It's nearly time to get the popcorn ready.

This coming Wednesday (May 24) the Reserve Bank (RBNZ) will be having its latest review of the Official Cash Rate (OCR). The recent history of these announcements suggests it won't be dull.

My best guess (and your guess is as good as mine) is that the RBNZ will increase the OCR by 25 basis points (bps), taking it to 5.5%, the highest level since December 2008.

Assuming that's what happens, this will be the 12th consecutive increase to the OCR since the beginning of this tightening 'cycle' in October 2021 and it will mean the cash rate has been raised - at unprecedented speed - by a thumping 525 bps from its pandemic low of 0.25%.

And if Wednesday's increase is 'merely' 25 bps this will follow eight consecutive hikes of at least 50 bps (with a 75-pointer thrown into the mix for good measure in November 2022).

The big question will be: What comes next?

Well, hopefully, we will get a few clues thrown our way.

This Wednesday's review will be accompanied by the RBNZ's latest Monetary Policy Statement (MPS) - so, the RBNZ's got plenty of scope to outline its current thinking and how it feels its strenuous efforts to rein in inflation are going.

Of vital interest will be the forecasts contained right at the back of the MPS.

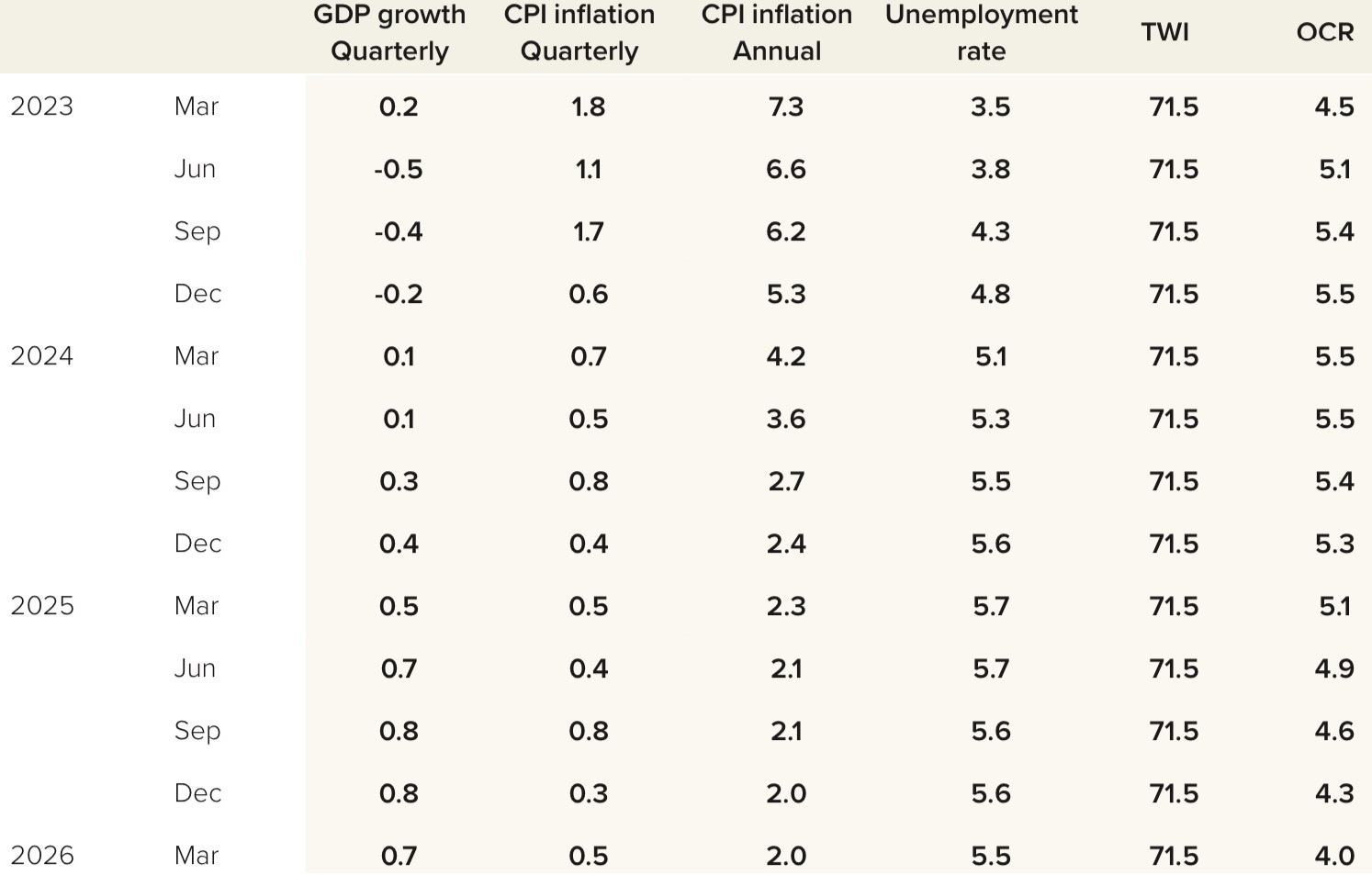

The last MPS was issued in late February. To refresh memories, here's an abridged table of the main forecasts made then. (The full table appears on page 57 of the MPS.)

Okay, so, the big thing on Wednesday is going to be looking at the latest set of forecasts and how they differ from those made in February - because they will. Actual economic developments since February demand that.

The first thing everyone will want to look at is that forecast figure on the far right - for the OCR. As can be seen from the table above, the RBNZ was forecasting the OCR to peak later this year at 5.5%.

So, if we do indeed get a 25 bps increase on Wednesday then we will be there. Already. The OCR will have hit what the RBNZ indicated was going to be the peak. Journey over. Apparently. But really?

Will the RBNZ want to give the impression it has definitely 'finished' with rate hikes? Hmm. I doubt it. Not when it will be all too aware of the 'market's' inclination to start pre-empting interest rate reductions.

Therefore there must be a better-than-reasonable chance that the RBNZ will want to forecast a new, higher peak of maybe 5.75% or even 6%.

In just the past week of course the Westpac NZ economists forecast a peak of 6%, very much breaking away from the previously existing general consensus among major bank economists that the peak would be 5.5%. Subsequently economists at the country's largest bank, ANZ, have forecast a peak of 5.75% by July, as have economists at global economic researcher Capital Economics.

Significantly, wholesale interest rates at time of writing were now 'pricing in' a peak OCR of over 5.75%. This would please the RBNZ. Falling wholesale interest rates (and the downward pressure this was starting to put on retail rates - IE mortgages) were the prime catalyst for the shock 50 bps rise the RBNZ implemented at its last OCR review in April.

Would a higher forecast peak from the RBNZ now be warranted, or at least justifiable?

Well, for a start it is worth remembering that a forecast is just a forecast. If the RBNZ forecasts a peak OCR of 6% this does not mean the central bank HAS to raise the OCR that high. We've seen before that whatever the RBNZ projects in terms of future OCR levels has a marked influence on how the wholesale markets and subsequently the banks price interest rates. The projection is just about as effective as the actual 'real' hiking of the OCR.

What economists are now starting to suggest is that the RBNZ will keep on hiking at the next two or three reviews (in 25 bps moves).

This does, however, leave the same 'problem' for the RBNZ come, say July, (less than two months away) that it has hit a perceived peak level of the OCR and the 'markets' are eyeing future rate cuts.

One thing I think the RBNZ could and perhaps should consider (and again this assumes that the OCR does move up to 5.5% on Wednesday) is forecasting a 'pause' in rate rises for the next few months but then forecasting the OCR moving up in say the final quarter of this year. Such a strategy would give the RBNZ the chance to take a breath and assess the impact of all its hikes to date, but would also keep the pressure on the markets in terms of expectation of further future rate rises.

That latter point could be vital, because as mentioned further up the article, even if RBNZ took the OCR to 5.5% and forecast that the rate would stay there for the next year the 'markets' would be immediately looking for reasons to start dropping rates. But the explicit suggestion by the RBNZ that, okay, it's pausing now, but it's going to raise rates again, would give second and third thoughts. And crucially from the RBNZ's perspective it will likely keep mortgage rates roughly where they are now - which is what it wants.

So, back to that question of whether a higher forecast peak is warranted, or at least justifiable, it's worth having a look at how actual economic events have unfolded this year when compared with some of those RBNZ forecasts made in February.

December quarter GDP shrank by 0.6%, when the RBNZ had picked it to grow 0.7%. March 2023 figures have yet to be released.

The Consumers Price Index (CPI) showed annual inflation of 6.7% as of the March quarter, which was considerably better than the RBNZ's expectation of 7.3%. But nothing is simple. The RBNZ had expected domestically generated inflation to be 7.1% and the actual figure was a reasonably adjacent 6.8%. And its the domestic inflation that the RBNZ can do something about and therefore worries the most about.

Unemployment for the March quarter came in at just 3.4% versus the RBNZ's pick of 3.5%, while private sector average ordinary time wages increased at an annual rate of 8.2% against an RBNZ pick of 7.6%.

So, a mixed bag there. The labour market was still hotter than the RBNZ wants and was picking, GDP much weaker than expected, and inflation not as strong as expected.

I would say there's still enough justification from those three key data sets (and particularly from the labour market data) for the RBNZ to go ahead with an OCR increase next week.

But beyond these, I guess you would say, 'big three' data sets, it is arguably some of the more 'minor' real time economic data we have seen recently that may well be causing the most consternation within the RBNZ.

We are still spending money, in greater volumes than would please the RBNZ although crazy food prices are playing a part there, because it's costing 12.5% more to fill the grocery basket this year. Such an obvious inflationary impact on households could help to fuel the dreaded 'inflationary expectations' - these self-fulfilling thoughts that lead to future inflation. However, one note of encouragement for the RBNZ will have come from its recent Survey of Expectations, which showed a marked drop in the expectations of future levels of inflation.

But if that's a positive for the RBNZ, well then there's the surging inbound migration...

The RBNZ has already made reference to the latter as a potential inflationary factor. And it's the migration situation that tipped the Westpac economists over to expecting a 6% OCR.

Anything the RBNZ says on Wednesday about migration (and it is sure to) will therefore be of the utmost interest, particularly as to how inflationary the RBNZ may judge the impact to be. Migration is complicated. On the one hand the influx of workers will take heat out of the labour market - which is good for the RBNZ. On the other hand all these extra people will increase demand in the economy, which could be inflationary. Bad for the RBNZ.

The migration concerns will come on top of concerns the RBNZ has previously expressed about how inflationary the aftermath of the Auckland Anniversary Weekend floods and Cyclone Gabrielle could be. And the RBNZ will be quickly trying to digest the impact of Thursday's Government Budget announcement and how potentially inflationary some of the rebuilding initiatives and other stimulus measures might be. Early indications are that the RBNZ was right to be concerned.

Obviously it will be interesting to see if the RBNZ has a view on whether the Budget might require it to do more work (IE interest rates higher than they would have been), although it is likely to be reasonably discreet about what it says. The media are already keen to play up a Government-versus-RBNZ conflict. But clearly the Budget looks to have added potentially more upward pressure on inflation - and by implication the OCR.

Taking all these various factors together, it is to be imagined that RBNZ Governor Adrian Orr will again be sporting his 'hawk' outfit on Wednesday and it may yet be some time before we catch a glimpse of 'the dove' again.

Will there be room for surprises in Wednesday's announcement? A 50 bps rise, for example? Well, it seems that under this Governor the RBNZ always has room for surprises.

That's why we will all be well advised to have that nice big bucket of popcorn by our sides on Wednesday.

Expect anything.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

106 Comments

With the swaps rates shooting off the scale, i think we are about to see the lambs get directed straight to the slaughter house.

Get the popcorn out for sure, the next 3 to 6 months will be fun.

I agree. Seeing the swaps reaction to the budget indicates to me that the feeling is the Govt just lit a rocket under the inflation bus.

High inflation coupled with an election year is a very dangerous combination.

I think there is only one more release of CPI before the election.

For generation naive, the message is about to get rammed home that the cost of borrowing determines the destiny of asset prices and jobs. As a nation we gauged our prosperity on selling ever more expensive houses to each other. Now, its reset time and we are about to discover just how poor we are and were for the duration of this epic illusion.

During the 'good ol days' there was always that mantra going around, "People's property values go up, they feel wealthier (albeit on paper) so they spend more (debt that is) which is good for everyone". I always struggled with that concept!

It worked well with an ever-decreasing cost of debt. Worked even better for those leveraged up into several properties. The other side of the curve will work even more…in the opposite direction

Yes. We did feel wealthier and spend. And the resulting increase in debt has been a disaster for the nation and many individuals.

That’s yesterdays orthodoxy rp. We have such a skills shortage that wage rises are eye watering. Try getting an audit done or hire someone with even basic accountancy quals. The wages are incredible.

anyone who has to arrange audits will know the challenges we have with skills shortages.

I can't help but think that First Home buyers especailly over the last few years have been screwed. So much of the media was talking about how house prices in NZ hardly fall historically, and emergency low interest rates causing house prices to balloon, creating so much FOMO. I saw very little about the risk of interest rates rising like they have. IMO this could be the equivalent of the finance company problems 15 years ago, where many first home owners may have to sell up if they can't afford to pay their mega mortgages.

If businesses have rates that are higher than mortgage holders, say 8% vs 3/4% do their rates increase at the same increments as mortgage holders? Just a thought but some businesses are leveraged to buy equipment….think transport, construction etc. Wonder how that’s going to play out.

Yield on business loans moved very quickly - now averaging 7% (up from 3.2% 18 months ago). Business loans are over $200 billion!!!

https://www.rbnz.govt.nz/statistics/series/exchange-and-interest-rates/…

I wonder if the business loan average is being dragged down by large corporates. Some of the smaller operators were well above that before interest rates really started climbing (appreciate that it is an average). Think the likes of the second tier lenders (when the bank won’t lend). There maybe quite allot of smallish businesses directly in the firing line.

Yes, the average will make a lot of variation. Revovling credit / arranged overdraft rates will be much higher than that for smaller businesses.

A cold look at the data:

- Budget was the most contractionary since 1992. What? You didn't hear that in the news? Take a look at the forecast consumption expenditure in the Treasury forecasts (Time Series - Economic Tab right at the end) - the drop from 22 to 23 (and into subsequent years) is huge and is happening alongside a major drop in private consumption. It's a recipe for demand collapse. People are focusing on the few giveaways and missing the 20% real terms reduction in police funding, school funding going back to 2018 levels, how much of the $ is going on interest payments etc etc

- Inward migration is filling jobs but any real wage growth was a year ago. We'll see some last gasp as public service jobs move a bit but most wages will lag CPI now

- The producers price index data last week showed a huge slowdown in price increases (input costs rose at 0.9% annualized rate) - following a similar stall in import prices index last month. These are both very reliable leading indicators of CPI

- Spending in real terms is slowing significantly - look at the latest card spending data for consumables and adjust it for price of consumables (10% to 12%) and the drop is very clear

- The Q4 2022 data shows that higher interest rates are benefiting households overall - more people are winning than losing. Most of these people are savers obviously but might they spend more as their savings go up?!? The same data also shows that interest costs to businesses are skyrocketing - billions of dollars a quarter extra. Is it not likely that they will pass those costs on to consumers?

- The farmers and food producers data last week showed that a whopping 52% of their cost increases in the last year were due to interest rates! Around 4% was labour!

- Auckland rents are shifting up a gear - particularly at the lower end. Demand is playing a role here of course, but is it not possible that much higher interest and other costs for landlords might just make those increases a bit more likely?

Anyway, enough. My strong view is that the biggest inflation risk is now RBNZ and their medieval monetarism. Interest rates are just driving costs into the economy and putting upwards pressure on prices. Higher rates are also leading to huge re-distributions of money from struggling younger families to people and bank shareholders that have already got more than they need.

It's time to stop.

Excellent post Jfoe.

Indeed. Superb comment and food for thought.

For example, investors are often told that the trillions of dollars of quantitative easing “supported” the economy by encouraging bank lending. They might be surprised to learn that despite the most aggressive monetary policy in U.S. history, commercial bank lending since 2008 has grown at just 3.4% annually, easily the slowest rate in data since 1947. Link

Be nice if you could provide some links to the data you are referencing. I tried looking for some of it but wasn't having much luck.

That aside, if we were to take this path and drop interest rates what would you propose occurs simultaneously to prevent the errors of the past 2 decades from being repeated? How do we prevent another explosion in house prices that are a major part of the reason we are in such a bad situation now? How do we create real wage growth? How do we limit the ability of property owners to shakedown renters to the detriment of both the renters and the broader economy? how do we move money from the cashed up households with paid off mortgages to the "struggling young families"?

You have an interesting perspective but I can't help but be a bit sceptical of this take if it isn't proposed alongside what you think would actually address the very real issues we do face.

Fair point on the sources - I've added a few links to the original post.

Lots of questions there!

My strong view is that we need to control the flow of credit with more sophisticated tools than a dumb single interest rate. Credit costs for productive enterprise, investment in green tech etc, should be on the floor, whereas credit rates for share buybacks, speculative property investment should be sky high. On house prices, I would go for a state-backed 25-year fixed rate mortgage (at say 4%) with buildings insurance included... but this would only be available up to a given amount (median house price) and would be for owner occupiers only.

A tax on land is also an obvious move - we need to embrace the redistribution! The Crown should also buy land (forced acquisition if necessary) and lease it for peppercorn rent to Councils and social housing organisations to build out social housing at scale. The State should not be afraid to step into the failing rental market aggressively.

I could go on, but that's enough for now!

Some pretty heroic assumptions in Treasury’s forecast.

For example, 3.2% GDP growth in 23-24????

And how the heck do they arrive at residential investment increasing by 3.9% in 23-24, and only contracting by 4.4% in 24-25?

And… their Table 1.1 shows residential investment increasing by 3.9%, But on page 14 they say residential investment will fall by 3.6%…

Gross errors questioning the credibility of their work or have I misinterpreted something???

https://www.treasury.govt.nz/publications/efu/budget-economic-and-fisca…

No, it's pretty shocking. They are assuming private borrowing picks right back up next year too - really?!?

Just unbelievable stuff. Are our government agencies so politically twisted now??? (Or are they just really really bad)

Someone needs to dig into this.

Any on to it journos out there?

Have I got that discrepancy correct JFoe, between table 1.1 and the text that follows in their report?

It’s likely that residential investment will fall by at least 30-40% I would have thought. And probably more.

Classic Builders saying the other day that their building activity likely to halve.

I think the text is referring to trends in the calendar year 2023 and the data is for the Govt fiscal year (to June)

I wondered that. But you would think they would use different language if that was so. And wouldn’t all their forecasts be fiscal year based?

Either way, totally unrealistically optimistic assumptions

"Interest rates are just driving costs into the economy and putting upwards pressure on prices. Higher rates are also leading to huge re-distributions of money from struggling younger families to people and bank shareholders that have already got more than they need"

An in reverse, over the past few decades, we were adding to the deflationary forces of globasliation by dropping interest rates, thus reducing expenses (interest rate expense) for businesses and households. This made everyone feel wealthy and think that they were genius investors.

And as such, each year debt became easier to service, so many took on even more debt (as opposed to paying down the debt they had). Projects and investments that provided a positive cash flow/NPV returns went ahead - even if they really added any value to the company/society for the debt that was created to support them.

Rising rates, risk reversing all of this - and once they gather steam they could become self supporting - like an avalanche that gathers momentum as we each pass our rising costs to one another in order to survive.

Great points. Interesting that the forecasts include continued significant current account deficit and an abrupt stop to Govt spending increases. This can only happen if private debt (household and businesses) continues to increase. Make it make sense!

The answer is here:

Household debt - Reserve Bank of New Zealand - Te Pūtea Matua (rbnz.govt.nz)

We're already maxed out with private debt.

So the government will keep deficit spending (because we have the room to do so) which will be inflationary which will limit interest rate cuts, because cuts will risk inflation getting out of control. But as the pressure rises on our indebted households with these higher interest rates, our ability to pay tax may reduce and we may see credit downgrades, resulting in higher costs/interest rates on our government debt.

I don't buy the Govt spending = inflationary line. That depends on the productive capacity of our economy - i.e. what real resources are available for purchase.

But, yes, if we run current account deficits, and the private sector does not increase debt (in aggregate) then Govt has to deficit spend to balance things out (we effectively 'export' Govt bonds to close the current account deficit). The same accounting rule applies to all countries of course - and many carry on for decades. However, our trade deficit is getting a bit daft now.

"That depends on the productive capacity of our economy - i.e. what real resources are available for purchase"

Globally we have already created more money than we have productive capacity - that is why we have an inflation problem.

And our biggest productive force, the boomer generation, are going from being producer/consumers just to outright consumers now - increasing demand with their collective wealth at retirement, but doing nothing to produce the goods/services required to satisfy their needs.

Big demographic changes are unfolding around us.

Ray Dalio has this covered indepth. Boomers retiring is an economic shockwave, many have denied at their peril.

Housing prices will be collateral damage.

Its begun.

The farmers and food producers data last week showed that a whopping 52% of their cost increases in the last year were due to interest rates! Around 4% was labour!

Farmers carry a lot of debt, but that reads two ways:

1. They're carrying far more debt than they should - how many have leveraged against the land, rather than [ahem] organic growth funded purchases?

2. They've increased their pay to workers less than inflation - pity the poor beggars working for them. (But don't forget a lot of labour cost got washed away before the harvest season along with the crops).

The banks and RBNZ keep a huge lid on what farmers can borrow. Borrowing 50 percent of farm going concern value would be absolute max. So there is a lot of equity needed.

Farm values have been in the doldrums except for sheep and beef conversions to carbon forest.

Fieldays opens in 3 weeks so you could ask some farmers then

Agriculture overall has around $60bn debt - the same as 6 years ago, so well down in real terms. within that, dairy farmers have been paying down theirs debt for the last few years, whereas horticulture has been increasing borrowing quite a bit, Unsurprising I guess given the challenges they have faced. All the data is here: https://www.rbnz.govt.nz/en/statistics/series/registered-banks/banks-as…

Now look at the increases in their other in puts: Electricity, Petroleum and Diesel, Fertiliser, Repairs and Maintenance, Animal care products and services.

Labour is only a very small component of a rural agricultural operation and I know in the dairy industry they go up pretty quick with a bit of experience.

The Banks have been hammering lending to rural operations over the last decade as the above comment notes, and rates are significantly higher than lending for housing. This sure has contributed to stagnating growth in the rural sector, not to mention the absolute landslide of new government policies and other red tape expenses.

Its a tough sector.

Jfoe, I believe higher interest rates are not just 'driving costs into the economy", they can also increase productivity. If two companies produce the same product, one has high debt, the other has no debt. When interest rates rise, the company with debt can't afford to put prices up or they will become uncompetitive. They either become more productive or go out of business. There are a number of companies that are only around because of the lower interest rates we've had for a few years.

Those that took up the 3 year offer recently, will thanking their stars..

With 10y close to 3.7 and moving up, those 3yr rates will look like a bargain in a couple of months

But how will those rates look in 1 year +...

But Tony said he was 99.9% confident rates had peaked...

There's nothing worse than a rude awakening you placed a bet on a Nag.

There's nothing worse than making assumptions...

My point exactly!

Tony who?

Tones A from Onewoof fame has had 20x experiences as talking up the "peak interest rates" moment. He is the boy who cried wolf soooo, soo many times, the baying crowd hopes the wolf just eats him to get over the "always wrong" monotony!!!

He has also done the heavy lifting to demonise the Landlording class. Talks of tenants/Actual People as chattels to be exploited (hike rents as much as possible, then blame the Govt fable) as much as the vampire can extract, near to death.

RBNZ have to raise rates to combat the loose monetary policies strated by them.

Now there is so kuch liquidity in the market that stopping the tap one turn at a time is now working. The ground is to soggy.

Got to push hard and turn the tap fully off, move to an OCR which is above the rate of inflation. This should have been done that an year ago.

By moving the OCR slowly is not helping and it's prolonging the pain and keeping inflation higher for longer. This will also result in higher rates for longer.

I used to agree but I think moving too quickly may just collapse the economy, although maybe delaying is just slowing the collapse down. I often look at house prices around the western world and NZ is expensive compared to just about anywhere, especially considering it’s a small country in the middle of nowhere.

I don't disagree with your statement but I clearly recall numerous comments, including here, back when the OCR was ~.25% that it would not be able to go to 3% as that would most certainly crash the economy.........and look where we are now. New realities can develop surprisingly quickly.

That’s true, and probably included me. I guess it depends on how many mortgages are coming off fixed rates over the next year, as well as how many people lose their jobs as sales slow I.e. places like Harvey Norman etc. The flow on effects of business rates increasing resulting in the need to raise prices could also be inflationary as well as reducing the demand and increasing unemployment.

I can't help but wonder if a lot of what we are seeing in the labour market has much less to do with interest rates than we think and much more to do with the aging out of the workforce of the baby boomers. It would go a long way to explain why the labour market is so much tighter than seems logical given the apparent overall outlook for the economy and also be a major reason why inflation is so stubborn (lots of boomers are still spending but less are working). It would also indicate that these things are unlikely to change much over the next couple decades as there is no countervailing force that can halt this trend (and if one emerges it will change so much all bets are off anyway).

Yes, I believe there is some truth to the boomers, but then I also wonder - How is there so much more work now, that requires so many more jobs, than say 50 years ago?

Technology was meant to be removing work, but it seems it is doing the productive stuff, while we (the humans) are just "working" on unproductive wastage.

I think the demand from boomers will drop off quickly. At the moment they are cashed up and looking to spend, down at the cafe every day or getting a new e-bike etc. when they turn 70 it will be a whole new phase and they will start living frugally.

With their house values dropping quite a lot, will they be quite as care free?

Two years ago the avg 2yr fixed mortgage rate was ~2.5%, today it is ~6.5%. There are a lot of people on 2 year fixed rates that are yet to feel the pain coming...

Some of this was correct 18 months ago. None of this is correct now.

25bps because the RBNZ does what it says it was going to do regardless, anything else would prove it was wrong. Last rise and hold and we will be told to wait for the lagging indicators to catch up. Its all good didn't you know. That's all folks. As above its going to have to be held at this figure for a very long time if inflation is proven to still be rising and the RBNZ do not want to raise it. Lets be honest here they are protecting the housing market still.

The artificial rocket boosters of cheap debt have splutter their last. Specarus is now struggling to cut off the boosters dead weight, and and pay tax as financial gravity applies.

https://i.stuff.co.nz/business/132055816/investors-pay-66-million-more-….

Picking at least .5 OCR if not more. How dem apples...

Yes averageman. And we already knew this some years ago.

I am not usually one for conspiracy theories but it is all looking rather good for the cashed up super rich. Inflation is coming down globally, but if they keep cranking up the interest rates they can crash asset prices and buy up the spoils from the poor suckers who believed that leverage was the way to get ahead. Immigration provides lots of nice low cost workers and justifies higher interest rates. It’s a win win for the super rich. This is the way to stop the aspiring middle classes from getting ahead and keep them in their place.

You are right. There is an old saying. Money makes money.

If you can't swim against the tide, swim with the tide. If you can't get rich, marry a rich.

Sadly its true, you get to a certain point with money and everything is a win win for you.

Not so. Seen someone inherit the family farm debt free, but loose it all by betting it all on residential based tax avoidance in Blue-chip. Many a silver spoon loose it all. Look up Mark Lyon.

You cannot help stupid people. I think you will find that anyone who has actually hard to EARN the money themselves is not stupid and they go on to everything being a win win, that's just the way it works, otherwise its easy come easy go for silver spooners who get greedy.

Hard men lead to good times, Good times lead to soft men, soft men lead to Hard times.

Talking to my uncle who has been farming in Parkes, NSW for the last 15 years and he has so many examples where the parents have worked their assess off building large farming businesses, only to retire or die and pass it on to the children. Most of these farms very rapidly turn to shit, or go bankrupt as the kids and their families squander the wealth without knowing how to do the work.

Its a very common theme amongst the latest generations. We have all been born with a silver spoon in our mouths relative to even a century ago. I would say only a minority of the population knows how to actually work and this is only going to cause more problems going forward.

Even just look at the politicians running the show, with the USA being the perfect example of weak men.

Hard times are coming in my lifetime.

Have you read 'The 4th Turning' Galloleous? It might be of interest given the theme of this post and provide a theory (and it is only a theory) of what could be unfolding around us.

The world made far more sense to me after reading this - in terms of demographics, the characteristics of each generation etc and the cycles that play out. Each generation plays out the darkside personality traits of their parents - so this would help to explain what you describe above.

You may be right but that's scratching away at the the global FIAT banking system v.s. what ever happens in NZ. Banks and speculators and the ticket clipers (agents etc) have all made serious bank.

That said what's unfolding was always coming.

Property in NZ have been grossly over priced for some time. This is due to the tax rinsing aspect, the ability to avoid tax on capital gain, ever cheaper debt, ease of foreign ownership, and mass immigration that no one voted for. All of those drove a lot of tax free speculation from both domestic and international sources. You take most of those away and you start the decline back to debt needing to be supported by income.That's is a long way back, at least 50% from peak

Some will have paid down debt in the last ten years to get ready for financial reality. Some will have embraced leverage like mindless junkie, blind to all signals by their own greed.

Accordingly some are positioned make play, some are positioned to be financial roadkill.The kaaaaark moment is indeed approaching.

Interesting piece of news about banks I just read. How does this impact us and RBNZ decision on interest rates? The intelligent readers here can probably disect this news and provide analysis.

https://www.thestreet.com/investing/yellen-sends-a-chilly-message-to-u-…

The RBNZ could have slammed the rising CPI gate shut 2 years ago when it started its move upwards by posting a prohibitive OCR of 3.5%. It didn't because it was too cautious; too uncertain of the possibility that the CPI would keep going upwards. I'll wager most of us here today would welcome a terminal OCR of 3.5% if it served to contain the CPI early on.

And here we are. Same place, different numbers.

The RBNZ has the opportunity to slam the gate shut again on Wednesday. Post the OCR at 6% and make noises that it is getting out ahead of what may come, regardless of the possibility that CPI could rapidly fall. If it does, cutting the OCR from 6% is an easy option. But if the gate stays wide open; if the CPI keeps climbing, and the OCR keep being dragged along behind it by that, then 6% will look as attractive to us in the future as 3.5% does today.

Fortune favours the Brave, and all of that.

They have disregarded the Taylor rule at their and NZs peril !!

https://www.investopedia.com/articles/economics/10/taylor-rule.asp

Yes 6% shock and Orr this week. Unfortunately, probably not and the pain will instead take years......

Excellent post. But Orr does not have the competence nor the balls to do it. Next week he will raise by 25 bps only.

He's been calling out "don't max out borrowing" for some time. Some listened. Some didn't.

Place your bets.

Irish inflation has tracked NZ inflation almost exactly and is now, like ours, coming down. Irish interest rates did not move *at all* until mid-2022 and only reached the dizzy heights of 3.75% this month. The idea that the OCR is having much depressive impact on the price of things we buy is looking increasingly stupid. We are a little price-taking island in the south pacific.

Jfoe - I assume that you are going to be as vocal about this when we start slashing the OCR as well?

I won't rest until they just park the bloody thing at 3% (or whatever) and leave it there. It's 2023 for heavens sake and we're still yanking a single lever up and down and pretending it has predictable impacts across a complex system. An obviously destabilizing mechanism sold as necessary for stability!

Prior to the creation of the Fed, we used to have long periods of deflation - i.e. falling prices.

Perhaps we should allow this again - instead of pumping more and more money at economies in a desperate bid to avoid deflation - i.e. central banks are willing to do absolutely anything/everything but allow the things we want to buy to be cheaper in the future. Why are they doing this? Because they know the highly leveraged debt/Fiat system will collapse if deflation shows up (it would happen within months if not stopped as entire economies, like NZ, would freeze up and households, companies and governments would default because they need the debt to be devalued via inflation for the system to keep running).

We've rewarded risky speculative debt ownership for too long and it has perversely incentivised people/companies to act very recklessly - and with the assumption that they will always be bailed out by the system with future artificially created inflation. Perhaps this is what we need to change.

#madness

JFoe the lever has a pretty good history of working, inflation has been much more consistent since central banks have targeted with the cash rate. Even now we are considering 7% inflation as the end of the world when it used to be common.

I think the central banks need to forget about trying to save the world all the time and just try and do their job and keep inflation in check. They kept the 0.25% way too long for no good reason, it was never their job to combat covid.

I'm sorry, I just don't believe that is true. We have had periods of serious inflation whenever we have had major shocks to critical input prices - oil, gas etc. The rising prices of critical input goods are contagious - flowing through quickly to other prices (including wages etc).

What brings an end to these period of inflation is generally resolution of the causal problem - the Iran / Iraq war and the restarting of supply chains for oil, India and Greece finding a route to market for Russian oil and gas etc.

The central banks are almost always spectators in these dramas unless they do something disruptive enough to break something. Volcker springs to minds. But even then, did oil prices slow down because Volcker did brutal things or because Carter negotiated peace in the middle east?

From what I'm reading the oil price has reduced recently due to the market seeing a recession being forecast in the US. There is a recession being forecast because interest rates have gone up. If interest rates didn't go up, oil price would be even higher as OPEC has recently cut supply. Doesn't this go against your theory that increasing interest rates, to the degree they have been hiked, is a bad thing? Edit: Taking that a step further, increasing interest rates in the US has reduced oil prices, reducing inflation. And if NZ didn't increase their interest rates at the same time, the NZ$ would drop, increasing the price of imported goods, oil??

6% is till too low . I say at least 10% OCR for next 10 years. It can be increased 20%. Home loan rate should be minimum 25% pa. House price decease by 90%. Inflation will be gone forever. We got deflation for many years. Just like Japan!

The labour market was still hotter than the RBNZ wants

Statements like that amaze me. RBNZ (and probably govt too) actually wants people to lose their jobs. Let that sink in for a moment...what sort of crazy system needs some people to be unproductive?

And remember, these are actual human lives we are talking about. The loss of those jobs will have a devastating effect on those families and as a consequence an effect on the rest of us.

Bonkers.

So much for Well-being budgets. More like a welfare budget if they force unemployment. Why not plan for success, since when has economic growth been seen as a negative thing?

It’s the unfortunate combination of tight labour markets and low productivity that alarms RBNZ. The wages inflation spiral will quickly destroy an entire economy if left unchecked.

According to some on here what awaits those who lose their jobs is a life of pampered indolence at the ratepayers expense.

I wonder how many who previously whinged about dole bludgers will change their tune when they become dole bludgers themselves. Might be slightly more appreciative of social safety nets and also more aware of how little support is actually provided.

One guy here has constantly mocked those on social security over the years then been happy to make money from said beneficiaries when he really needed it with his motel business.

Hopefully just the immigrants tbh

I've tended to be hawkish in my view but I think we are about where we need to be on rates. Just fly by the instruments from here.

1 year swap 75bps above OCR.

90 day bank bill rate 55bps above OCR.

Do we think the RBNZ will look through this or use it as a guide for their OCR announcement?

CPI does appear to have peaked but the markets are saying that interest rates are/should be going higher. Confusing times - a hard call for Orr and his team.

It is a hard call. The data basically says that this period of inflation is over. But, the media are running around saying that the budget is dangerously inflationary, egged on by bank economists with a clear conflict of interest! The media stories and bank reports are feeding directly into market expectations and pushing on swap rates. It is now really hard for RBNZ to go with 25 pts (and signal that they will pause for a while) because swap rates will drop, which RBNZ will be trying to avoid.

My view is that they will err on the side of aggression now and go for 50pts but signal a pause for a few months. I sincerely hope I am wrong though, they should pause now and say they will wait to see how the coming months play out.

Agree - the RBNZ risk losing credibility if they go too softly and retail rates become detached from OCR before the next meeting so they may want to try and get ahead of that. But as you say, (and I agree) they've probably done enough for now - but as history suggests, the central bank has a high probability of overplaying its hand in every direction. So it wouldn't surprise me if they keep raising aggressively with the 'path of least regrets' as they can always start cutting if they go too far, but they won't be able to raise fast enough if retail rates keep climbing the way they are.

The psychology around this is quite fascinating.

In the mainstream media it seems that the budget reporting has more been focused on our esteemed finance minister's generous hosepipe of lollies and his leading of the downtrodden masses to a land overflowing with milk, honey and free prescription drugs, and of course contrasting that to the mean-spirited antics of Christopher "Fagin" Luxon and Nicola Thatcher wanting to make the poor poorer and the sick sicker (are they competing for the prize of worst political campaigners ever?)

Most of the coverage I've seen has been fairly superficial and very much focused on the "goodies" aspect, until you head to more specialist news sites like this or NBR.

As long as inflation is above target, it's not 'over'. Call it over too early, and it will just re-ignite.

If you take into account all the inflation in house prices over the last ~30 years, we've been above target for a very long time - including the period where the OCR averaged 6% pre-GFC. This suggests that, to maintain target long term, the OCR needs to go higher, for longer. Just because we ignore some of the data doesn't mean it doesn't have an effect - you can only ignore it for so long till everything goes *boom*.

Your statements in recent times have been very interesting - it does seem like suddenly you've switched to 'the OCR is too high', when it's still below historical averages present during a time of high [but ignored] inflation.

I largely agree with JFoe but I fail to see how - given their own framework, however flawed it may be - the RBNZ cannot continue hiking, at least a further 50-75 BPs. The CPI is still far too high and while there are warning signs, unemployment is very low.

Yip given what swaps have done this part week, it wouldn't surprise me if they threw in a 75bps as a warning to say enough is enough. The 1 year swap is already 75bps above OCR and the 90 day bank bill already over 50bps above OCR so they have enough evidence from the market to say it is necessary.

If swaps hadn't gone vertical this last week then I would have been arguing for 25bps but I don't think that this is enough now.

Given there are a lot of 'I reckons' on here lately;

'I reckon' we've just broken out of a 40 year interest rate cycle. See the US 10 year yield. Pretty clear reverse of trend. Will we ever see interest rates again as low as what they were 2019 - 2022? I don't know. But it is quite possible we don't see them again in our lifetimes. I think the retiring boomer cohort has changed all of the dynamics that pushed rates to zero.

Not necessarily higher for longer. It is more than likely time for a pause, after next weeks .25 rise, to see the effects of 18 months of tightening. Otherwise there is a risk the RB will overshoot the target and cause unnecessary suffering via unemployment and mortgage distress. May be a need to stay at current levels for a while. But we probably don’t need to go much higher.

Weren’t there people saying new migration would save house prices.

Not before they help bump up interest rates first though I guess.

I picked a bottom for house prices in August in my New Year's predictions. Recently I've noticed that houses that have sat on the market for a while have sold, no idea at what price. My impression is that things have started to circulate, people are moving, buying and selling.

I would imagine that people are aware that the interest rate increases are trailing off. Inflation is subsiding everywhere in the world, the oil price is struggling to stay elevated. Russia is a soggy mess, China is in trouble and the belt and road countries can't pay back the Chinese loans so are having to starve their own productive industries of the imported inputs required to power the factories.

I think the supply driven inflation has been stopped by lack of consumer ability to finance their consumption of goods and services and that this is happening worldwide. Regardless of the shortage of labour, increased wages cannot substitute for lack of credit and the increased cost of credit.

I think that the RBNZ has probably gone too far with it's rate hikes but that rate hikes are nothing compared to the damage done by the CCCPA and the non-existent tweaking Govt has supposedly been done to that act. People don't understand that fiscal policy enabled interest rate policy to have an impact and the reverse is true also.

China cut credit off at the knees a year or two ago and now it can't reverse the effect. It doesn't have to be the same here but I have a horrible feeling that it may be so.

I don't think it was wrong to spend money to keep the economy afloat during the lockdowns but I think it was wrong to spend money on bureaucracy rather than on housing, infrastructure and productive business. The govt has spent literally billions on paperwork with not much to show for it. Like developing countries that have wasted billions of $US Chinese loans on unfinished railways, leaking dams and ports in politician's remote home villages so we have spent billions on people sitting in rooms chatting to each other, writing reports and torturing any productive enterprise that they can get their talons on.

I'm picking a large economic thump downwards registering in the political consciousness in the next few months followed by some minor reversals in policy, followed by some major reversals to stop the whole thing falling over.

We are in a period of volatility which means things going up, falling down, then going up, then falling down, then going up then falling down. The trick is to dampen the reverberation not exacerbate it.

I am struggling to reconcile what you wrote in your first paragraph with the balance of your post.

Translation. People in govt gripping the wheel are deluded in thinking they call the show. Orr swinging from oversteer to understeer like a drunk driver thinking the same, and overdoing it both ways. That volatility causes damage.

Role the dice and take your chances.

I get that.

What I was struggling with was his point in his first para that housing might be near the bottom - but then (correctly) mentioning the economic carnage on its way in the balance of his post.

It's only record increases because we were at record low. It took way too long just to get to neutral zone and now no one believes the RB will keep going up. They will and more so because the banks and public aren't taking heed to the warning signs.

I believe they will. The speculative and its lobby and all making lots of noise about returning to OCR of circa 3%. #roadkill

OCR must be 20% or more to bring the inflation down .RBNZ must brave enough take OCR to 20% on 24/05/2023 !!!!Just do it before it is too late.keep 20% OCR for 20years!

RBNZ target should be deflation of 20% 。Price of goods and service decrease by 20% yearly, by achieving this target. RBNZ must increase OCR to 10%~20%. RBNZ must act and think aggressively

I think you forgot to take your meds jack in the box.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.