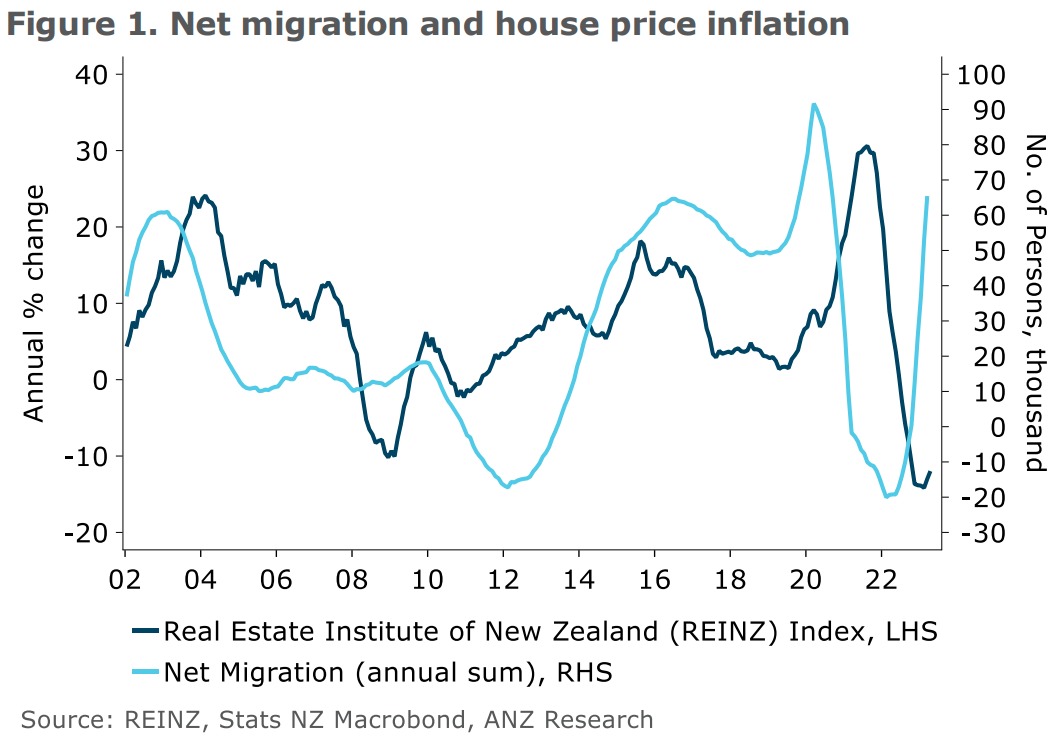

The boost to housing demand from surging migration figures poses "some upside risk" to house prices, according to economists at the country's largest bank.

In their NZ Weekly Data Wrap publication the ANZ economists say the latest figures released last week showed that the REINZ House Price Index was unchanged on a seasonally adjusted basis in April.

"Coupled with a 7.1% month-on-month (seasonally adjusted) increase in sales (albeit from very low levels), and no change in the number of days to sell, the outturn was consistent with a housing market that’s nearing a turn," the economists said.

"While it’s only one month of data, it adds upside risk to our recently updated house price forecast (an 18% peak-to-trough decline, from 22% previously). While we’re not expecting house prices to take off again, the boost to demand from surging migration does pose some upside risk."

The economists say there tends to be "a lagged relationship" between net migration and house prices, "and while correlation doesn’t necessarily imply causation, the increased demand for housing at a time when new supply is slowing is likely to put upward pressure on prices".

"That said, there’s still plenty of downward pressure from other headwinds, namely relatively high borrowing costs, a slowing economy, and a loosening labour market."

The ANZ economists have been forecasting an annual increase in net inbound migration of 40,000 this year.

But they note that net migration continued to surge in March, with a net inflow of 12,100 new migrants, and revisions to Stats NZ’s historical data adding an extra 1000 migrants in the last year.

"The annualised rate for the first three months of the year is nearly 130k – well in excess of the highs we saw pre-Covid. That certainly adds upside risk to our forecasts for activity, labour supply and house prices, as we all budge up," the economists said.

They noted that the impact on inflation of migration, however, is ambiguous.

"All else equal, greater labour supply will ease capacity constraints in the tight labour market and reduce wage pressures.

"But wages tend to respond with a lag, and new migrants entering the country add to demand in other areas, particularly the housing market."

The economists say the overall inflation impact of migration will partly depend on the composition of new migrants (eg families tend to boost demand more than single working migrants).

"Research has tended to show that migration is net positive for demand, and the RBNZ noted in April that it poses upside risks to inflation in the medium term.

"Given the current capacity constraints in the labour market, labour supply growth may be more disinflationary than usual. But our gut feel is that it’s an upside risk to the OCR [Official Cash Rate]."

The RBNZ has its next review of the OCR next week and is widely expected to do one more 25-basis-point move (taking the rate to 5.5%) before pausing to assess the situation and gauge how the inflation outlook pans out in coming months. Inflation as measured by the Consumers Price Index (CPI) was at an annual rate of 6.7% as of the March quarter, down from 7.2% as of the December 2022 quarter - but still a long way outside of the RBNZ's targeted 1% to 3% range.

87 Comments

I think the graph says it all. No point trying to argue with that, its a straight supply and demand correlation.

It's not that simple, as I suggest below.

Are the immigrants going to work in a different jobs market (with double the wages) and be lent money from a different banking system to the current residents who can't afford current house prices?

Or am I missing something?

Some would defend the concept of cashed up foreigners.

Yes - well my question would be what jobs are these immigrants doing that we aren't already?

The vast majority of the people I meet in NZ from overseas are doing low paid labouring. Especially those who arrived here since the borders reopened.

There's a fair few from the PRC with plenty of money who don't work here and who love property. Might be a fair chunk of cash continually flowing from family and friends in offshore jurisdictions via permanent residents and Singapore too. i.e. don't discount the ability of people to get money into safehavens such as NZ and be willing to lose a bit on the way.

Most probably not. But they will be wanting a house to rent and compete with people already here. So investors who have been sitting there waiting for the market to bottom out will now step into the market these are the big property holders who don't use retail banks. And they will buy new builds and since consents for them are dropping what do you think will happen. Bingo

Most (nearly all) I've met who are here for longer than a few weeks on holiday, having been living in campervans and tents (because the rental market is too expensive) doing orchard and vineyard work. Not sure if they were intending to stay the winter but it didn't appear to be the case. As I say, there were a lot of transient type people arriving for a 'get away' after COVID, with no long term aspirations to live here long term.

Great analysis of independent data

by HW2 | 15th May 23, 1:55pm 1684115728

Great analysis of independent data

I've met ~20 recent immigrants this year through work, socially etc. Some come as students, interns, nurses, IT workers. Most of the people I encounter arrive for a few years for the experience, work for a year or two then travel the country and leave. That's just from my circles though. Just my anecdotal evidence of the day.

A proportion, albeit small will be in a position to buy so there will be upward pressure. I wonder if we are also witnessing others enter the market because they think the OCR has peaked and they believe things will improve from here on in?

No most will compete for a place to rent which will cause the big property investors who have been sitting back while the mayhem happened to step in start buying new builds and choose from a large pool of tenants

It would be easy enough for anyone with the raw data to calculate the correlation coefficient, and I suspect it's not as strong as what you're trying to make out. Other factors like mortgage rates, household incomes, ease of accessing credit etc are likely to have a much stronger correlation.

Yes the period show just has to be the two decades where we have had a massive housing boom primarily caused by falling interest rates/ease of credit.

Might be one of those things that is highly correlated until it isn't and you find out that you've been fooled by randomness.

People have come here because of the expansion going on caused by the housing boom - but equally they will leave if the boom ends because the jobs market will become so terrible, the relative cost of rents/housing so high and the quality of life eroded so much that the original desirability of the place so removed that it is no longer recognisable.

Your points are well made. I too believe the downside pressures are still overwhelming and we will see sustained (but slower) drops in property prices for some time yet. However, the article is describing data that is new to the party and it's hard to believe that it will not alter the status quo to a small degree. In that regard the article is correct I think.

Agree,but people still need somewhere to live.Will investors re enter the market to provide more rentals as others are suggesting?

I think so.

All very interesting.

Not sure if sarcasm or not...

Our policies across government and central bank are a basket case. Can't think of any other way to put it.

Its like watching a train crash in slow motion.

Our policy coordination at the highest level reminds me of a Jackson Pollock painting. You're left thinking, 'WTF am I looking at here?' It is completely nonsensical.

Any 'upside risk' to the Property Sector of our economy is mitigated by the current 'encouragement' by the RBNZ to those who hold multiple properties to sell them before the costs, and continued price falls, become too onerous.

It's not that we are actually short of houses. What we have is an inequitable distribution of what exits. Some have 100 others have 0. By and large we all went to sleep under a roof last night. All that needs to change is 'who owns that roof'.

Yes someone had the stats on here recently showing population growth vs housing stock growth. I think our housing stock had increased at a greater rate than the population - but as you say it has just been purcahsed by those who don't need it but want it for their own financial gain (multiple property owners). This is the factor that needs to be reduced to bring back a sense of balance/equilibrium so that those who need it for their own security/stability (both social and financial) can do so - as opposed to further rewarding those who already have enough and don't need more.

Would be interesting to know how many properties owned by property investors have gone from the long term rental market into the short term rental market (such as Airbnb). Many property investors have gone into the short term rental market as this is one way of earning higher revenues to meet higher financing costs and continue to be cashflow positive (or at least, less cashflow negative than a property being rented out in the long term rental market). Many highly leveraged property investors in the long term rental market are negative cashflow.

The short term rental market is a different business model and targets an entirely different customer than that in the long term rental market. Only government policy can address the incentives for property investors in the short term rental market.

Many have rented to housing NZ , you get int deductions.

The squeeze will be the working renters.

Which could explain why the AirBnB up the road has gone from the occasional guest and family from the UK (say) to a regular rotation of, shall we say, people who you give a wide berth to. I hope the interest deduction compensates for the damage that looks like it now happening (garden ruined by 4 or 5 dodgy cars a night now)

Yes, there are currently no laws protecting resident neighbours from tenants of neigbouring properties. For instance, in my case, in a group of units or townhouses, the Asian absentee owner doesn't give a monkey's toss about adjacent unit owners. He's safely in Australia earning high wages in IT while being guard-dogged by Ray White, an Australian real estate franchisor. The Indian tenants are well-meaning but haven't a clue about the rudiments of gardening,etc. The real estate property manager makes excuses all the time and I am doing maintenance work for the absentee owner.

Tell me of a political party who will address this type of problem and I will vote for them.

Quite hilarious really. All those NIMBYs who complained about AirBnBs in the suburbs now get to enjoy permanently living next to gang members, sex offenders and drug addicts, instead of the temporary European or American family of 4 who stay for a few nights at a time. As they say, "be careful of what you wish for, because you just might get it".

I find the whole situation morally and ethically empty - actually worse than empty - more like perverse.

The sooner we can collectively move back towards seeing property as a place of 'home' and family and social cohesion the better off we will all be.

Using it as a road to riches, regardless of the social and financial consequences, is the opposite of those values and principles.

Many highly leveraged property investors in the long term rental market are negative cashflow....

What a great business model, relying on capital gain and being able to liquidate. But please don't tax my capital gains, I'm providing a service.

I don't think it's as simple as population vs housing stock though. Whether there is sufficient housing stock also depends on the demographics of the population. E.g., we wouldn't think that 5 people in a three bed house is a problem if those people are two parents and three kids. But if those five people are unrelated adults in their late 30s? Living that way not by choice but because they can't afford any other housing options? In a case like this, we should conclude that the housing stock is insufficient (even if the raw numbers are the same) because it's preventing family formation. Can't realistically have kids if you are still living in share houses in your late 30s.

In 1991, there were about 1.28 million properties and a population of 3.53m, which equated to a property to people ratio of 0.361.

Thirty years later, in 2021, there were 1.87m properties and a population of 5.1m, which was a property to people ratio of 0.367.

In 1992 there were 1.31m private dwellings. In 2022 there are 1.98m private dwellings. A 51% increase.

In 1992 our population was 3.5m. In 2022 it's 5.1m.A 45% increase.

Yep I can remeber reading a article by Master Builders just as the GFC was happening saying how far behind we were in houses for people. And only just because we have had two to three yrs of more builds than needed people think the situation is sorted it ain't. Am building a brand new at moment only at floor stage and already property manager has 5 families that want it. There is no houses for rent in the town I am in

The thing is thou since the early 70s we have not been building enough houses for population every yr. So that by covid we were way behind all of a sudden over a two to three yr period do you think we even came close to rectifying that. And that doesn't include two things now one building consents are dropping and now the surge in immigration.

Same playbook as in Aussie. Govt opens the gates for migrant slave labor putting greater demands on existing infrastructure, including houses. The irony is that the govt claims to want to increase wages / income to drive the bubble economy while increasing the workforce at the same time.

https://www.macrobusiness.com.au/2023/05/new-zealands-house-price-crash…

Reminds of the central bankers thinking that the solution to the problem is to create more of the problem (i.e. we will avoid recession by creating more debt/money). But we now know this is a very bad idea as they are stuck between a rock and a hard place - whatever they do, the future is worse than the present (to raise or drop interest rates).

And now governments thinking we will boost the economy by bring in more people, even though our infrastructure is already maxed out.

All we will end up doing is exacerbating the problems we have - not solving them. The GDP numbers could look better in the short term - but the quality of lifestyle will be eroded for everyone living here.

I can see this getting very messy.

Yep. In terms of leadership, it's abysmal. No doubt they will be talking up how the migrants will be riding buses so there will be no stresses on traffic gridlock. Focus on the superficial and unverified.

The government of the day gets to cash in on more revenue from bringing in more earners/consumers. Easier to divert this revenue towards vote-buying instead of investing in major infrastructure upgrades and structural reforms to lift wages.

When there is no more road to kick the can down and the under-investments begin to bite, dodge the blame towards global business cycles, external factors, previous governments, etc.

The Central Banks spent a decade and more trying to provoke Inflation to 'rescue' the monetary system. All to no avail. Then Covid gave them the reason to saturate the world with more Debt, and voilà, Inflation arrived with bells on.

The same applies to our tiny, property reliant economy. Successive Governments have told us we had to do something to correct the economic imbalance and 'make houses more affordable" (John Key; Jacinda Ardern). But political reality has stopped that.

Then Covid arrived - and left. And just as the global Central Banks took the Covid opportunity to spur Inflation, so our RBNZ is taking the unexpected Covid-left opportunity to correct what so many politicians haven't, and can't.

There is no point having come this far to turn back now. This is it. The ONE, and last, chance we have to make a more sustainable economic future for us and our descents. Given what I see of Adrian Orr, I can't see him changing tack until the job is done. He's going to suck out the excess liquidity that Covid generated, and it's all in one place

Guess it depends on how much money they are coming with?

Kiwis seem to think all the immigrants are coming in flat broke, are plain stupid and are in a line for a hard labour job breaking rocks or something. I would suggest that many are coming in with shit loads of money looking to start a better life because well, they can afford to get out of where they were and legally enter the country. We are not talking boat people here or those trying to cross the Mexican border illegally with just a bag of clothes in their possession.

ok

wealthy fruit pickers are pouring in, ready to buy now the market has bottomed. Be quick.

5x from Port villa out bid me on an overpriced Orakei villa.

WTF!... I wasn't wearing the right jandalls today.

"I would suggest that many are coming in with shit loads of money"

Do you have any evidence of this or is it just one of those 'i reckon' points of view?

I haven't met any arrivals in the last 12 months who are cashed up. I have meet a lot of transient people crusing around the country, living in campervans, doing transient work like cheap labour and not much else. Most had no intention of staying here - when I think about it, exactly zero (out of hundreds that I've talked to) said they were staying or intending to apply to stay. All on short stays to get away for a while after COVID before returning home.

It's not even a reckon, they're just making stuff up. We know exactly what type of workers are coming in, the green list pathways have all been published, including the skills/trades we're accepting. They are not likely to be running around buying overpriced houses of each other.

I met one recently who, to celebrate arriving here with his family, stayed for two weeks at that place out at Cape Kidnappers where Benedict Cumberbatch holed up during the Covid lockdowns. He bought two new vehicles while staying there, and will be house shopping towards the end of his rental lease, as he fully intends to settle and raise his family in a much more stable environment than his homeland. I'm sure you can guess where that was.

Obviously I don't consider this to be typical of all immigrants (I'd say less than 1%), but some are definitely not short of a bob.

Fair call - I'm sure there are these cases among the arrivals. But its hardly the 'watch out there are tens of thousands of foreign millionaires arriving here to buy houses' type situation being described.

Most I've met have been living in campervans and tents doing orchard/vineyard work or cafe work - and not even renting.

Many of the people you outline come here and scope the place out - usually, Queenstown or the like, and realise that we are really a tiny place at the back end of nowhere and go off to a bigger, more sophisticated place. And a comment when they are in Queenstown reflects that - "Small, isn't it!" one Australian guest remarked to me before they left, for the UK, and I thought. It "So it is"

Can anyone provide any colour re, what percentage of new migrants buy a house vs rent.....

If its just renting then they are not buyers, and investors are not active in the market, so we will have a rental squeeze (can see a mile off). But yields are so low it wont bring any more supply on....

NZ bus drivers must struggle to buy, let alone philipino new immigrants.

Yip as I say above - if you combine our current policies across the government and central bank, the result resembles a Jackson Pollock painting. It is nonsensical.....insane.....lacking in planning.....you just throw stuff around and see what happens then call it a beautiful mess.

Doesn't matter mate, a house is a house. Doesn't matter if they rent or buy, both put upward pressure on house prices. Its so predictable, this government are going try and dig themselves out of a hole with massive net immigration because the numbers are so easy to control, unlike actually building anything like houses or infrastructure, these take time and money.

"Doesn't matter if they rent or buy, both put upward pressure on house prices."

Not always.

They will not necessarily put upward pressure on house prices. The upward pressure is capped by how much banks are willing to lend them unless they have enough cash to buy outright. For immigrants to put upward pressure on house prices they have to be earning enough to borrow or be cashed up.

They will also not necessarily put upward pressure on house prices if they rent. Their wages will determine how much they can afford to pay in rent. If rents rise above what people can afford to pay compared to their wages they will move to a country that offers better cost of living prospects or sleep in cars, share rooms, etc...

Dam! Foiled again by agnost :)

Hey look at the time of each post.... perfect

Optimism or wishful thinking? How many immigrants can afford a million dollar loan at 8% interest?

Banks were pushing bigger and riskier loans down people's throats over the last few years and many buyers were more than happy to max out their pre-approval limits without much of a second thought.

I just hope even the well-off immigrants aren't as stupid as the average Kiwi to being swindled into a housing Ponzi with FOMO and the promise of ever-increasing house prices.

Hmm interesting that there were net 60,000 less people in the country at the end of April than there were at the start of March.

Most interesting is the use of the word 'risk'. Do your own research, make your own judgement of risk.

There is also risk of inflation, deflation, recession, depression, joblessness, homelessness, multi-market crash, bank run... what is the probability of any of these things? There is risk the housing market could go in either direction, either outcome is possible, but buying into that risk depends entirely on personal circumstance and whether your can afford to take the risk.

As I've said before, this is not a choice for FHB in this country, access to credit is gone. Banks are trying to get as many people through the door as possible in hopes that a few of them qualify for a mortgage and are willing to soften the blow at a lower risk to the bank.

(deleted)

April to July last year was net negative.

Massive surge over November-February here though - 58,997 extra people in february.

We've gone negative a little early this year, and significantly harder, but the March/April drop only cancels out the February surge.

Note that late Jan/early Feb is the start of the fruit picking season in earnest - how many were temp RSE workers/working holidayers heading to the orchards who are now heading home due to ruined crops?

Grape harvest doesnt start until March - which is why Feb saw a big influx of workers. Kiwifruit harvest starts mid-Feb. They all leave at the end of May.

I would say this is just another real estate promotion in a subtle way. They all choose to ignore the immigration data after March, which doesn't look good.

It's the FOMO marketing executive hard at work.

FOMO has been a pretty successful strategy recently in getting punters into debt that not long ago would of been inconceivable!

"increased demand for housing from migration is likely to put upward pressure on prices"

No it won't! We've had expert commentators on here saying immigration absolutely doesn't have any effect on house prices!

Indentured slave labour from the subcontinent arguably should have no impact on house prices

Quality policy from our esteemed overlords.

Got to get the Plantation economy going again. Cheap Labour, Suppressed Wages, artificial demand inflation, infrastructure deficit.

Accelerating our economy into a wall like a Wylie Coyote cartoon.

Should this graph also not have either the OCR rate or 2 year average mortgage rate on the axis as well, if we are trying to find correlations?

House prices are tumbling from a massive overpriced levels, rates will be staying around current range if average wage families have no chance of buying from scratch in most areas how can immigrants be able to purchase a property unless we are only taking people with a million dollars to invest. next month we will have another article with headlines house prices down another .08%

The critical thing missing in that graph is interest rates. They are the core factor influencing both migration and house prices.

Well if historical rates are at about what they are currently, probably not. IIRC the historic average is like 6.5%. Everywhere else worth living in the world is also going up, up up and even a few one eyed Kiwis are about to find out that NZ is actually a great place to live.

"even a few one eyed Kiwis are about to find out that NZ is actually a great place to live"

I have two eyes, and with those I have been able to see that the country has been getting worse with the high levels of immigration, not better. Our infrastructure has been unable to handle the extreme rate of growth.

(i'm not xenophobic, but I can see policy failure when it is happening right in front of me)

(and what is worse, only having one eye, or having two eyes but covering them with rose tinted glasses?)

A somewhat different, and probably more likely, take from a Jardin analyst. He reckons the floor is about 12 months away and expects the drop to be 24-26%. It’s currently 15.7%. He also thinks people are extrapolating from what is happening in Aussie, but they opened their borders 9 months before us, and 80% of Aussies are on flexible mortgage rates, which means the pain of higher interest rates was felt more immediately over there. Conversely, in NZ, over 90% of mortgagees are on fixed rates. Finally, he thinks construction will hold up due to cyclone recovery work.

not paywalled

https://www.nzherald.co.nz/business/markets-with-madison-house-price-fl…

I tend to look at analysis by the likes of Jardin, CBRE, Savills, et al with a jaundiced eye.

And yet here on this very site is another take on it - a collapse in work visas this month as those who took up seasonal employment or came post covid have already done so

https://www.interest.co.nz/property/121143/big-drop-number-overseas-wor…

Also what you need to take into consideration. Is just not immigration but the tourists as well because alot of people are taking their rentals out of the market and putting them back into Air B and B cause of all the regulations causing more demand for less houses

What are “all the regulations” Colin that cause more demand for less houses?

From health homes plus the new regulations added onto new builds 1st of May.

So you object to providing a healthy home? Would you rather an Olivier twist style situation?

What specifically about the new regulations onto new builds from 01 May?

Changes to the building code minimum performance requirements.

In particular the doubling of the ceiling insulation rating requirements from R3.3 to R6.6 and staged increase to the thermal resistance values for windows and doors. Will certainly add cost.

Yeah true upside..

A million dollar mortgage will be 70,000 in just interest payments a year. Only interest.

How much rent per week will conver that interest payments?

What will be the on going appreciation per year for this to be a smart investment or buying home for personal use even?

Does buying property still make sense?

Only HW2 has the secret sauce... maybe he is on the sauce.. his sauce involves buy property with lots of land and then subdiving it once National take the Brightline off..... what could possibly go wrong

For me yep I can buy at least three houses for that get 400 at least a week and all three will have sections I can build a brand new 4 brm on the back. So get 500 a week.

Property development is one of the few strategies that can pay current prices for a house with a large section of land that can be built on.

If property developers can get finance, these buyers can outbid many other buyers for that same property (such as first home owner occupier buyer & upgrader owner occupiers)

That 1350 per week on interest only, add all other expenses just craziness. Also if you purchased early last year that million dollar property would now be worth 800k, you would have to be batshit crazy to take this on yet so many on this site continue to pump up housing not realising how stupid they sound.

I suspect there will be thousands of people leaving NZ shortly from the construction sector. There’s truckloads of construction workers from China working on building sites across Auckland, many of these projects will be finished over the next few months.

There's a direct correlation between people using an umbrella and rain. Therefor if I want it to rain on a sunny day all I need to do is convince people to open their umbrellas. /s

This is the problem with economics - everything is Ceteris Paribus whereas in the real world people are dealing with 100 different factors such as raising interest rates, raising cost of living.

Anecdotally, decreased job security will also mean people would rather stay in employment than jump to a new company and risk being last in first out when profit margins start falling.

Beyond belief, that instead of changing our behaviour and pioneering something new, we revert to the old chestnut of population must keep growing at an exponential rate to make things better.

All well and good in theory within the beehive until your average trip to drop off the kids to school takes twice as long, more people die due to the added pressure on infrastructure, crime increases as more people fail to make something of themselves and turn to it, prices continue to rise to even further unsustainable levels, and the country doesn't adapt due to the rate of change forced upon it, and fixed views in the eschelons that make big-ticket decisions.

I guess this goes to show that the government, as we already know, are simply little children trying to get a seat at the big boys table of other more prosperous western countries in order to make themselves appear competent.

Perhaps the reason popcorn is increasing in price is due to those in parliament chomping down on it daily from their multi-million dollar houses.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.