Kiwibank economists are sticking with their long-held view that the Official Cash Rate (OCR) will need cutting to 2.5% by the end of this year - and they say their house price forecasts for this year have "proved too optimistic".

In a detailed publication updating their economic forecasts Kiwibank's chief economist Jarrod Kerr, senior economist Mary Jo Vergara and economist Sabrina Delgado say the Kiwi economy "is crawling out of last year’s deep recession".

"But the recovery is taking longer than we expected. The outlook for global growth is cloudier than ever. And as a small open economy, we’re especially vulnerable."

They forecast the economy growing "just" 0.9% this year, down from their previous forecast - "which was already below-trend, and consensus, of 1.4%".

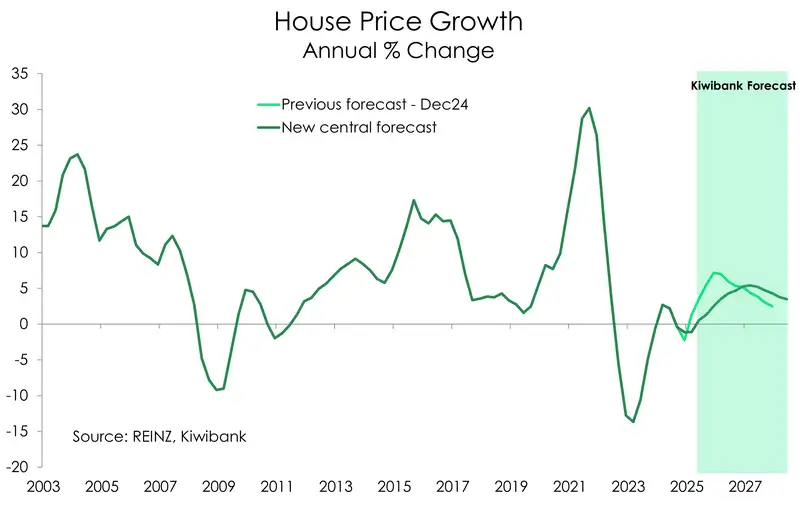

Previously they forecast house price growth of 5%-7% this year.

"Our previous house price forecast has proved too optimistic, as high levels of stock have flooded the market. We still (somewhat optimistically) expect to see a lift in prices over the spring and summer months, recording a 2-3% gain by year end. Trailing the broader economic cycle, a further loosening in the labour market is expected before employment growth rebounds into 2026."

Since August of last year the Reserve Bank has been cutting the OCR, from a cycle peak of 5.5% to a current 3.25%. In its latest forecasts the RBNZ hedged between the final low point for the OCR in this cycle of between 2.75% and 3.00%. Financial market pricing is similar - with a low point of 3.00% marginally more backed.

But the Kiwibank economists have been saying 2.5% for a long time. And they are still saying it.

"For the RBNZ, they will need to move policy settings from restraining the economy to supporting it," the economists said.

"The outlook requires further easing. The RBNZ has delivered 225bps [basis points] of cuts since August 2024, and we forecast another 75bps to set policy at more stimulatory levels.

"A 2.5% cash rate is still our forecast terminal rate, although the path toward is shrouded in uncertainty."

The economists say the housing market "has continually surprised us, and the RBNZ, on the downside".

"And we’re holding out for a recovery. We’ve seen green shoots emerge, and then die off, only to re-emerge again. But we must wait, like gardeners, until spring… to see if the green shoots start blossoming, or remain in drought."

The Kiwibank economists are not alone in trimming house price forecasts. The RBNZ was at one point forecasting house price growth of a tick over 7% for this year. But it's now forecasting 3.5%.

"Ultimately, we trust the process," the Kiwibank economists say.

"Lower interest rates, and we still need lower rates from the RBNZ, will stimulate demand (eventually) and lift house prices (and other assets). And the housing market plays an important role in the Kiwi economy. Rising prices boosts consumer confidence, and business confidence, especially within the SME space. This is the 'wealth effect' of monetary policy.

"The expected recovery in the housing market will not just boost confidence. But a rising housing market will encourage households to spend a little more (or save less), and may just help businesses repair their balance sheets a little faster, and eventually help lift hiring and investment intentions. It’s been a long time coming.

"The housing market remains sluggish in 2025, as it did in 2024, but better than the correction in 2023. House prices have virtually traded sideways over the past two years. Nonetheless, we (somewhat optimistically) believe we will see a pick up over the spring and summer months, and record a 2-3% gain by year end. We maintain our long-held forecast of 5-7% house price growth next year," the economists said.

They say falling interest rates is one strong tailwind for the housing market. The return of the investor is another.

"We continue to hear from investors that they are waiting to rebuild equity in their portfolios – they need house prices rising not going sideways. And many are worried about a change in Government with a possible reintroduction of a harsher brightline test and/or the removal of interest deductibility. To be clear, investors today are worried about an election late next year. But that may be turning, at least in the data.

"First-home buyers remain active participants in the market. Atypically, more bank lending was going to first home buyers than investors. However, we are seeing a lift in investor activity, off a very low base. We expect this segment of the market to be more involved going forward."

4 Comments

Nice to see some realism from a bank for a change.

Agree, good to see realism Kiwibank

As long as no one breaks the real estate and bank economist protocol of never mentioning house price decreases in the past year or predicted then all is well.

But it's now forecasting 3.5%

Where are you getting that from? I can see the part where they say 2-3% increase from now until year end, but didn't see a full year figure

Generally we still seem to be a country entrenched in "House prices always go up" From what I am seeing the oft quoted "we have a shortage of housing" doesn't seem to be the case any more. The thing is there's no coordination between any housing entities in terms of when there's enough housing, there's a massive lag between need and supply, and there's always changing demographics within the model of who and how many per household. So there's always a shortage until there isn't. There was a shortage in Spain until there wasn't as in Ireland. I don't know whether or not there is still a shortage but rental inflation and houses on the market would suggest not.

I also find in every metric that doesn't make sense in NZ you can trace it back to house prices being too high, e.g: minimum wages rising- cost of living - rent - yield too low on the investment property vs. price

I know it could be construed as a tenuous link but every unaffordable situation we have in NZ could use. one of these links back to the value of what we put on houses.

I actually hope we see a further decline in housing so that we can make it more affordable for our next generation. It's non-sensical we have effectively either locked out of ownership or forced paying off debt for the life of our next generation.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.