Kiwibank economists say households are showing few signs of financial stress so far in the face of higher interest rates - but "a lot hinges on the labour market".

In an Inner Kiwi economics publication, Kiwibank chief economist Jarrod Kerr and economist Sabrina Delgado say they are forecasting unemployment (currently 3.9% and rising) to reach a peak of 5.5% next year. The Reserve Bank (RBNZ) is forecasting a peak of 5.3%.

"Any increase in unemployment produces a sore spot but a peak at around these levels will achieve a soft landing," they say.

"The material risk is if things turn uglier than forecast. Unemployment rates beyond 7% are when we start to see a more exponential rise in mortgage defaults…"

The economists say so far, signs of acute financial stress have been low.

"The number of arrears have increased over the past year, but they’re rising off historic lows. Current, and forecast, arrears remain well below GFC levels. As pointed out in the Reserve bank’s November Financial Stability Report, the economy has proven resilient to high interest rates, thanks to strong labour market and wage growth.

"But pockets of stress will emerge. Buyers made decisions on the rate they were given at the time. They made decisions on rates in the mid 2’s to 3’s and were tested on rates only up to 6%. They’re now rolling off on to rates of 7% and higher. And new loans are being tested at 9% and higher.

"A lot hinges on the labour market. Low unemployment has supported households. But in a high interest rate environment, demand weakens, businesses pull back, and unemployment rises. We’re seeing that already."

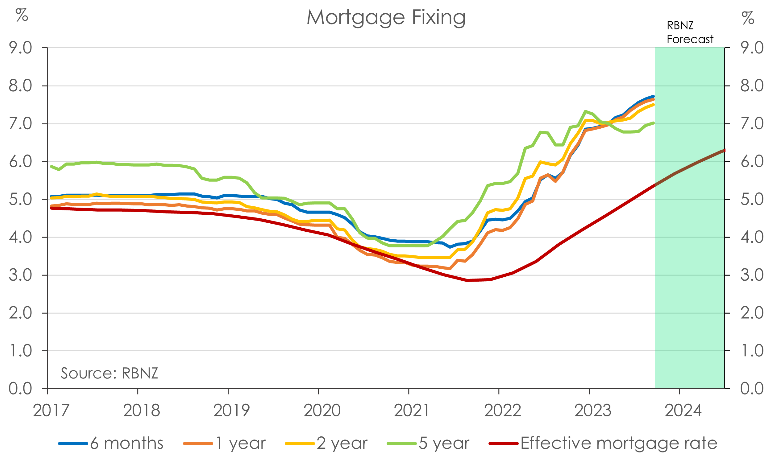

The economists say the last of the record low mortgage rates from 2021 are "rolling off".

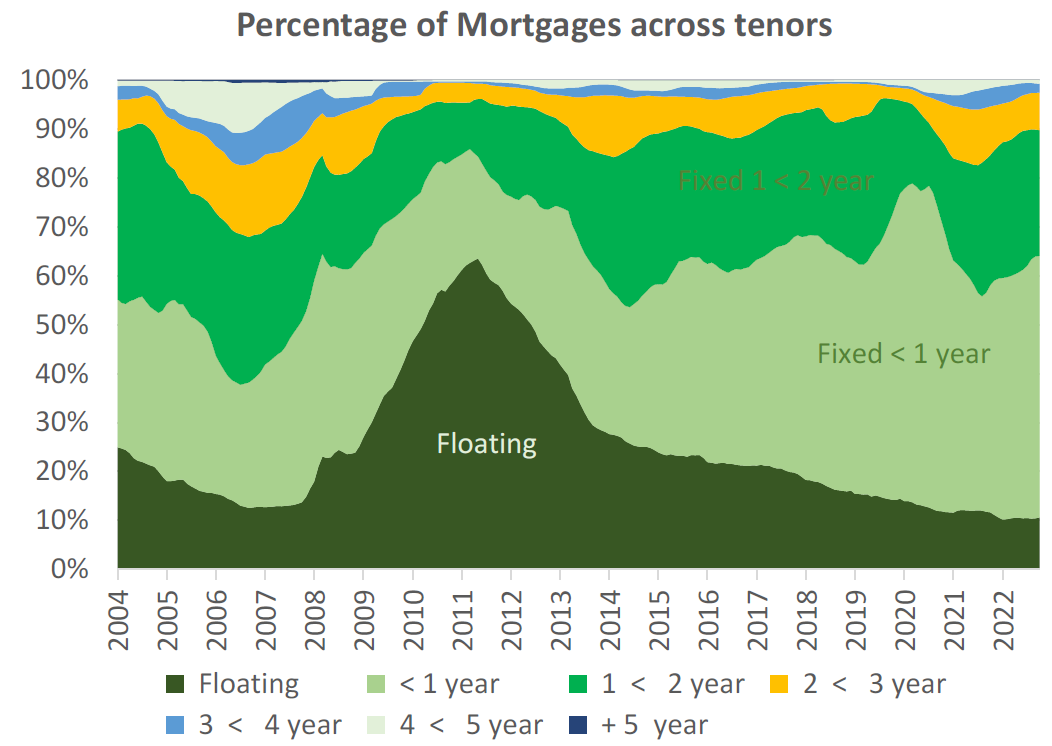

"About 10% of the book is on floating, with around half on fixed rates for 1-year and under, and a quarter fixed for 2-years. The important point here is that it takes up to 2 years for previous interest rate hikes to fully feed through the system."

They say the 525 basis points of RBNZ tightening of the Official Cash Rate (OCR), taking it from 0.25% to 5.5%, "is still feeding through for some".

The effective mortgage rate - the average rate paid across the stock of all mortgage lending - is 5.4%, up from the record low of 2.9% in 2021, Kerr and Delgado say.

"With more mortgages yet to roll off, the Reserve Bank expects the effective mortgage rate to lift to 6.4% by mid-2024. The average share of disposable income going to interest payments is also estimated to double from it’s 9% low in 2021, to around 18% by mid-2024. On mortgaged households, it is expected to lift from less than 10% to over 20% by year end, and continue higher into 2024."

The result of ‘higher for longer’ monetary policy is simple, the economists say. Indebted households will pay a much greater proportion of their disposable incomes on interest. Household budgets have already been stretched by the cost-of-living crisis. Households are spending a lot more, to get a lot less.

"The rapid rise in the cost of essential items has forced households to spend less on more discretionary items. We’ve seen this in our credit and debit card data over the last year or so. The pullback in home contents and furnishings is a classic example. The average number of purchases is sitting ~5% below pre-covid levels. And the restraint to splurge began a year ago. Non-essential goods and services remain under pressure.

"Households with debt are paying a lot more on interest repayments. And the main asset, to which the debt is tied, has fallen close to 20% in value. That’s a knock to confidence. We continue to forecast a mild contraction in economic activity, largely due to the stresses on household spending."

Kerr and Delgado note that the country has witnessed "the most aggressive hiking cycle in the RBNZ’s history" in order to fight the return of inflation.

Inflation peaked at an annual rate of 7.3% as of the June quarter last year and most recently, at the September 2023 quarter, it was 5.6%.

"While inflation remains high above the RBNZ’s 2% target midpoint, the distance is narrowing," the economists say.

"Inflation is moving in the right direction. We are winning the war. But for the RBNZ to uphold its inflation-fighting credentials, interest rates will have to remain high and restrictive for some time yet.

"However, 15-year-high rates should be enough to see inflation back at the target 2%. No further tightening from the RBNZ is needed.

"Phase II will be a normalising in monetary policy. And we may see the rate cutting cycle commence next year."

61 Comments

Spruikers spreading of fear to FHB's will keep a floor under the housing market for the next couple of months at least. If it all tracks the same as last year then, come Autumn 2024, widespread weakness will once again return.

I remember the calling of a "floor" this time last year too.

Have those house price growth forecasts by the property promoters incorporated those rising levels of unemployment?

I highly doubt it. They read one b/shit headline "homeowners have adjusted well to higher rates" and run with it. As time goes forward and companies cut back on overtime, trim staff, cancel existing vacancies or whatever, this so called "adjustment" will be exposed as more a band-aid than anything sustainable.

The rapid rise in the cost of essential items has forced households to spend less on more discretionary items

Blind Freddy knows that the relationship between the bubble and the wealth effect (propensity to spend on discretionary) is what this is all about. The ruling elite typically don't talk about it. The smart people know that the wealth effect (and discretionary spend) relies on the bubble.

Banter at the water cooler and BBQs tend not to discuss it at any meaningful level. But my thesis is that less discretionary spend feeds into a doom loop that impacts the bubble. Without drunken sailor activity, where is the money multiplier in the consumption parts of the economy? Without it, it means less revenue, profit, and downward pressure on incomes.

If you're suggesting that the RBNZ doesn't have a good grip on the size and scale of the money multiplier effect in NZ - I'd be inclined to agree.

It would explain why they overshoot so frequently. IMO, their actions throughout covid have brought this gap in their knowledge into sharp relief.

Anecdotal evidence: my son just home from uni for the summer. Much slimmer pickings in the summer job market this year. Previous two years he walked into jobs.

Correct - another dot plot on the trend line - down.

Whoa. Careful, pointing out risk supported by facts makes you a kitten drowner.

Our economists should be more transparent about it if it is the de facto economic model (which is difficult to assume that isn't). At the least, it puts everyone on the same page and enables them to make decisions that account for different risk (or lack of it).

Just amazing in all your baying for blood, not a shred of empathy for the people who are projected to lose their jobs in order for that to happen.

Guess you gotta break a few eggs for a schadenfreude omelette.

Empathy was the creed of the last government, but empathy, while valid, only goes so far and many will have attributed this with all show and no competence. Inflation effects us all irrespective of job status. The sooner we knock it on the head, the sooner the next cycle can start heading back on the upswing.

No sign of empathy from the last government. Mind you all the talk about it sucked in the luvvies.

Free school lunches, free prescriptions, increased minimum wage faster than inflation, 13000 new state houses, 20 hours free childcare for 2 year olds, extended parental leave to 26 weeks, restricted firearms laws after a massacre, higher minimum standards for rental properties, removing tax advantages for landlords. To name just a few.

You are probably doing just fine in life and don't need help (empathy) from the government. That is why you feel they weren't kind.

It's just the usual misinformation from KH the Nat/Act party shill. You don't have to like or vote Labour, I certainly don't, but pushing false claims all the time really speaks volumes about a person's ethics. I usually just scroll past KH's comments as I'm not interested in fiction.

Not so. Layoffs happening left and right, and unless there is a miracle turnaround over the Xmas holidays (.000001% chance) will continue into next year. Inflation is driving it. The cost of shelter is such a great engine of inflation, along with food. Who made people increasingly pay twice the going rate for shelter..tax avoiding capital gain for the unimaginative cough cough.

If only life was not the way it was...but it is.

Lay the blames were it really lies - RBNZ am I wrong ORR right?

The labour market can't create quality jobs at the rate that immigration is growing. At least that's what my Uber driver told me and he had a masters degree in economics.

The business community has been so well looked after since 2017 that I'm sure they are ready to step into the breach

Yes but only when christmas day falls on good friday.

Retail is through the floor and restaurants are emptying out. Cracks in the dam.

100% retail is dead. Closures everywhere. Any construction outfits with staff are struggling to find the hours, and that’s during the run up the Christmas. Hold on 2024 will be rough, soft landing? Na.

The RBNZ should reduce the OCR at their next meeting. But they wont.

NZ should slow immigration and cut welfare subsidies for tax free investment.

Blindingly obvious to the seeing unfortunately 38.6% of NZers are wilfuuly blind to the facts before them.

Good analogy ... I guess the thing about mortgage defaults is that they don't show up much until there really is a problem. People keep paying the mortgage until they can't

Indeed. Banks keep extending the term and offering interest free options to keep them on the hook. Eerily similar to an addict and a drug pushers relationship. Must say at some point the pusher bully boy does actually kick in the door and want their money.

Oscar - Correct so follow the trend - its your best friend.

Well said you are one of the few with eyes & ears open and a working connection to a functioning brain.

If it hasn't happened yet, can it be a material risk, more like ghostly, immaterial risk in an Economist's nightmare? Like the Ghost of Christmas future? More Gravy than Gannt? (come on go with it, its nearly Friday).

It's subjective. Some friends and colleagues talk about them not having eaten at a restaurant, been on an overseas trip, money to set aside for savings, for as long as they can remember, or having to suspend their Kiwisaver contribution, because there is barely enough left for bills (including maxed out credit cards) after the mortgage repayments.

Most of them don't appear stressed to me, but that would stress me out.

Mixed bag isn't it. Many are genuinely struggling but others will repeat this regularly while having large discretionary spends on all sorts that could help them trim back and weather rent or mortgage increases. Humans, we are our own worst enemy and do not like when confronted with this.

If they're fhb, they might just be reverting to what it was like saving for their deposit.

Hardship is a matter of perspective sometimes. Until they are choosing which creditor is not getting paid this month, they're not really in hardship - though the potential for hardship from an adverse event of course is much higher.

Food in the belly, bills paid - not hardship.

Honestly, I have been surprised that there hasn’t yet been more signs of profound weakness in the residential construction sector. While there been a very significant drop away in consents, not yet seeing much evidence of unemployment increasing in the sector, and related sectors.

Is that a story for next year, or is the sector much more resilient than I thought?

If it is more resilient than I thought, why??? Are there many thousands more households out there than I thought who can get approvals for 600-700k mortgages stress tested at 9%??? After all, house building will only stay afloat if people can afford to buy.

Or are things going to come crashing down in 2024?

Activity has definitely dropped off a cliff. I'm in architecture and work for a multi-disciplinary. There is no work out there anymore for the planners/land surveyors with regard to resource consents and subdivisions for residential developments.

The contractors who were particularly exposed to residential are struggling unless they're on those Kainga Ora pannels. Most are diversifying into commercial which seems to be holding up pretty well at present, although I'm noticing more and more projects being put on "pause".

Friends in architectural practices specialising in residential are struggling for work, but thus far avoiding redundancies. Many have seen the writing on the wall and already jumped ship to practices with more diversified workstreams.

My observation is that while things are certainly getting stretched, we still have major skill shortages for tradesmen and good technical professionals, and immigration isn't plugging these gaps at present so just enough tension remains in the labour market, even though revenues are falling away. For now.

Thanks for that excellent overview, which is pretty consistent with what I am seeing. And I think your last para sums it up well - things aren’t dire simply because there was such a profound skills shortfall to begin with. That’s saving a few asses, for now…

Work as a civil engineer and have to agree. Land development, subdivision, and new houses are on there last legs. Enquiry level is about 20% what it was in 2021. Plenty of work in roading and council infrastructure so I have had to pivot towards that. Engineers without the flexibility are being laid off.

You'd think with the infrastructure deficit in this country that there should be a wave of work coming soon (now?).

But, can the government in tandem with the councils co-ordinate this.

Can we afford it? (Can we afford not to?)

Well it's one thing to have a deficit, but another to actually start working away on it. Councils seem quite indebted already, and job cuts are starting to come through.

I think we will limp along with falling infrastructure for quite a while

Back in August, a mortgage broker noted that the banks have made very few mortgagee sales.

The mortgagee sales were initiated by non bank lenders.

If a highly leveraged borrower loses their employment and is unable to make their mortgage payment on an interest only basis, then the banks may become less lenient after a period of time of mortgage payment deferral. Just don't know how many are vulnerable to this situation.

If a borrower is able to continue making mortgage payments on an interest only basis, then the bank may allow this to continue to allow the borrower to buy time to get a new job.

Also remember that most mortgages require more than one income. So if any of the income earners supporting that mortgage lose their job, then the others may not be able to meet the total mortgage payments. Saw 4 single sisters combine their financial resources to buy one residential property - so if one of these sisters was unable to pay due to job loss, not sure if the other 3 could make up for the shortfall.

Also seen loan applications contingent on boarder income. One comment I saw was that they merely got a friend to sign as a boarder and they didn't move in. Not sure how prevalent this behavior is.

I think so far everything has held up ok because there haven't been large scale redundancies (interestingly my cousin who worked in real estate analytics, or at least something at corelogic, got let go recently) or at least people have been able to find an equivalent job quickly enough. When there aren't many equivalent jobs around, and people are forced to take big wage cuts, it will be interesting to see how well the stress tests work out.

Personally I hope construction holds together. A career in a trade like building is life changing for so many young guys and it would be tragic to see opportunities dissolving in front of them.

In terms of that boarder income aspect, it would be interesting to know, from people who understand bank lending better than I, as to how legitimate and common this practice might be.

"how legitimate ... this practice might be"

The borrowers have signed mortgage contracts with their lender - those contracts have terms and conditions. Even though the borrowers signed, the borrowers may be unaware of certain terms and conditions.

From an IRD perspective a boarder and a flat mate are different.

A boarder is provided with food and other living benefits (e.g. use of vehicle) and does not pay any portion of the bills so the IRD allow monies to be un-taxed unless a thresh hold is exceeded, circa $220 per week if memory serves. A boarder is considered "part of the family".

A flat mate is living in your house but not "as part of the family". If they buy their own food and pay portions of the bills, IRD says you must class their rent as income and claim the necessary expenses.

The whole area is quite grey and I suspect IRD is often being scammed.

Banks that I have spoken too aren't interested in the distinction and they generally class 50% of the board / rent as income. But this varies from bank to bank ... Exactly what percentage gets agreed to as being "income" comes down to whether the bank wants your business. If you're an existing customer, especially one with a good LVR, get ready to be screwed as they can count none if they wish - citing commercial judgement - and you'll be paying a higher interest rate to account for the additional risk.

"the IRD allow monies to be un-taxed unless a thresh hold is exceeded, circa $220 per week if memory serves"

From Inland Revenue:

You may need to pay tax on rental income you receive from private boarders or home-stay students.

If your income from boarders or home-stay students is higher than your total costs you need to pay tax on the difference.

https://www.ird.govt.nz/property/renting-out-residential-property/resid…

"Also seen loan applications contingent on boarder income. One comment I saw was that they merely got a friend to sign as a boarder and they didn't move in. Not sure how prevalent this behavior is."

I have a hunch that it's relatively prevalent.

My older brother bought recently, and his mortgage broker advised that getting my younger brother to do this could help get the loan across the line. All it took was my younger brother signing a piece of paper and the bank was willing to lend another 60k.

I have another friend who bought a house. Six months later he wanted to get some renos done, so got another friend to do the same thing (on the advice of his mortgage broker), managed to borrow another 70k, based on nothing but a signed piece of paper saying friend two would move in and pay 200 a week.

Now I understand it's pretty difficult to verify the signee's intentions when we're talking about prospective FHBs who don't yet have ownership of the house. But in my friend's case, how difficult would it have been for the bank to say "OK. Have him move in for several months, show us the money coming in, and then we'll advance the loan"?

It seems like such a simple way to push your borrowing power out to get that application across the line, which mortgage brokers are encouraging people to do. Given most people tend to borrow to their max to get the best house they can possibly afford, why wouldn't everyone be doing it?

"It seems like such a simple way to push your borrowing power out to get that application across the line, which mortgage brokers are encouraging people to do"

That is the financial self interest working. Mortgage brokers are gaming bank lending criteria so that the lender will approve the mortgage and the mortgage broker earns their commission from the lender. If the bank discovers these repeated infringements, then the bank may choose to restrict or suspend any new loan applications from the mortgage broker - saw this happen in the US with a mortgage broker who was gaming the lending rules of the government sponsored entities.

https://finance.yahoo.com/news/freddie-mac-halts-dealmaking-meridian-00…

Given most people tend to borrow to their max to get the best house they can possibly afford, why wouldn't everyone be doing it?

Go and read the terms and conditions of a bank mortgage contract. It is in there.

And I guess if a party doesn’t actually get the boarder in, they may find things very tight financially. But hey, desperation knows no bounds!

"And I guess if a party doesn’t actually get the boarder in, they may find things very tight financially"

At the moment, the bank might be stress testing the borrower at 9-9.5%, but the borrower might be paying less than that (say 7.0- 7.5%) so there is a little buffer there.

The borrower has put themselves in a financially vulnerable position. They have buffers that are very small . They haven't allowed for any unexpected events such as

1) fall in household income - loss of job, cut in hours for wage earners, reduced bonus, reduced commission for commission earners, unexpected illness, etc

2) increase in living costs - increase in mortgage payments due to rise in interest rates, increase in rates, insurance, maintenance, or unexpected expenses - unexpected auto repairs for a WOF approval, other unexpected cost, etc

I think NZ is in the Lag phase and it will end and all will be revealed, it wont be pretty in fact I suspect it will f***ing ugly reminding me of a couple of recent PMs.

Awesome graph, just incredible basically nobody went long like 5 years when rates were low, its not even on the graph in dark blue. Blame the RBNZ I guess with crap like rates are going negative so everyone went short and got caught with their pants down. Our whole economy would now be in a totally different place if the majority went long. 2024 is crunch time.

The graph is kind of intriguing in its own right. 5 year terms started dipping in 2023 - quite logical when interest rates are increasing. Yet…. Started rising again over the past few months. I don’t know why anyone would lock in for 5 years right now, unless you believed ‘Higher for much much longer!’ 😂

"I don’t know why anyone would lock in for 5 years right now,"

Peace of mind knowing that their mortgage payments will remain unchanged for the next 5 years. Any highly leveraged borrower might be just able to pay current mortgage interest rates on an interest only basis. These borrowers want to reduce the risk that they have inadequate cashflow if rates do increase.

If they chose to fix their mortgage rates on short term basis , here are the two scenarios.

- interest rates fall - I continue making mortgage payments

- interest rates increase - cashflow stress upon interest rate renewal and they are unable to make higher debt payments, and be put in a position of having their lender mandate debt reduction - this might mean a forced sale below their purchase price if they purchased in 2020 - 2021.

Many highly leveraged borrowers may be trying to buy time and keep their head above water until interest rates fall.

Thx

Good comment. I'd agree that some borrowers may think that way.

But so many? I doubt it.

I suspect most will have bought into the HFL B.S. that the banks are pushing ... But the banks have absolutely zero evidence, at any level, to justify why they believe HFL will be a thing. Further, most non-bank economists are saying no such thing. And even the RBNZ isn't either. In fact the RBNZ is looking at future retail rates closer to 5%.

A note for highly leveraged borrowers looking whether to fix long ...

When I was working in the banking sector in Europe I had the privilege of talking often with two extremely well respected economists from inside the banking industry. They made these two points:

"People should not fear their governments, governments should fear their people. Banks are no different to governments."

... and ...

"If you can't pay a debt of $100,000 - you have a problem. If you can't pay a debt of $10,00,000 - the bank has a problem. Note that in English the word "you" is both singular and plural."

In essence, if you are a highly leveraged borrower ... among many highly leveraged borrowers ... The banks have a problem, not you.

Don't get conned into being screwed over by your bank because you think you're the only one.

You're not. And the banks know that.

I wonder how many highly leveraged borrowers are being "encouraged" by their banks (or forced as part of a resolution process) onto long durations at high rates? That would be extremely profitable for the banks. ... Yet another thing for ComCom to investigate.

My experience overseas living in failing states:

Up to a 10-15% unemployment rate the society is doing OK although not thriving. Those unemployed are supported by family households that are employed.

At greater than 15% things start getting sinister. Spiraling crime, protests, calls for revolution etc.

I don't think NZ has ever been anywhere near 15%, and we have the soft pillow of unemployment to keep things from really unraveling. That said, those on meth and the attached crime stats (majority of crime) to pay for that habit probably a good example of worst case.

There is a quote somewhere about the collapse of society being only three missed meals away...

It was pretty bad in the early 90s, 11% I think

What's our youth unemployment at? What was it at during the GFC? Are we at risk of another generation graduating into nothingness, if it all falls apart?

I believe the demographic change will help shield us - but not if we continue to import low-wage workers at the rate we are.

What will happen as those younger folk age, and their voting bloc grows? I imagine the late boomers/early Gen-X will feel their wrath in future policy decisions in the next 2-3 decades.

The graph above that shows the spread of mortgages between floating and > 5 years is interesting.

Begs the question: why so few took the opportunity to fix long (5 years) when rates were down at 2.99% or lower? I mean, breaking the existing fixed rate mortgage of 1 or 2 years and fixing long would have benefited just about everyone!

Ignorance? Too hard? Or, "I asked the bank but they fobbed me off". Or "they gave an outright NO" citing the universal get-out-of-jail-clause, "commercial judgement".

Another thing for ComCom to look at? It would certainly explain why the banks are so profitable at this time!

As an aside, I asked two mortgage specialists at two separate Aussie banks what they fixed at when rates wre low and whether they broke their existing mortgages. Neither broke and both re-fixed at 3 years.

The break fees were, like every bank in NZ, based on nonsense and were unjustifiably high.

Their reasons for fixing at just 3 years were essentially because they were "encouraged to" by their bank and for "commercial reasons" that their banks never explained to them.

I know of a few who bought in the silly period, and the mortgage brokers were telling them rates were going to go lower so 1-2years would be fine. All it would have taken was to check a historical graph of the OCR to realise that the good times wouldn't last.

To be fair to the mortgage brokers, they were just regurgitating what bank economists were saying in their bank's infomercials.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.