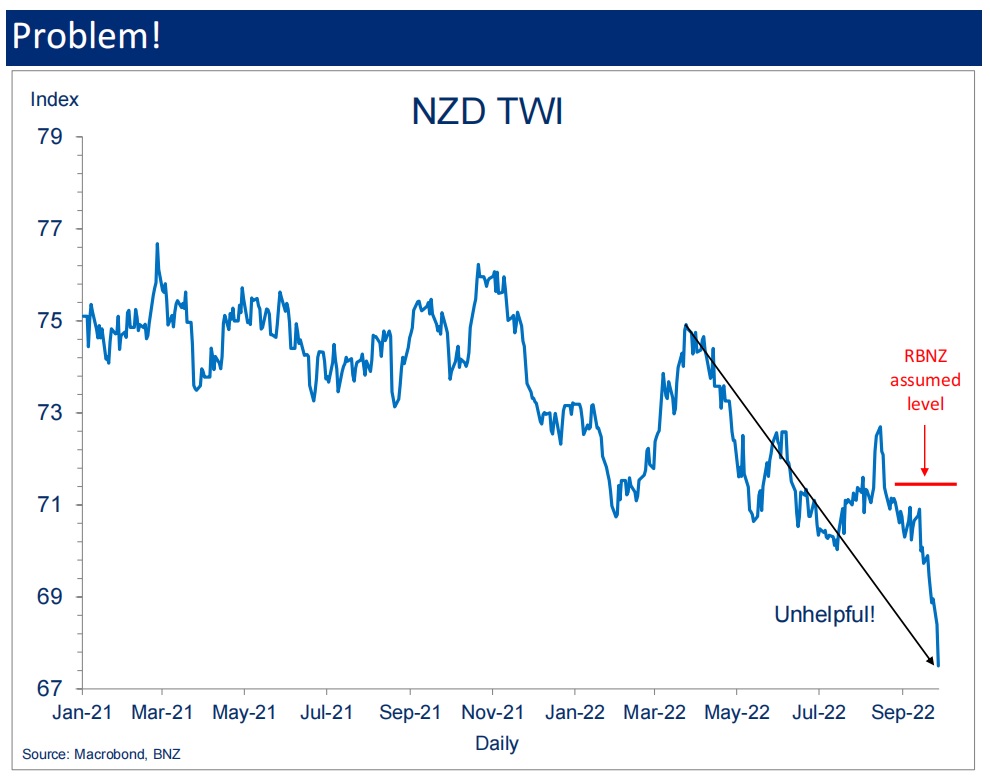

"There are, nonetheless, developments that the Reserve Bank will be very wary of. To start with, global inflation has nudged higher than anticipated and forecast inflation for calendar 2023 has increased. Importantly for New Zealand is that these upward revisions are being accompanied by a currency that continues to depreciate.

"At the time of writing the NZD Trade Weighted Index was sitting at 67.5. This is 5.9% below where the RBNZ had assumed it would sit. If it stays here that could add as much as 0.6% to CPI forecasts, which is clearly unhelpful."

Toplis said an argument made by some is that recent downward pressure on mortgage interest rates will be annoying the RBNZ so it will have to tighten more to get the same impact.

"We are not so sure. We would be concerned if current mortgage lending rates were resulting in a spike in lending to households but this is clearly not the case.

"To the contrary, growth in lending to households continues to fall. Moreover, we assume that once the Funding for Lending Programme [lending for banks from the RBNZ priced at the OCR level - due to end in December] stops providing cheap funding to banks, at the end of this year, mortgage rates will come under further upward pressure.

"This will be accompanied by increased competition for term deposits. The RBNZ acknowledges this will put upward pressure on rates. The big question is how much? We really don’t know. But were spreads between mortgage rates and wholesale rates to return to “normal” levels then this could have the same impact on monetary conditions as at least 50 basis points of rate hikes."

Posing the question of whether the RBNZ could eventually deliver a series of further rate hikes in 2023, Toplis said - "absolutely".

"But we think it is too early for it to feel comfortable making this its central scenario now. For this to happen the Bank’s view on future inflationary pressures needs to be revised higher which, in turn, would probably require it to believe the labour market remains tighter than previously thought as well."

On the international picture, Toplis said global inflation may be rising but this is heavily concentrated in the Eurozone where the Russian invasion of Ukraine continues to result in devastating increases in energy prices.

"While this is problematic for inflation, it is even more problematic for growth with expectations for economic activity being revised much lower on the back of the resulting disposable income hit, which is being accompanied by aggressive central bank responses as they seek to prevent a 1970s style wage-price spiral.

"Outside of the Eurozone, growth forecasts are also being lowered.

"It has been a very long time since the world has witnessed such a synchronised tightening cycle.

"In our opinion, folk are now underestimating the likelihood of a global recession. And even the optimists concur that growth will fall below average such that spare capacity will start to develop. This being so, the medium-term pressure on global inflation must be sharply downward.

"The RBNZ can’t ignore this. Indeed, it is conceivable that when the RBNZ convenes in February, to decide whether or not to push its cash rate above 4.0%, that it is staring down the barrel of a global recession."

182 Comments

What's that saying about banks giving you an umbrella while the sun is shining?

Last year they were practically begging me to borrow a fortune and plough it into lousy Auckland housing.

Iceman has "picked" his numbers. There will be no recession in NuZelund😜

Please don't people who belong to the ice age

This kinda highlights were we are at in the scheme of global finance. Wage and Price spiral has been underway in NZ for some time and offshore who cares. Any hint of it doing so in the US and its action stations. Summary, we have attempted a soft landing with FLP etc, but we are only partially thru the landing approach.

Time to flashback to parachute training, brace brace brace. For imminent impact...

What's happening over in the UK at the moment is mind-blowing. It's like they're actively trying to destroy the economy. Makes the Fed's efforts look tame in comparison.

I wonder where NZ's response will fall on a scale from "pissing on a bushfire" to "shovelling coal on it".

This be us with a National government next year....tax cuts for the wealthy after years of excessive fiscal spending...(part sarcasm, part not).

Tax cuts for property speculators.

Look, it's only fair. If they wanted to pay tax they'd work for wages like the plebs. Let the working folk fund society!

In most cases, property investors are also working folks.

Also there is no law which says one has to work for wages, the alternatives of investing or building and owning a business or even doing several of the above, is there for everyone,

If the problem is that wage and salary earners are shouldering too much of the tax burden and investors/asset owners too little, then it's hard to see why the solution to that is that those who make their money from wages or salaries should just stop doing that and become an investor or asset owner instead. Society needs people to work in those businesses, and people to work in jobs like nursing and policing and teaching. Someone who makes their money by working as a nurse is no less valuable than someone who makes their money from investing in property, and they shouldn't have to shoulder more of the tax burden because of it. The fact that some nurses might also be property investors doesn't change that. (Edited for typos)

This quote perfectly sums us the problem issue - wage and salary earners are shouldering too much of the tax burden and investors/asset owners too little. Vote according next election. #notnational.

I totally agree that nurses and teachers should earn more, a lot more, but the fact is they're not (blame Labour). If these nurses and teachers are not happy where they are, nothing is stopping them from starting their own business or investing, if they think it's easier and they will be better off.

If the tax burden was more equally split between labour and capital then nurses and teachers would net higher earnings.

Society shouldn't incentivize nurses and teachers to leave the field.

You talk about what "should" or "should not" be, I'm talking about what "is".

You talk about making individual choices to address what is a societal problem - that teacher and nurse salaries are too low.

It doesn't fix the underlying issue, you're just presenting a convenient scapegoat - blame the individual rather than the system.

Rather than just applying band aids we should deal with the underlying issue which requires comparison between what is and what should be.

I don't "blame" the individual, quite the opposite, I point out that an individual has got choices to better their own lives. This is much more likely to improve that individual's life than to complain about how the system should be, and wait for things, which are out of the individual's control, to change.

It's not hard to walk and chew gum at the same time. It's possible to both think about how to make your own life better in the circumstances that you are in, and to think about (and fight for) broader changes that you think are necessary. Working towards political change is, in any case, one of those things that people can do to improve their lives. The suffragettes (to take one example) didn't just sit around 'waiting' to be given the vote because it was outside the control of any one individual. They thought and talked about how things should be - not just how things were - and complained, and organized, and campaigned - and made their own lives and the lives of many women to come better.

Well said.

Great response. Organisation and empathy is what Capital fears the most, they will try to undermine it and break it by any means possible.

I've found it's best to focus on what "should" be, rather than what is, at least in determining the future and thus investing. People are inherently good and eventually we'll steer ourselves in the direction we need to go. Otherwise you're banking on society collapsing.

This comment thread is about your thoughts on what teachers "should" do if they aren't happy with what their compensation "is".

Moreover, who cares. We're talking about the same subject, only difference is tense.

I just find sticking to present tense limits us to a terse rundown of the current state of the world, suboptimal as that may be.

>I totally agree that nurses and teachers should earn more, a lot more,

You too talk about what "should" be. It's a bit of a non-response, that last post.

@Yvil: No, you explicitly agreed that nurses and teachers "should" earn a lot more than they do. That's (part of) the point; that's the kind of claim that forms the basis of a different politics than we currently have, one in which workers earn more and perhaps shoulder less of the tax burden; and property investors (amongst others) earn less and/or shoulder more of the tax burden.

In Germany, school teachers salaries are on par with back bench MPs.

I think teachers should be paid more, but that sort of parity would be fair.

Around 90k per annum.

And all other MPs should be paid proportionally.

I'd be interested in how many hours they actually spend working each year to justify that. If it was pro rata like nurses I'd say it may be fair.

Hi Juzz,

I know a few teachers. Are you looking at all the "time off" they get? This is what they call "non-contact" time. Just because they aren't teaching doesn't mean they're not working. Teachers are extremely hard working and spend countless "unpaid" hours planning for the school day, month, year. They also are rewarded with higher costs when they do try and have some time off as it's peak travel time.

A report from PPTA claims they work an average of 54.5 hours per week, including "on-site work, off-site work and extracurricular activity". A teacher with this workload would clock up the equivalent of 14 extra 40-hour weeks in a year, bringing their total workload for the year to about 52 40-hour weeks.

The average salaried kiwi about 48 40-hour weeks.

This is the article I'm quoting from.

https://i.stuff.co.nz/national/education/97717614/truth-or-fable-are-te…

That tells me they have 14 weeks off per year. And I would say most teachers don't work anywhere near 54.5 hours a week. The only teacher I have seen work that much was grooming students.

Investing requires money though, which nurses and teachers don't tend to have a lot of.

Well if you truely believe that, you're a poor investor.

...investing doesn't require money?

It does't require one's own money, chebbo.

But it requires the ability to get it. Nurses and teachers don't feature often on Dragon's Den.

Good point Chebbo, and why don't they often feature in Dragon's Den? Is it because they don't have enough money ? Clearly not, Dragon's Den is precisely designed to help budding entrepreneurs who don't have enough money…

No, they're obviously flush with cash, they're just too lazy to get off their bums and make a go of it.

What.

What??? There is nothing stoping anyone, including teachers and nurses going to a program like Dragon's Den, pitching a great idea and asking for money to float their burgeoning business.

Why doesn’t it Yvil?

If you are suggesting to simply borrow from the bank, then that is only a half truth because you need a decent deposit. And to afford repayments on the loan.

And invest in what?

HM, I grew up in a middle class, working family, my parents never owned a house and I believed, as they did, that money is needed to make money, I didn't just believe it, I knew it! My wife came from a poor family where they had no money to buy meat and the toilet was outside their house. They had much less than my parents, they came to NZ with nothing but they believed they could make a much better life for themselves, and they did! At the beginning, I was extremely uncomfortable when my wife told me, "start your own business" then later "let's borrow to invest", because I believed it couldn't be done. This is so untrue, yet so many of us believe this and it holds us back from having a better life.

Teacher and nurses have a steady income, if they really wanted to, they could borrow and start something for themselves, what stops them is not the money, believe me, it's that they think it can't be done, just like I used to believe.

What probably stops them is, certainly with nurses, the exhaustion of working 12 hour shifts in a high paced and stressful environment surrounded by all sorts of diseases and bodily fluids.

Teachers can get extremely fatigued spending upto 5 hours a day in classrooms for 9 months of the year.

Not all teachers. My wife is in Early Childhood, which doesn't have "school holidays" and last time I checked she works over 40 hours per week.

Actually I have seen some very hard working ECE's and would say they work as hard as nurses which is alot more than teachers.

The problem with borrowing to invest is that leverage works both ways.

If you make poor choices or are just plain unlucky you can end up in a world of hurt.

Yep as per my comment below. Lots of businesses fail or just tread water.

Well of course, risk-reward. If it was guaranteed to succeed and easy everyone would do it.

Apparently existing business owners are allergic to investing in productivity, so all you need to do is that and you can crush it.

Absolutely agree we should incentivise people to invest in building a value-creating business.

Raise land value tax on the unimproved value of land and reduce income tax on companies (~75% of which is borne by employees in the form of lower wages anyway), for example. We don't need working Kiwis to incentivise and carry speculators.

I would favour a policy mix that incentivises people to be entrepreneurial, and rewards the likes of yourself for doing so.

I know someone who started a cafe business just 6 months before Covid hit. Poor guy, he totally went under.

But borrow how much? And invest in what?

if it’s a business - there’s no guarantee the business will be a success. We hear all the success stories in the media but much less about all the failures.

Also, I would suggest, that there are many businesses that would make money but wouldn’t necessarily make an ex nurse more than they were previously earning as a nurse.

Also many people don’t have a good feel for business. You can say you can learn, but I genuinely believe that people are more naturally business minded than others.

Well your two questions are the million dollar questions, literally! I hope you find an answer to them.

Of course there's no guarantee that a new business will succeed, most actually fail! But you can't on one hand tear down business owners and then on the other hand say "hey I won't open a business because it's not guaranteed to succeed". You can also buy into an existing busines if you believe you can improve it, which is a little less risky.

Also, have you ever considered that, in order to have a job, you need a business owner who has taken the risk of running a business, then grown the business to need staff and offered people jobs (unless you work for the government, but we can't all do that)

I think the "and the toilet was outside" shows your age... and that finishing statement " I used to belive"

Will banks lend on a business without some collateral nowadays? Like a house ?

Nope probably not... not on a "lets set up a business regime" probably fine if youve already done 2 or 3 years of profit yourself, but in my experience - generally parents step in at this point and say yes well back you...

Even the most spoken about investment on this site is "get yourself a property portfolio" .... but I do hope you agree @yvil its not what it was 6, 8 or 10 years ago... 10 years ago it seemed steady.. just wait and make sure everyone is happy and you will make steady money... correct in the fundamentals... you get your pay cheque in 20 years... however the last decade has been ridiculous - imagine being a 28 year old couple turning up in the last three years... no house yet.. one job in IT and one in childcare.

Do you honestly think the bank will lend for person A to set up a software company or person B to buy a day care location ?

Youre talking from the 1980s book... not 2020's ....

Im happy for you to have done well.... but exactly the same as some parents say "just buy a do up in Devenport, work hard, do it up and then buy your 4 bedder in Ponsonby, like we did" isnt todays life....

I however still enjoy 1980s comedy shows ...

Hi Clementé,

Yes I'm not that young, I'm GenX.

I also agree that things are not easy today if you're in your 20's especially with housing which is ridiculously overpriced. Note I didn't say it was easy, it's not, I was making the point that you can't bash business owners or investors and then say "I won't do it, it's too hard, there's no guarantee of success". Yes being an employee is tough, so is being an employer or an investor. I don't like the tribal categorising "they" are all bad.

yeah lets all become borrowers

Haha yeh they'll just save up the capital to start with the excessive amounts of money they get paid, good one.

So you've never heard of a loan huh?

If these nurses and teachers are not happy where they are, nothing is stopping them from...

While anyone can do something else, not everyone can. Or we will have no nurses and teachers.

This is why it is important to make society functional for more than just speculators.

Exactly.

But nothing will meaningfully change, until we are well and truly up shit creek. And then it will be too late

Actually I take that back. Even when we are up that creek, all we will do is extend and pretend. Neoliberalism is so deeply embedded in our political economy, I can’t see way out of that.

Totally agree. Some commentators here may change their view if they find their school age kids without enough good teachers or enough good nurses to take care of them in illness or old age. These professions are the rock upon which decent society is built (property investment is not…). We need to incentivise capable people into these professions and ensure their career choices remain attractive throughout their working lives. They will need better rewards either through higher salaries (higher govt spending and taxes) or lower income tax, the cost of which should be transferred to….others deriving un(der)taxed income

Nothing like people experiencing themselves the downsides of an insane housing market to start to see the value in policy that redresses it.

Pity that people need to be affected themselves, rather than showing empathy and understanding without that.

Too many seem to favour a direction that ends with us looking like a developing country, with huge inequity and wealthy folk hiding in gated subdivisions from the effects their favoured policy had on society.

No, blame National or the voters. If labour thought they could politically survive doing somthing about it then they would.

Apart from a moral compass and passion to help people. Not all things can be measured Yvil.

yvil,

When you you and others here get it into your thick heads that the Kiwi obsession with property has been unequivocally BAD for NZ-though rational for individuals.

try a report from the New Zealand Initiative; " New Zealanders' attachment to property and the resulting high mortgages are key contributors to NZ's high levels of private debt". Then later; The artificially inflated price of our houses is a drag on NZ's investment patterns; capital and investment hungry industries are losing out at the expense of housing". Or see Business NZ's March '22 Planning Foreast; "Higher levels of household and government debt do pose ongoing risk as interest rates rise, while higher levels of debt also constrain the choices that governments and households can make in the future."

Then do the right thing and dont vote for them, if we all vote on policy and disregard historically who we've voted for or what our parents did, then we can break the political pendulum of national and labour for the benefit of our country. Every vote counts

Can't wait for National to come back and help save this economy and take out all the trash policies Laborr had put in. Things like not being able to claim "interest mortgage" is completely absurd. I'm a home owner, not even an investor and I can tell you as a businessman that's not how things work.

National isn't perfect. But they are surely better than Labour. I hope they put a Finance Minister in that isn't a Political Science major, and actually has done business and took degrees in Finance.

No, unfortunately their policies are worse than Labour's at the moment. This version of National is very underwhelming.

And working Kiwis are tired of carrying freeloading speculators. It's one thing giving a helping hand to those at the bottom, but another being asked to carry speculators who are also benefiting from welfare benefits.

But you're a recent FHB that was banking on their house appreciating in value so you could leverage the equity into an investment property. The phasing out of mortgage interest deductibility is a massive thorn in your long term goals.

by 7jai | 4th Aug 21, 12:17pm

Hope prices continue to rise. As part of a big cohort of FHB who were able to buy these last few months, I would like to see my only asset appreciate in value.

https://www.interest.co.nz/property/111618/barfoot-thompsons-july-sales…

by 7jai | 24th Mar 21, 5:59pm

Not hurting myself. Not a property investor, but after this news, I do hope prices fall, because I have been looking at ways of buying a 2nd investment property but the prices were too expensive. Super excited about what's to come!

https://www.interest.co.nz/property/109663/prospect-home-ownership-has-…

So what if 7jai would like his newly bought house to appreciate in value? I remember you buying your first house (with my encouragement) 4 or 5 years ago, you got capital appreciation which I'm sure you enjoyed.

Yes we're all entitled to enjoy and wish for capital appreciation in our houses. No you didn't encourage me to buy my first house at all, I signed up to Interest.co on 31/8/17, but bought my first home in May 2017.

7jai is clearly disguising his motives when calling out the mortgage deductibility to try add more weight to his argument "I'm just a home owner, not an investor". I'm just calling out his vested interests.

I kind of hope the nats keep the RBs employment mandate. The mandate keeps the rb from going full throttle interest rate hikes.

@7jai. 😂

The minute I see housing speculation treated as a business, and by this I mean commercial interest rates, and buying with a yield, not CGs, then sure bring back interest deductibility. As long as it is still ring fenced.

How does 10.2% sound?

"I wonder where NZ's response will fall on a scale from "pissing on a bushfire" to "shovelling coal on it".

Here in NZ we can probably manage to both at the same time

Good time to form a really good relationship with your bankers so that by end of 2023 or into 2024 you have a really good line of credit availbale to buy the bargains

Good time to form a really good relationship with your bankers so that by end of 2023 or into 2024 you have a really good line of credit availbale to buy the bargains.

Genius, in one line you've shown why NZ is a basket case of low productivity & wages, and high house prices. Well done.

Care to point out where is not a "basket case"?

How about Germany or Japan.

Wanting to take advantage of the system does not make you the cause of the problems. You need to look out for yourself, because nobody else will.

Well ZC, Interest.co.nz, a site about money with a motto of "helping you make FINANCIAL decisions, has been totally hijacked by righteous people who believe they are morally superior to anyone who has money.

You have just made a whole lot of enemies with your post.

You keep going on about the motto, yet the website has many articles that are much broader in scope than ‘financial decisions’.

Let's see:

interest rates = money

deposit rates = money

exchange rates = money

(un)employment = money

GDP = money

stock market = money

CPI = money

OCR = money

Crypto = money

Inflation = money

Price of gold = money

price of crude oil = money

LVR, DTI, LSAP, FLP = money

Mortgage payment calculators = money

House prices, median HPI = money

Bonds/treasuries = money

Yvil, you need to understand what this forum is, rather than what you want it to be. The sooner you realise that, the faster you can make the right decisions for yourself on blog readership/contribution. Complaining about how things are, gets you nowhere in life.

Haha, you're a funny guy, I see what you're trying to do; take my point of view and turn it against me.

Good relationships won't be enough to earn lines of credit in a crisis; stable incomes and a huge deposit will be, and it's unlikely most people are going to have access to either one.

TA and friends will still be saying now is a good time to buy ... lolz

The last time I heard him on the radio he was talking about buying property in Australia... maybe he's going to run off and start with a new audience?

A lot of the well heeled branch off into a second home/bach somewhere. He is just doing that

Peter Schiff, who must be a brother disciple of 2022, is forecasting 8% 30 year mortgage rates in the US by the end of the year.

"The 30-year fixed mortgage rate is now 6.87%, its highest in 20 years. But as the #Fed still has a lot more work to do on rate hikes, and the realization that #inflation is here to stay has yet to set in, mortgage rates still have along way to rise. 8% by year-end seems likely"

https://twitter.com/PeterSchiff/status/1574525830671261709?s=20&t=z9uur…

Peter Schiff is a perma-bear gold bug. Civilisation has never been more than a cup of tea or two away from total collapse so long as I've been aware of him. something something blind chipmunk...

He is exhausting .... however after 17 years of the same spiel he may now be correct and say "Ive been warning this for 19 years!"

So the banks are slowly and belatedly coming to the realisation that the NZ economy cannot sustain much higher interest rates. So the question is asked "why keep increasing the OCR aggressively?" The NZD should give a pretty good answer to that question. Until the Recession is official, interest rates will rise, after that time, they will drop again, (sharply IMO) but the damage will have been done, business closures, employee layoffs and some mortgagee sale. You won't be able to "pick up a bargain" either, as lending will be very hard to access.

Bonus problem: our trade deficit and how to finance it in the future...

By printing more money and creating more inflation.

The road to hell is paved with good intentions.

Awesome IO, that's gonna solve the problems...

We're in this mess now, because we decided to create more of the problem, to face the problems we already had (see 2008 and 2020). But now the problem is even worse!

The speed at which market intervention turns into more financial difficulties will speed up as the impacts blow up in the central bank and governments faces.

2008 - 2020 = 12 years.

2020 - 2022 = 2 years.

2022/2023 - ? = ?

In NZ we could have allowed the housing bubble to burst in 2020 and we would now be in a much stronger position. But we didn't, so now we are in a far more precarious position where fighting inflation (or deflation) will create even more pain.

Even better, there was obviously no plan for what might happen if house prices did reset - there was no strategic walkback or meaningful intervention on the cards, ever, just like there wasn't when they exploded in 2020/2021. The pain, however, from the fallout will be very, very real.

Fascinating isn’t it. It’s hard to understand how asleep at the wheel the RBNZ was from mid 2021. No one there was remotely thinking that inflation might explode?

Seems like central banks were all so certain that inflation would be transitory that no one actually made contingency plans.

Bless their little hearts. Why do they get paid so much?

Indeed IO

The more this experts try to untangle the noose, greater will be the squeeze.

Wait and Watch.

Wonder if this experts can help us by not helping us as they do more harm in helping than otherwise, one would face.

There is no magic bullet.

The solution was not to over-reach in the First place.

Now its Just a question of how bad. did your save any of that Blood money? Pay down your debts? Or did you buy a new boat and a Ford Ranger?

It's not so bad. Embrace the inivitable, don't fear it. So what if There is a Major recession. We have well and truely earned it.

Reckon there could be some good deals on near new boats in the not too distant future! If I didn't use mine at least weekly I'd be seriously considering selling now with the hope of buying a better boat for cheap towards the end of summer.

If interest rates go double digits, and that is a possibility, then I'll be getting myself a rather large mortgage and a very nice house. Thank you very much.

Are the bankers that dumb, Yvil, or are they playing a game?

I suspect they are playing a game as I don’t believe they or their models can be *that* dumb…

They can play all they like but I really don't think the RBNZ and their models matter. We have borrowed and "invested" as much credit as possible into housing, so we have almost no room to move. To slow the collapse of the NZ dollar the RBNZ will push up rates as the FED goes up, print a bit to plug the biggest holes in the employment dam, oops now more inflation, NZD tanking anyway, and so on. A cork on an ocean with a growing whirlpool sucking everything in.

For decades it's been pleasure for asset owners and pain for the rest. Now it's pain for everyone, and all the govt/RBNZ can do is shuffle it about a bit. I watch the whirlpool, not the cork.

"So the banks are slowly and belatedly coming to the realisation that the NZ economy cannot sustain much higher interest rates."

The economy sustained higher rates in the 90's and early 2000's. It's the high debt the economy can't sustain. Maybe the economy can't sustain the greed, the over inflated share and property markets. The economy certainly can't sustain a healthy planet.

Our current account deficit shows how much we rely on our import to run our economy, and with our weak currency value, it won't be helpful for taming our inflation. I don't see RBNZ has any other choice rather than continuously hiking its OCR. Can't blame anyone else, but to blame whoever in power to let our assets inflated economy running for decades without improving our productivity. We cannot stop it from happening, but we can take this opportunity to learn lessons and make corrections for our economy.

The RBNZ should not be increasing its forecasts of how high the Official Cash Rate might go at this stage

I disagree entirely, I think the RBNZ should precisely increase their FORECAST of how high the OCR will go. Expectation of where interest rates will be is a real thing. The first outcome is that the NZD will be supported a little better, the second outcome is that the expectation of a higher OCR is likely to alleviate the need to actually hike the OCR as high as predicted.

I think that the Fed is talking tough for that exact reason, I don't believe the Fed will actually hike by another 2 x 0.75%

Yep, it will be interesting to see how Orr talks next week. If he keeps to the same approach it certainly won't help our $.

"You can't handle the truth" Got to love that line, the RBNZ should start using it.

I think they were originally doing that with their 4% projection, but yes now that we are pretty likely to see 4% maybe they should be talking about 5%.

Excellent comment.

The BNZ should know as much as anyone the value in jawboning. And it’s done a lot.

Well, attending a housing conference today and a guy from CreditWorks is saying everything is going gangbusters and there’s nothing to see here….

I cashed in all of my chips 3-4 months ago, and every RE agent I have spoken to at open homes since then has said the same thing. Amazing then that some of them were showing the same homes this past weekend while the asking price is now $60k and 100k lower and no more than two groups through either house

What a dumb statement.. so they prefer for borrowers to be blind about future interest rate decisions?

Well, they would say that, these are the bank lenders aren't they ?

We need a recession as a cleansing agent. Far to many economic activities that shouldn’t exist under a true cost of capital environment.

I don't think we need one, its just what we're going to get to bring back reality because we've been in dreamy time land for far too long now.

We've had recessions and depressions in the past but seem to repeat again and again. What aren't we learning?

credit cycles. Its just part of capitalism.

The trick is the accept they exist and plan accordingly.

Lobbying - trying to influence and put pressure on Mr Orr

After the transitory inflation saga the Reserve Bank left itself with little option but to raise rapidly as they completely missed the boat.

Look, we're all clever enough to know that in some form the end of ZIRP will squeeze borrowers. People got very used to single digit interest rates but we can't keep bailing everyone who mistook low interest rates for financial genius. Asset prices will decline, possibly GDP as well but we'll come out the other side ready to enter a new growth cycle. Write downs and bankruptcy are a normal part of any economic cycle.

That BNZ piece looks all very sensible and measured, so let's just take it at face value and ask, "What happens if that is all there is to the OCR rises; what happens then?". We all know exactly what the response of our citizens will be.

The alternative might be to remind ourselves of Jerome Powell's recent words:

“These are the unfortunate costs of reducing inflation, but a failure to restore price stability would mean far greater pain.”

We cannot afford for the BNZ report to be right.

This is my cynical me! The BNZ just found out that a lot of their customers can't service a higher level of interest rates for a longer period. They don't want to be left with non performing mortgages for properties there is no future mortgagee market!

The BNZ prediction also means there is a recession, which is deflationary.

OCR will continue to rise until they cause a recession at which point the OCR will drop. Only question is how high will the OCR go before this happens

Fed went 0.75, if we dont attempt to match that we will be chasing our tails...or we could just ignore it and start thinking about how many peso's the nzd will buy.

Funny you mentioned the peso. But the peso actually strengthened against the NZD - from the last 52 weeks of around 15 pesos to 1 NZD to just 11.59 pesos to 1 NZD today. That should tell you all you need to know.

Yep we cant even foot it with the peso....lol

I don't know why so many people think high interest rates are going to destroy everyone. 68% of people don't have a mortgage on their house and interest rates are barely above 2018. If you borrowed against you house to finance the new SUV or an expensive holiday overseas then that was foolish.

Those of us who have given you all that cheap money we will be getting some interest and paying tax.

I don't know why so many people think high interest rates are going to destroy everyone

Is this a trick question?

https://www.stats.govt.nz/news/mortgages-and-other-real-estate-loans-dr… :

Total household debt increased 29 percent from the year ended June 2018 to the year ended June 2021, Stats NZ said today.

Property debt represents 89 percent of New Zealand’s total household debt, not including properties held in a trust. Debts on the primary residence accounts for 66 percent of total household debt.

I'm assuming your 68% only covers mortgages on the primary residence, which isn't the whole picture even if you limit your view to only to property debt.

Even if you don't have a mortgage, the economy is a connected system. For example, if you run or work for a business that relies on discretionary spending, you're still impacted.

Yup. huge amounts of property debt - in the hands of a very small amount of people.

The 68% are those mortgage free - i.e. renters and clear freehold. And even then, over 2/3 of the 1/3 remaining have very cheap mortgages that they've paid ahead during the low-interest times.

Not everyone leveraged up to the eyeballs to play the property game.

Debt permeates all levels of society.

So it's not just mortgages, companies will have higher debt costs as well as private individuals and their personal debt.

Borrowing money personally or for business is quite different to stacking up debt on housing speculation. The Banks first question to option 1 and 2 is...how much is your house worth?

According the debt loading exposure is very squed in option 3.

Things are usually relative.

Personal debt only gets so high, because usually security is low and the borrowing is for depreciating purchases. Pretty hard to rack up a house price worth of debt on personal spending (although not impossible)

Business debt is not insignificant, but it's also fairly expensive compared to property. Far shorter loan durations at double or more the interest rate of housing. But the risk is also significantly higher.

In any event the cost of both is going up also, and as the economy deteriorates, there's a cumulative effect.

I thought banks had to hold more capital against business loans, which is why they cost more. Yes I get this is a risk situation, also far less appealing to a bank when they can lend the same money 4x to specuvesting.

Because high interest rates, that are going higher, have every chance of derailing the economy and increasing unemployment significantly. Which could hurt some people with mortgages and some without mortgages.

I'm an economics ignoramus. Yet I've been puzzling for some time about what's happened over the last three years:

(1) Insane money-printing in an attempt to mitigate the catastrophic damage caused by global lockdowns;

(2) then despite the obvious and inevitable inflation as a result, central bankers sitting around on their arses for months, arrogantly proclaiming "it's just transitory" and nothing to worry about;

(3) then central bankers waking up from their stupor and apparently panicking, pushing interest rates up aggressively and rapidly, without waiting for the effects to flow through to economies.

WTF?!

Are central bankers across the world all incompetent? Or are they deliberately trying to push us into a global recession? Because it sure looks like the latter. Why would they do this?

Off to purchase a tinfoil hat...

If you watch and understand the concepts here (Ray Dalio - Changing world order), the insanity will make more sense...

And because of the size of the problem, there is very little that we individually can do about it. Nor any central bank in isolation.

Excellent watch, thanks.

If you are an ignoramus, and have worked all that out, what does that make the world's fancy pants bankers?

Mobsters?

Because of WEF's "The Great Reset" maybe?

After the GFC, they went to town on QE. Aside from inflating asset prices (which voters in the main loved), there was no negative consequence.

For whatever reason, we are now seeing that all come to roost. My view is that the inflation is perhaps also due to the money created over the past decade, not just the covid crazy money. Not that I have anything to back that up with of course.

So they where perhaps conditioned to do too much in response to covid, due the lack of negative effects of what they'd been doing since 2007.

IMO yes at an honest mistake. At worst? not deliberate. but culpable none the same.

It will be transitory, they can print all they want but the fundamentals of growth and limits are still there. The only question is how hard it will fall back.

When the dollar drops + 3% in a few days you have big problems , you can blame it on the Fed or pull out a big stick and bump your OCR to try and attract support. Mortgages /household debt...are weighed against what?...foreign raiders buying in to your local economy at dirt cheap prices...oh but the exchange rate is good for our exports...yes everyone likes a cheap bargain... The RB is supposed to be fighting excessive inflation not saving mortgage holders....

Yip we saved mortgage holders by dropping rates to zero in 2020....now we may need to throw mortgage holders under the bus to save the currency (and other parts of the economy).

Its just how the cycles work. NZ pretended we had some control over our local economic destiny for ages - by dropping rates too low for too long, importing too many immigrants and shutting our borders .. then we went on boasting how clever we were and how much our little wooden houses had become!

Now we will have to face the reality - where the likes of USA, China, EU and UK are facing massive economic issues and will change their rates, taxes and so on - to whatever is needed to combat inflation and their own issues. As they move their chess pieces we will be forced to move ours .... and no matter the bleating from BNZ that the OCR should be low.. the reality is that we have to follow the big boys and if the OCR hits 10% we have to suck it up, follow on and eat baked beans from the can and survive as best we can.

If i was leveraged up now i would definitely have a little fire sale while some people are still buying at todays bargain prices.

Ahh yes, the old pump n dump wealth transfer, it's almost like a cycle we do it some much. If only there was a way of recording events of the present so that our future selves could look at historical data and not repeat past mistakes. Have we been teaching children to be good at life or to be productive subservient employees?

Teaching them to be ram raiders mainly.

Recent OCR hikes haven't even made a dent in the NZD depreciation. It, like many currencies around the world, is in a whirlpool of doom way outside of our control.

Unfortunately, the comparison against other currencies only shows just exactly how terrible the mismanagement of the NZ economy has been. Sure, other currencies have declined. But not to the extent of the NZD. It's the 2nd worst performing currency in the last year, and 2nd only to the GBP without the NZ government even doing anything. It's worse off compared to the Euro AND the EU is currently dealing with a war on their nearby lands.

To say that this is outside of NZ's control is to believe in the complete BS sprouted by RBNZ and the government.

hehe - future economics lecturers will use Orr, Robertson and Ardens mismanagement of our nations economy as the basis of many lessons on how to destroy an economy.

Cant think of much they didnt do wrong, and continue to do wrong. The bigger issue is that the other main party doesnt want to rock the boat because they all own investment properties too.

They will look at the last two decades in NZ as one of folk pretending to be rich by foisting ever larger debt on following generations, rather than by creating value. Policy of entitlement, and how it broke the economy. Orr and the government are only the latest group perpetuating the model.

Reading on the above comments, I realize that everyone is hoping for a crash. I think that is quite a irresponsible statement and wish considering there were many FHB's who worked hard and saved for a deposit to get their first home. You are grouping them with the likes of landlords who have multiple properties etc. I think it depends what angle you are looking at it from. NZ is still a high in demand place for many. Those who've lived there for much longer may think otherwise, but many people outside of NZ appreciate the little things it offers. There is never a "perfect" country. There's pros and cons to every country.

I also don't see a "crash" coming. What would you do with all that free floating money? You wouldn't invest in stocks (because of the risk and recession coming). Or would you simply leave it in a term deposit bank account and lose value on your NZD?

I always zoom out on these situations and look at the 5-0 year outlook. For me, it tells me that things will work themselves out and at the end of the day, a house is still an asset people want to buy and invest in for themselves and their families.

-7

The facts point to a crash - 7jai. The reasons have been well articulated in the comments above and most folks here I think, argue the facts and when their forecasts materialise are unhappy that Orr et al didn't see what they saw. It's always good to have another point of view in these threads so could you flesh out why you believe NZ will avoid a recession?

Sorry to hear/see you are worried, I’m a fairly recent fbh as well but its pretty dam obvious whats happening and going to continue to happen. No matter how much you comment on interest/FB etc etc it will make no difference. You are not going to get the paper gains you thought you would. Just accept it and enjoy life and your home.

There's a difference between hoping for a gain and hoping not to have whatever miniscule equity you might have accumulated wiped out. But perhaps we'll finally be rid of that awful 'property ladder' that justified pricing a modest starter home in a far-flung regional satellite town near Auckland at approx. one entire career's worth of earnings once you'd paid interest on it, or even considered having things like a family and possibly requiring another, bigger home.

Don't be worried.

Here's how this plays out for you:

- if you believe in what you believe and it does come true, then nothing said here will affect you and property prices will go up.

- if you are hoping to get an investment property, then the best thing for you is that the commentators here are right and the market crashes so you can buy it cheaper. If the property prices go up, your investment property will be more expensive to purchase.

- if things will work out in the end and you believe that in the next 5 years a house is still an asset that people want to buy, then nothing will change and you will still enjoy your property gains.

- if the commentators here are right and the market crashes, you lose some of that paper gains but you don't have to worry because the next house you buy (presumably it will be an upgrade) will be cheaper.

In other words, win-win for you. In fact, you really should hope for a market crash. And putting it in a term deposit and losing value on the NZD? You don't have to put in the bank to lose value on the NZD - it dropped by around 18.5% for the last 52 weeks against the USD. That interest rate means nothing.

Plan for the worst and hope for the best. I don't think anyone here wants any existing homeowners to experience hardship. It's bittersweet for those who have purchasing power and sitting on the sidelines waiting for FLP to cease and OCR to rise.

It really does feel like there's a contingent that wants to do a Nelson Muntz style "ha-ha" at people losing their shirts.

Most are happy that land is coming down in price. I haven't seen anyone specifically wanting first home buyers to lose their houses. I have seen people say that when you buy a house there is no guarantee of future capital gains, and people shouldn't over-extend themselves. Buyer beware. That is not wishing them ill.

However, many are happy that investors might lose their shirts. This is only natural as the investor class have been making ridiculous capital gains at the expense of NZ society recently. In a stable society, inflation adjusted capital gains should always come with equal risk of losses. Renters are hopeful that land prices may one day become more affordable, so they can provide a stable housing platform for their families to thrive from. If that requires investors to lose out, they are all for it. Who would blame them?

IMO those who don't understand these points innately, are those who have chosen not to think about them. They normally can laugh it off as they are sure they are on the profit making side of the divide, but now things are uncertain they are taking it to heart more.

You should never encourage reckless, dangerous and unproductive investing/business by bailing it out. It sucks for the over-leveraged but it saves the economic equilibrium and people learn a lesson.

Our son finally got on to the property ladder today in Wellington where he works. Bought in Miramar with a friend and the friends partner. So shared equity 50/50. House on the market 5 months ago for $1.1m + and they just bought it for $785k. Roughly a 30% discount. So pleased for him. House needs some TLC of course but mostly cosmetic.

More courage than me, for sure. I wonder which way the ladder will head from here.

Well done, sounds like a good buy.

It’s along the lines of what I have been saying, buy if you can afford and at a value at least 25% below peak value.

That's great news, congrats to your son and co. Sounds like a far more manageable, fair, and 'sustainable' price.

Madness... $785k plus interest = $1.4mil+... If he had waited until March - june he would save another 30%

The brown stuff hasn't hit the rotating device yet brah!

The Reserve Bank’s forecast for NZD TWI appears to be far too optimistic & shows their lack of understanding the consequences of ultra loose monetary policy & cheap loans to banks though the FLP until Dec 2022.

NZ’s current account deficit (Exports - Imports) of $27 billion for year ending 30 Jun 22 or $5k per person shows that NZ is living beyond its means. This deficit has to be funded from overseas cash inflows.

The drop in NZD TWI shows an increasing lack of confidence in the NZ economy.

The Reserve Bank’s credibility for its forecast of 13 consecutive quarters of GDP growth between 0.0% & 0.6% is way too optimistic given the current NZD TWI trajectory.

Hard landing is now > 50% probability & stagflation (no GDP growth, high inflation) is the probable outcome in next 12 months.

As day follows night - the bust always follows the boom.

The error was trying to fight it and now making the correction bigger instead of just letting it play out and enjoying a shallower peak and trough. Egos are to blame as usual.

Viewed as the glass half full.. in the downturns are always great opportunities, typically exciting innovation and some great investment opportunities. (Though maybe not in real estate for 5 years or so lol)

This is correct and very alarming.

You've got a perfect cesspool of a rapidly declining currency, increasing current account deficit, declining business confidence internally and an inept government and RBNZ. Europe is fighting a war and yet its currency has appreciated against the NZD.

The current OCR is 3%. The Fed Rate is currently at 3.25%. Who in the right mind would invest in NZ at this stage in the global flight to safety? Even if RBNZ increases the OCR by 50 points, that's simply insufficient to compensate for the significant risk. Unfortunately, it's in a serious bind - and I'm not sure if it has the courage to do the right and only thing which is to raise the OCR by at least 100 points and stem the currency outflow.

Stagflation is a lock. We will have a country so expensive that no one can afford to pay for anything that isn't going to and from work.

I keep referring to the early 1990s when NZ was recovering from structural economic fallout and this has the potential to be as bad, if not worse.

Ironic that New Zealand had previously suffered from the fallout of Muldoon's subsidising and protecting of one favoured sector, to the point it almost bankrupted the country. In that case, farming. And now we've done it all over again with property speculation, favouring it and protecting it via tax, subsidies, and zoning protectionism.

Instead of rewarding value-creators, politicians went all-in on land speculation, and now we're seeing the economic fallout.

It would seem though that our economic values, our greed for economic wealth are the cause of our problems. Value creation just sounds like another narrative with no substance, much like the value added concept. It's as if we've been brainwashed and indoctrinated into a false belief system. Our values are upside down and backwards. The fact that homes have been turned into speculative financial assets, that one is taught to spend most of their energy just trying to afford a home or climb the property ladder is evidence of this. That entire industries have been created that exploits people's need for shelter and security just shows how far humanity has fallen.

Value creation is a pretty simple term. If you take raw ingredients and build a product that people value, you've added value to the ingredients and to the economy. If you buy a house, hold it but don't improve it, then sell it for more...you have not added value. The economy has been based on speculation rather than creating things.

The Reserve Wank need to focus on thier original mandate!... Not the Stalinda " be kind and save the " gay Maori whales " agenda that he has been forced to " compromise" our economy with.

Orr should stop playing with the rabbits and running with the hounds!

His and Stalinda dumb actions have driven the economy to the edge of recession (standby for recession in march 23) and you can't blame Covid or Putin's oil/ gas pipeline for that... You can blame Stalinda's...

Min wage hikes

Banning oil / gas exploration

Wasted$$ on comms staff, govt agencies over staffing, working groups...

Taxes/ house value recession.

Dot dot dot

The United States just destroyed Nord Stream 1 and 2. That's an act of economic terrorism committed against an entire continent of 700 million people. The US can now sell expensive gas to Europe though. There'll be a severe and prolonged economic recession in Europe now that Germany has been hobbled.

Alternative facts

Yep investigation 101 who stands to gain the most.

Custard, mmmmm. Make mine vanilla with a dusting of turmeric, waitron.

No amount of dusting will mask the taste of ground economy

0.5595.

Any lower and Adrian is going to have to pull 1.5% out of tool bag to fend off imported inflation.

Am I right in thinking that if we continue to allow un regulated fiscal stimulus from the reserve banks in a capitalist environment the economic Rollercoaster cycles will forever be with us?

Yes. Not 'unregulated" though, the banks get the government to write the regulations they will agree to, a better word would be 'insane'.

So a direct conflict of interests then. Where else is this allowed in any democratic organisation? I feel we all waste time talking about the issues that stem from this when all the suggestions are fallible, ambulance at the bottom of the cliff, and not addressing the source of the problem. It will be the down fall of America and the rest of the western civiliasation.

Prove me wrong.

I've never understood this phrase, I love custard.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.