They say we shouldn't look back.

But sometimes we have to. Sometimes it is imperative to do that in order to know where we are now.

And that's very much the case with New Zealand's official GDP figures, which have taken on a much more unpredictable nature than is desirable in recent times.

So, it is then, that the release of the September quarter GDP figures on Thursday, December 18, will be watched as much for what is revealed about previous quarters as for what the figures tell us about the latest quarter.

But to start briefly with the latest quarter - it's expected to show a bounce-back in activity. In recent days economists’ forecasts have been going up, and up - starting from earlier picks of about a 0.5% rise in GDP, to a point where, among the big four banks, economists at the largest bank, ANZ, are now picking 1.0%, while their counterparts at BNZ and Westpac are each picking 0.9%, and ASB, 0.8%.

However, if I may be indulged, I would like to spend a reasonable bit of time first up on what happened in previous quarters. We can expect the figures for previous quarters will be revised - and there will be much interest in just how many revisions there are, and the extent of them.

If we recall, the official figures for the June quarter showed GDP falling 0.9%. When released in September those figures prompted a strong public reaction and a fair bit of 'woe is us' sentiment. But in its latest Official Cash Rate (OCR) review in late November, the Reserve Bank (RBNZ) politely dismissed those figures, saying there were "a lot of one off factors and statistical quirks". Westpac senior economist Michael Gordon had earlier offered a compelling explanation. The upshot is that nobody really believes our economy shrank 0.9% in that quarter.

For the record, I made this comment about the June quarter GDP figures in an article published about a week after they were released:

Do we believe the -0.9% figure? Well, we'll have to wait and see how accurate it is, won't we. I instinctively doubt the economic performance in the quarter was as bad as that. And I will not be surprised at all if we see a bounce back by a similar, if not slightly higher amount for the September quarter. Although we won't sadly see that result till mid-December.

There's a great deal of interest therefore in what sort of revisions and updates there are along with the September quarter data. This is a quarter that does usually have a lot of revisions anyway because it is the time of year in which annual national accounts data is incorporated. In laypersons terms this means better and more accurate information becomes available, so, previous figures may well be changed, but they should be more accurate. We now get the definitive view, which could be quite a bit different to what we were earlier told.

What might we expect then? Well, the inclination, based on recent GDP releases, is to expect anything. There have been surprises galore and usually not of the good kind. What we might hope to see is that at the very least the June quarter figures are revised upwards (and it would be astonishing if they are not) and will therefore show a rather smaller fall than that originally announced 0.9% plummet. Nobody is debating the point that the economy did stumble in the June quarter, but there are reasons to believe from other data that it certainly didn't dive off a cliff as the original figures released portrayed.

But as already indicated above, the revisions will likely not just be confined to the June quarter. And it will be most interesting to see what happens to the figures for March 2025 and December 2024. The March 2025 figure in particular portrayed a reasonably robust recovery that other high frequency data didn't really reflect. Yes, the economy was ticking up, but not necessarily by that much.

If we could order up revisions that paint a clearer picture of where the economy has been, I would suggest an ideal scenario might be some downward revision of particularly the March quarter and most definitely upward, and fairly substantially upward, revision of the June figures.

How the economy has felt this year is that there was a cautious recovery beginning in the first half, which stalled in June and has been followed by resumption of a cautious recovery in the September quarter and flowing into the current quarter. But we shall see what the official data says.

These revisions matter

Are the revisions important, however? Is this just rewriting history that has no relevance? Well, no. It's important. That's because these are figures measuring the size of our economy at a point in time. We need to know what the starting point is in order to have a clearer idea of where we are going and what kinds of policies we need to be pursuing. This is particularly relevant this year when we have been dealing with the consequences of a strong cycle of interest rate hikes (2021-23), followed by sharp reductions (2024-25) in interest rates.

We do need to know how the economy was reacting to this at various points to give a better clue as to what comes next. And it would also be very instructive to know just how the economy was or was not responding to the pace of particularly the reductions in the interest rates. The GDP figures for the year to date so far don't give us a clear steer on this at all. Similar problems were encountered last year when the big hole our economy fell into in the June quarter (which appears to have been real enough) was not at first being properly picked up.

And this all matters. It is possible, for example, that if we could have had greater clarity with our GDP figures earlier, the RBNZ might have done both the timing and pace of its OCR reductions somewhat differently than it did.

It was significant that in the middle of last year, and again in the mid part of this year, the RBNZ appeared to be taking much more notice of other 'high frequency' data than the GDP figures when setting the OCR. But really, that's not ideal either. The RBNZ does need to have GDP figures it can trust, oh, and dare I say one more time, it would be good if our GDP quarter results - currently released when the next quarter has almost finished - were issued in a more timely fashion.

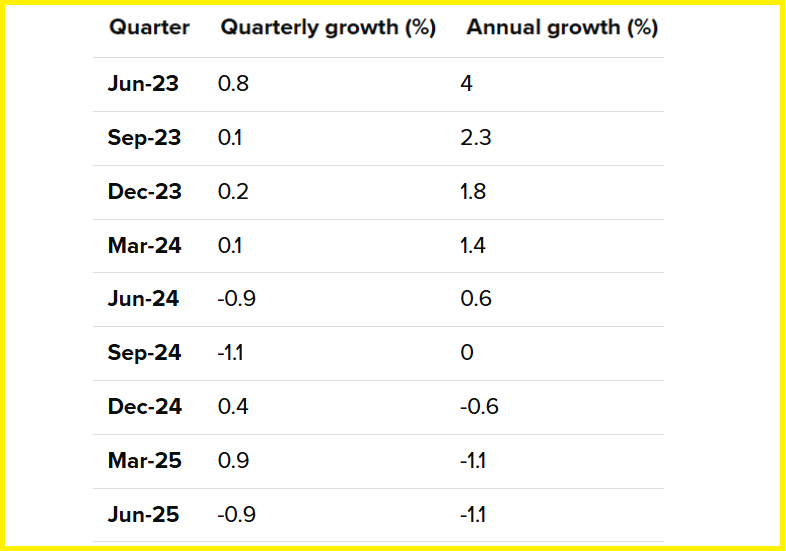

This is the picture the Stats NZ figures are currently painting for the recent past of NZ's GDP:

It's quite a mixed bunch isn't it!

Okay, so, let's assume at least some of those figures above will look rather different following revision when we see the figures come out next Thursday. What else should we be looking for?

Well, there is of course the actual, new, September 2025 quarter figure. Let's not forget about that! And I wouldn't want to give the impression from all the above preamble that I don't see the new September quarter figure as important. Because it is. And made more so by what's come before. Even if the figure is already quite old.

One of the maddening things I think about having our GDP figures coming out so late is that if we get a figure that's a real shock then this has a big impact on public confidence. And that's regardless of the fact that this 'shock' relates to three-month-old information. The problem is that public behaviour in regards to things like spending might be adversely affected by such a shock - despite the fact that the economy has actually started to recover in the intervening three months. And the high frequency data did clearly indicate that the economy had started to pick up again pretty soon after June. We risk entering into 'doom loops' where the public reacts badly to bad, old, GDP news and then by their behaviour prompts another stall in the economy.

Give us a spring in our steps

With the figures coming out next Thursday, however, there is the chance of the opposite reaction, which in the current circumstances could be quite useful. Some 'good news' heading into the Christmas-summer period could send everybody off on their holidays in a more buoyant mood. And people in a more buoyant mood may be more inclined to spend, which helps the economy. The virtuous circle as opposed to the doom loop.

The RBNZ in its November Monetary Policy Statement (page 47), forecast a 0.4% rise in September quarter GDP, followed by a 0.7% rise for the December quarter we are currently in. As far as the September quarter figures are concerned, though, the RBNZ didn't have the benefit of the latest data immediately ahead of the release of the figures next Thursday. More recent data coming out have suggested the figure's more likely to be well above 0.4% and as mentioned above economists have been steadily revising their views upwards in recent days. The RBNZ's economic modelling 'Nowcast' forecast was, at time of writing, forecasting a 0.8% rise for the September quarter.

As usual, we've had some clues as to at least the direction of the figures. And the signs have been positive. The key three so-called 'partial indicators' have come out like this:

• The volume of total manufacturing sales rose 1.1% in the September quarter, following a 2.8% fall in the June 2025 quarter. Wholesale trade sales rose a seasonally adjusted 2.7% after a 0.1% rise in the June quarter.

• The seasonally adjusted volume of building work done in the September quarter rose 1.5%, largely reversing a fall in the June quarter. Residential activity rose 2.8% in September, while non-residential fell 1.3%.

• Retailers as we know have been doing it tough for quite a while but Stats NZ reported that retail activity increased 1.9% ($472 million) on an inflation-adjusted, seasonally-adjusted basis in the September quarter - with the increase led by rises in electronic goods sales and motor vehicle and parts retailing. Elsewhere the picture was more mixed, with eight of the retail industries showing rises and seven falls. Economists, however, saw the figures as a good portent for the GDP figures.

So, that all bodes well for a considerably better looking figure to be announced next Thursday, which should provide some cheer for everybody before Christmas. If that is the case, it will provide a nice contrast to the same time last year when we were trying to digest some very nasty GDP revisions that were revealing the true extent of the recession during 2024.

Assuming there has been an uptick in GDP during the September 2025 quarter then, the next trick will be to maintain it...But that's another one to watch out for next year.

*This article was first published in our email for paying subscribers early on Friday morning. See here for more details and how to subscribe.

10 Comments

Looks like even if GDP growth was 0 last quarter, the Sept quarter last year falls out of the annual, so the annual increases from -1.1% to 0%.

Or if the banks are right and we get 1% this quarter, the annual could increase from -1.1% to 1%, a significantly different position.

All the commercial banks and the RBNZ have consistently over-estimated GDP in the NZ economy for the last 2 years. I don't expect this to change since their modelling is incomplete.

For a rise in GDP there needs to be an expansion of credit in the private sector and this is unlikely given stagnant house prices and rising unemployment. The government is facing increasing pressure to cut spending further to meet fiscal rules and this will also continue to drag on GDP.

Is this more of the same over-optimistic egging of the economic pudding that we've been hearing for 2 years:

Here's some cold facts for 2026.

-

Unemployment still rising.

-

Net migration outflows continue.

-

Inflation > 3% - partly driven by falling NZD.

-

Mortgage rates rising again - already on the way up.

-

Housing oversupply + falling prices - housing market flat.

-

Consumer spending weak - high levels of existing debt to pay down.

-

Constrained fiscal policy continues to weaken demand across the economy.

Not true re the first two. Unemployment has at least stabilized recently. Net migration showed a strong rebound for the month of October.

My Keynesian spidy sense tells me otherwise - where is the demand coming from? That path to cyclical recovery has been trodden into a sinking, muddy and stagnant track. NZ household debt is somewhere around 160% of GDP and mostly into housing. 70,000 mostly working age people left NZ in 1 year - what are the lagging effects of that on a small economy?

I’d say most recessions have ended with many of those still in play. Lagging indicators.

I think GDP per capita is more important, because you can just import people to increase GDP

Both are important. On the world stage no one cares about the tiny countries with high GDP per capta.

Completely off topic - but this is why I think National will win the next election. The justice system is an absolute joke and National are the only hope. https://www.nzherald.co.nz/nz/crime/auckland-bus-driver-attacks-501-car…

“Judge Bonnar said he wasn’t entirely sure the sentiment was genuine” - it’s not genuine if you said it at the last 3 trails dumbass.

On topic for me. 22 years ago I was on a mid-morning Birkenhead bus heading for the city and they changed driver; the new driver turned to his passengers and said "good morning everyone" with a warm, genuine voice and that for me was the staw that broke the camels back - I decided to apply for NZ residency and avoid returning to London. The new bus driver security safety screens are a barrier between driver and passenger. If I was a driver I would want them but as a passenger they are sad.

Until reading this article I never approved of 'Three strikes and you are out".

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.